User Reviews

More

User comment

2

CommentsWrite a review

2023-08-22 17:00

2023-08-22 17:00 2023-03-28 10:17

2023-03-28 10:17

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 2

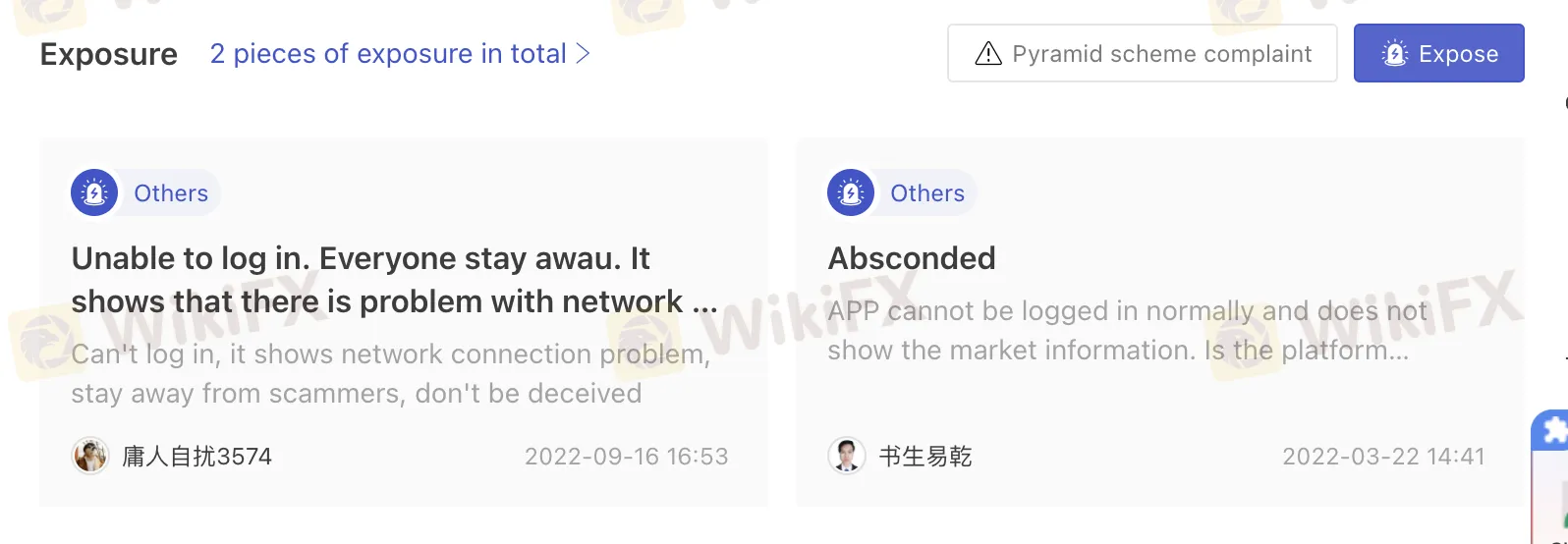

Exposure

Score

Regulatory Index0.00

Business Index6.98

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

UP WAY GLOBAL MARKETS DMCC

Company Abbreviation

JRFX

Platform registered country and region

United Arab Emirates

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Note: JRFXs official site (www.jryfx.com) is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

| JRFX Review Summary | |

| Founded | 2010 |

| Registered Country/Region | United Arab Emirates |

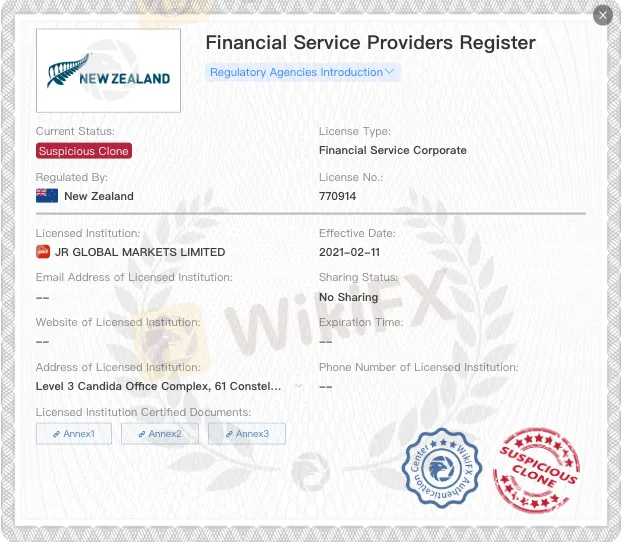

| Regulation | Suspicious clone |

| Market Instruments | Forex, stocks, index, futures, precious metal, energy |

| Leverage | 1:1000 |

| EUR/USD Spread | 0.7 pips (Std) |

| Trading Platforms | MT4 |

| Minimum Deposit | $100 |

| Customer Support | email, telephone, 24-hour online messaging |

JRFX is an unregulated brokerage firm that offers a diverse range of trading instruments across various asset classes, including forex, stocks, indices, futures, precious metals, and energy. With multiple types of accounts, such as EasyPro, Standard, and ECN, JRFX aims to cater to the needs of traders with different experience levels. The company provides access to the widely recognized MetaTrader 4 (MT4) trading platform, known for its robust features and user-friendly interface. In addition, JRFX offers various trading tools, including newsletters, a financial calendar, technical analysis tools, and risk management features, to assist clients in making informed trading decisions.

| Pros | Cons |

| • Diverse trading instruments | • Lack of regulation |

| • Multiple account types | • Reports of login issues |

| • Competitive spreads | • Unavailable of website |

| • MetaTrader 4 (MT4) platform supported |

JRFX is listed on the Financial Service Providers Register (FSPR) of New Zealand, but it has been flagged as a Suspicious Clone. This means that while the broker claims to be regulated in New Zealand under license number 770914, it is suspected of being a fraudulent or unlicensed entity attempting to impersonate a legitimate regulated firm.

Market Instruments

JRFX is a brokerage firm that offers a diverse range of trading instruments across various asset classes. Here is a brief summary of the market instruments provided by JRFX:

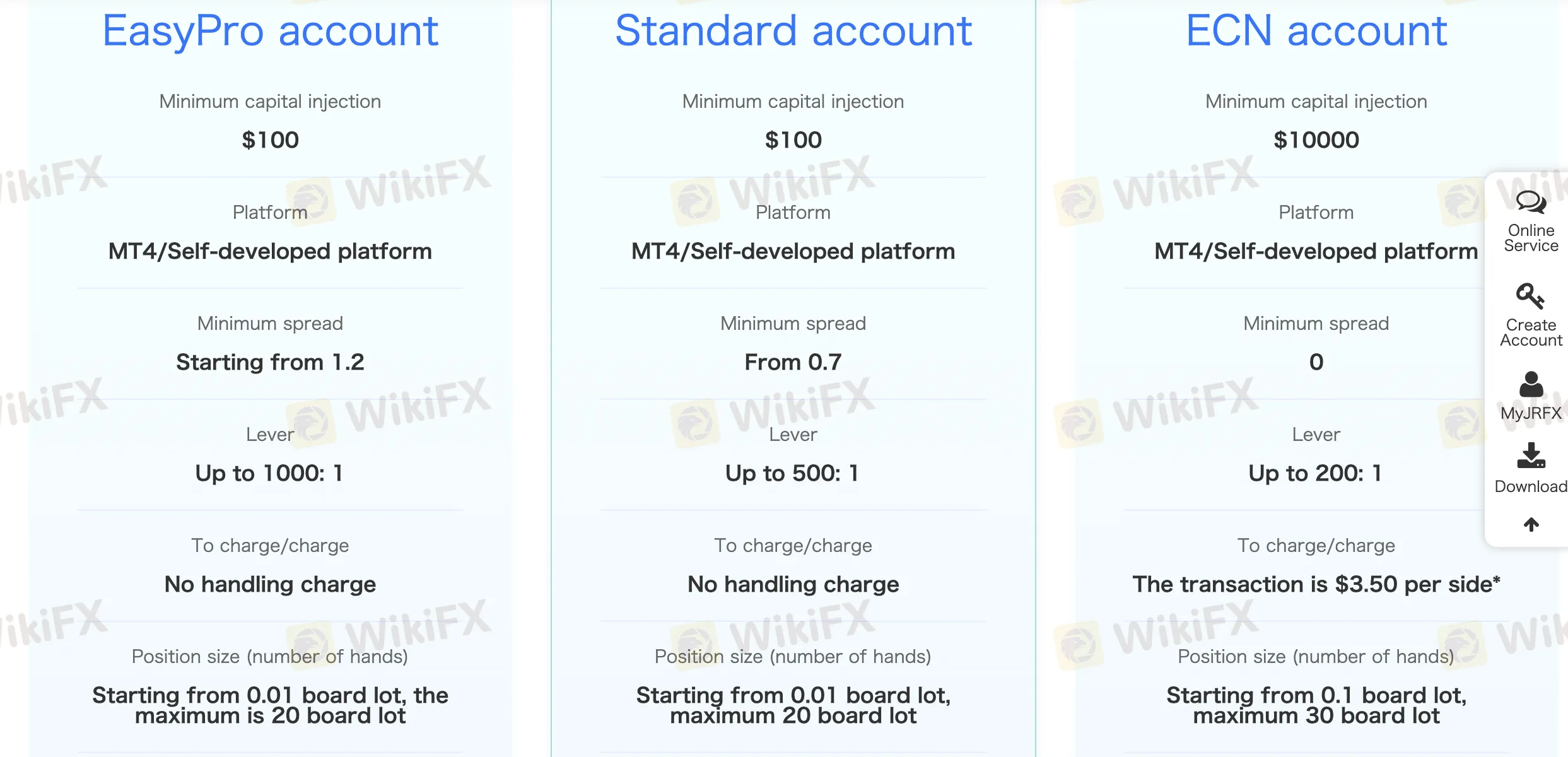

JRFX provides a range of account options to cater to the diverse needs and preferences of its clients. These include the EasyPro account, the Standard account, and the ECN account, each having its own distinct features and benefits. The EasyPro account requires a minimum deposit of $100, making it an accessible choice for beginner traders or those looking to start with a smaller investment. The Standard account also has a minimum deposit requirement of $100, offering a broader range of trading features and instruments compared to the EasyPro account. For experienced and professional traders seeking direct market access and a transparent trading environment, JRFX offers the ECN account, which requires a higher minimum deposit of $10,000. With the ECN account, traders can enjoy tighter spreads, faster execution, and access to deep liquidity from multiple liquidity providers.

| Account Type | Minimum Deposit |

| EasyPro | $100 |

| Standard | |

| ECN | $10000 |

JRFX provides different leverage options tailored to the specific account types it offers. For the EasyPro account, the maximum leverage available is 1:1000, allowing traders to control positions that are up to 1000 times the size of their trading capital. This high leverage level can potentially amplify both profits and losses, making it essential for traders to exercise caution and implement effective risk management strategies.

The Standard account, on the other hand, offers a maximum leverage of 1:500. With this leverage level, traders can control positions that are up to 500 times the amount of capital in their trading account.

For those opting for the ECN account, JRFX provides a maximum leverage of 1:200. This leverage level is comparatively lower than the EasyPro and Standard accounts, aiming to provide traders with a more controlled exposure to the market.

| Types of Accounts | Maximum Leverage |

| EasyPro | 1:1000 |

| Standard | 1:500 |

| ECN | 1:200 |

JRFX provides competitive and transparent pricing through its spread and commission structures across different account types. For the EasyPro account, traders can enjoy spreads starting from 1.2 pips, representing the difference between the buying and selling prices of a trading instrument. This implies a moderate cost associated with executing trades in this account type.

For the Standard account, JRFX offers tighter spreads starting from 0.7 pips, which indicates a reduced cost compared to the EasyPro account. Traders opting for the Standard account can benefit from more competitive pricing when executing their trades.

The ECN account stands out with its 0.0 pip spreads, indicating that traders have access to raw interbank spreads without any additional mark-up from the broker. This allows ECN account holders to enjoy highly competitive pricing and potentially lower transaction costs.

One notable feature across all account types offered by JRFX is the absence of commissions. This means that traders do not incur any additional fees based on the trading volume or value of their trades. The absence of commissions can be advantageous for traders, as it eliminates an extra cost component and simplifies the calculation of trading expenses.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| JRFX | 0.7 (Std) | No commission |

| Degiro | 0.8 | $2.50 per trade |

| IG | 0.6 | $10 per trade |

| Avatrade | 0.9 | None |

JRFX provides convenient and accessible options for depositing and withdrawing funds from trading accounts. The company supports deposits and withdrawals through popular payment methods, namely VISA, JCB, and UnionPay. JRFX aims to provide a smooth and secure experience for depositing and withdrawing funds by supporting widely recognized payment options. However, it is always advisable for traders to review the specific deposit and withdrawal policies, including any associated fees or processing times, by referring to the official JRFX website or contacting their customer support.

JRFX offers its clients the popular MetaTrader 4 (MT4) trading platform. MT4 is a widely recognized and widely used platform in the financial industry, known for its robust features and user-friendly interface. With MT4, JRFX clients can enjoy features such as one-click trading, customizable charts, multiple timeframes, and a wide selection of analysis tools. The platform is available for desktop download, web-based trading, and mobile devices (iOS and Android), enabling traders to access the markets and manage their positions from anywhere at any time.

Trading Tools

JRFX provides its clients with a range of trading tools to enhance their trading experience and decision-making processes. Here is a brief description of the trading tools offered by JRFX:

On our website, you can see reports of unable to log in. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section. We would appreciate it and our team of experts will do everything possible to solve the problem for you.

JRFX offers multiple channels for customer service, ensuring that clients can easily reach out for assistance. Clients can contact the customer service team via email at info@jrfx.com, allowing them to communicate their queries, concerns, or requests in a written format. In addition to email support, JRFX provides telephone support for direct and immediate assistance. Clients can reach the customer service team by dialing +65 8372 7701. To further cater to clients' needs, JRFX offers 24-hour online customer service.

Q1: What types of trading instruments does JRFX offer?

A1: JRFX offers a wide range of trading instruments, including forex, stocks, indices, futures, precious metals, and energy.

Q2: What are the minimum deposit requirements for JRFX's different account types?

A2: The minimum deposit requirements for JRFX's account types are $100 for the EasyPro account, $100 for the Standard account, and $10,000 for the ECN account.

Q3: Does JRFX charge commissions for trades?

A3: No, JRFX does not charge commissions for trades across all its account types.

Q4: What leverage levels are available at JRFX?

A4: JRFX offers leverage of up to 1:1000 for the EasyPro account, 1:500 for the Standard account, and 1:200 for the ECN account.

More

User comment

2

CommentsWrite a review

2023-08-22 17:00

2023-08-22 17:00 2023-03-28 10:17

2023-03-28 10:17