User Reviews

More

User comment

21

CommentsWrite a review

2026-01-07 05:28

2026-01-07 05:28

2025-07-15 16:43

2025-07-15 16:43

Score

5-10 years

5-10 yearsRegulated in Seychelles

Derivatives Trading License (EP)

MT4 Full License

Global Business

Medium potential risk

Offshore Regulated

Benchmark

Influence

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index1.76

Business Index7.46

Risk Management Index8.22

Software Index9.83

License Index0.00

Single Core

1G

40G

Danger

More

Company Name

Gleneagle Asset Manangement Pty Limited

Company Abbreviation

Fusion Markets

Platform registered country and region

Australia

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Quick Fusion Markets Review Summary | |

| Company Name | Gleneagle Asset Management Pty Limited |

| Founded | 2010 |

| Registered Country | Australia |

| Regulation | ASIC, FSA (Offshore) |

| Tradable Assets | 250+, forex, energy, precious metals, equity indices, stocks |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Account Types | Zero, Classic |

| Min Deposit | $0 |

| Leverage | 1:500 |

| EUR/USD Spread | Floating around 0.0 pips |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView |

| Copy Trading | ✅ |

| Payment Methods | Bank Wire Transfer, Visa/MasterCard, Interac, PayPal, PayID, Crypto, BinancePay, Skrill, Neteller, Jetonbank, MiFinity, AstroPay, SticPay, ZotaPay, DragonPay, VNPay, VAPay, XPay, DuitNow, FasaPay, DurianPay, FPX, Pix, MPESA, UPI |

| Deposit & Withdrawal Fees | ❌ |

| Customer Support | Live chat, contact form |

| Tel: +61 3 8376 2706 | |

| Email: help@fusionmarkets.com | |

| Regional Restrictions | Afghanistan, Congo, Iran, Iraq, Japan, Myanmar, New Zealand, North Korea, Ontario, Palestine, Russia, Spain, Somalia, Sudan, Syria, Ukraine, Yemen, or the United States |

Fusion Markets is well-regulated forex broker with an excellent operation. With Fusion Market, traders can access forex trading with 250+ trading instruments, including forex, energy, precious metals, equity indices, and stocks with leverage up to 1:500 and spread from 0.0 pips via MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView platforms. Demo accounts are available and there is no minimum deposit requirement.

| Pros | Cons |

|

|

|

|

| |

| |

| |

| |

| |

|

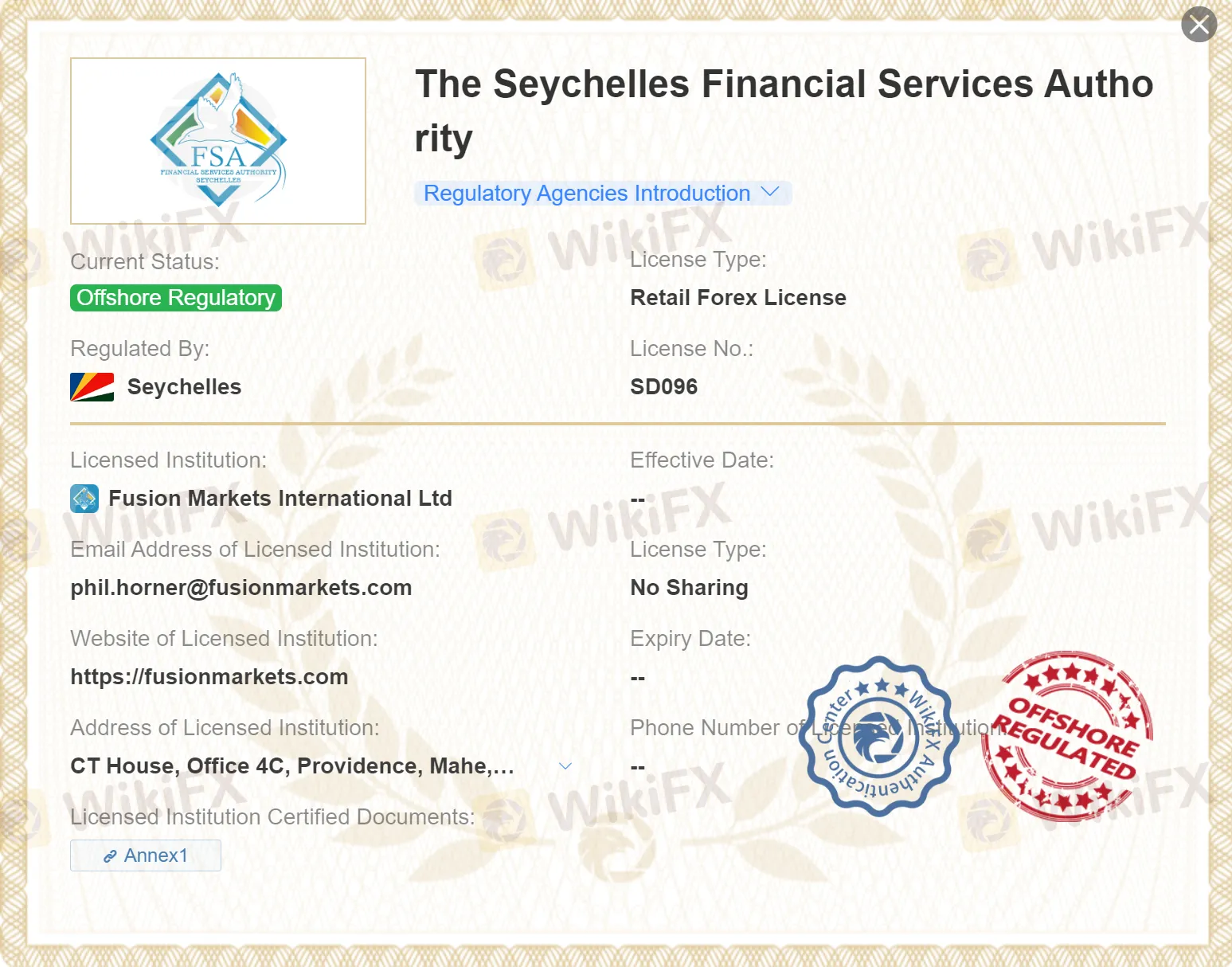

Fusion Markets operates with a double layer of regulatory protection, offering traders peace of mind.

Within Australia, they hold an Australian Financial Services License (AFSL 385620)issued by the ASIC, a stringent regulator known for its high standards.

Additionally, they're licensed as a Securities Dealer by the Financial Services Authority of Seychelles (FSA, offshore) under license number SD096.

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License Number |

| ASIC | Regulated | FMGP TRADING GROUP PTY LTD | Market Making (MM) | 000385620 |

| FSA | Offshore Regulated | Fusion Markets International Ltd | Retail Forex License | SD096 |

Fusion Markets offers 250+ trading instruments, including forex, energy, precious metals, equity indices, and stocks.

| Tradable Assets | Supported |

| Forex | ✔ |

| Energy | ✔ |

| Precious metals | ✔ |

| Equity Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Zero Account:

The Zero Account is the most popular account among Fusion traders. It is designed for individuals who have previous trading experience, understand how commission sizing works, and tend to be more active in their trading. This account offers spreads starting from 0 pips and an industry-leading commission of AUD $4.50. It appeals to traders who are comfortable with the commission structure and prefer low-cost trading.

Classic Account:

The Classic Account is suitable for beginners who prefer a straightforward approach to trading without the need to calculate commissions before each trade. Spreads on this account start from 0.9 pips, and it does not charge any commission.This account type provides simplicity and ease of use for traders who are starting out and want a hassle-free trading experience.

In addition to these two account types, Fusion Markets also offers demo accounts and Islamic accounts.

| Account Type | Spread | Commission |

| Zero | From 0 pips | AUD $4.50 |

| Classic | From 0.9 pips | ❌ |

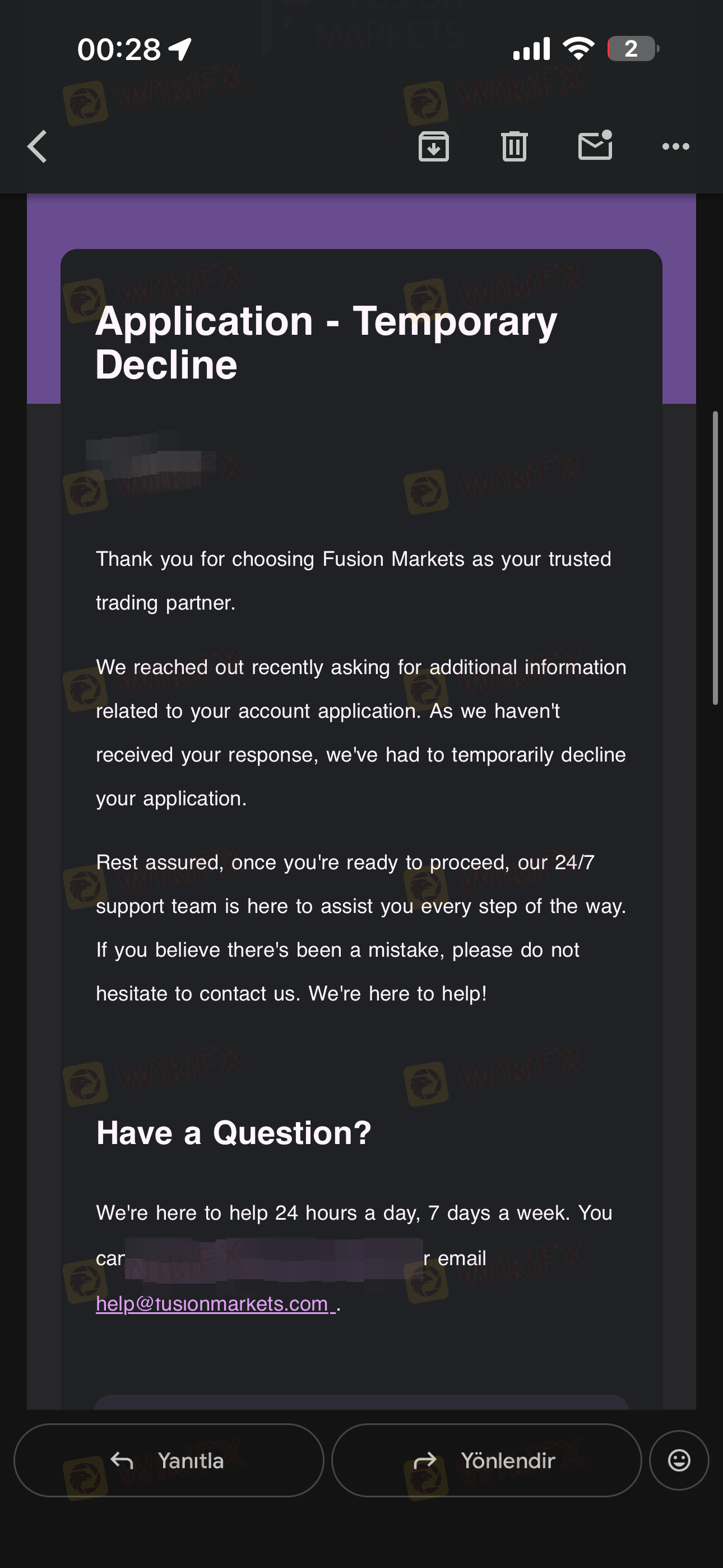

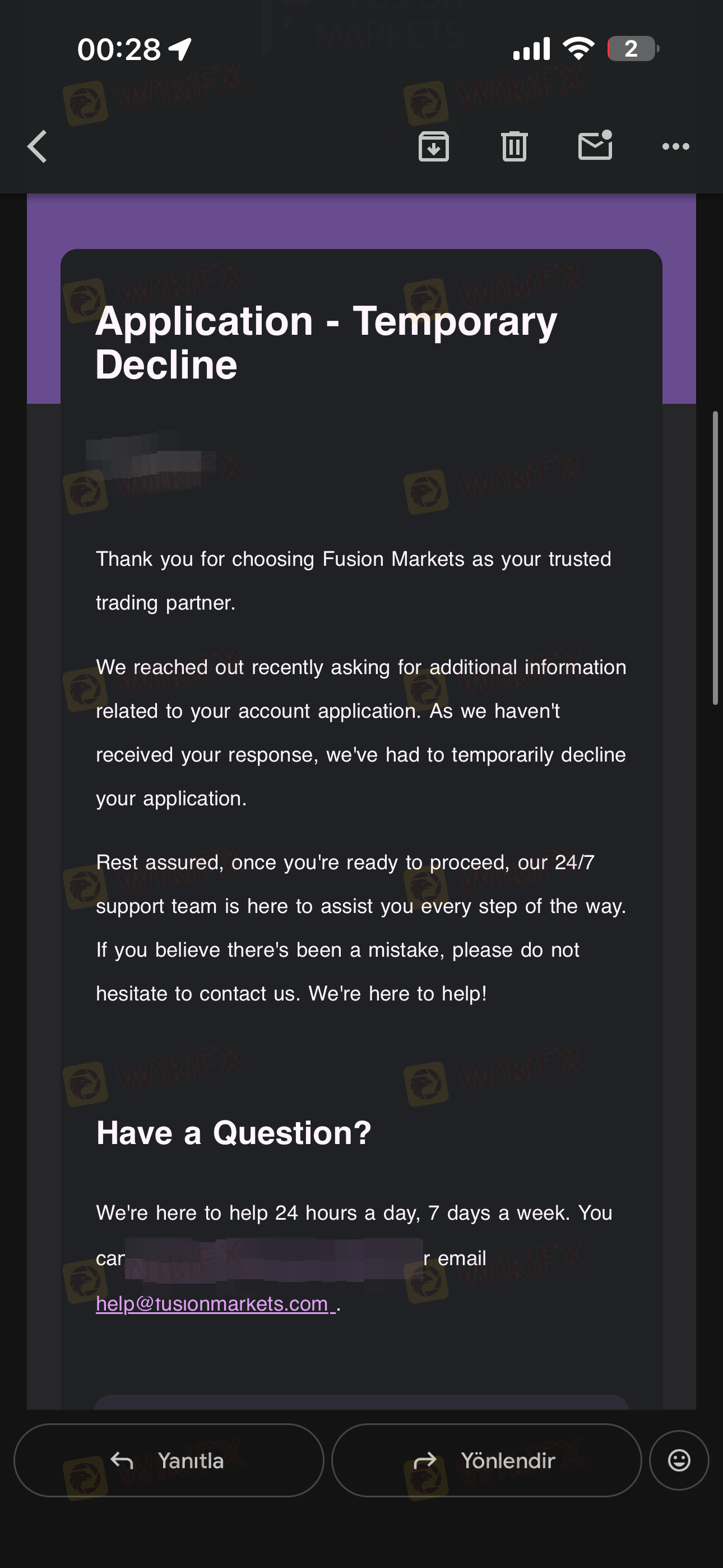

To open an account with Fusion Markets, follow these steps:

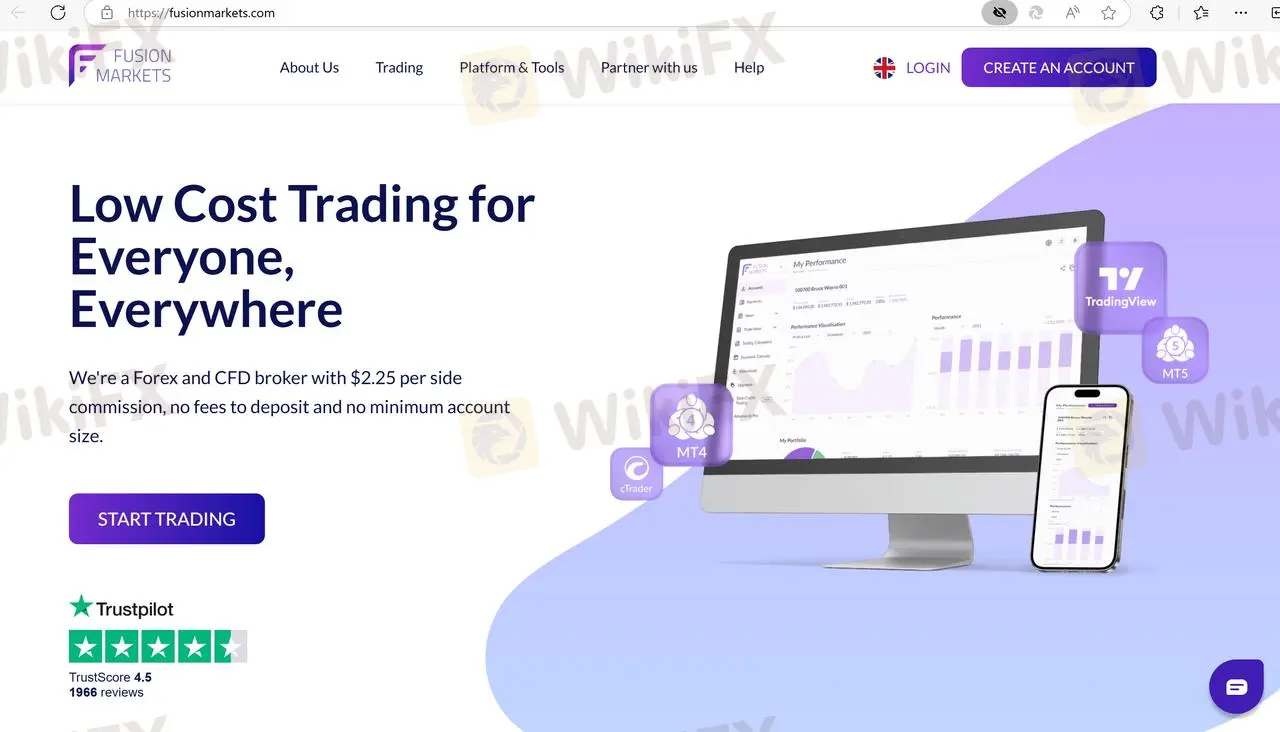

Step 1: Visit the Fusion Markets website and click on the “CREATE AN ACCOUNT” button.

Step 2: On the sign-up page, enter your email address in the designated field.

Step 3: Create a password that meets the specified requirements, which typically include a minimum of 8 characters, at least one capital letter, and one number.

Step 4: Confirm that you are over 18 years old and accept the Terms and Conditions of Fusion Markets.

Step 5: Proceed to upload a scanned or electronic copy of a government-issued photo ID, such as a passport or driver's license. This document serves as identification verification.

Step 6: Additionally, provide a recent proof of address document, such as a utility bill or bank statement, that matches the information provided in your application.

Step 7: Ensure that the documents you upload are clear and legible to facilitate the account approval process.

Step 8: Submit your application, and wait for the Fusion Markets accounts team to review and approve it.

Fusion Markets offers a maximum leverage of up to 1:500, which is categorized as high. It's important to note that high leverage can both amplify potential gains and losses in trading.

Fusion Markets offers a range of trading tools to cater to the needs of traders. These tools include MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, and cTrader.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| TradingView | ✔ | Desktop, Mobile | / |

| cTrader | ✔ | Desktop, Mobile, Web | / |

MetaTrader4:

MetaTrader 4 (MT4) is considered the industry standard in FX trading. It offers a fast, and stable trading experience. While many brokers offer this platform, Fusion Markets enhances it with unique technology, such as low pricing, fast execution (0.02ms), and connectivity to the proprietary Fusion Hub for account management. The platform can be accessed through desktop applications for Windows and Mac, as well as mobile apps for iPhone, Android, and tablets.

MetaTrader5:

MetaTrader 5 (MT5) is the latest platform offered by MetaQuotes and powered by Fusion Markets. It is designed to be multi-asset, allowing traders to connect to multiple exchanges and access various markets. MT5 offers features such as trading Forex, Stocks, Futures, and more as CFDs, faster processing speeds, advanced pending orders, over 80 technical analysis objects, market depth, full EA (Expert Advisor) functionality with MQL5, and a built-in Virtual Private Server (VPS).

TradingView:

Fusion Markets offers the popular trading software -TradingView, available on Desktop and Mobile Devices ( Andriod and iOS).

cTrader:

cTrader is also provided, and it is compatible with Desktop, Mobile and Web devices.

Fusion Markets offers a comprehensive range of trading tools designed to empower traders.

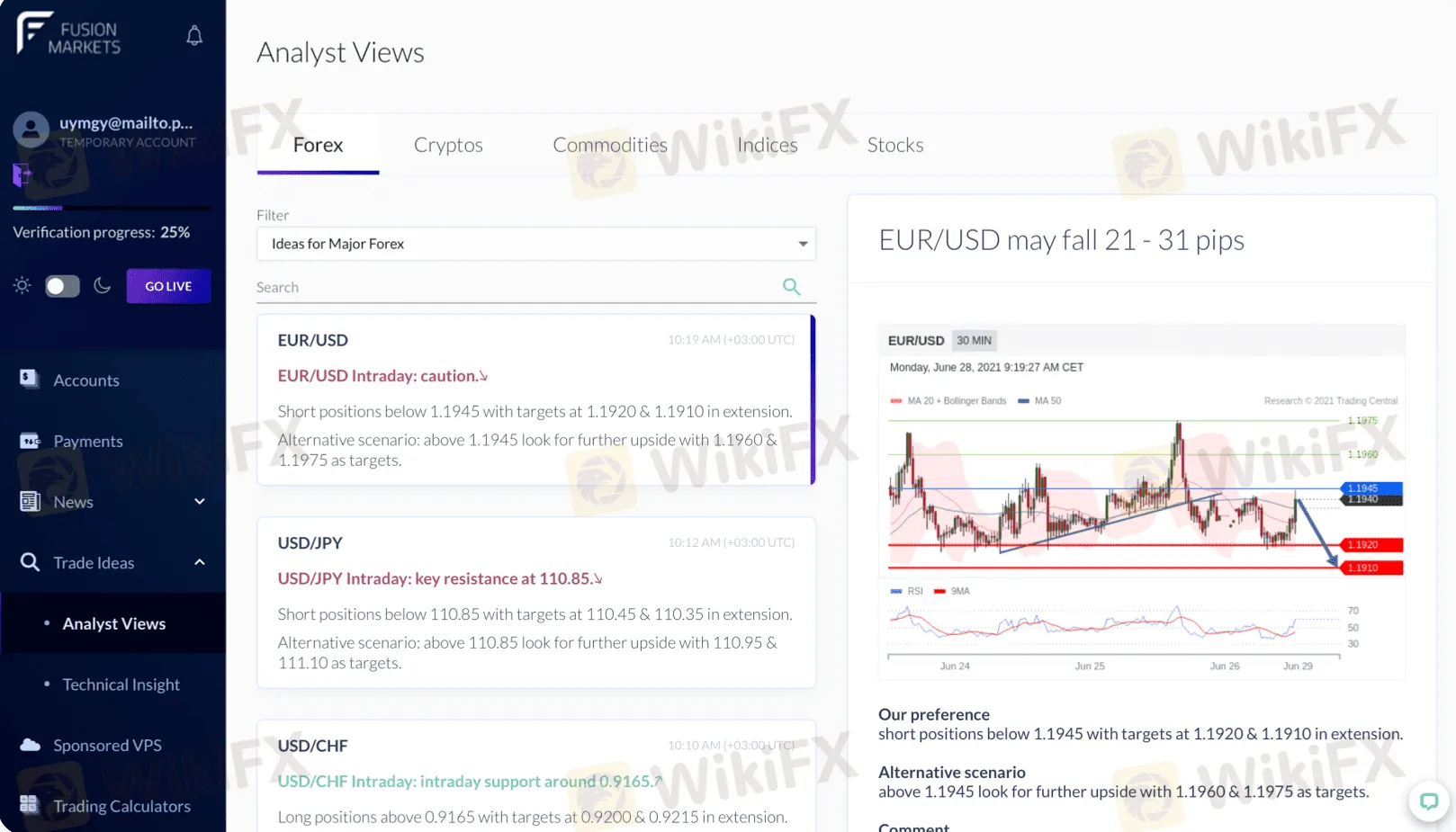

Analyst Views:

Fusion Markets provides analyst views that offer quick, actionable insights on the market. These views cover a wide range of products, including Forex, Commodities, Shares, and Indices. Trade setups are provided and updated in real-time, along with key support and resistance levels, alternative scenarios, and comments and reasons for the trade. These views are also available as a custom indicator on the MT4/MT5 platforms.

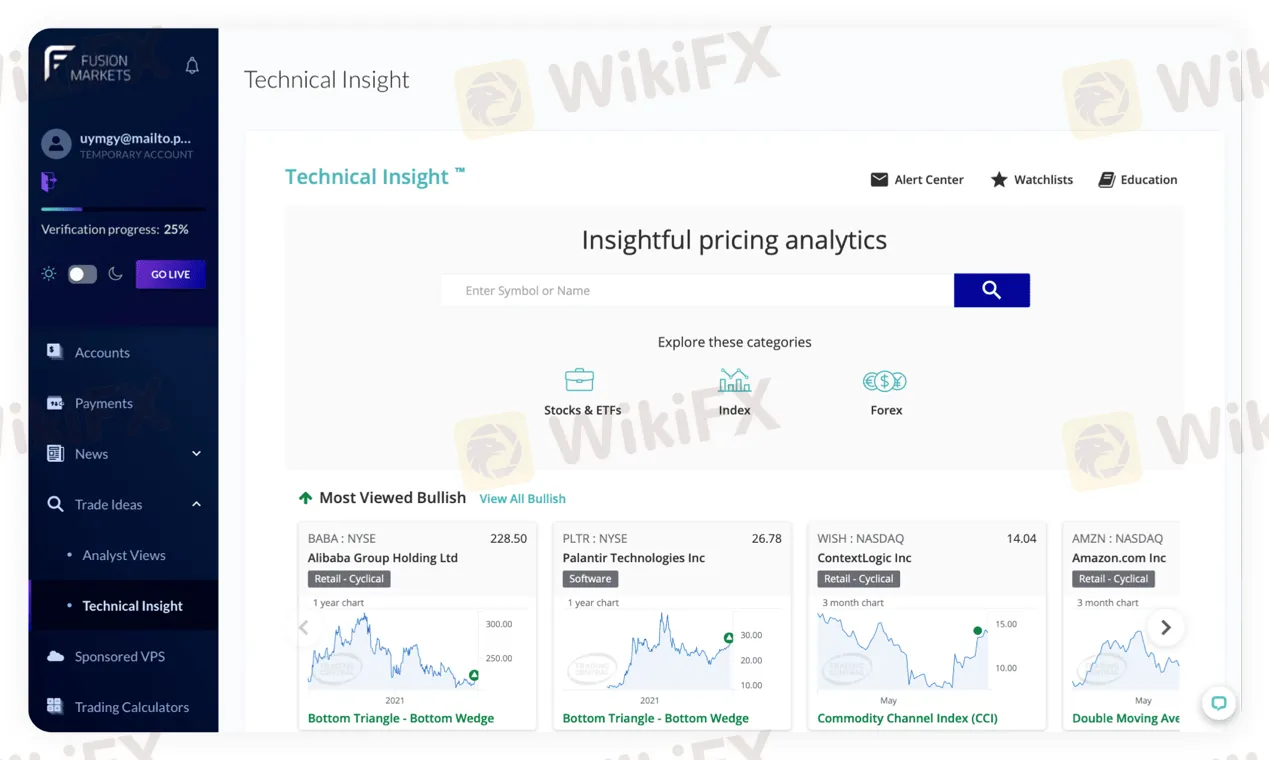

Technical Insight:

The Technical Insight tool empowers traders of all skill levels to view opportunities in the market. It offers detailed, proactive analytics, educational guidance, and customizable options. Traders can learn more about technical analysis indicators, work with interactive charts, create alerts on favorite products, and view the short, medium, and long-term technical picture. Additionally, they can see the most popular trades in the community.

Market Buzz:

Market Buzz is a tool that harnesses the power of cutting-edge Artificial Intelligence (AI). It sifts through thousands of articles and sources to summarize the wisdom of the crowd for traders. It provides insights on hot topics, detects news types including price movement and news announcements, displays the ratio of social media commentary vs. professional financial media, and shows the buzz meter to gauge the level of attention a specific instrument.

Virtual Private Server for Forex Trading:

Fusion Markets offers a Virtual Private Server (VPS) option for uninterrupted trading. Traders can connect their trades 24/7 on a virtual machine, eliminating connectivity issues. There are two VPS options available: the Sponsored VPS, which is complimentary for clients trading more than 20 lots of FX or Metals in a 30-day period, and the New York City Servers VPS, which provides a low latency solution for traders.

Myfxbook AutoTrade:

Myfxbook AutoTrade is a social trading platform that allows traders to follow and copy successful traders from the Myfxbook community. It offers the benefit of showcasing only the best run systems, live accounts with real trading activity, no volume-based incentives, and the freedom to add or remove systems on the trader's account.

DupliTrade:

DupliTrade is a user-friendly copy trading platform offered by Fusion Markets. It allows traders to duplicate the actions of successful traders hand-picked by DupliTrade into their Fusion Markets MT4 account. DupliTrade focuses on a handful of strategies with strict selection criteria, offers an easily automated trading process, and provides 24/5 support for platform-related queries.

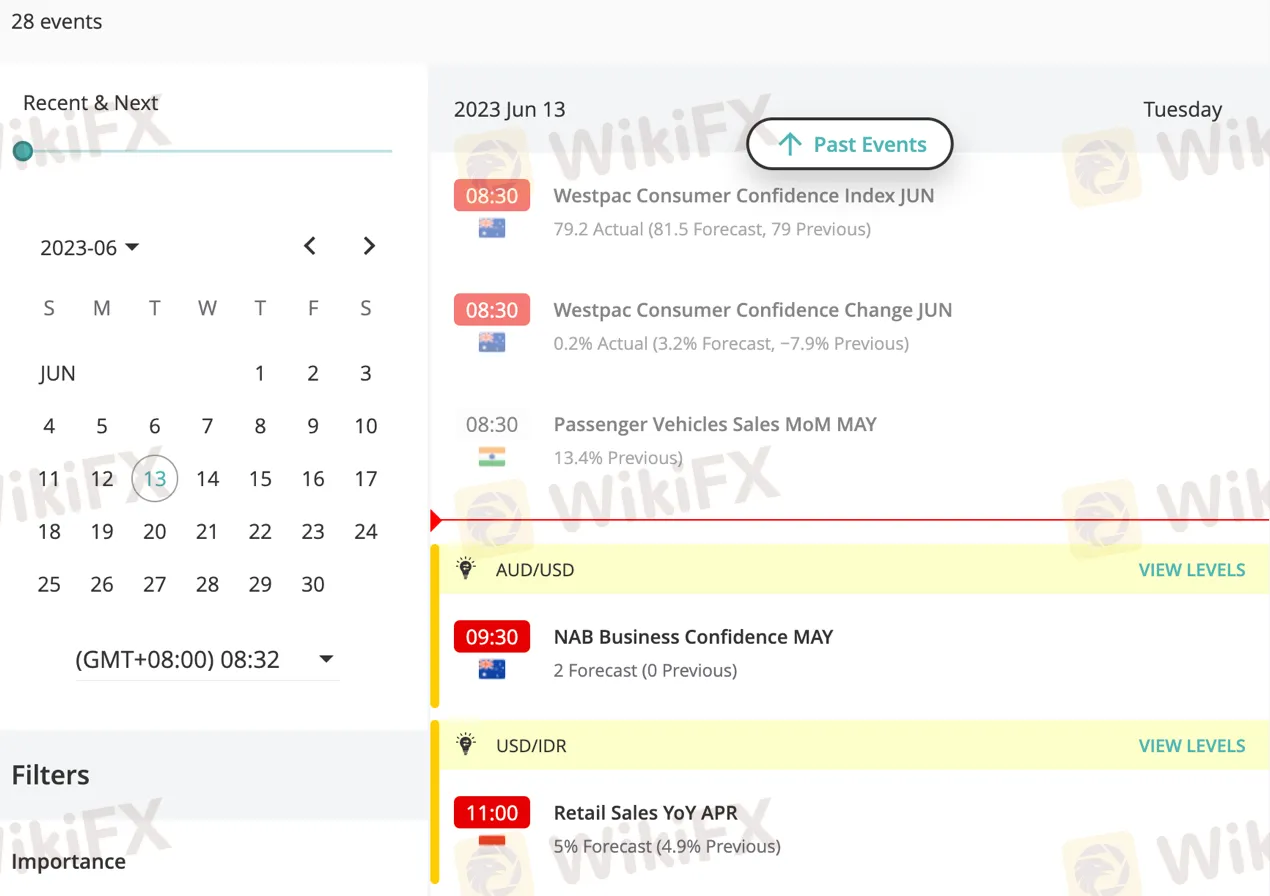

Economic Calendar:

Fusion Markets provides an economic calendar to keep traders informed about upcoming economic events, announcements, and data releases that may impact the markets.

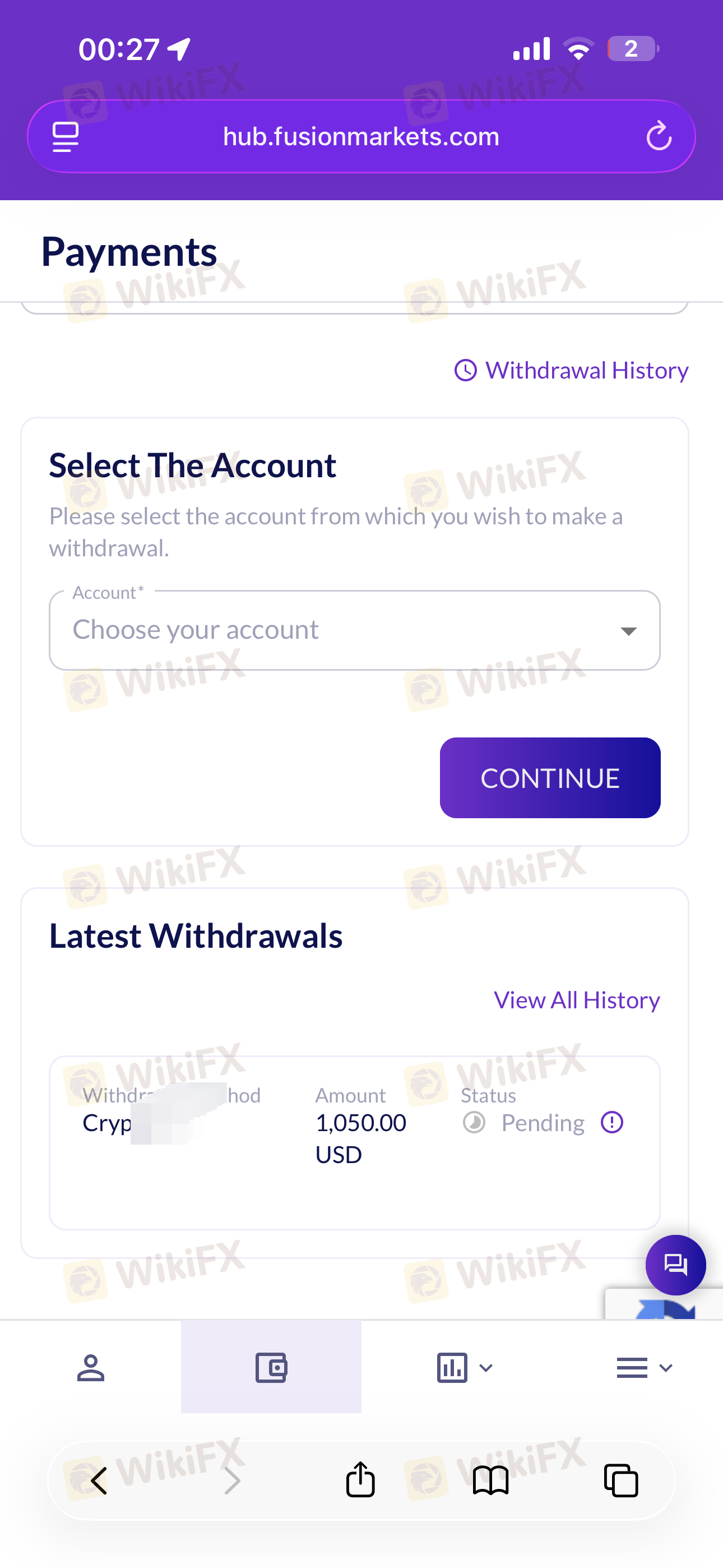

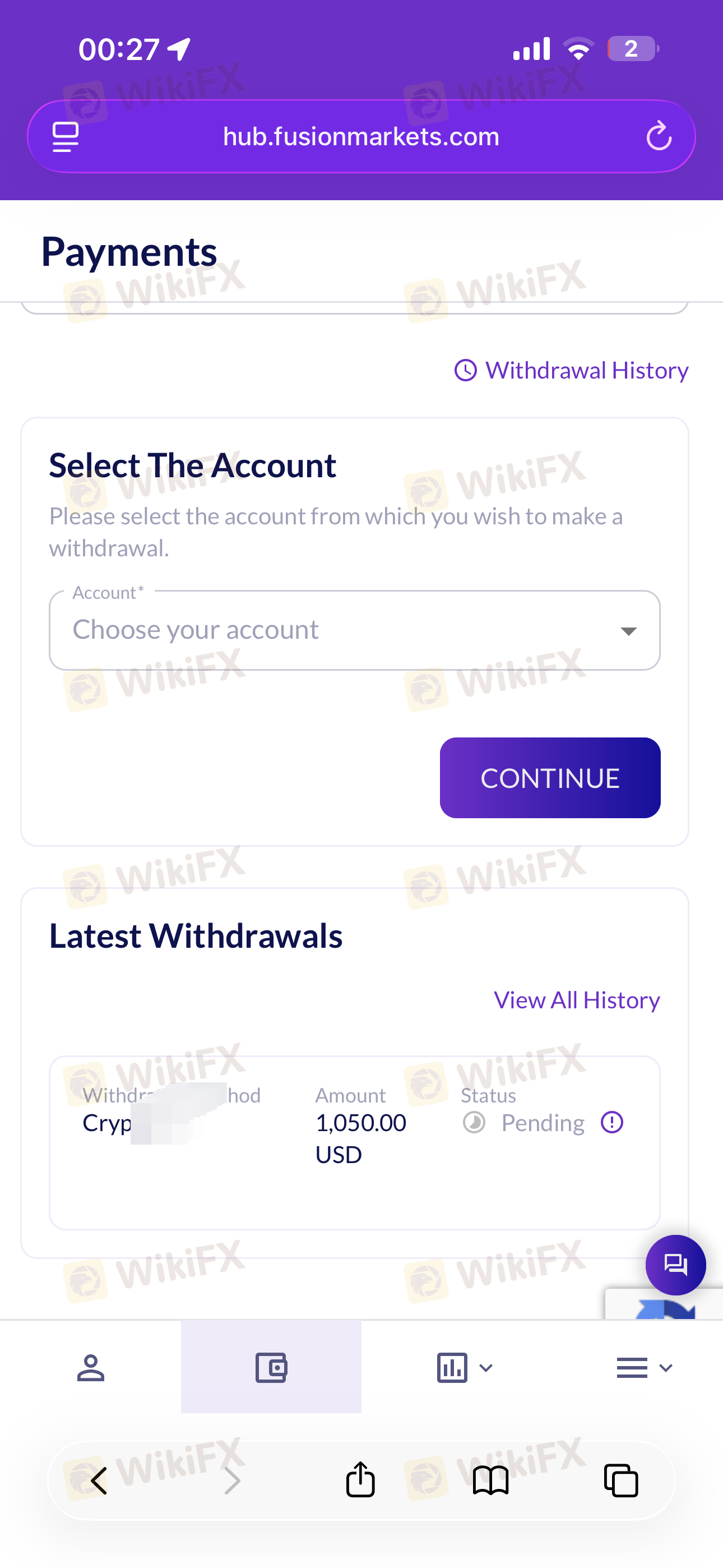

Fusion Markets offers free deposits and withdrawals via Bank Wire Transfer, Visa/MasterCard, Interac, PayPal, PayID, Crypto, BinancePay, Skrill, Neteller, Jetonbank, MiFinity, AstroPay, SticPay, ZotaPay, DragonPay, VNPay, VAPay, XPay, DuitNow, FasaPay, DurianPay, FPX, Pix, MPESA, and UPI.

| Live chat | ✔ |

| Contact form | ✔ |

| Phone | +61 3 8376 2706 |

| help@fusionmarkets.com | |

| Social media | Telegram, Twitter, Facebook, Instagram, and YouTube |

| Headquarters | Level 10, 627 Chapel St, South Yarra VIC 3141, Australia |

| Other offices | Govant Building, BP 1276 Port Vila, Vanuatu |

| CT House, Office 9A, Providence, Mahe, Seychelles |

What market instruments can be traded on Fusion Markets?

Fusion Markets offers 250+ market instruments, including forex, energy, precious metals, equity indices, and stocks.

What types of trading accounts does Fusion Markets offer?

Fusion Markets offers the Zero Account and Classic Account.

What is the maximum leverage offered by Fusion Markets?

1:500.

What trading platforms are available on Fusion Markets?

Fusion Markets offers MT4/5, TradingView, and cTrader as trading platforms.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Fusion Markets is an Australian-based online forex broker providing a competitive trading environment across various asset classes. Regulated by the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), and the Vanuatu Financial Services Commission (VFSC), Fusion Markets emphasizes regulatory compliance to ensure a secure and transparent trading environment for its clients.

WikiFX

WikiFX

Fusion Markets is an Australian-based online forex broker providing a competitive trading environment across various asset classes. Regulated by the Australian Securities Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), and the Vanuatu Financial Services Commission (VFSC), Fusion Markets emphasizes regulatory compliance to ensure a secure and transparent trading environment for its clients.

WikiFX

WikiFX

Fusion Markets, renowned as Australia's Lowest Cost Forex and CFD Broker, has recently forged a partnership with TradingView, facilitating traders to chart and execute trades directly on TradingView's platform.

WikiFX

WikiFX

Fusion Markets levelled up its trustworthiness alongside its newly obtained Financial Commission membership.

WikiFX

WikiFX

More

User comment

21

CommentsWrite a review

2026-01-07 05:28

2026-01-07 05:28

2025-07-15 16:43

2025-07-15 16:43