User Reviews

More

User comment

1

CommentsWrite a review

2024-01-09 18:11

2024-01-09 18:11

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 6

Exposure

Score

Regulatory Index0.00

Business Index7.65

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

UGM SECURITIES LTD

Company Abbreviation

UGM Securities

Platform registered country and region

Cyprus

Company website

Company summary

Pyramid scheme complaint

Expose

Margin is required for wrong info. I've checked the info before I applied for withdrawal. How can the info be wrong?

After several attempts to withdraw my money from UGM Securities i can tell you they are a fraud platform. I made an initial deposit of 160 thousand yuan which yielded profits over time. When i tried to withdraw, a 10% tax was requested after which they blamed the Restrictions on technical problems,. When I pressure for answers they don't answer messages or calls. The office is a waste of time. I would be financially ruined but for assetspoor.tech financial recovery. Any dealings done with UGM Securities LTD would end up bad, i hope their tricks are exposed soon

Promise 100% profit. But unable to withdraw. I confirmed that the bank info was right. They must modify my data. Ask for margin to modify the bank info to withdraw funds. This is a scam. They first attract u via WeChat and instruct u via QQ. All the things are fake. You will be cheated more and more money. Please stay alert.

At first, ask u to add money to the desiganated amount for wrong operation. After you profit, you will be told that your bank car number was wrong and your account will be frozen. The margin is required at that time. Ask for money all along.

Unable to withdraw. Once they asked for 110,000 as margin for wrong bank card info. Once they asked for 150,000 for insufficient credit score

The initial transactions went smoothly, Then i wanted to withdraw money on my account, Usually withdrawals are processed within 30 minutes to 1 hour, but this time two weeks passed and nothing was process, By the way, i tried to contact customer support to handle everything but to no avail as my withdrawal request was not to be processed until i pay an international remittance certification fee, so a complaint was made to financialrecovery.tech and their activities helped me through to a refund. All the parameters on UGM SECURITIES LTD are fake. You will be cheated and more money will be lost. Please stay alert.

| Name | UGM Securities Ltd |

| Location | Nicosia, Cyprus |

| Founded Year | 2017 |

| Regulatory Authority | Cyprus Securities and Exchange Commission |

| Services | - Order Reception and Transmission of Orders |

| - Execution of Orders | |

| - Investment Advice | |

| - Safekeeping and Administration | |

| - Foreign Exchange | |

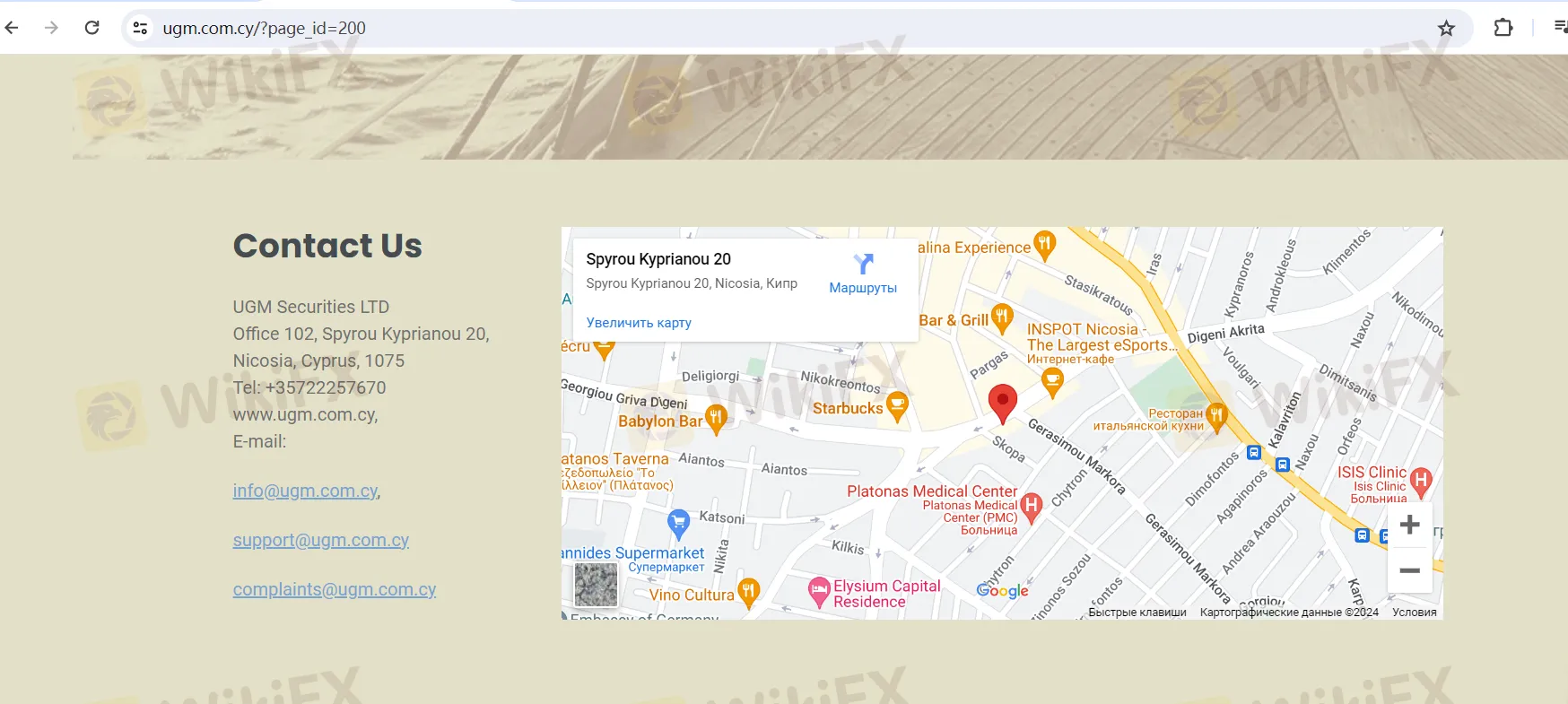

| Customer Support | - Telephone: +35722257670 |

| - Website: www.ugm.com.cy | |

| - General Inquiries Email: info@ugm.com.cy | |

| - Technical Support Email: support@ugm.com.cy | |

| - Complaints Email: complaints@ugm.com.cy |

UGM Securities Ltd, established in 2017 and based in Nicosia, Cyprus, operates under the regulatory oversight of the Cyprus Securities and Exchange Commission. The company offers a diverse range of financial services, including order reception and transmission, execution of orders, investment advice, safekeeping, and foreign exchange activities, catering to the needs of its clients in the financial markets. UGM Securities prides itself on maintaining a transparent fee structure. Additionally, the company places a strong emphasis on customer support, with multiple communication channels, including a dedicated telephone line and email addresses, to ensure accessible and responsive assistance for its clientele, fostering a seamless and satisfactory financial experience for its customers. Visit their website at www.ugm.com.cy for more information.

UGM Securities Ltd obtained its license from the Cyprus Securities and Exchange Commission on December 28, 2017, with the official license number 352/17. This regulatory approval signifies that the company is authorized to operate within the financial industry under the oversight and regulations set forth by the Cyprus Securities and Exchange Commission, ensuring compliance with the established standards and requirements for securities and investment activities in Cyprus.

| Pros | Cons |

| 1. Diverse Services: | 1. Fee Structure: The fee structure, while transparent, involves multiple charges, including commissions and fees for various services. |

| 2. Regulatory Approval: | |

| - Licensed by the Cyprus Securities and Exchange Commission, ensuring adherence to industry regulations and standards, instilling confidence in clients. |

UGM Securities Ltd offers a comprehensive range of financial services, including order execution, investment advice, safekeeping, and foreign exchange, catering to diverse client needs. However, the fee structure, although transparent, involves multiple charges, including commissions and fees for various services. On the positive side, the company is regulated by the Cyprus Securities and Exchange Commission, instilling confidence in clients due to its adherence to industry regulations and standards.

UGM Securities Ltd has been granted authorization by the Cyprus Securities and Exchange Commission to provide a wide array of investment and ancillary services in full compliance with regulatory standards. These services encompass:

Reception and Transmission of Orders: The company can receive orders from clients and then transmit these orders for trade execution, ensuring clients have access to a range of financial markets and instruments.

Execution of Orders: UGM Securities can directly execute orders on behalf of clients, including buy and sell orders for various financial instruments, such as stocks, bonds, and derivatives, following clients' instructions.

Investment Advice: The company is empowered to offer investment advice to clients, furnishing recommendations and insights on diverse investment opportunities and strategies to assist clients in making well-informed decisions.

Safekeeping and Administration: UGM Securities is authorized to provide secure safekeeping and administration services for financial instruments. This entails the meticulous management and secure storage of clients' assets, diligent record-keeping, and the facilitation of corporate actions.

Foreign Exchange: The firm is equipped to engage in foreign exchange (Forex) activities, enabling clients to engage in currency trading and participate in the global foreign exchange market. This service allows clients to manage currency risks or speculate on currency fluctuations.

In terms of financial instruments, UGM Securities Ltd can work with:

Transferable Securities: This category includes a broad spectrum of financial instruments, such as stocks, bonds, and other securities that are readily transferable and tradable in secondary markets.

Money Market Instruments: These are short-term debt securities known for their high liquidity, such as Treasury bills, commercial paper, and certificates of deposit, which UGM Securities can deal with.

Units in Collective Investments Undertakings: Clients can invest in collective investment schemes like mutual funds and exchange-traded funds (ETFs), purchasing units or shares in these funds, which combine investments to achieve diversification and professional management.

UGM Securities Ltd offers a comprehensive suite of investment and ancillary services, along with access to a wide variety of financial instruments, to cater to the diverse needs of its clients in the financial markets.

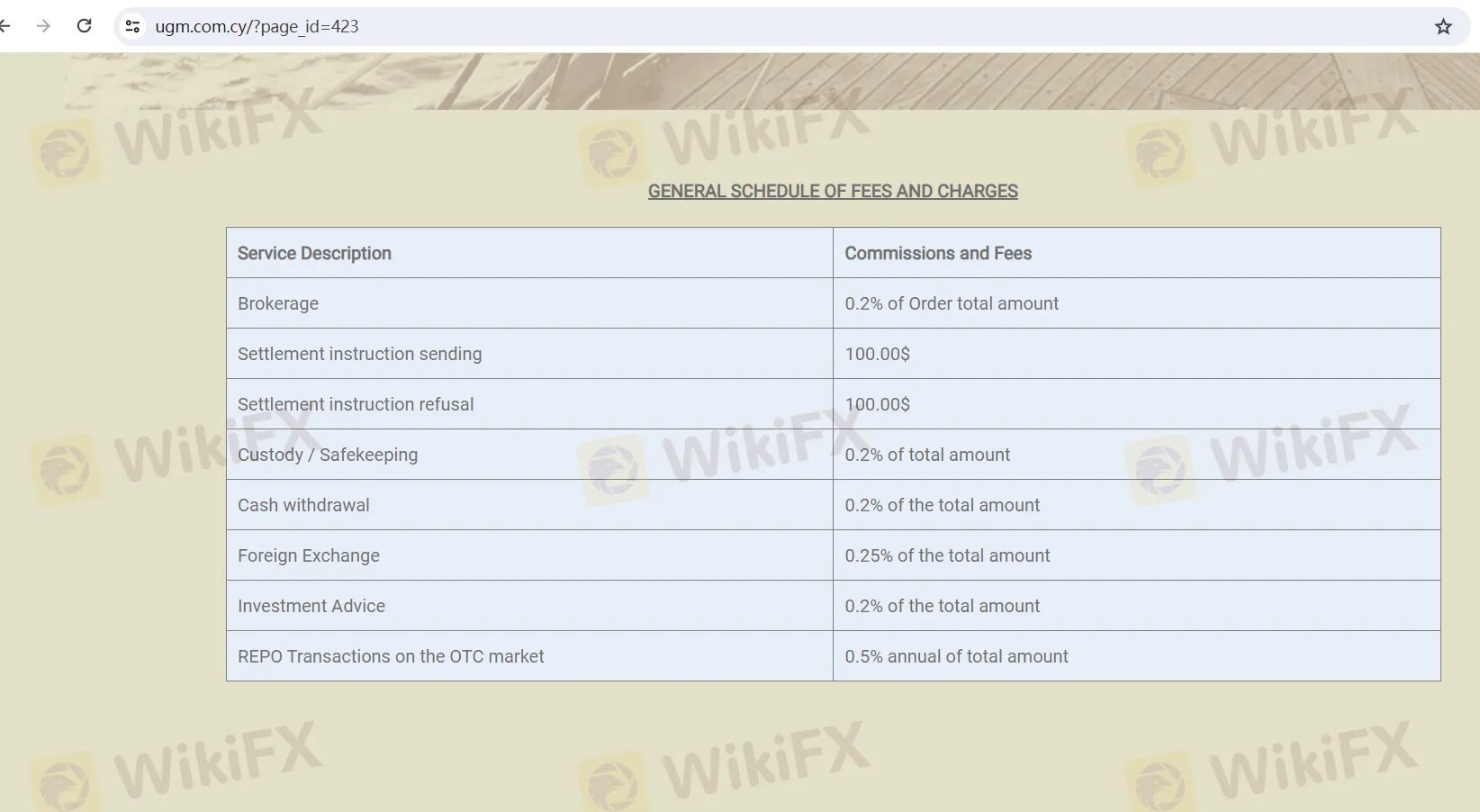

UGM Securities Ltd offers a comprehensive fee schedule for its range of financial services. These fees are designed to provide transparency and clarity to clients regarding the costs associated with various transactions and services.

Firstly, for brokerage services, the company charges a commission equal to 0.2% of the total amount of the order. Additionally, there is a fee of $100.00 for both sending and refusing settlement instructions, ensuring that clients are aware of the costs involved in these processes.

Furthermore, UGM Securities calculates the fee for custody and safekeeping as 0.2% of the total amount of assets being held. Cash withdrawals are subject to a fee of 0.2% of the total withdrawal amount. For foreign exchange services, the company charges a fee amounting to 0.25% of the total transaction value.

In addition to these charges, clients seeking investment advice will incur a fee equal to 0.2% of the total amount, reflecting the cost of expert guidance. Lastly, for REPO transactions on the OTC market, an annual fee of 0.5% of the total transaction amount is applicable.

To provide a practical example, consider a scenario where a client wishes to purchase 5 million ABC Eurobonds with a nominal value of $1.00 at a price of 126% of nominal, carrying a coupon rate of 3.875%. The trade is set to settle on T+2 (two days after order placement). The total value of this trade amounts to $6,300,000.00, with accrued interest on the settlement date calculated at $26,909.72.

For the brokerage fee calculation, a commission of 0.2% is applied to the total value ($6,300,000.00), resulting in a brokerage fee of $12,600. Additionally, an instruction commission fee of $100.00 is added, bringing the total brokerage fee to $12,700. Therefore, the total expense for this trade, including the total value, accrued interest, and brokerage fee, is $6,339,609.72.

Regarding the fee for safekeeping, the calculation is based on the quantity (5,000,000) multiplied by the nominal value ($1.00), resulting in a base of $5,000,000.00. The fee, determined at 0.002% per annum and adjusted for the number of days in a year and month, amounts to $833.33. This fee is payable if the securities remain in the custody account on the last business day of the month.

In summary, UGM Securities Ltd's fee schedule is designed to ensure transparency and to help clients understand the costs associated with the services they receive, promoting clarity and informed decision-making in their financial transactions.

UGM Securities LTD maintains a robust customer support system to assist clients with their inquiries and concerns. Located in Nicosia, Cyprus, the company offers multiple channels for communication, including a dedicated telephone line at +35722257670 and a user-friendly website at www.ugm.com.cy. Clients can also reach out via email, with dedicated addresses for general information atinfo@ugm.com.cy, technical support at support@ugm.com.cy, and handling complaints atcomplaints@ugm.com.cy. This comprehensive customer support infrastructure demonstrates UGM Securities' commitment to providing accessible and responsive assistance to its clientele, ensuring a seamless and satisfactory experience for its customers.

UGM Securities Ltd, a licensed financial firm regulated by the Cyprus Securities and Exchange Commission since December 2017, offers a wide range of investment and ancillary services, including order reception and execution, investment advice, safekeeping, foreign exchange, and more, catering to the diverse needs of its clients in the financial markets. The company maintains a transparent fee structure, with charges based on percentages and flat fees for various services. With a commitment to customer support, UGM Securities ensures accessibility through multiple communication channels, including telephone and email, to address client inquiries and concerns promptly. This comprehensive approach underscores the company's dedication to providing a seamless and satisfactory financial experience for its clientele.

Q1: What is UGM Securities Ltd's license number and regulatory authority?

A1: UGM Securities Ltd is licensed by the Cyprus Securities and Exchange Commission with license number 352/17.

Q2: What services does UGM Securities offer?

A2: UGM Securities provides a range of services, including order reception and execution, investment advice, safekeeping, foreign exchange, and more.

Q3: How are brokerage fees calculated?

A3: Brokerage fees are calculated as 0.2% of the total order amount, with additional charges for settlement instructions.

Q4: What types of financial instruments can clients trade through UGM Securities?

A4: Clients can trade transferable securities, money market instruments, and units in collective investment undertakings, among others.

Q5: How can clients contact UGM Securities for assistance?

A5: Clients can reach UGM Securities through a dedicated telephone line at +35722257670 or via email at info@ugm.com.cy for general inquiries, support@ugm.com.cy for technical assistance, and complaints@ugm.com.cy for handling complaints.

More

User comment

1

CommentsWrite a review

2024-01-09 18:11

2024-01-09 18:11