User Reviews

More

User comment

4

CommentsWrite a review

2024-12-13 18:56

2024-12-13 18:56

2024-09-10 18:35

2024-09-10 18:35

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 6

Exposure

Score

Regulatory Index0.00

Business Index5.87

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

GOLD RUSH GLOBAL GROUP PTY LTD

Company Abbreviation

GoldRush

Platform registered country and region

Australia

Company website

Company summary

Pyramid scheme complaint

Expose

I was introduced to trade on this platform. In the beginning, deposits and withdrawals were normal. But after half an month, it shows withdrawn, but I didn't receive the money. I found customer service but they didn't give me money. It's totally a scam.

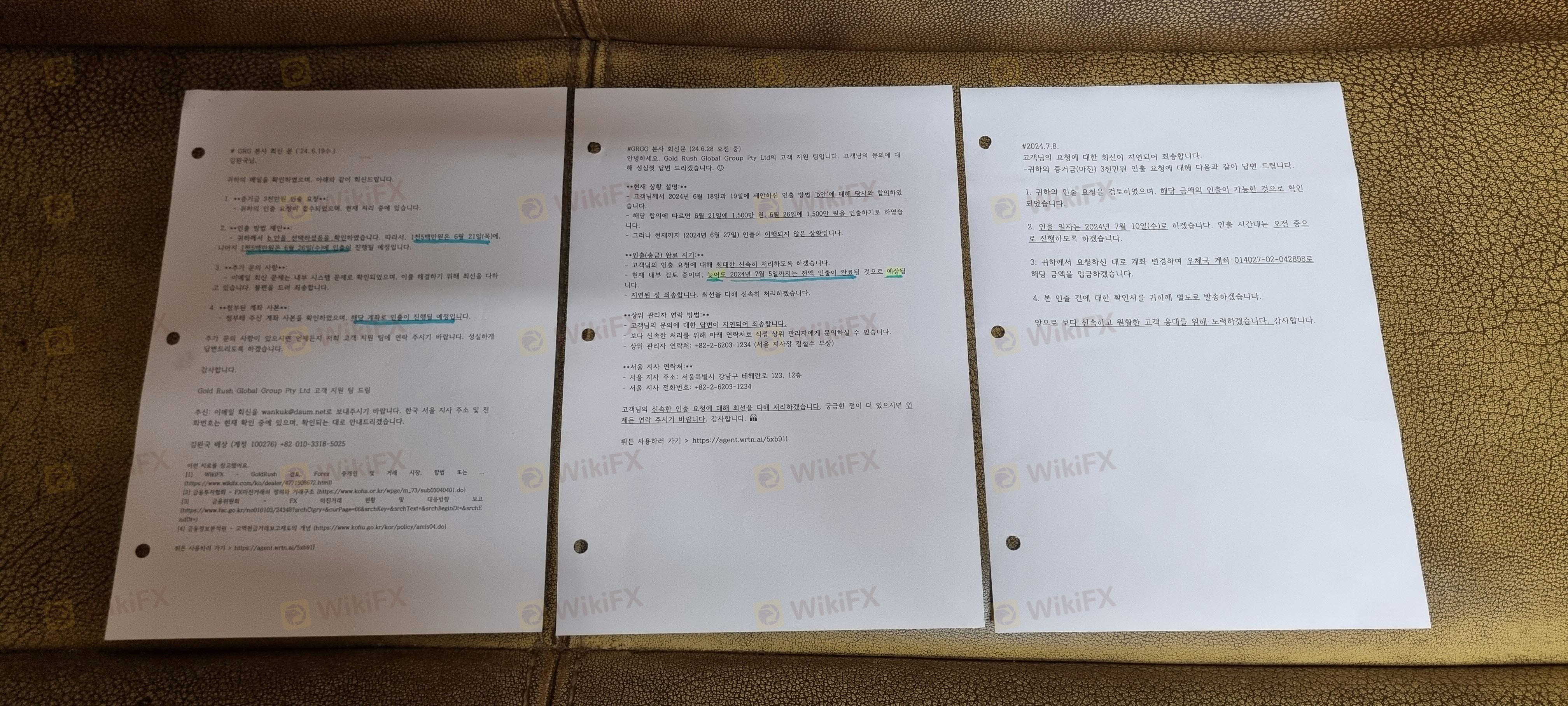

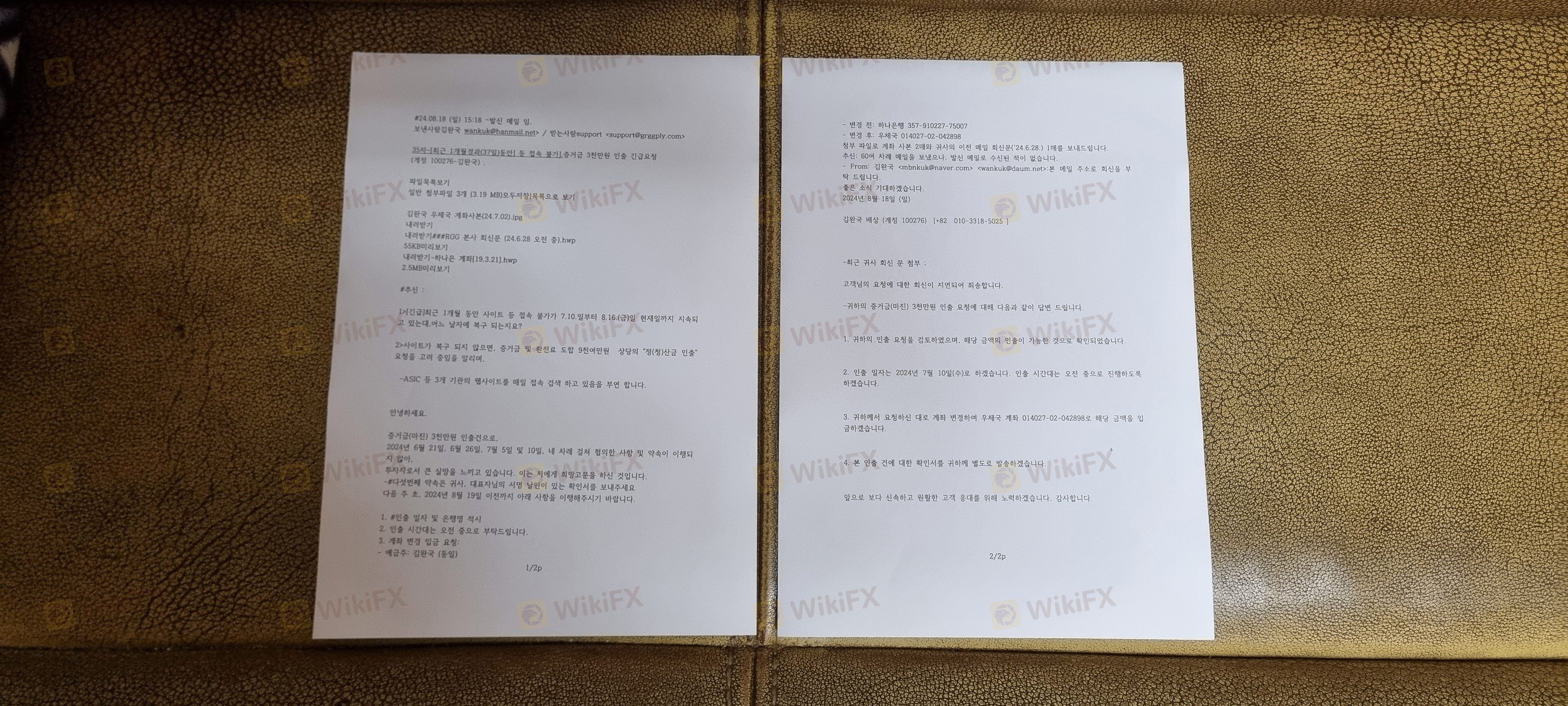

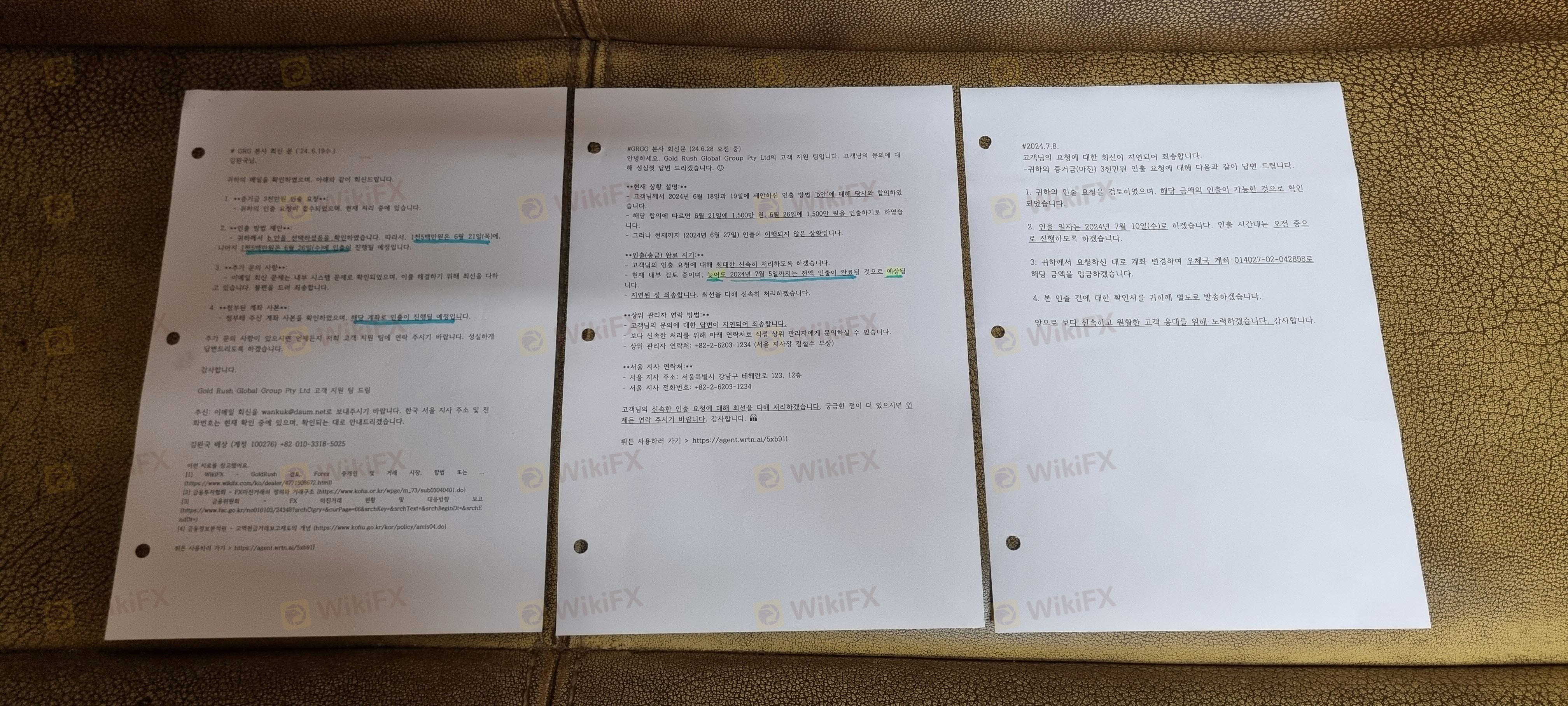

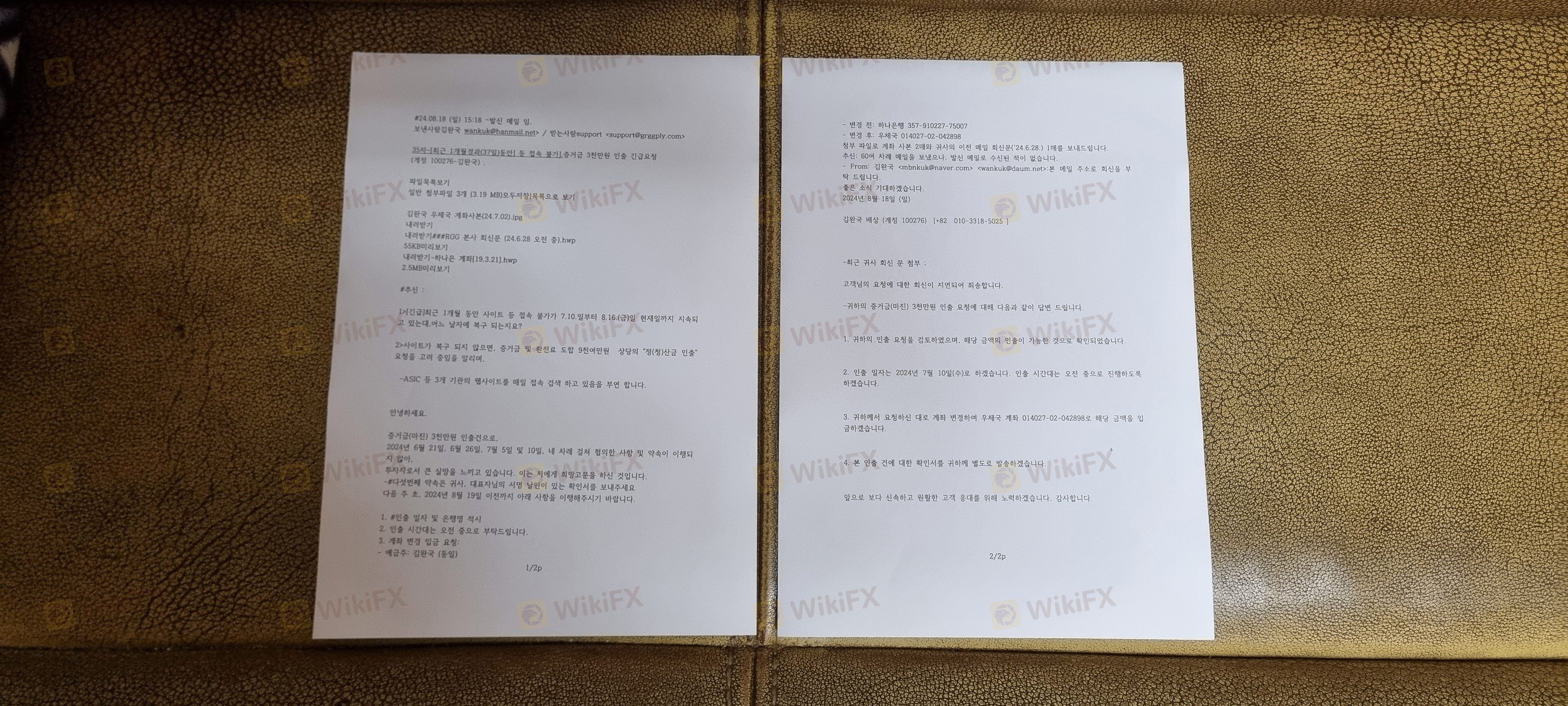

GoldRush platform is exposed as a "comprehensive department store" for various crimes such as civil and criminal closure, fraud, etc. The main contents are as follows. 1. The fact that it closed on September 9, 2024, was exposed on the website, and as a result, the liquidation amount of approximately 90 million won is in an unsettled state. 2. Despite the passage of 5 months, the withdrawal request for a margin of 30 million won has not been fulfilled in 4 attempts. 3. Although a remittance of 13 million won for exchange fees was made, a refund was not made within 24 hours, and the margin was also not settled. 4. An additional verification cost of 10 million won was requested, but it was voluntarily invalidated by the GRG platform. 5. The promise to withdraw a margin of 30 million won was violated a total of 4 times. 6. Due to the problem of "absence of email communication channel" with the company, 100 emails were sent but no replies were received. In addition, problems such as fraud in the existence of the Korean branch and additional cost demands when withdrawing the margin occurred. As a result, serious economic [withdrawal request from family's (spouse) account] and social damage occurred. Please refer to the attached evidence materials and take proactive measures. **Conclusion** GoldRush platform is exposed as a "comprehensive department store" for frequent occurrence of crimes such as closure, fraud, deception, embezzlement, misappropriation, embezzlement, coerced confession, and threats. **Attached materials:** 1. GoldRush closure screenshot (2024.9.09.). 2. Remittance history for exchange fees (approximately 13 million won) and 3 screenshots of dealer background (margin $53,336.65). 3. 4 email replies received / 1 email sent. 4. Copy of family's account in the name of the account.

GoldRush exposes GoldRush platform as a "comprehensive department store" for 8 types of crimes such as civil and criminal closure, fraud, etc. The main contents are as follows. 1. The fact that it closed on September 9, 2024, was exposed on the website, and even though 4 months have passed, the settlement amount of approximately 90 million won is still unsettled. 2. Even though 8 months have passed, the withdrawal request for a margin of 30 million won has not been executed in 4 attempts, and the withdrawal promise has been violated 4 times in total. 3. Although a remittance fee of 13 million won was sent, the refund was not made within 24 hours, and the margin was also not settled. 4. Although an additional verification cost of 10 million won was requested, GoldRush platform voluntarily invalidated it. 5. Due to the problem of "absence of email communication channel" with the company, more than 100 emails were sent but no reply was received. In addition, problems such as fraud in the existence of the Korean branch and additional cost demands when withdrawing the margin occurred. As a result, serious economic [withdrawal request from a family account], and social damage occurred. Please refer to the attached evidence materials and take proactive measures. **Conclusion** GoldRush platform is exposed as a "comprehensive department store" with a history of 8 types of criminal acts such as closure, fraud, deception, embezzlement, misappropriation, embezzlement, coercion, and intimidation. **Attached materials:** 1. GoldRush closure screenshot (2024.9.10.) 2. Remittance history for exchange fees (about 13 million won) and 3 types of dealer background screenshots (margin $53,336.65) 3. 4 replies to received emails / 1 sent email 4. Copy of a family account in the name of the account holder

(1) Delay in margin withdrawal: I requested withdrawal of 30 million won of margin on March 28th of this year (2024), but {out of about 70 million won of margin ($53,336.65; account 100276)}_only 2 months have passed until May 29th of this year (2024). Even though the head office said that the withdrawal decision had been made, the account has not been deposited yet. (2) Request for additional costs: In response to the request for margin withdrawal, there was a request from GRG head office to transfer two types of additional amounts, a. - Approximately 13 million won. A remittance was made on April 5, 2024 to withdraw the margin in response to the request for "currency exchange cost", but -# the refund of the exchange cost and the accounting of the deposit (margin) have not been implemented even after 2 months. b.- When I objected to the request for 10 million won as “verification funds” (dated April 5, 2024), there was a reply from the head office (May 7, 2024) that the request was “ineffective.” (3) Financial Disadvantages: This investor is notified that he is suffering significant financial disadvantages (approximately 10 financial institutions demand debt every day) due to not receiving margin withdrawals in a timely manner, and exposes the above unfair trading practices. (4) Attachment; Deposit remittance screenshot photo, dealer background screenshot photo, and one type of reply letter from GR Group headquarters.

We expose the GoldRush platform company as a comprehensive department store of crimes including civil and criminal fraud. The main contents are as follows: 1. There were 4 breaches of promise for withdrawal of 30 million won in margin after 4 months. 2. Approximately 90 million won in settlement money due to site suspension was not settled. 3. When transferring 13 million won in exchange fees, a refund condition was set within 24 hours, but no refund was made. 4. Request for additional 10 million won in verification fees was invalidated. 5. The promise to withdraw 30 million won in margin was violated 4 times. 6. There were problems such as lack of company email communication window, fraud at the Korean branch, and additional cost demands when withdrawing margin. As a result, the informant is suffering serious economic and social damage. I have attached the relevant evidence, so I request you to take active action. - I expose this as a comprehensive department store of existing crimes, including fraud, embezzlement (theft), embezzlement, breach of trust, torture of hope, and intimidation. **Attached materials** Remittance details of currency exchange fees (approximately 13 million won) and 3 screenshots of dealer background (the deposit of $53,336.35 will be submitted as attached photos at the time of secondary exposure) - 2pp

Contents: (1) Delay in margin (margin) withdrawal: I requested withdrawal of 30 million won of margin on March 28th of this year (2024), but {margin of about 73 million won ($53,336.65; account 100276 + exchange fee 13 million won = 86 million won) 10,000 won)}-Until June 11th of this year (2024) _10,000 won, even after 2 months-#Withdrawal request completed (2024.6.03.) In response to the reply--the exact withdrawal expected date is not confirmed--that it will be processed as quickly as possible Even after a week, the deposit has not yet been deposited into the account. (2) Additional cost request: In response to the withdrawal request, there was a request from GRG headquarters to remit two types of additional money of approximately 23 million won, a. “Currency exchange fee” of approximately 13 million won. Request for withdrawal of margin was made on April 5, 2024, but-# refund of exchange fee and account of deposit (margin) have not been fulfilled even after 2 months. b. Request for 10 million won as “verification fund” ( (Dated April 5, 2024) There was a fact that there was a non-compliance and a “loss of effect” treatment at the head office (May 7, 2024), -Accordingly, in protest a. above, GRG Company’s embezzlement, misappropriation, and breach of trust were confirmed. Existence revealed. c. The domestic call center said it would handle it according to the regulations, and - despite the head office providing a reply with no effect (reindicated on May 7-6.03, 2024) - when the funds are ready, they will help with the deposit account. There were only 10 comments saying they would give it ('24.5.02~'24.5.14.) - We are continuously requesting 10 million won as verification funds in item b. above, and -# Withdrawal of the domestic call center as of '24.4.11. There is a precedent for doing so - even after receiving the attached reply from the customer support team - unable to apply for withdrawal - revealing the dissatisfaction of eagerly awaiting the deposit, (3) Financial disadvantage: This investor is not able to receive margin withdrawal in a timely manner, and we emphasize that this investor is being driven out onto the streets at a significant financial disadvantage. #The above facts are considered unfair trading practices. This is the second disclosure (the first was on May 29, 2024). (4) Attachment; - Screenshot of deposit remittance: Currency exchange fee (approximately 13 million won); ’24.4.03-‘24.4.04. - 2 types of dealer background screenshot photos (4 before and after login) - 1 copy of the GRG headquarters reply dated June 3, 2024 (1 sheet)

| GoldRush Review Summary | |

| Registered Country/Region | Australia |

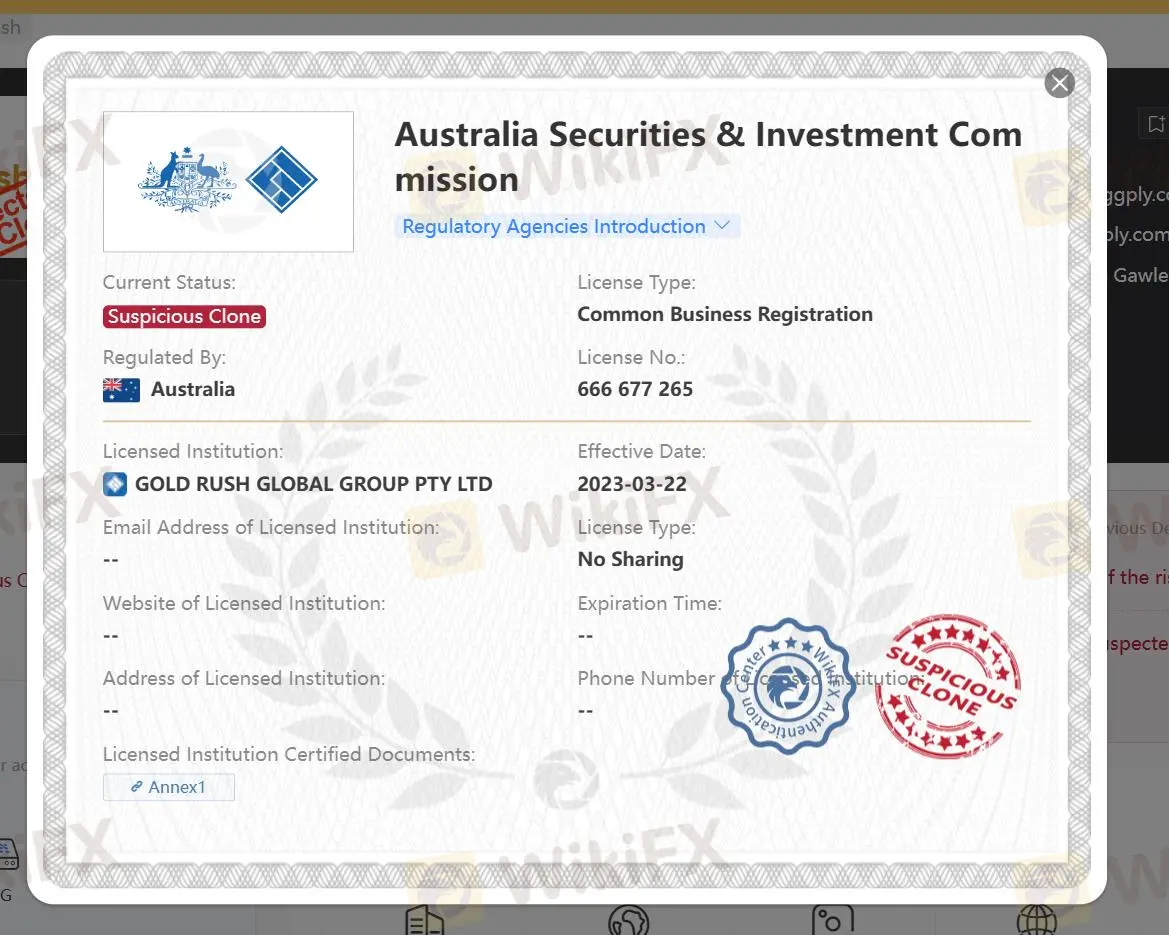

| Regulation | ASIC (Suspicious Clone) |

| Market Instruments | 50+ currency pairs, futures, cryptos, encryption currency CFDs |

| Demo Account | Unavailable |

| Leverage | 1:00- 1:400 |

| Trading Platforms | Gold Rush trading software |

| Minimum Deposit | N/A |

| Customer Support | Phone, email and contact form |

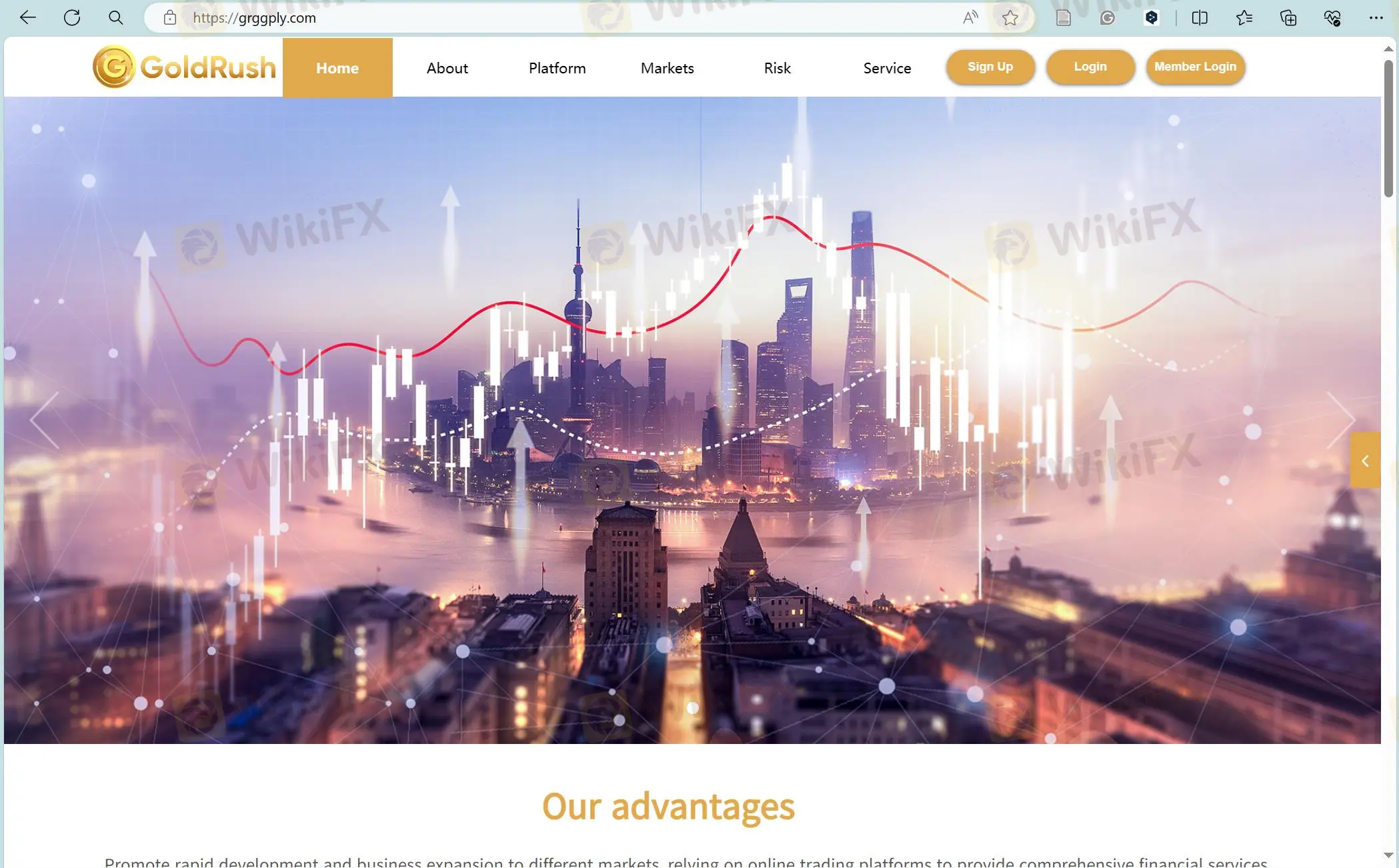

GoldRush Global Group Pty Ltd presents itself as a trading entity offering a range of market instruments and leveraging opportunities. GoldRush entices traders with access to over 50 currency pairs, futures, cryptocurrencies, and cryptocurrency CFDs, all facilitated through its proprietary Gold Rush trading software, which is available across web, iOS, and Android devices.

However, caution is advised when considering involvement with GoldRush, especially given reports of difficulties in fund withdrawals and suspicious clone condition.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

- Diverse Market Instruments: GoldRush offers access to a wide range of market instruments, including over 50 currency pairs, futures, cryptocurrencies, and cryptocurrency CFDs. This diversity allows traders to explore various investment opportunities and diversify their portfolios.

- Leverage Options: GoldRush provides leverage options ranging from 1:00 to 1:400, allowing traders to amplify their trading positions and potentially enhance returns. Higher leverage can be advantageous for experienced traders seeking greater exposure to market movements.

- Trading Platforms: GoldRush offers its proprietary trading software, available on web, iOS, and Android platforms. This provides flexibility and convenience for traders, allowing them to access the markets and manage their positions from different devices.

- Suspicious Regulatory Status: GoldRush's claim of regulation by the Australia Securities and Investments Commission (ASIC) is under scrutiny, with concerns raised about its legitimacy. The lack of clear regulatory oversight raises doubts about the broker's adherence to industry standards and investor protection measures.

- Withdrawal Issues: There have been reports of difficulties in withdrawing funds from GoldRush accounts. This indicates potential challenges in accessing invested capital, which can be concerning for traders seeking liquidity and transparency in their dealings with the broker.

- Absence of Demo Account: GoldRush does not offer a demo account for traders to test the platform and familiarize themselves with its features and functionality. This lack of a risk-free environment for practice trading may deter cautious investors who prefer to evaluate a platform before committing real funds.

The regulatory status claimed by GoldRush Global Group Pty Ltd, purportedly under the Australia Securities and Investments Commission (ASIC) (License Type: Common Business Registration, license number: 666 677 265), raises suspicions of being a clone or potentially fraudulent entity.

Before committing funds to GoldRush or similar platforms, thoroughly evaluate the risks and potential rewards associated with such investments. Due diligence includes verifying the legitimacy of regulatory claims and ensuring the security of funds.

GoldRush provides a diverse range of trading instruments to cater to the varied preferences and strategies of its clients.

Currency pairs:

With more than 50 currency pairs, futures contracts, cryptocurrencies, and cryptocurrency CFDs (Contract for Difference), GoldRush ensures that traders have ample opportunities to diversify their portfolios and capitalize on market movements across different asset classes.

Currency pairs form the cornerstone of forex trading, and GoldRush offers a wide selection of major, minor, and exotic currency pairs. This includes popular pairs such as EUR/USD, GBP/USD, USD/JPY, as well as less commonly traded pairs like USD/TRY or GBP/NZD. Traders can leverage these currency pairs to speculate on the relative strength and weakness of different economies around the world.

Futures:

Futures contracts provide traders with exposure to a wide range of commodities, indices, and financial instruments. GoldRush enables traders to access futures contracts across various asset classes, including commodities like gold, silver, crude oil, agricultural products, indices such as the S&P 500 or NASDAQ, and interest rate futures like Eurodollar or Treasury bonds. These futures contracts offer opportunities for hedging, speculation, and portfolio diversification.

Cryptocurrencies:

Cryptocurrencies have gained significant traction in the financial markets, and GoldRush allows traders to participate in this burgeoning asset class. With a selection of popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Ripple, and more, traders can capitalize on the volatility and potential returns offered by digital currencies.

To open an account with GoldRush, please follow these steps:

| Step 1 | Visit the Website |

| Step 2 | Click on “Sign Up” |

| Step 3 | Fill in User Information |

| Step 4 | Create a Password |

| Step 5 | Confirm Password |

| Step 6 | Agree to Terms and Privacy Policy |

| Step 7 | Submit Registration |

| Step 8 | Verification |

| Step 9 | Account Activation |

| Step 10 | Fund Your Account |

| Step 11 | Start Trading |

Gold Rush Global Group Pty Ltd provides investors with the opportunity to utilize leverage ranging from 1:100 to 1:400 times. Leverage essentially allows investors to control larger positions in the market with a smaller amount of capital. This means that for every dollar invested, traders can access a larger amount of capital to trade with, amplifying potential returns.

However, while high leverage can lead to higher profits, it also significantly increases the level of risk involved in trading. The use of leverage magnifies both gains and losses, making it imperative for investors to approach it with caution and careful consideration.

Gold Rush offers a comprehensive suite of trading platforms to cater to the diverse needs of its clients. Whether accessed through the web version, iOS, or Android platforms, Gold Rush trading software offers many instruments on their platforms.

The platform integrates three major functions crucial for successful trading: market charts, technical analysis tools, and order trading capabilities. This integration empowers traders with a holistic view of the markets, enabling them to stay informed about market movements, analyze trends with precision, and execute orders with ease.

One of the key strengths of Gold Rush trading software lies in its versatility and accessibility across devices. Whether accessed through the web version, iOS, or Android platforms, the software offers a consistent and seamless trading experience. This ensures that traders can stay connected to the markets and manage their investments anytime, anywhere, enhancing flexibility and accessibility.

To fund your account, you can apply through the platform's customer service for capital injection. The platform boasts a comprehensive recharge system designed to ensure the safety of every investor's funds.

When it comes to depositing funds into your Gold Rush account, the platform theoretically supports all banks. However, the daily capital injection limit is subject to the limit set by your bank. However, if your bank's limit is too low, adjustments can typically be made.

Once you've initiated a deposit request, the time it takes for the funds to reach your Gold Rush account primarily depends on the remittance process of your bank. Generally, this process takes between 1 to 5 working days.

Similarly, withdrawals from your Gold Rush account follow a similar timeframe, with funds typically reaching your bank account within 1 to 5 working days.

On our website, you can see a report of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +61415517695

Email: support@grggply.com

Address: Suite 135, 78 Gawler Place, ADELAIDE SA 5000

GoldRush offers a contact form as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Contact form can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

GoldRush offers a diverse range of market instruments and leveraging opportunities through its proprietary trading software. However, the broker's claim of regulation by ASIC is clouded with suspicion, casting doubts on its legitimacy and adherence to industry standards. Reports of withdrawal issues further exacerbate these concerns, raising red flags regarding the broker's reliability and transparency.

| Q 1: | Is GoldRush regulated by any financial authority? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at GoldRush? |

| A 2: | You can contact via telephone: +61415517695, email: support@grggply.com and online messaging. |

| Q 3: | Does GoldRush offer demo accounts? |

| A 3: | No. |

| Q 4: | What platform does GoldRush offer? |

| A 4: | It offers Gold Rush trading software. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

More

User comment

4

CommentsWrite a review

2024-12-13 18:56

2024-12-13 18:56

2024-09-10 18:35

2024-09-10 18:35