User Reviews

More

User comment

2

CommentsWrite a review

2022-11-25 19:09

2022-11-25 19:09

2022-11-23 10:49

2022-11-23 10:49

Score

Above 20 years

Above 20 yearsRegulated in Cyprus

Forex Execution License (STP)

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 8

Exposure

Score

Regulatory Index5.50

Business Index8.00

Risk Management Index0.00

Software Index4.95

License Index5.50

Single Core

1G

40G

More

Company Name

Argus Stockbrokers Ltd

Company Abbreviation

ARGUS

Platform registered country and region

Cyprus

Company website

Company summary

Pyramid scheme complaint

Expose

Ask the company to refund

ARGUS DON'T REPLY /ANSWER ALL MY REPORTS AND CLAIM ON WEB SITE ARGUS STOCKS BROKERS LTD

Fraud platform, romance scam, change customer information and card number for withdrawal. I check the card number for three times to make sure that it is correct, but it changed during withdrawal. Then, they ask you to pay the margin and freeze the fund to not let you withdraw. Trap!

According to the invitation from the broker of ARGUS Compny, I borrowed $32000 to invest in ARGUS.. fortunately I have a profit of $399168.10 plus capital is $425368.10 ,,, This is the current account in my account. After the brokerage transaction, nt told me to withdraw immediately, or not so long, the system will report an error and will lock the account (??) after following the withdrawal instructions, htt reported DONE because not yet. deposit 15% Personal income tax (????) brokerage system nt deposit 15% tax $USD 59,875.00 EQUAL 1 billion 437,000,000 into personal account or separate company account of broker before exotic instead...ARGUS FAMOUS STOCKS COMPANY didn't do that... Now I'm CALLING .. ASKING ARGUS COMPANY INTEREST OR DIRECTLY REFUND FULL AMOUNT THAT I HAVE IN AN ACCOUNT

They do not withdraw due to wrong bank card number and ask for 15% margin

Demanding for 15% margin due to wrong card number. Otherwise, they will not withdraw and lock the account.

I was among the victims of this scheme, guided to invest in argus by a taiwanese woman who romantically deceived me and instructed me through the process of trading and investing. It was within this period i discovered fintrack .org and made out a complaint because Argus wouldn't allow withdraw, they restored my withdrawal access within weeks

Today is May,27th,2022 ... the Board of Directors not Blinders neither Deaf peoples .....[Two more weeks May 19th ****Another Month] for waiting my money back , SAD... MAY5th,2022War went worst . I dont push U ..Dear ARGUS COMPANY ..Today is April4,2022.. The war may made YOU really busy ..But I have to remind YOU TRY to Payback all my money as fast as like You PUSH me deposit Thanks ...... …BEST WISHES TO ARGUS STOCKSBROKERS ( AnDri Tringidou & CHRISTOS AKKELIDES ) and HAPPY BD My Love DẠ THẢO PHƯƠNG .. Proud of people of Cyprus .. BE STRONGER ..APRIL20.2022 TODAY is April21st-2022 .... ( WHERE's Christoforos ANTONIADES -Executor )???? WHO WILL BE ANSWER ALL MY THESE QUESTIONS ... which I complainted from the day company block and do not pay back all my money I have in ARGUS StocksBrokers LTD ACCOUNT ... PLEASE DONOT LET MY QUESTIONS GONE WITH THE WINDS OR THROWED THEM IN UR GARBAGE CANS ...WAIT FOR THE ANSWERS OF ARGUS's BOARD OF DIRECTORS …ARGUS still no answer after scamming… So I thought they try to rob/ steal all my money

| ARGUS Review Summary | |

| Founded | 2000 |

| Registered Country/Region | Cyprus |

| Regulation | Regulated by CYSEC |

| Services | Asset Management, Global Brokerage, Investment Advice, Corporate Finance & Consulting |

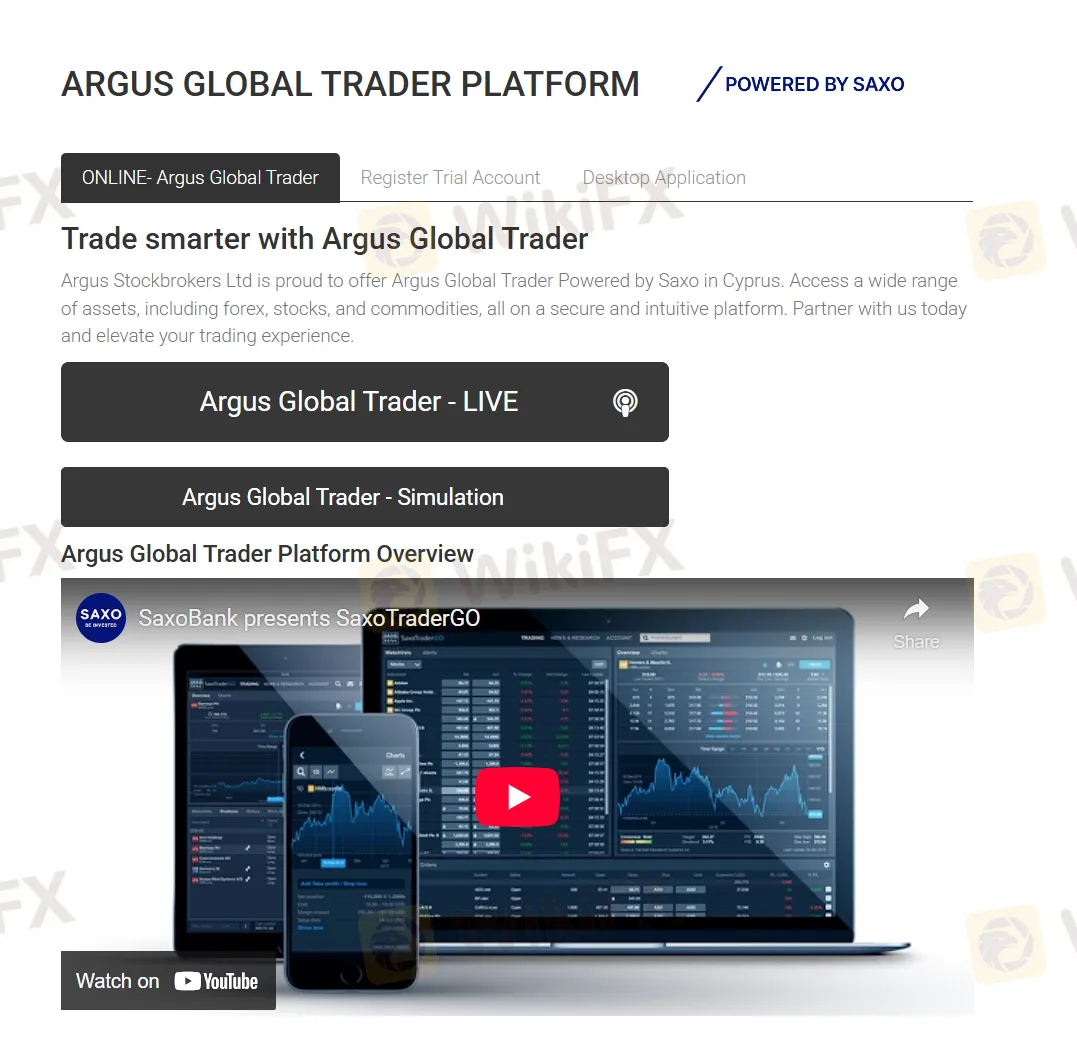

| Trading Platform | ARGUS Trader, Argus Global |

| Customer Support | Tel: +357 22 717000 |

| Fax: +357 22 717070 | |

| Email: argus@argus.com.cy | |

| Address: 25 Demosthenis Severis Ave., 1st & 2nd Floor, 1080 Nicosia, Cyprus; P.O. Box 24863, 1304 Nicosia, Cyprus. | |

Founded in 2000, ARGUS offers financial services including asset manageemnt, globla brokerage, investment advice, corporate finance and consulting.

The good thing is that the company is well regulated by CYSEC, which means is financial activities are strictly watched by the authority body, to some extent guarantees a certain level of customer protection.

| Pros | Cons |

| Many years' experience in the industry | / |

| CYSEC regulated | |

| Variety of financial services offered | |

| Multiple contact channels |

ARGUS is currently being well regulated by CYSEC (Cyprus Securities and Exchange Commission) with license no. 010/03. The regulation is authorized in 17 other countries, which expand your reassurance to trade with this company.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| CYSEC | Regulated | Argus Stockbrokers Ltd | Straight Through Processing (STP) | 010/03 |

Argus offers a comprehensive range of financial services, including independent asset management, global trading brokerage via the ARGUS Global Trader Platform, licensed brokerage on the Cyprus and Athens Stock Exchanges, corporate finance solutions for IPOs and M&A, discretionary fund management, and tailored investment advisory across various asset classes such as equities, bonds, and alternatives.

Argus Stockbrokers Ltd offers two trading platforms:

More

User comment

2

CommentsWrite a review

2022-11-25 19:09

2022-11-25 19:09

2022-11-23 10:49

2022-11-23 10:49