User Reviews

More

User comment

1

CommentsWrite a review

2023-03-06 12:02

2023-03-06 12:02

Score

5-10 years

5-10 yearsSuspicious Regulatory License

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.41

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

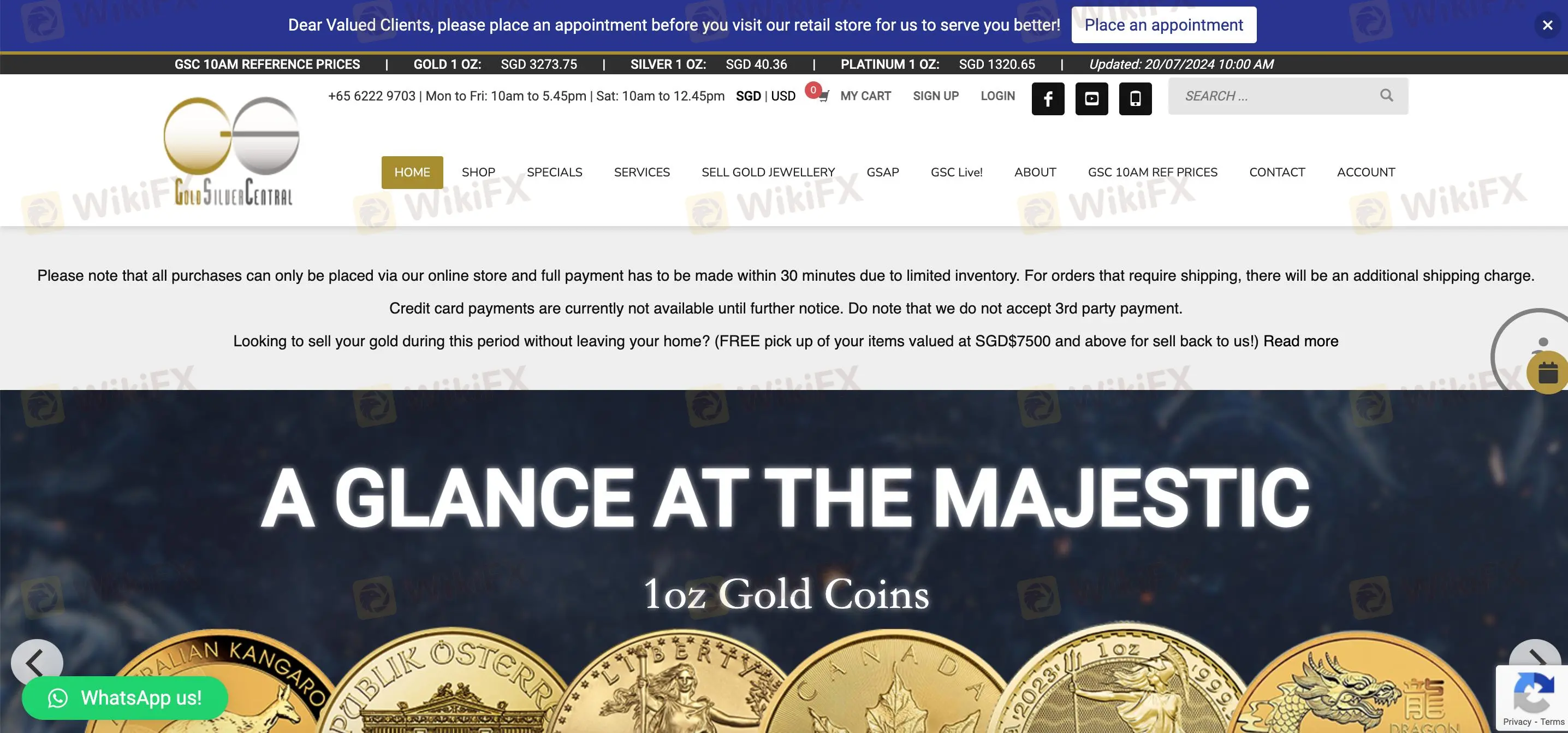

GoldSilver Central Pte Ltd

Company Abbreviation

GoldSilver Central

Platform registered country and region

Singapore

Company website

X

YouTube

658893 9255

Company summary

Pyramid scheme complaint

Expose

| Aspect | Details |

| Company Name | GoldSilver Central |

| Registered Country/Area | Singapore |

| Founded Year | 5-10 years ago |

| Regulation | Unregulated |

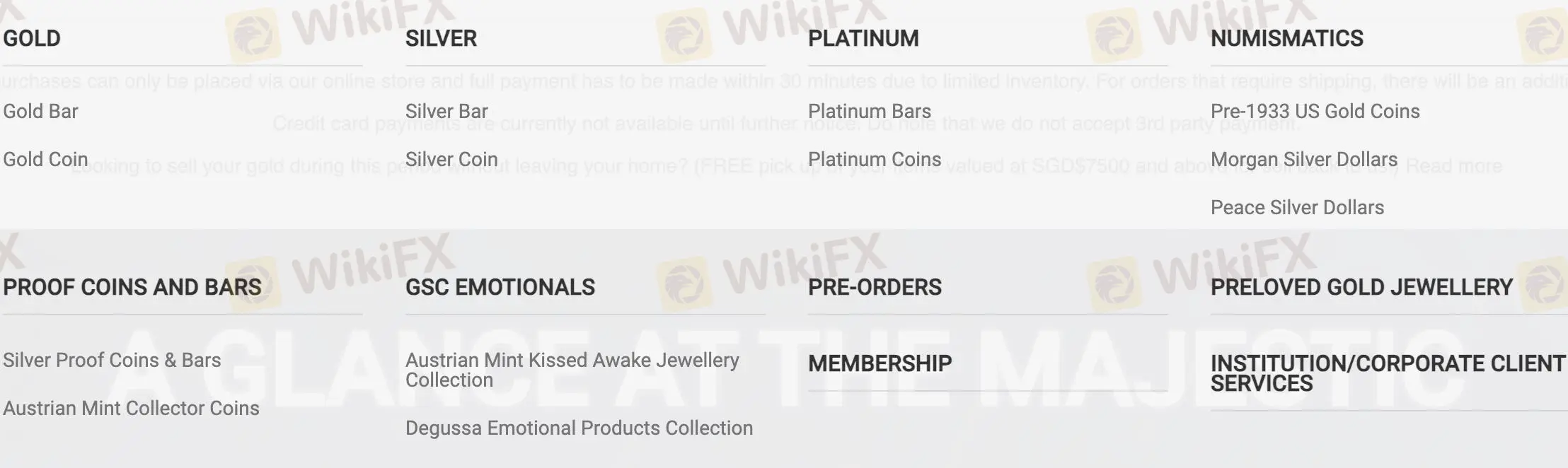

| Market Instruments | Gold, Silver, Platinum, Numismatic Coins, Collectibles |

| Fees | 0.25% trading fee for buying and selling |

| Customer Support | Phone at +65 6222 9703, WhatsApp at +65 8893 9255, fax at +65 6750 4513, or email at enquiry@goldsilvercentral.com.sg |

| Deposit & Withdrawal | Cash, Internet Banking, PayNow, NETS, Telegraphic Transfer, Personal and Cashier's Cheque |

| Educational Resources | Simple FAQ, User Guide |

GoldSilver Central, founded 5-10 years ago and located in Singapore, specializes in trading precious metals such as gold, silver, and platinum.

The platform operates without regulatory oversight. Users can trade with a low fee of 0.25% for both buying and selling, and face high distributor fees of 3% for smaller transactions.

Payment methods include cash, internet banking, PayNow, NETS, telegraphic transfer, and cheques. Customer support is accessible via phone, WhatsApp, fax, and email.

GoldSilver Central operates without regulatory oversight, meaning it is not monitored by any official financial authority. This lack of regulation can lead to higher risks for investors, as there is no guarantee of protection or adherence to industry standards.

| Pros | Cons |

| Low trading fees (0.25% per transaction) | Unregulated |

| Various payment methods | High distributor's fees for small trades (3%) |

| No storage fees for unallocated gold and platinum | Limited range of trading assets |

| Various customer support channels | Basic educational resources only |

Pros

Cons

GoldSilver Central focuses on precious metal trading.

Their offerings include 514 different gold products and 343 silver products. Platinum is represented by 53 products, while the platform also features 38 items under the GSC Emotionals category and 63 proof coins and collectibles.

GoldSilver Central charges various fees for trading and storing precious metals.

The Trading Fees for both buying and selling are set at 0.25% of the transacted amount.

The Distributor's Fees for buying range from 3.00% for transactions between USD 5,000.00 to USD 9,999.99, down to 2.00% for amounts of USD 100,000.00 and above.

For selling, the Distributor's Fee is 3.00% for transactions between USD 5,000.00 to USD 9,999.99, with a flat rate of 1.0% for all amounts.

Compared to popular brokers, GoldSilver Central's trading fees of 0.25% are relatively standard, but the distributor fees, particularly for lower transaction amounts, are higher. For example, many brokers typically charge lower percentages or flat fees for larger transactions, making GoldSilver Central's fees more suitable for smaller, frequent traders rather than large, high-volume investors.

Additionally, there is a Certificate Fee of USD 50.00 and Storage Fees for pooled allocated silver at 0.95%. Gold and platinum have no storage fees for unallocated accounts.

GoldSilver Central offers various payment methods for customer convenience. You can make Cash Payments in SGD at their retail store or upon order collection. For online purchases, an advance payment of 20% is required to lock in the order, with the balance payable within five business days. Internet Banking and PayNow provide electronic transfer options, while NETS allows direct debit transactions. Telegraphic Transfer is available for international payments. Personal and Cashier's Cheques are also accepted.

For online orders, GoldSilver Central requires a minimum deposit of 20% of the total purchase amount to secure the order.

GoldSilver Central offers customer support through various channels.

Customers can reach them by phone at +65 6222 9703, WhatsApp at +65 8893 9255, fax at +65 6750 4513, or email at enquiry@goldsilvercentral.com.sg.

For payment and accounts matters, contact accounts@goldsilvercentral.com.sg.

Operating hours are Monday to Friday, 10am to 5.45pm, and Saturday, 10am to 12.45pm. They are closed on Sundays and Public Holidays.

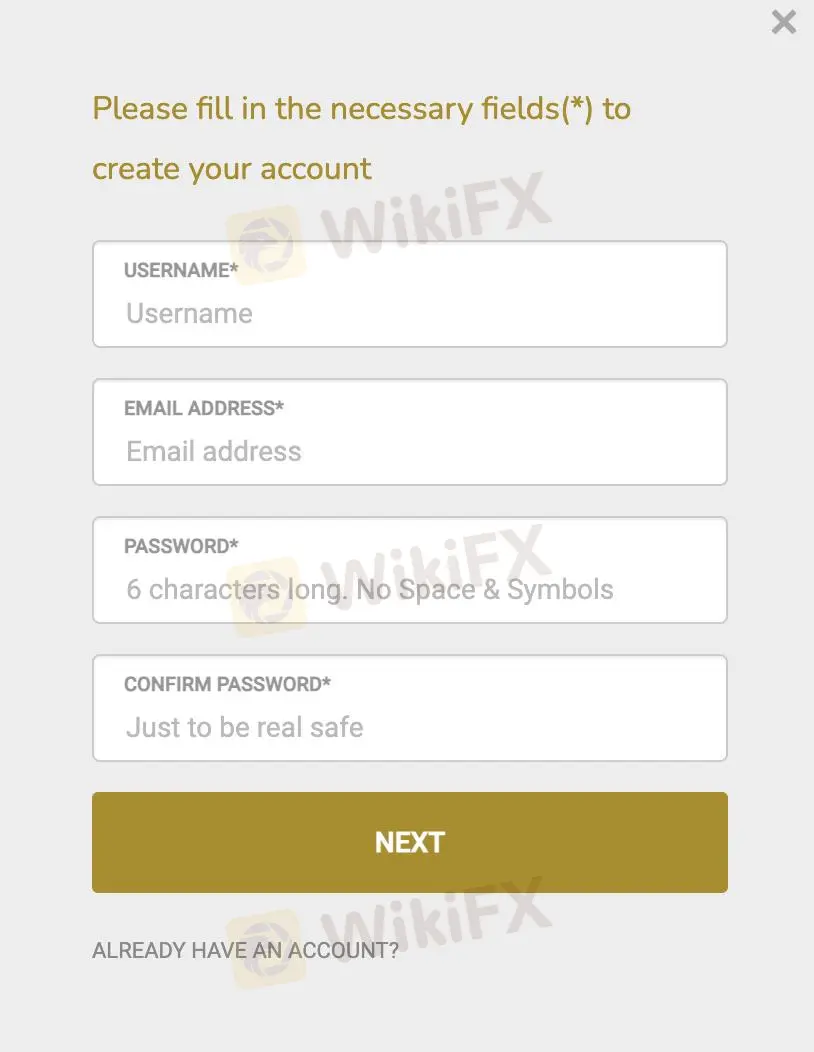

GoldSilver Central provides basic educational resources, including a Simple FAQ and a User Guide.

The FAQ section addresses common questions about trading, payment methods, and account management, offering straightforward answers to help users navigate the platform.

The User Guide provides step-by-step instructions for account setup, trading processes, and utilizing various features. While these resources are helpful for beginners, they can be limited for advanced investors seeking in-depth market analysis or sophisticated trading strategies.

GoldSilver Central offers a range of advantages, including low trading fees of 0.25% per transaction and various payment methods like cash, internet banking, and PayNow. Additionally, there are no storage fees for unallocated gold and platinum.

However, the platform's disadvantages include its unregulated status, which poses potential risks. Distributor fees can be high, reaching 3% for transactions between USD 5,000.00 and USD 9,999.99, and educational resources are limited to a basic FAQ and User Guide.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

More

User comment

1

CommentsWrite a review

2023-03-06 12:02

2023-03-06 12:02