User Reviews

More

User comment

4

CommentsWrite a review

2023-02-17 15:46

2023-02-17 15:46

2022-11-24 14:29

2022-11-24 14:29

Score

10-15 years

10-15 yearsRegulated in Malta

Forex Execution License (STP)

MT4 Full License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index5.50

Business Index8.00

Risk Management Index0.00

Software Index9.45

License Index3.92

Single Core

1G

40G

Danger

More

Company Name

Blue Suisse Limited

Company Abbreviation

BLUESUISSE

Platform registered country and region

Malta

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Blue SuisseReview Summary | |

| Founded | 2024 |

| Registered Country/Region | Malta |

| Regulation | Regulated |

| Market Instruments | ForexCommoditiesIndicesStocks |

| Demo Account | ✅ |

| Leverage | / |

| Spread | From 1.5 |

| FTrading Platform | MT4MT5CRM, MAM and DSP |

| Min Deposit | $500 |

| Customer Support | Phone: +356 2155 0060+49 30-555790940 |

| Email: info@bluesuisse.cominfo@bluesuisse.com | |

| Social Media: Instagram, Facebook, Twitter, Linkedin | |

| Online Chat: 24/5 | |

| Physical Address: Gozo Innovation Hub, Triq il-Pitkalija,Xewkija, XWK3000, Gozo / MaltaPotsdamer Platz 10, 10785 Berlin, Germany | |

Blue Suisse, founded in 2024, is a new brokerage registered in Malta. Currently regulated by the MFSA, it provides traders with 130+ trading instruments, 3 kinds of accounts, the deposit threshold requires $500, and supports the use of MT4 and MT5.

| Pros | Cons |

| Well regulated | The minimum deposit threshold is high |

| 130+ trading instruments | No specific commission information |

| Support the use of MT4 and MT5 |

| Regulated Country |  |

| Regulated Authority | MFSA |

| Regulated Entity | BLUE SUISSE LIMITED |

| License Type | Straight Through Processing(STP) |

| License Number | C 59928 |

| Current Status | Regulated |

Blue Suisse has 130+ trading instruments. You can trade 80+ currency pairs; 25+ commodities, including crude oil, natural gas, gold, silver and platinum; 15+ Global indices; Contracts for difference on stocks from companies like Tesla, Apple, Alphabet and Facebook.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Bonds | ❌ |

| ETF | ❌ |

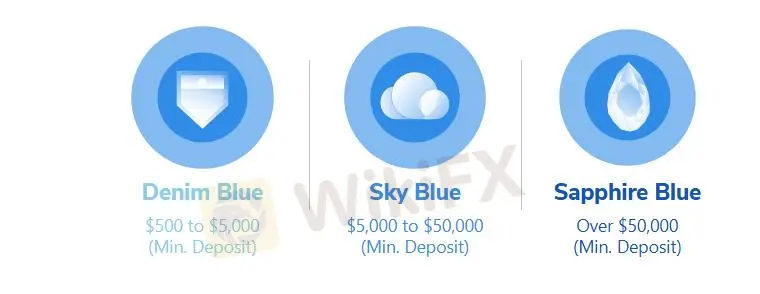

Blue Suisse has three accounts-Denim Blue, Sky Blue and Sapphire Blue.

Their minimum deposit requirements range from a minimum of $500 to a maximum of $50,000, with the same tradable products and platforms.

| Account Types | Denim Blue | Sky Blue | Sapphire Blue |

| Minimum Deposit | $500 to $5000 | $5000 to $50000 | Over $50000 |

| Products | Currencies, Commodities, Indices | Currencies, Commodities, Indices | Currencies, Commodities, Indices |

| Commission | Oil Products | Oil Products | Oil Products |

| Trading platforms | TradeMasterMetaTrader 4MetaTrader 5Mobile | TradeMasterMetaTrader 4MetaTrader 5Mobile | TradeMasterMetaTrader 4MetaTrader 5Mobile |

The procedure for opening an account is clear and follows the steps Blue Suisse provides:

All three accounts charge commissions on oil products, but the details are unknown.

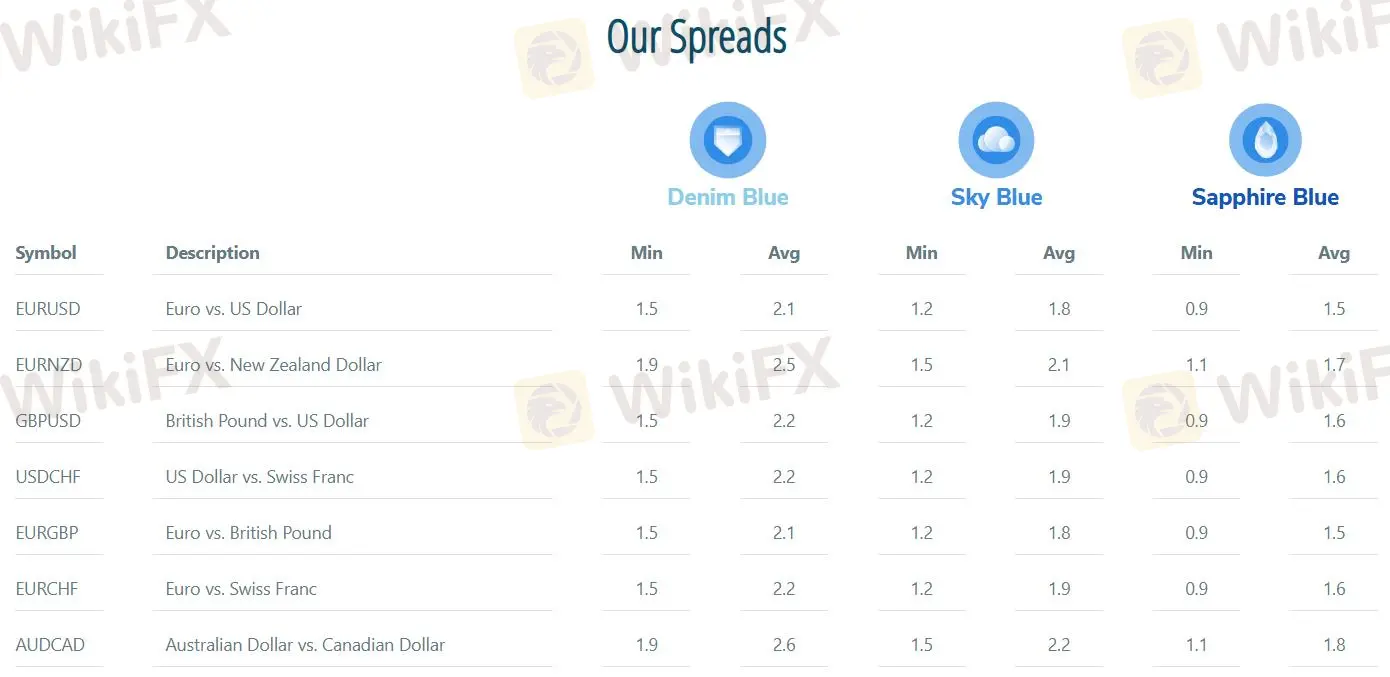

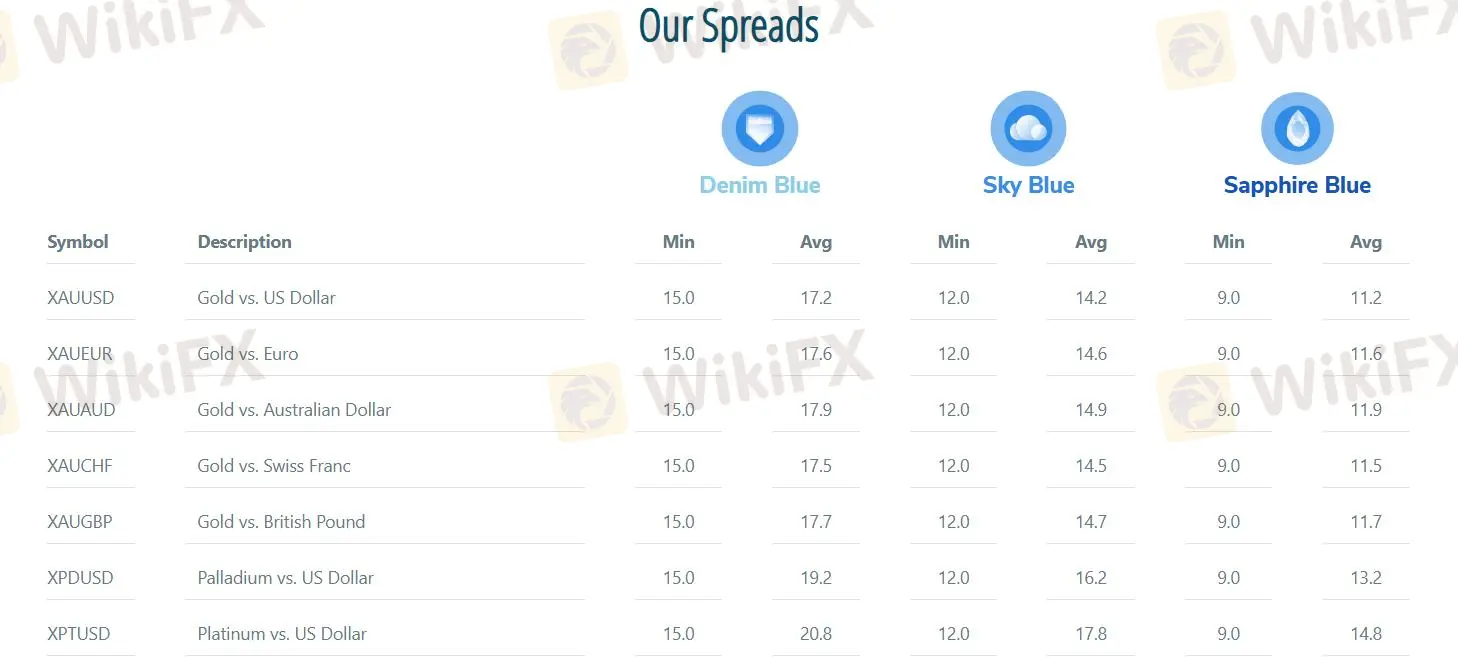

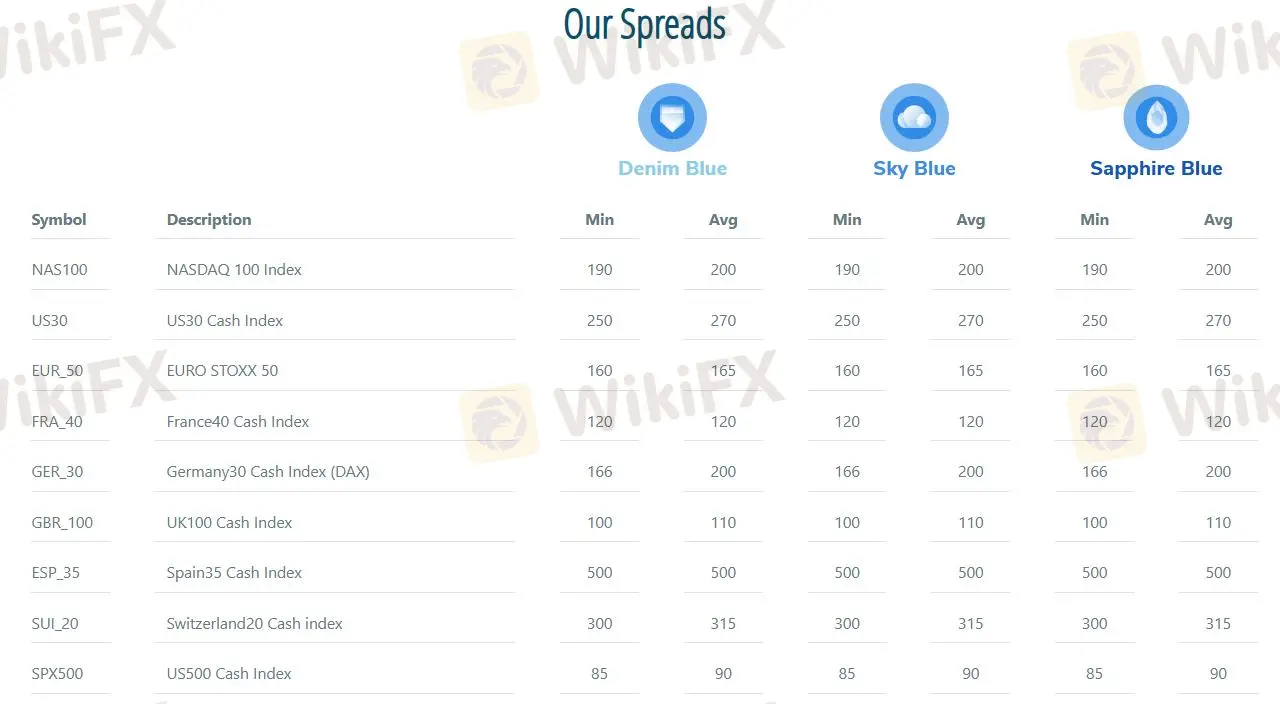

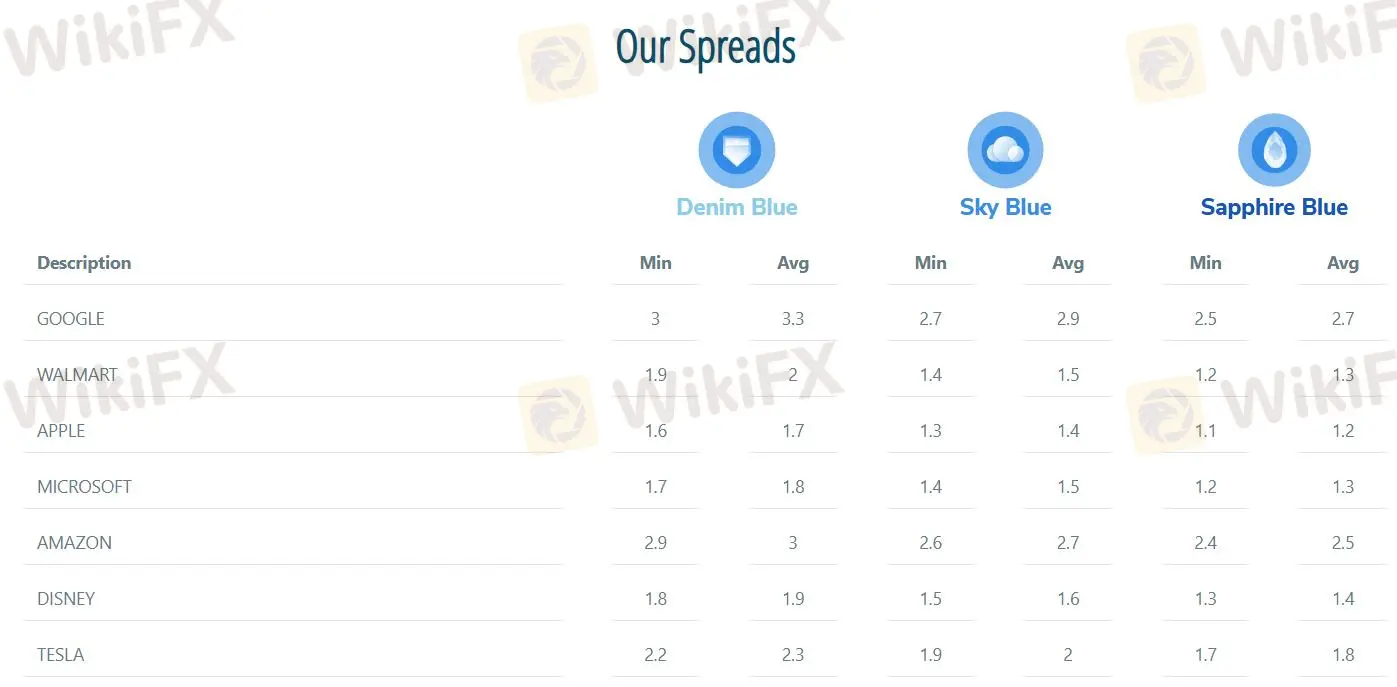

This broker provides forex spread details for 3 types of accounts, with EUR/USD spreads as low as 0.9; The minimum spread for commodities ranges from 0.01 to 15.0; The minimum spread of the indices ranges from 85 to 500; The minimum spread for stocks ranges from 1.07 to 2.9.

Blue Suisse supports traders using MT4, MT5, CRM, MAM and DSP, both desktop and mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile | Beginners |

| MT5 | ✔ | Desktop, Mobile | Skilled traders |

| CRM, MAM and DSP | ✔ | Desktop | All traders |

It supports payment methods including BANK TRANSFER, Skrill NETELLER, RAPID TRANSFER and Paysafe. Withdrawal requests are processed within 1 to 2 business days and traders receive their money within 3-5 business days. A withdrawal of not less than $100 is recommended.

More

User comment

4

CommentsWrite a review

2023-02-17 15:46

2023-02-17 15:46

2022-11-24 14:29

2022-11-24 14:29