User Reviews

More

User comment

4

CommentsWrite a review

2025-04-18 16:18

2025-04-18 16:18

2024-06-21 11:46

2024-06-21 11:46

Score

5-10 years

5-10 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.43

Risk Management Index0.00

Software Index9.11

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

CG Global Ltd

Company Abbreviation

cginvest

Platform registered country and region

Mauritius

Company website

X

YouTube

16504919997

97148725650

Company summary

Pyramid scheme complaint

Expose

| CGFX Review Summary | |

| Founded | 2011 |

| Registered Country/Region | Mauritius |

| Regulation | FSC (Offshore) |

| Market Instruments | Forex, Metals, Indices, Shares and Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | From 0.0 pips |

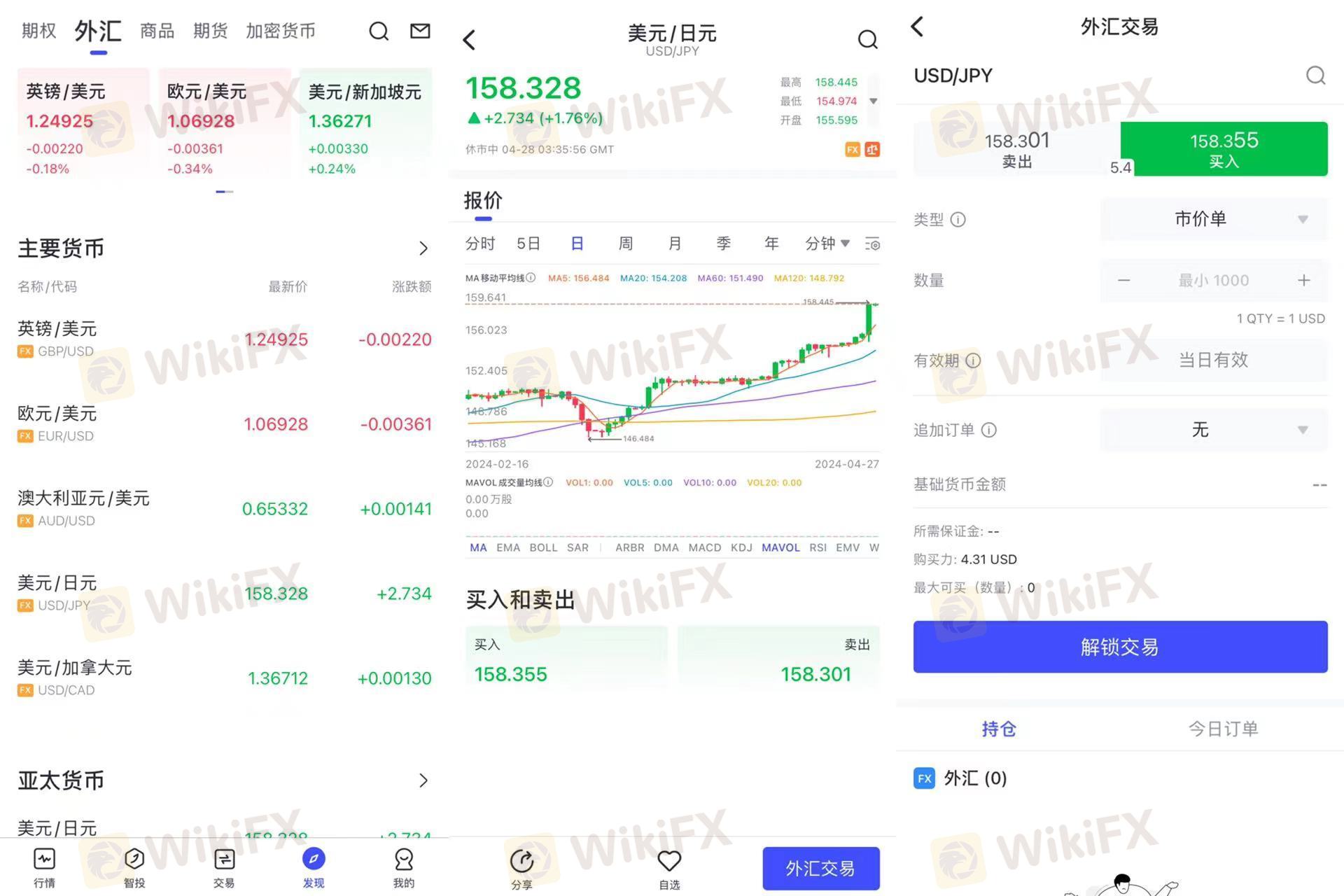

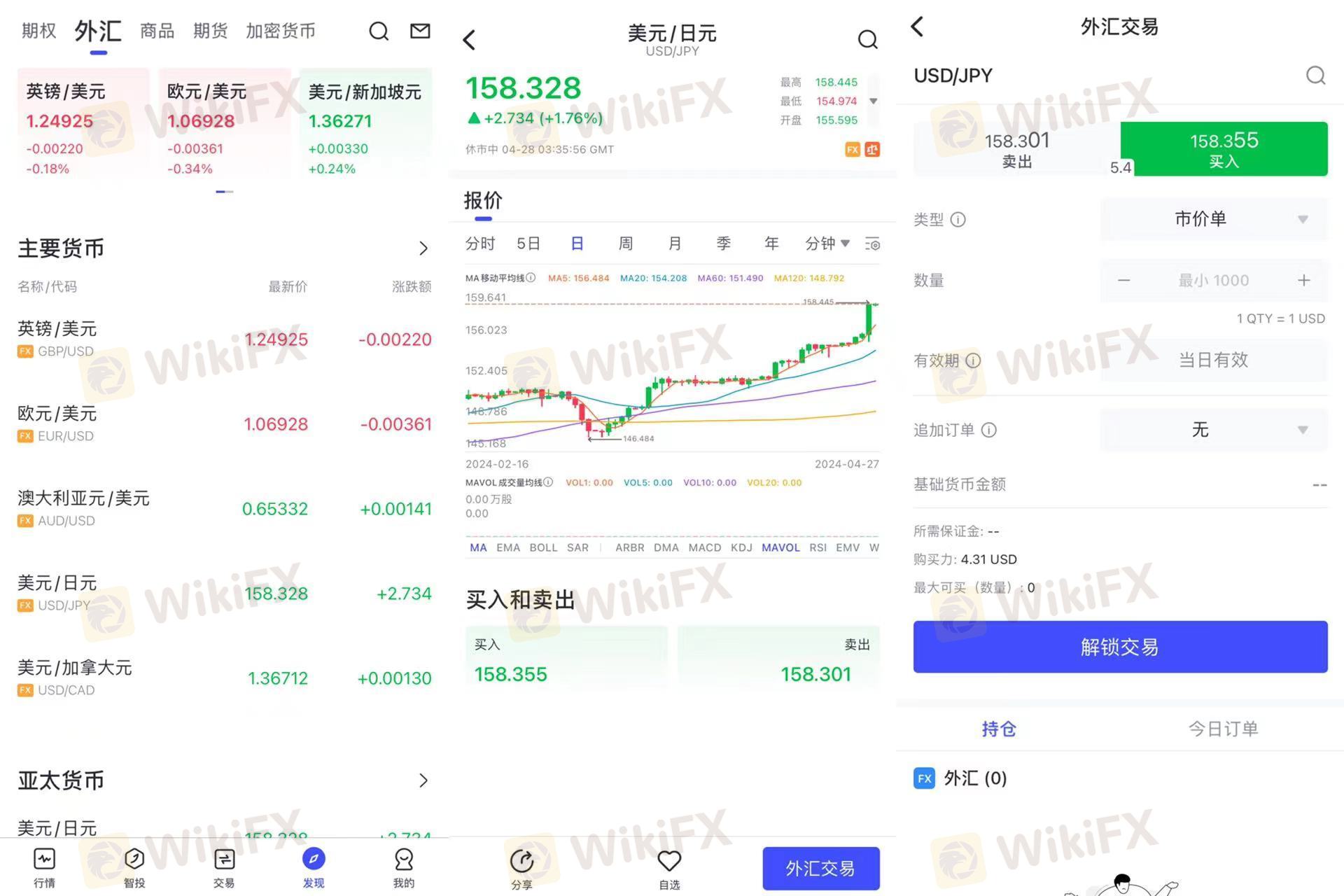

| Trading Platform | MT5 |

| Social Trading | ✅ |

| Min Deposit | $50 |

| Customer Support | 24/6 multilingual support |

| Live chat, contact form | |

| Tel: +1 (650) 491-9997, +44 204 571 6608 | |

| WhatsApp: +1 (650) 491 - 9997 | |

| Email: info@cgfx.com | |

| Social media: Facebook, Instagram, YouTube, Linkedin, WhatsApp | |

| Address: Suite 305, Griffith Corporate Centre, Pobox 1510, Beachmont, Kingstown, Saint Vincent and the Grenadines | |

| Premier Business Center, 10th Floor, Sterling Tower, 14 Poudriere St., Port Louis, Republic of Mauritius | |

| Regional Restrictions | The United States, Iran, Syria, and North Korea |

CGFX, also known as Commercial Group FX, is an online trading broker that provides access to the popular MT5 platform. It offers a variety of trading instruments across different asset classes.

The company was originally established as Commercial Group for Trading in International Markets (CGTIM) in 1998 and was the first of its kind to be registered in the Hashemite Kingdom of Jordan. In 2011, CGTIM underwent rebranding and expansion efforts, leading to its current name, Commercial Group FX (CGFX).

| Pros | Cons |

| Various trading assets | Offshore FSC regulation |

| Demo accounts offered | Regional restrictions |

| Multiple account types | |

| Commission-free account offered | |

| Tight spreads | |

| Popular trading platform MT5 | |

| Social trading | |

| Low minimum deposit | |

| Multiple payment options | |

| Live chat support | |

| 24/6 multilingual support |

CGFX states that they have implemented safeguards such as Segregation of accounts, Banking relations, and secure technologies and services to protect their clients.

However, it is offshore regulated by the Financial Services Commission (FSC). Therefore, investing with CGFX carries a certain level of risk.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| The Financial Services Commission (FSC) | Offshore Regulated | CG Global Ltd | Retail Forex License | GB22200249 |

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Commodities | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

CGFX offers three account types: CG-Plus, CG-PRO and CG Prime. Demo accounts, swap-free accounts are also offered.

| Account Type | Min Deposit |

| CG-Plus | $50 |

| CG-PRO | $250 |

| CG Prime | $1 000 |

CGFX's leverage is capped at 1:400. Note that high leverage not only brings high profits but also high losses.

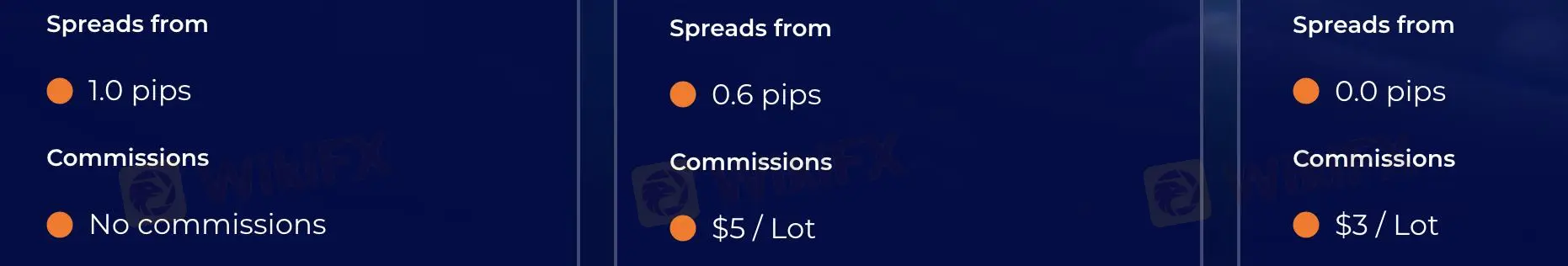

CGFX's spreads and commissions both vary by accounts.

| Account Type | Spread | Commission |

| CG-Plus | From 1.0 pips | ❌ |

| CG-PRO | From 0.6 pips | $5/lot |

| CG Prime | From 0.0 pips | $3/lot |

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC and Mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

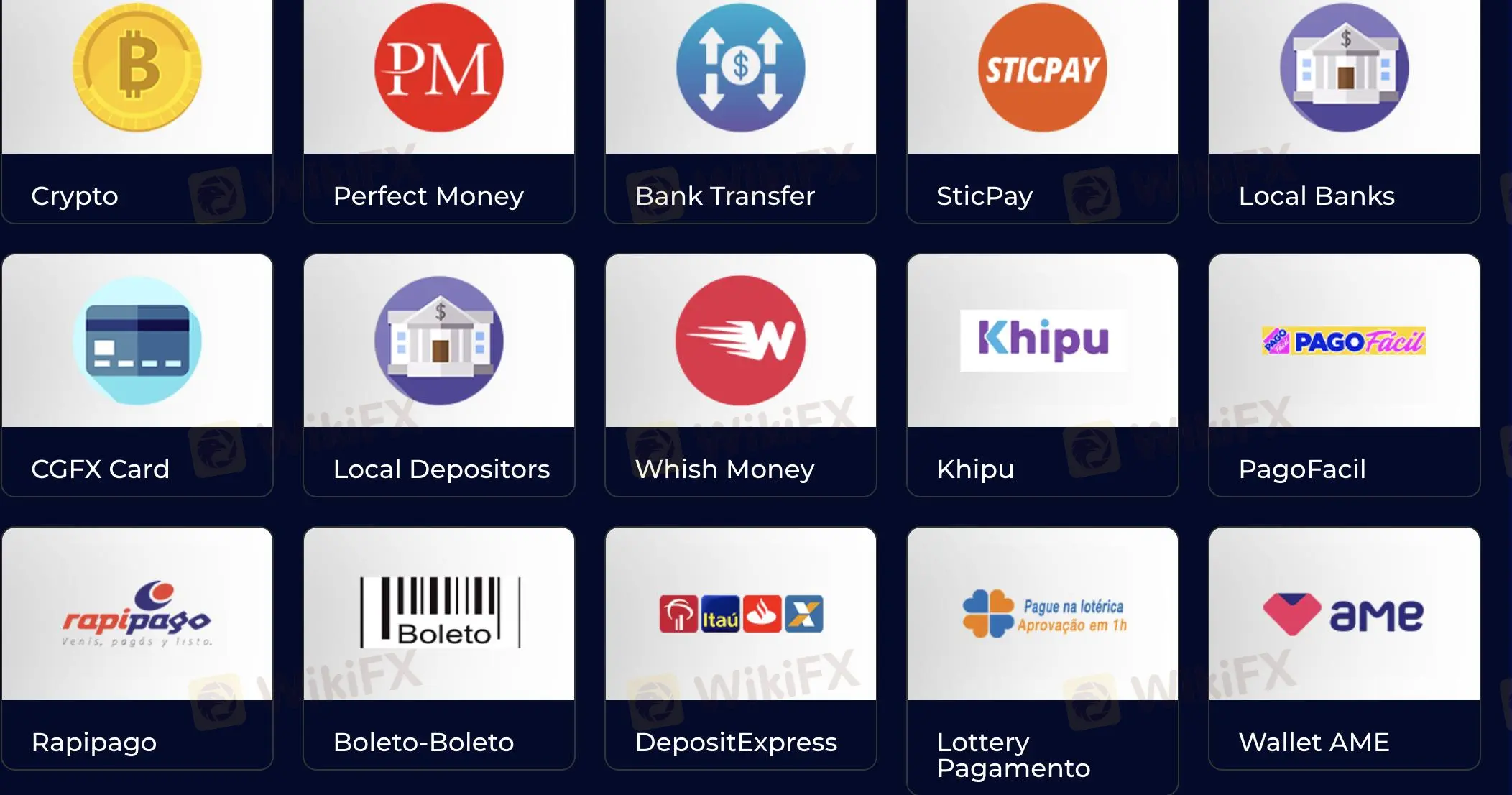

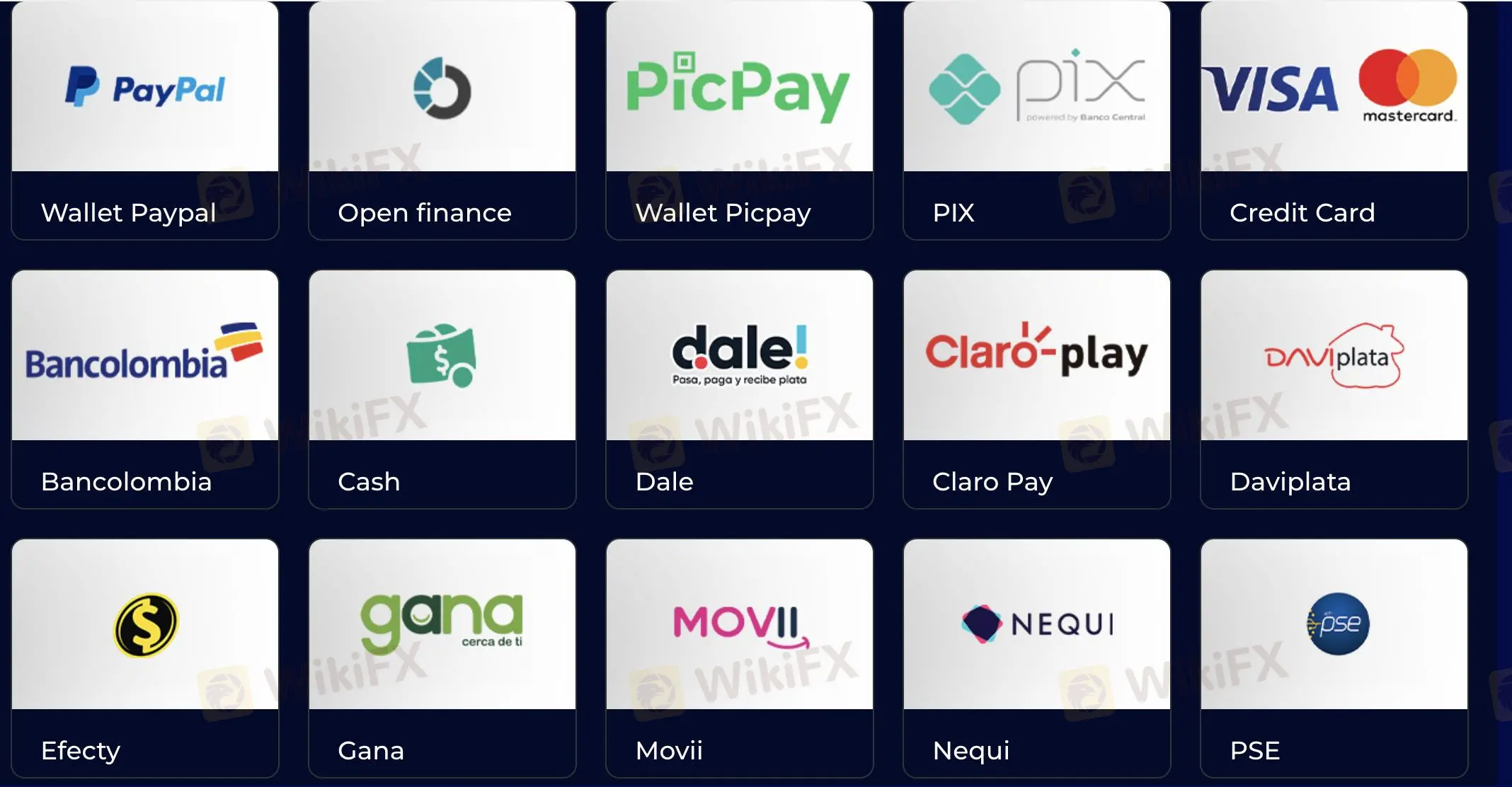

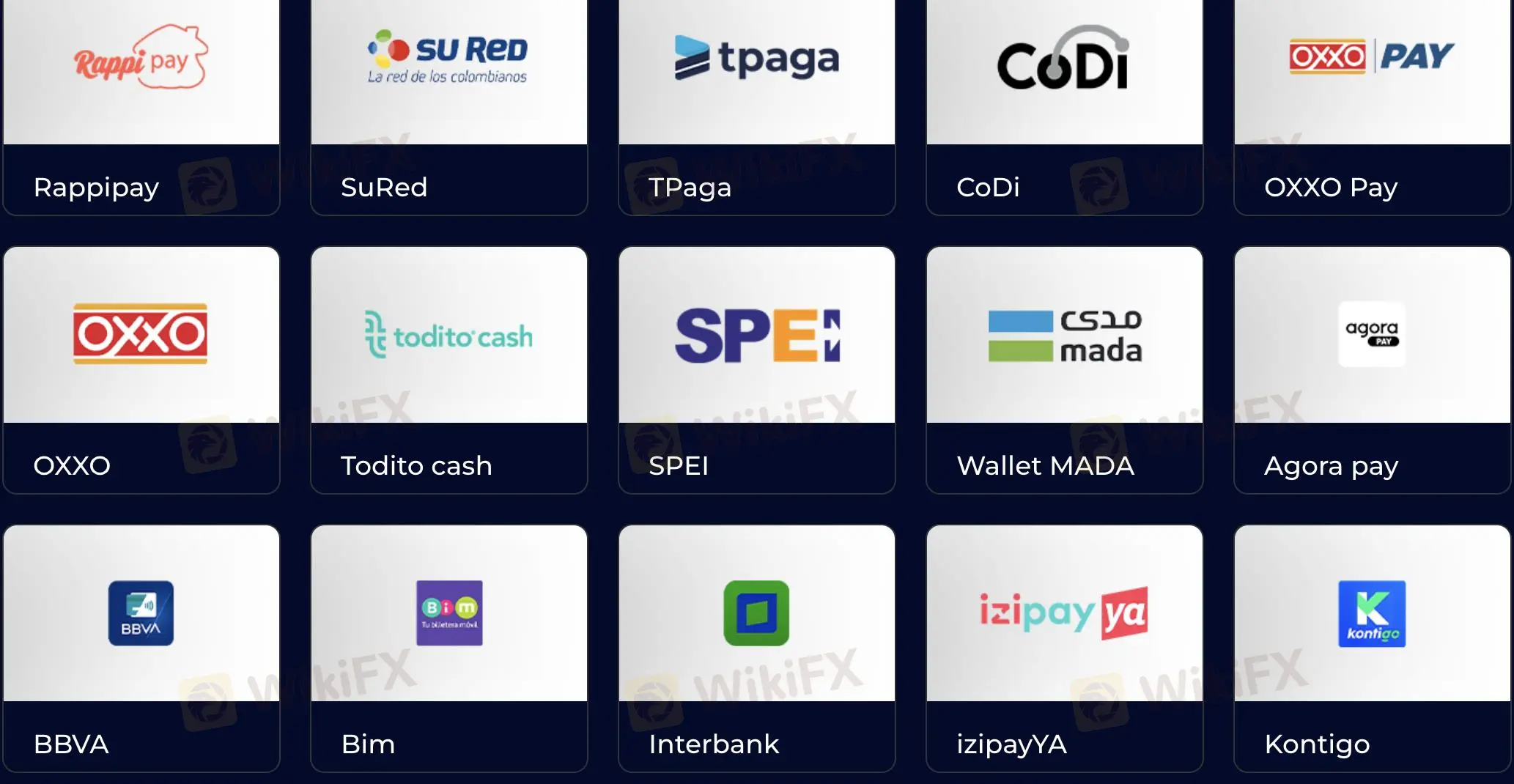

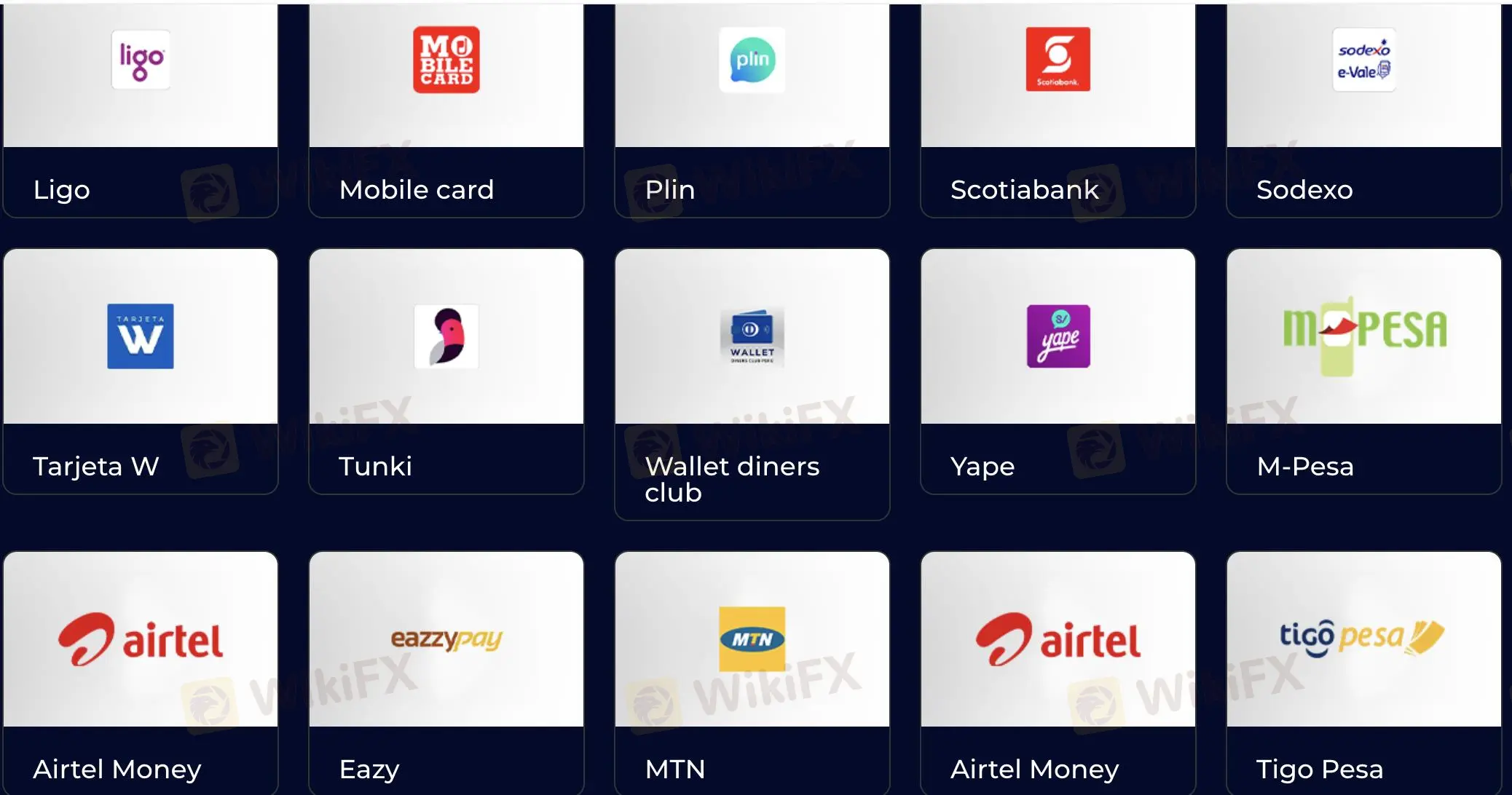

CGFX accepts deposits and withdrawals via Crypto, Perfect Money, Bank Transfer, SticPay, Local Banks, CGFX Card, Local Depositors, Whish Money, Khipu, PagoFacil, Rapipago, Boleto-Boleto, Lottery Pagamento, Wallet AME, DepositExpress, Wallet Paypal, Open finance, Wallet Picpay, РІХ, Credit Card, Bancolombia, Cash, Dale, Claro Pay, Daviplata, Efecty, Gana, Movii, Nequi, PSE, SuRed, CoDi, Rappipay, TPaga, OXXO Pay, OXXO, Todito cash, SPEI, Wallet MADA, Agora pay, BBVA, Bim, Interbank, izipayYA, Kontigo, Ligo,Mobile card, Plin, Scotiabank, Sodexo, Tunki, Tarjeta W, Wallet diners, Yape, M-Pesa, Eazy, ΜΤΝ, Airtel Money, Tigo Pesa, Zamtel, Halo Pesa, and Vodacom Mpesa.

More

User comment

4

CommentsWrite a review

2025-04-18 16:18

2025-04-18 16:18

2024-06-21 11:46

2024-06-21 11:46