User Reviews

More

User comment

5

CommentsWrite a review

2023-02-20 09:48

2023-02-20 09:48

2023-02-16 10:14

2023-02-16 10:14

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.76

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

UR TRADE FIX Ltd

Company Abbreviation

Tradeo

Platform registered country and region

Cyprus

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Registered in | Cyprus |

| Regulated by | CYSEC |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks, bonds |

| Minimum Initial Deposit | $1,000 |

| Maximum Leverage | 1:30 |

| Minimum spread | Information not available |

| Trading platform | Information not available |

| Deposit and withdrawal method | bank transfer, VISA, skrill, safecharge, trust, neteller, worldpay, emerchantpay |

| Customer Service | Email/phone number/address |

| Fraud Complaints Exposure | Yes |

General information and regulations of Tradeo

Tradeo is a forex broker registered in Cyprus and regulated by local institution CYSEC with a history of no more than a decade.

Its worth mentioning that on the homepage of Tradeo we see this notice: Tradeo ceased offering trading services last year in May. Trading and ancillary will not recommence, and the brand/platform will be permanently discontinued.

As a result, if you‘re interested in being a new client of Tradeo, we’re afraid that you may need to find another forex broker.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on.

At the end of the article, we will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Market instruments

Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks, bonds .....Tradeo allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on Tradeo.

Spreads and commissions for trading with Tradeo

Tradeo does not detail on its website additional trading costs such as spreads, commissions, SWAPs, etc. These costs are very important when calculating profits and losses, and should be considered in aggregate and not chosen in isolation. If you want to trade with Tradeo, we recommend that you take the time to calculate these transaction costs.

Account Types for Tradeo

Demo Account: Tradeo provides a demo account that allows you to try out the financial markets without the risk of losing money.

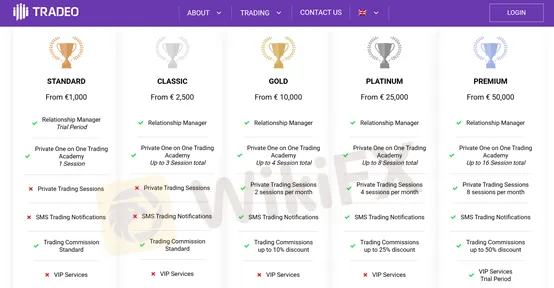

Live Account: Tradeo offers a total of 5 account types: standard, classic, gold, platinum and premium. The minimum deposit to open an account is $1,000, $2,500, $10,000, $25,000 and $50,000 respectively. If you are still a beginner and don't want to invest too much money in Forex trading, a standard account will be the most suitable option for you. However, we should also realize that too little capital not only reduces losses, but also reduces profitability. Therefore, you may find it “unexciting” or unprofitable. In addition, accounts with smaller initial deposits tend to have poorer trading conditions.

Trading platforms offered by Tradeo

Tradeo does not give information about its trading platform, but from the peers and the website as a whole, it should be a trading platform developed by itself.

Leverage offered by Tradeo

The maximum leverage offered by Tradeo is only 1:30, which may seem too low to you. In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

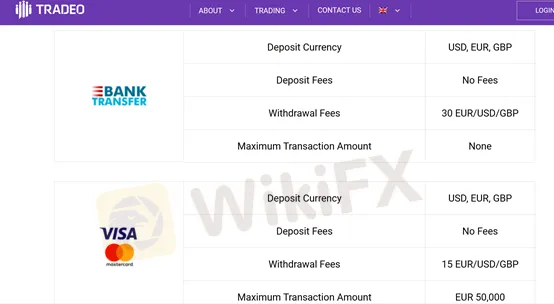

Deposit and withdrawal methods and fees

In terms of deposit and withdrawal, like many good brokers, Tradeo provides a detailed form with important information about currency, payment method, minimum amount, fees, etc. The feasible payment methods are bank transfer, VISA, skrill, safecharge, trust, neteller, worldpay, emerchantpay.

Educational resources

There is no education section on the Tradeo website. Many brokers are able to provide a variety of educational resources such as video courses, seminars, e-books, related articles, glossaries that provide some basic knowledge about trading. This is not the case with Tradeo.

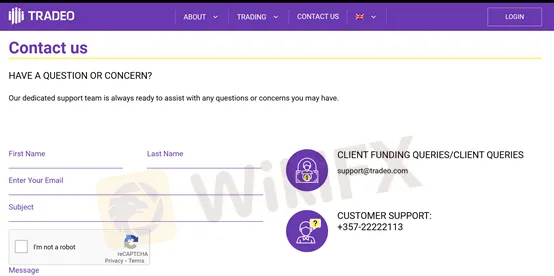

Customer support of Tradeo

Below are the details about the customer service.

Language(s): English, Spanish, German, Dutch

Email: support@tradeo.com

Phone Number: +357-22222113

Address: 15, Spyrou Kyprianou Ave, Matrix Tower II, 4th floor, 4001, Limassol, Cyprus.

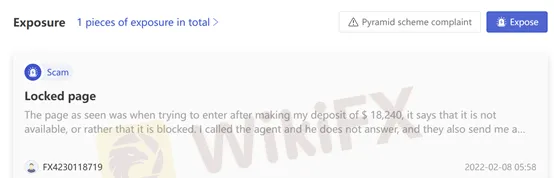

Users exposures on WikiFX

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Advantages and disadvantages of Tradeo

Advantages:

Well regulated

Many instruments available

Demo account

Disadvantages:

Complaints

Few information available

No educational resources

Few deposit and withdrawal methods

No MT4/MT5

No copy trading

Frequent asked questions about Tradeo

Is this broker well regulated?

Yes, it is currently effectively regulated by CYSEC.

More

User comment

5

CommentsWrite a review

2023-02-20 09:48

2023-02-20 09:48

2023-02-16 10:14

2023-02-16 10:14