User Reviews

More

User comment

4

CommentsWrite a review

2024-07-22 17:54

2024-07-22 17:54

2024-06-14 15:40

2024-06-14 15:40

Score

2-5 years

2-5 yearsSuspicious Regulatory License

White label MT5

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

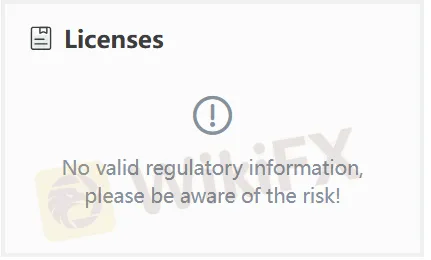

Regulatory Index0.00

Business Index6.57

Risk Management Index0.00

Software Index8.74

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Warning

More

Company Name

Five Percent Online Ltd

Company Abbreviation

The 5%ers

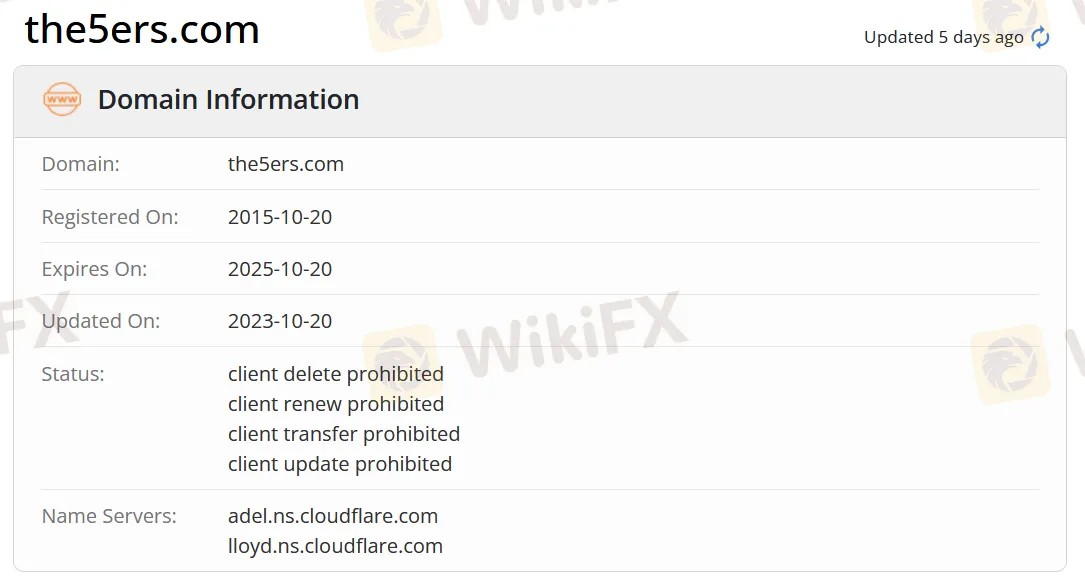

Platform registered country and region

United Kingdom

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| The 5%ers Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Israel |

| Regulation | Unregulated |

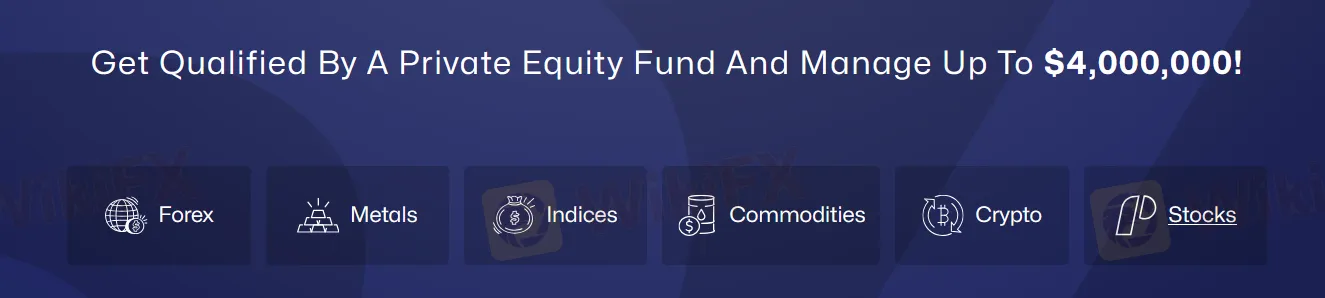

| Market Instruments | Forex, indices, metals, commodities, cryptocurrencies |

| Demo Account | ❌ |

| Leverage | Up to 1:100 |

| Spread | from 0.0 pips |

| Trading Platform | MT5 |

| Min Deposit | / |

| Customer Support | X, Youtube, Facebook, Insgram |

| Email: help@the5ers.com | |

| Address: 2 HaTidhar st, Raanana, Israel | |

The 5%ers was registered in 2016 in Israel. It offers investment services for trading with forex, indices, metals, commodities, and cryptocurrencies on MT5, and this company is currently unregulated.

| Pros | Cons |

| Various Funding choices | Unregulated |

| Long history | Limted fees information |

| Free 1-on-1 performance coaching |

No. The 5%ers has no regulations currently. Please be aware of the risk!

The 5%ers provides a range of choices like forex, indices, metals, commodities, and cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| Metals | ✔ |

| Stocks | ✔ |

| ETFs | ❌ |

| Options | ❌ |

| Bonds | ❌ |

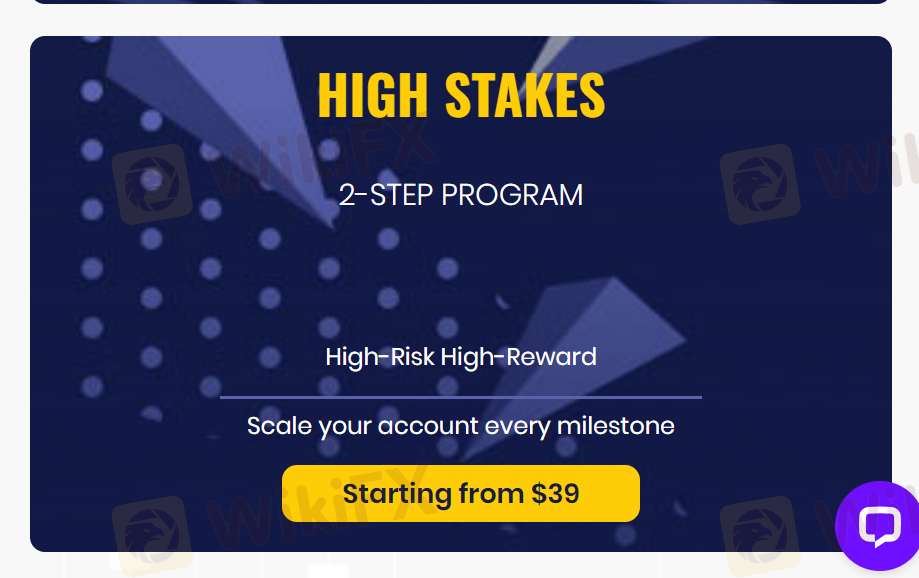

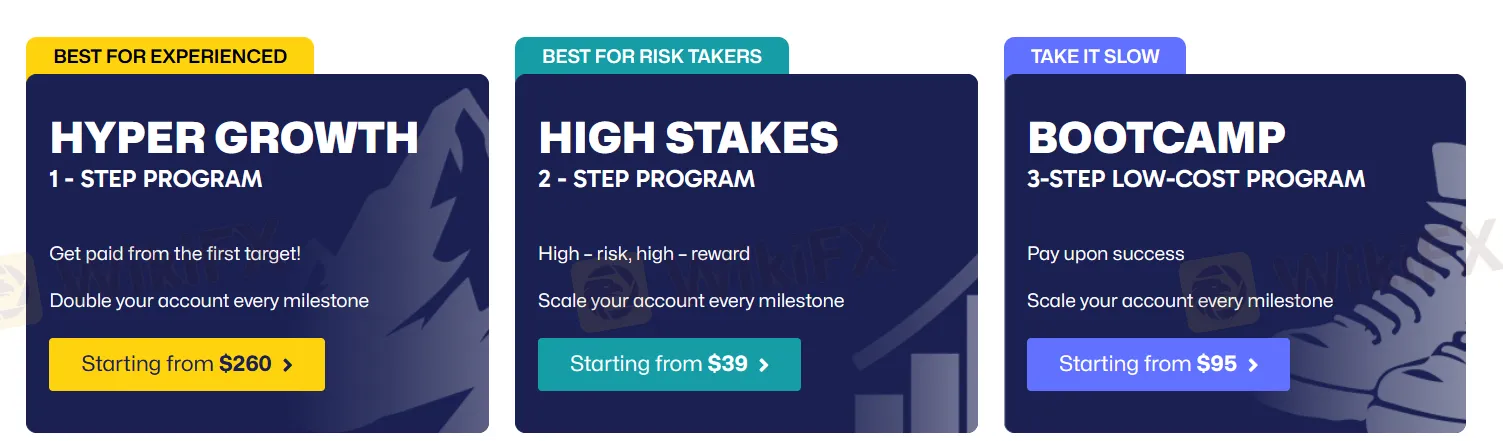

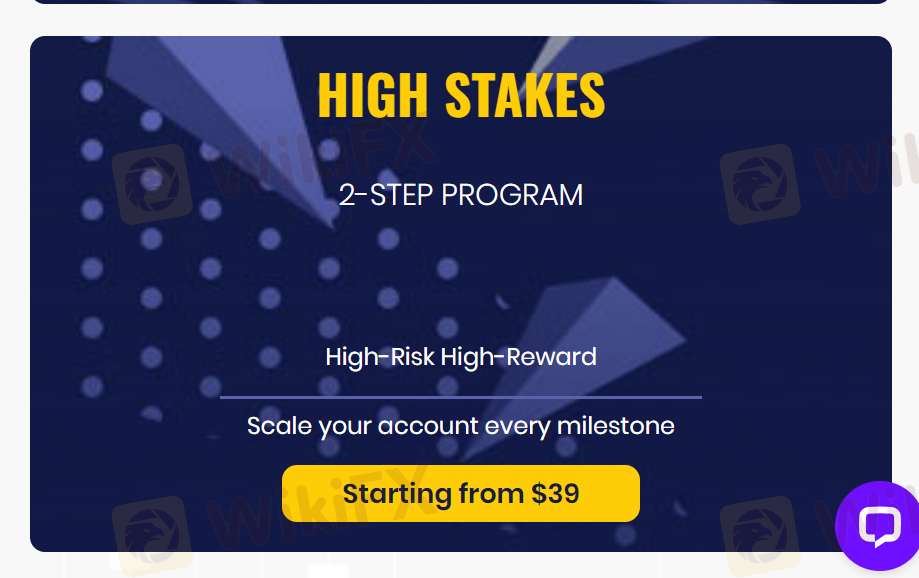

The 5%ers offer three main challenge types with different evaluation processes, risk rules, and scaling opportunities.

| Challenge Type | Evaluation Steps | Profit Target | Max Loss | Scaling Potential |

| Bootcamp | Three Step | 6% per stage | 5% (4% funded) | Up to $250K |

| High Stakes | Two Step | 8% (Phase 1), 5% (Phase 2) | 10% (5% daily) | Up to $137,500 |

| Hyper Growth | One Step | 10% | 6% | Up to $4M |

| Challenge Type | Leverage |

| Bootcamp | 1:10 |

| High Stakes | 1:100 |

| Hyper Growth | 1:30 |

The 5%ers have competitive commission fees compared to other prop firms, but their spread transparency is limited.

When it comes to trading platforms available, The 5%ers gives traders Meta Trader 5.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ❌ | / | Beginners |

| MT5 | ✔ | Desktop, Android, iOS | Experienced traders |

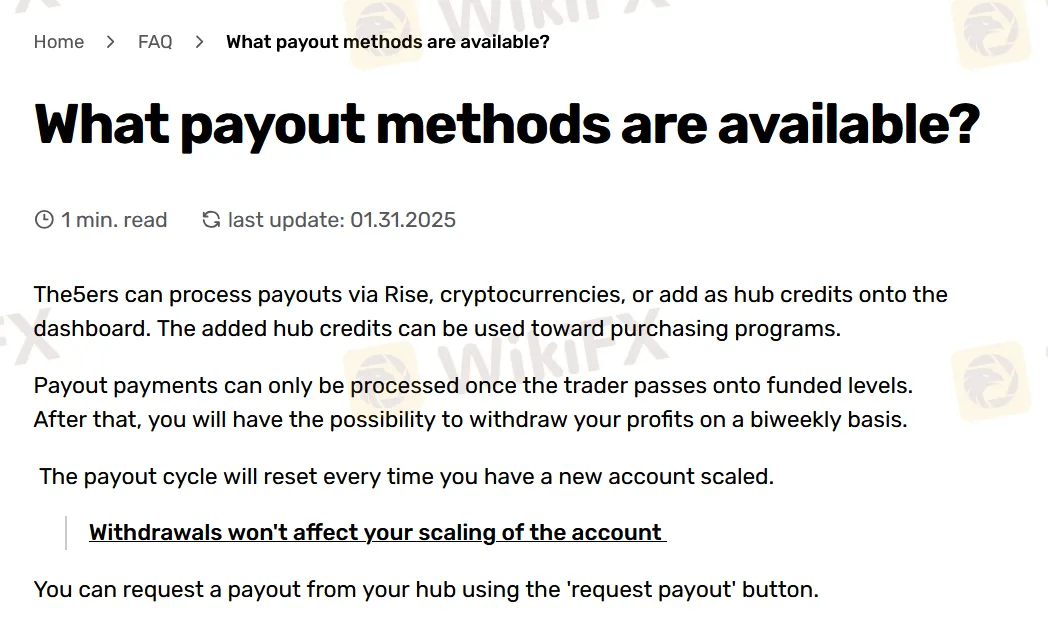

Traders can pay challenge fees using several methods, including Rise, The5ers VISA Card, and cryptocurrencies.

Did you face reduced leverage and hiked fees without any explanation from The 5%ers broker? Do you find The 5%er rules strange for getting a funded account from this prop trading firm? Has the broker closed your trade inappropriately, preventing you from making gains in the forex market? All these allegations have dominated The 5%ers review segment online. Looking at this, the WikiFX team investigated and found some startling comments against the broker. In this article, we have shared those complaints. Read on!

WikiFX

WikiFX

The aim of this article is to enlighten the reader and show you how to find trading setups and key volatility areas to take advantage of emerging opportunities using Autochartist.

WikiFX

WikiFX

Losses are part of trading, but how do you feel when taking a loss? Does your stomach churn and heart palpitate? The feeling after a loss can linger for minutes, hours, and sometimes days. Taking a loss is definitely not as fun as taking home the trophy.

WikiFX

WikiFX

Somethings we all need to know here is that, trading is not what most people think it is. The Hollywood version of trading, where huge sums of money are made effortlessly by smiling traders in a matter of seconds, can often seem alien to anyone who trades for real.

WikiFX

WikiFX

More

User comment

4

CommentsWrite a review

2024-07-22 17:54

2024-07-22 17:54

2024-06-14 15:40

2024-06-14 15:40