Company Name

Make Capital Ltd

Company Abbreviation

MAKE CAPITAL

Platform registered country and region

Cayman Islands

Company website

Company summary

Pyramid scheme complaint

Expose

Score

5-10 years

5-10 yearsRegulated in South Africa

Derivatives Trading License (EP)

MT4 Full License

Benchmark

Influence

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index3.60

Business Index8.21

Risk Management Index9.07

Software Index9.71

License Index7.56

Single Core

1G

40G

More

Company Name

Make Capital Ltd

Company Abbreviation

MAKE CAPITAL

Platform registered country and region

Cayman Islands

Company website

Company summary

Pyramid scheme complaint

Expose

| Make CapitalReview Summary | |

| Founded | 2010 |

| Registered Country/Region | Cayman Islands |

| Regulation | ASIC and FSCA |

| Market Instruments | Forex, Indices, Metals, Commodities, Cryptocurrencies, and Stocks |

| Demo Account | \ |

| Leverage | Up to 1:2000 |

| Spread | From 0.0 pips (ECN Account) |

| From 1.0 pips (STD Account) | |

| From 1.9 pips (PLUS Account) | |

| Trading Platform | MT4, MT5 |

| Minimum Deposit | $20 |

| Customer Support | Live chat |

| Email: services@makecapital.com | |

| Address: Artemis House, Fort Street, Grand Cayman, Cayman Islands, KY1-11111 | |

| Regional Restriction | The United States, Israel, New Zealand, Iran, North Korea, Australia, and South Africa. |

Founded in 2010 and registered in the Cayman Islands, Make Capital is a financial services company that is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Conduct Authority (FSCA) of South Africa. The company offers a variety of trading assets, including forex, indices, metals, commodities, cryptocurrencies, and stocks, supports MT4 and MT5 trading platforms, and offers five account types (ECN, STD, PLUS, CENT, and Swap-Free) to meet the needs of different traders. The minimum deposit is only $20, and the leverage ratio is flexible (up to 1:2000). However, the company does not provide services to some countries and regions.

| Pros | Cons |

| Regulated well | Regional restrictions |

| Swap-Free Account available | No demo account |

| MT4 and MT5 available | Lack of payment information |

| Various trading products | |

| Live chat support | |

| Low minimum deposit of $20 |

Make Capital is regulated in both Australia and South Africa:

In Australia, MAKE CAPITAL PTY LTD is regulated by the Australian Securities and Investments Commission (ASIC) as a designated representative (AR), with license number 001307785;

In South Africa, MAKE CAPITAL MARKET (PTY) LTD is regulated by the Financial Sector Conduct Authority (FSCA) and holds a financial services license, with license number 53179.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Australia Securities & Investment Commission | Regulated | MAKE CAPITAL PTY LTD. | Appointed Representative(AR) | 001307785 |

| Financial Sector Conduct Authority | Regulated | MAKE CAPITAL MARKET (PTY) LTD | Financial Service | 53179 |

Make Capital offers a variety of trading assets, including Forex, Indices, Metals, Commodities, Cryptocurrencies, and Stocks.

| TradableInstruments | Available |

| Forex | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| Stocks /Shares | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| Funds | ❌ |

| ETFs | ❌ |

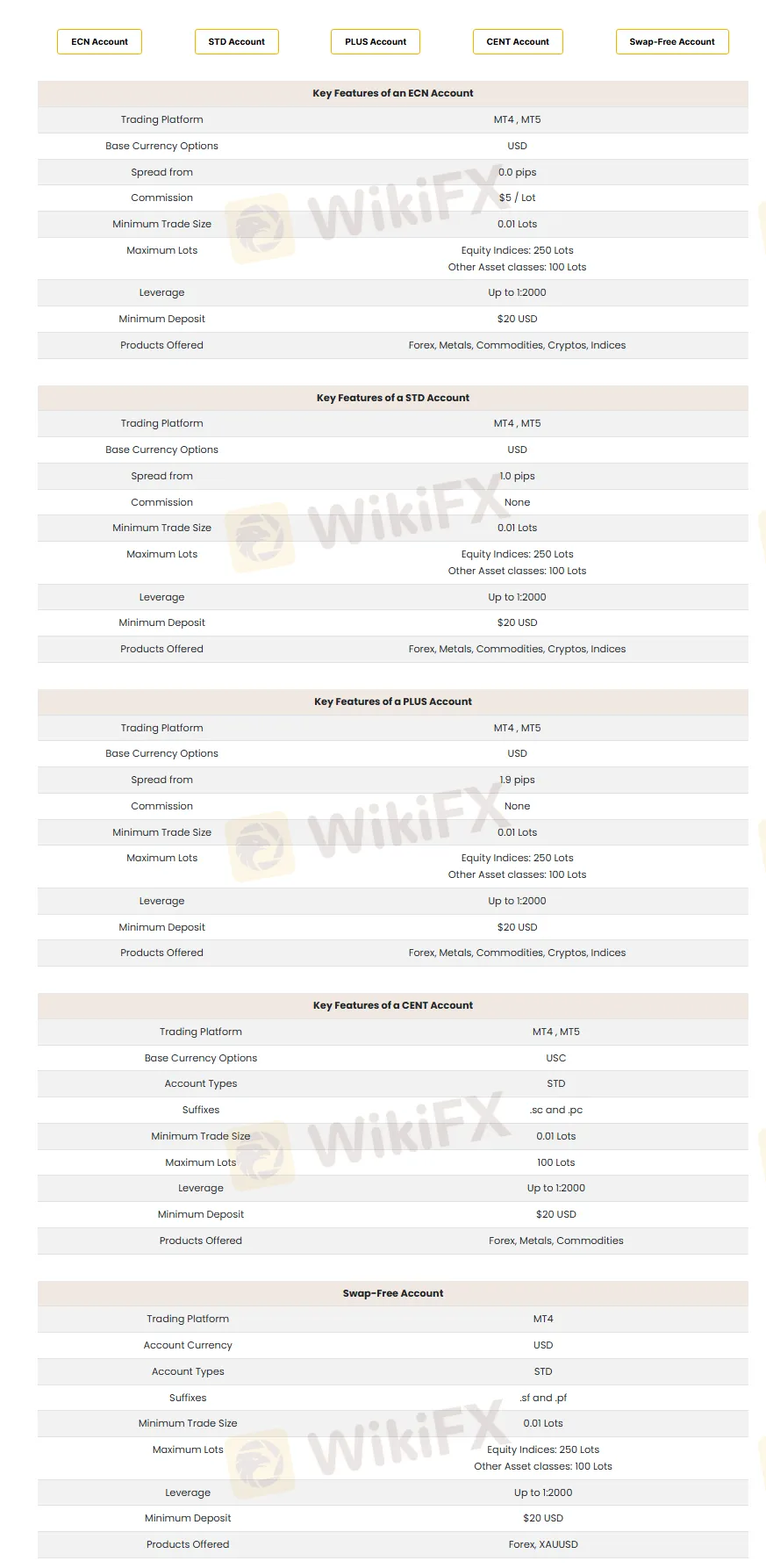

Make Capital offers five types of live accounts: ECN Account, STD Account, PLUS Account, CENT Account, and Swap-Free Account.

| Account Type | Minimum Deposit | Leverage | Spread from | Commission | Base Currency |

| ECN Account | $20 USD | Up to 1:2000 | 0.0 pips | $5 / Lot | USD |

| STD Account | $20 USD | Up to 1:2000 | 1.0 pips | None | USD |

| PLUS Account | $20 USD | Up to 1:2000 | 1.9 pips | None | USD |

| CENT Account | $20 USD | Up to 1:2000 | N/A | None | USC |

| Swap-Free Account | $20 USD | Up to 1:2000 | N/A | None | USD |

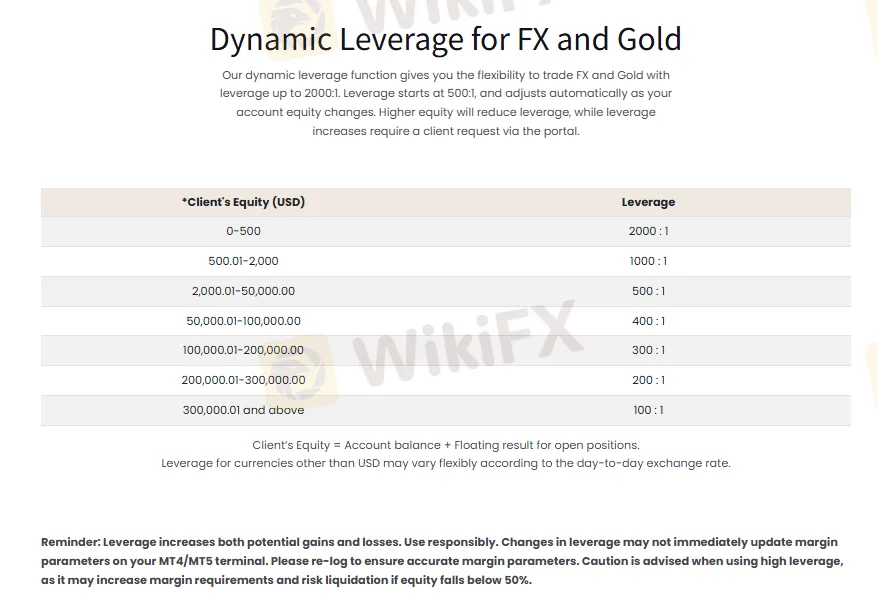

Make Capital offers dynamic leverage for forex and gold from 1:100 to 1:2000 for greater market exposure with less capital. High leverage brings high returns but also high risks, so traders should be careful when trading.

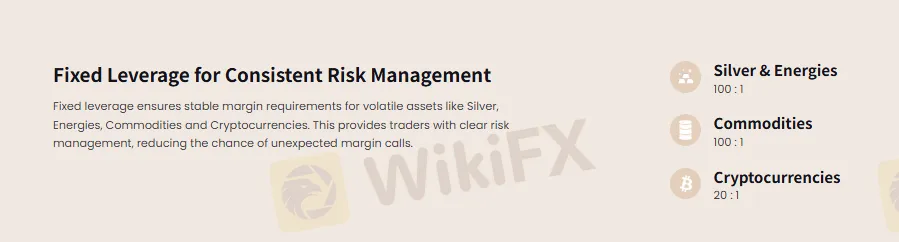

Make Capital provides fixed leverage for different asset classes, with a leverage of 100:1 for silver and energy, commodities, and 20:1 for cryptocurrencies, to ensure stable margin requirements and reduce the risk of unexpected margin calls.

Spreads: ECN accounts have the lowest spreads (0.0 pips), STD and PLUS accounts have spreads of 1.0 pips and 1.9 pips, respectively, and CENT and Swap-Free accounts have unspecified spreads.

Commissions: ECN accounts charge $5 per lot, with zero commissions on all other accounts.

Swap Fee: There is no swap fee for Swap-Free accounts; other accounts may charge swap fees, the specific rate needs to be further confirmed.

Minimum Deposit: The minimum deposit for all accounts is $20 USD, and the threshold is consistent and low.

Make Capital supports both MT5 and MT4 trading platforms and is suitable for traders of different experience levels: MT5 is for experienced traders, while MT4 is more suitable for newbies. Both platforms are available on desktop, mobile, and web.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

The payment options, fees, and the processing time are not clear, and only the deposit and withdrawal steps are revealed on the official website.

The withdrawal process is simple and quick; just click the 'Withdraw' button, enter the amount you wish to withdraw, and submit your request.

After the request is submitted, the finance team will process the withdrawal within 1-3 business days and send a confirmation email. Customers can check their withdrawal records in the background at any time to understand the application status; if the application has not yet been processed, they can also cancel the request.