User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

15-20 years

15-20 yearsRegulated in Japan

Market Making License (MM)

Self-developed

Capital Ratio

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index8.00

Risk Management Index9.79

Software Index7.05

License Index7.85

Single Core

1G

40G

Warning

More

Company Name

MARUSAN SECURITIES CO., LTD.

Company Abbreviation

MARUSAN

Platform registered country and region

Japan

Company website

Company summary

Pyramid scheme complaint

Expose

Capital

Higher than 99% Japanese brokers $0(USD)

| MARUSAN Review Summary | |

| Founded | 1996 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Investment trusts, stocks, and bonds |

| Demo Account | ❌ |

| Leverage | / |

| Spread | Varies with different currencies |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: 0120-03-1319 (hours 9:00~17:00 / Except Saturdays, Sundays, holidays) |

| Email: toiawase03@marusan-sec.co.jp | |

| Address: 東京都千代田区麹町三丁目3番6 | |

MARUSAN, established in 1996 and based in Japan, is a financial services company regulated by the Financial Services Agency (FSA). Clients can trade various trading instruments such as investment trusts, stocks, and bonds. The firm offers a General Account a Specific Account.

| Pros | Cons |

| Regulated by FSA | Limited info on accounts |

| Diverse customer support channels | Limited info on trading fees |

| A wide range of products | No demo accounts |

| Lack of info on trading platforms |

Yes, at present, MARUSAN is regulated by FSA, holding a retail forex license.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| The Financial Services Agency (FSA) | 丸三証券株式会社 | Regulated | Retail Forex License | 関東財務局長(金商)第167号 |

MARUSAN provides traders with investment trusts, stocks, and bonds.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Investment Trusts | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

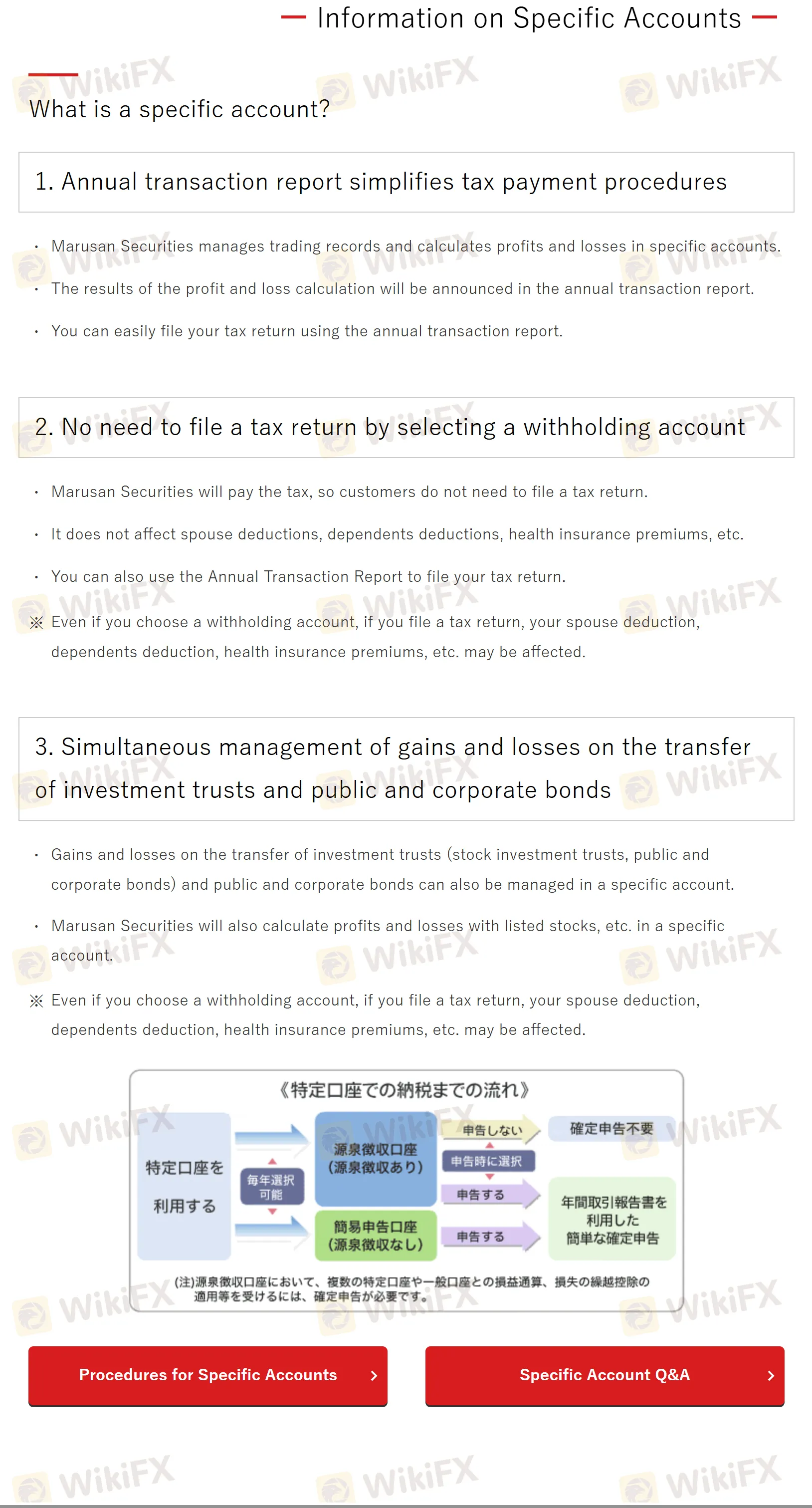

MARUSAN offers the General Account and the Specific account.

The General Account serves as a comprehensive platform for managing and administering funds allocated for purchasing stocks and investment trusts. Funds deposited into this account are managed within the Money Reserve Fund (MRF), which primarily consists of short-term bonds and highly rated public bonds.

The Specific account offers additional features tailored to meet specific user needs, such as simplified tax procedures with an annual transaction report.

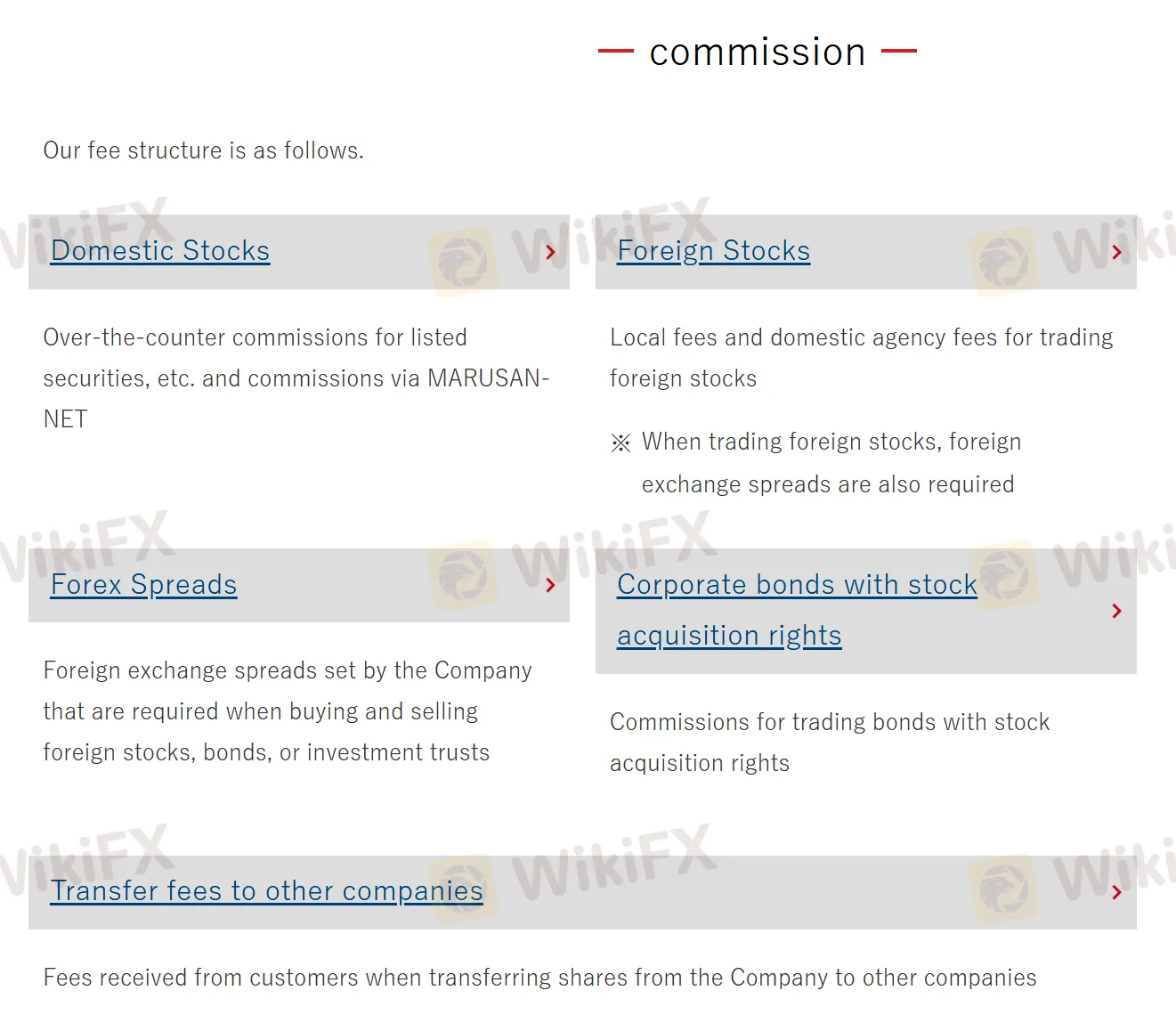

| Currency | Spread |

| US dollar | Less than 100,000 US dollars 50 sen, 100,000 US dollars or more 25 sen |

| Euro | 75 sen |

| Canadian dollar | 80 sen |

| British Pound Sterling | ¥1 |

| Australian Dollar | ¥1 |

| New Zealand dollar | ¥1 |

| Mexican Peso | 10 sen |

| Hong Kong Dollar | 15 sen |

For other detailed infomation about fees, you can refer to the company's official website: https://www.marusan-sec.co.jp/torihiki/fee/.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment