User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 7

Exposure

Score

Regulatory Index0.00

Business Index5.96

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

PNX FINANCE

Company Abbreviation

PNX FINANCE

Platform registered country and region

United States

Company website

Company summary

Pyramid scheme complaint

Expose

I was a victim and so many deposits were asked to be made with no guarantee for withdrawal. scamreveal

These pig butchering con artists are operating under several aliases in an attempt to deceive as many people as possible and steal the life savings of unsuspecting individuals. Take caution and report them for chargeback.

I was trading here and had accumulated my profits, all of a sudden the price fluctuated in away that I suspect the broker was responsible and from no where all my funds were lost, when I contacted the customer service personnel by name of William which he told me to deposit more for withdrawal but unfortunately for them ForteClaim recovery reassure withdrawal Kindly be advised that PNX Finance is an unlicensed platform and stay away.

Group originally started talking about stocks and then since the stock market wasn’t doing well they said that the forex market was more lucrative. After watching for over a month people making over ridiculous amounts of money, I went in and invested, since they were offering a bonus’s to anyone who would invest $100,000, with PNXFinance.com. I borrowed money for everyone I could, sold all my crypto and went all in. Made trade after trading in MT5 (it’s a public platform isn’t it?) slowing building up until my account was worth $1,593,985. But it’s all in vain because it won’t let me withdraw anything, other than $1,000. I’m finding out now it’s all a scam. My entire life’s savings.

https://www.instagram.com/reel/C2AbQViL72h/?igsh=cHRhejUzOGdlcnZu PnX finance ,Amberlight ,Stellar,osmosis fx all are same people running the scam in different names

They are running this scam in different names ,This pig butchering scammers are trying to fool as many people and suck away the life long savings of innocent folks, Beware ..!The most recent one is OsmosisFX - Your Gateway to Financial Freedom.PNX ,Amberlight ,Stellar all of them have same fake Address:They are all the same scammers . 30 Broad St., New York, NY 10004, United States

| Aspect | Information |

| Registered Country/Area | United States |

| Company Name | PNX FINANCE |

| Regulation | Operates outside the scope of NFA regulation |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | MetaTrader 5 (MT5) |

| Tradable Assets | Cryptocurrencies, Forex currency pairs, Gold, Indices |

| Account Types | Not specified |

| Customer Support | Email, Social Media, Contact Form |

| Payment Methods | Visa, Mastercard, Cryptocurrency, Wire Transfer |

| Educational Tools | Not provided |

| Website Status | www.pnxfinance.com (Accessible) |

| Reputation (Scam or Not) | Regulatory concerns; Reputation not specified |

PNX FINANCE is a trading company registered in the United States that operates outside the scope of NFA regulation, raising regulatory concerns. While the company offers a MetaTrader 5 (MT5) trading platform and provides access to a range of tradable assets, including cryptocurrencies, forex currency pairs, gold, and indices, several crucial details such as minimum deposit requirements, maximum leverage, spreads, account types, and educational tools remain unspecified. Customer support is available through email, social media, and a contact form, while payment methods encompass Visa, Mastercard, cryptocurrency, and wire transfers. The company's website, www.pnxfinance.com, is accessible. However, its reputation, particularly regarding potential scams, is not clearly defined, underscoring the importance of conducting thorough due diligence before engaging with this broker.

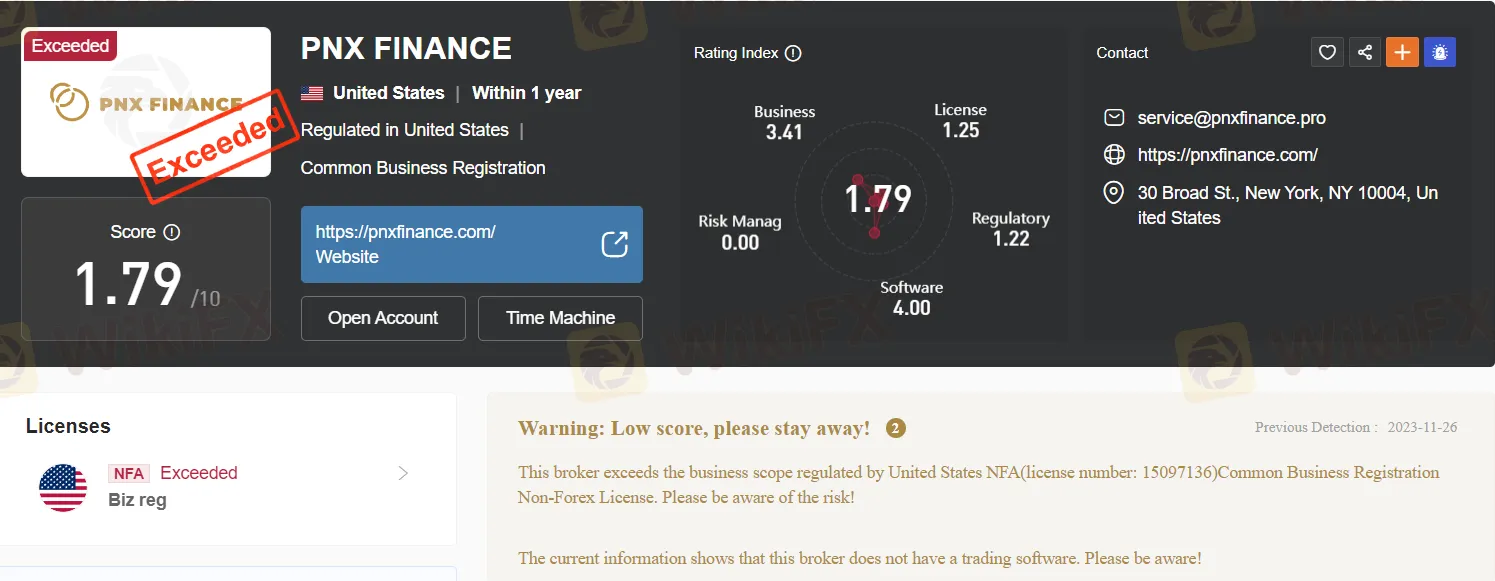

PNX FINANCE is operating outside the scope of its business license as regulated by the United States NFA (National Futures Association). The license number provided, which is 15097136, seems to indicate that they hold a “Common Business Registration Non-Forex License.”

However, the warning suggests that this broker exceeds the business scope regulated by this license. Additionally, it mentions that the broker does not have trading software, which could be a concern for individuals looking to engage in trading activities through this broker.

Overall, the regulation status of PNX FINANCE based on the provided information appears to be in question, and potential investors or traders should exercise caution and conduct further due diligence before engaging with this broker to ensure their financial security and compliance with regulatory requirements.

PNX FINANCE offers a diverse range of trading instruments, including cryptocurrencies, and provides a user-friendly MetaTrader 5 (MT5) platform for trading. Multiple deposit methods are available, and traders can automate their strategies using Expert Advisors (EAs). Customer support channels are accessible. However, there are regulatory concerns about operating outside the scope of their license, and information on account types and leverage is unclear. Detailed information about spreads and commissions is not provided, and a 2% standard withdrawal fee is charged. The absence of educational resources may be a drawback for traders seeking learning materials.

| Pros | Cons |

| Diverse Range of Trading Instruments | Regulatory Concerns |

| Availability of Cryptocurrency Trading | Lack of Clarity on Account Types and Leverage |

| User-Friendly MT5 Trading Platform | Absence of Detailed Spreads and Commissions |

| Multiple Deposit Methods | 2% Standard Withdrawal Fee |

| Automated Trading with Expert Advisors (EAs) | Lack of Educational Resources |

| Accessible Customer Support Channels |

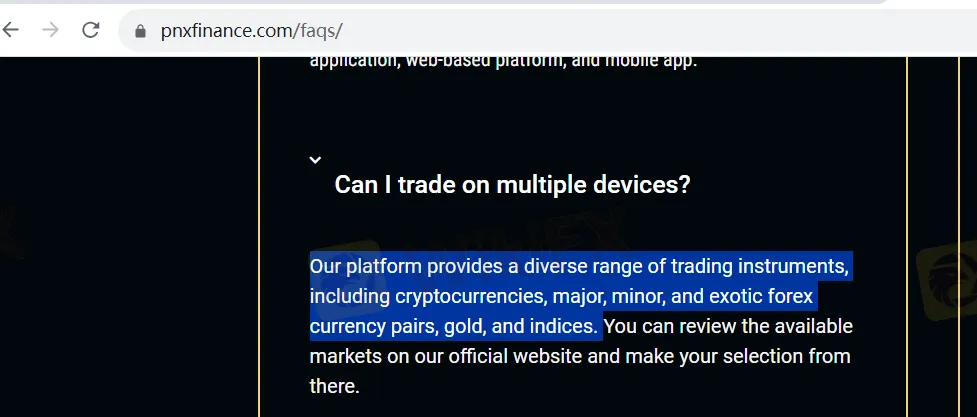

PNX FINANCE offers a diverse range of trading instruments for its users. These instruments include:

Cryptocurrencies: PNX FINANCE provides the ability to trade cryptocurrencies, which are digital assets like Bitcoin, Ethereum, and other popular cryptocurrencies. Cryptocurrency trading is known for its volatility and is popular among traders seeking potentially high returns.

Major Forex Currency Pairs: Major currency pairs typically include combinations of the world's most widely traded currencies, such as the EUR/USD (Euro/US Dollar), USD/JPY (US Dollar/Japanese Yen), and GBP/USD (British Pound/US Dollar). These pairs are often the most liquid and actively traded in the forex market.

Minor Forex Currency Pairs: Minor currency pairs include combinations of currencies that are not among the major ones but still have significant trading activity. Examples include EUR/GBP (Euro/British Pound) and AUD/CAD (Australian Dollar/Canadian Dollar).

Exotic Forex Currency Pairs: Exotic currency pairs involve one major currency and one currency from a smaller or less commonly traded economy. Examples of exotic pairs might include USD/TRY (US Dollar/Turkish Lira) or EUR/TRY (Euro/Turkish Lira).

Gold: PNX FINANCE offers trading in gold, a precious metal that is often used as a safe-haven asset and a hedge against inflation. Gold trading can be popular during times of economic uncertainty.

Indices: Indices represent the performance of a group of stocks or assets from a specific market or sector. PNX FINANCE provides access to trading indices, which can include major stock market indices like the S&P 500, Dow Jones Industrial Average, and more.

Overall, PNX FINANCE offers a comprehensive range of trading instruments, catering to a wide variety of trading preferences and strategies. Traders can choose from cryptocurrencies, forex currency pairs, precious metals, and indices to diversify their portfolios and take advantage of different market opportunities. It's essential for traders to thoroughly research and understand the risks associated with each instrument before trading.

The provided information lacks clarity regarding account types and leverage levels offered by PNX FINANCE. This lack of transparency can be frustrating for potential clients, as these details are crucial for making informed decisions about trading. To clarify these aspects, clients should consider reaching out to the company directly or consulting their official website. Insufficient information about account types and leverage can create uncertainty and hinder the decision-making process for traders.

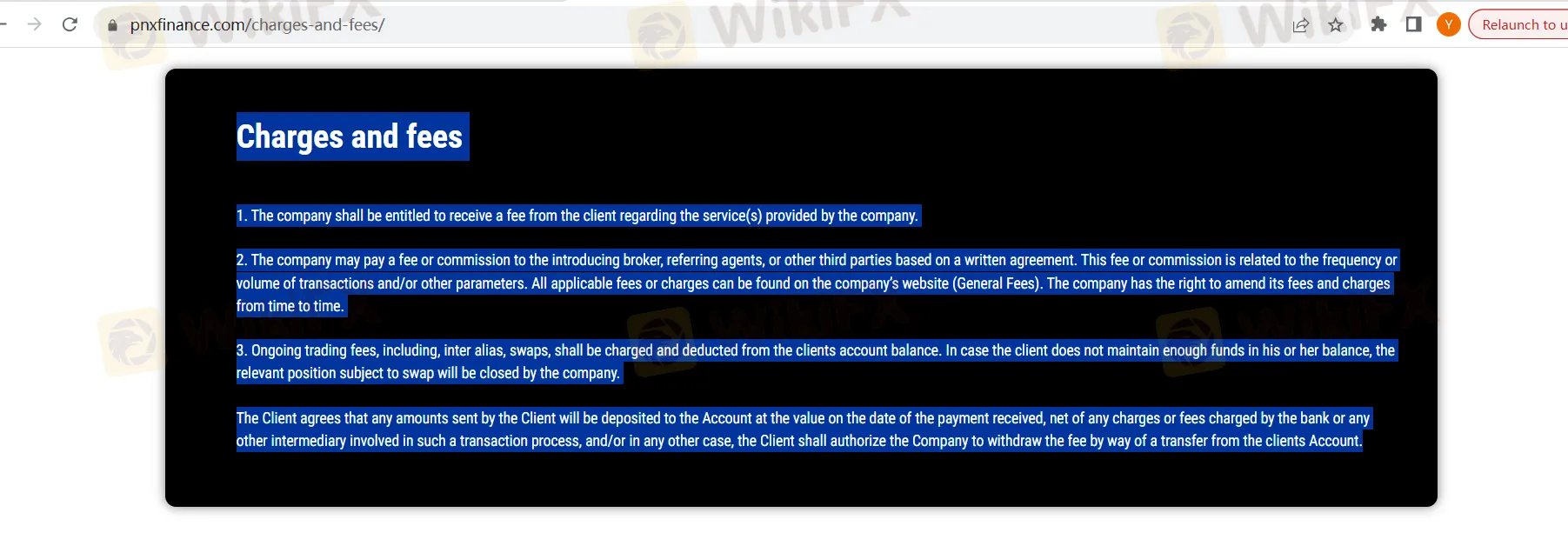

Based on the provided information, the document mentions several aspects related to charges and fees associated with trading through PNX FINANCE. However, it doesn't provide specific details about the spreads and commissions that the company charges for its trading services. Instead, it outlines the following general points related to fees and charges:

Service Fees: The company is entitled to receive a fee from the client for the services provided. The document does not specify the nature or amount of this fee, so it would likely vary depending on the specific services offered.

Introducing Broker or Referring Agent Fees: The company may pay fees or commissions to introducing brokers, referring agents, or third parties based on written agreements. These fees or commissions may be related to factors such as the frequency or volume of transactions. The specific terms of these agreements would be outlined separately and may not be provided in this document.

General Fees: All applicable fees and charges are mentioned to be available on the company's website. The company reserves the right to amend its fees and charges from time to time. These fees would include various charges related to trading and account maintenance.

Ongoing Trading Fees (Swaps): The document mentions that ongoing trading fees, including swaps, will be charged and deducted from the client's account balance. If the client does not maintain sufficient funds in their balance to cover these fees, the relevant position subject to swap may be closed by the company.

Bank or Intermediary Charges: Any amounts sent by the client will be deposited to the account at the value on the date of the payment received, net of any charges or fees charged by the bank or any other intermediary involved in the transaction process.

The document does not provide specific details about the spreads (the difference between the bid and ask price for an asset) or commissions (fees for executing trades) that clients would incur while trading with PNX FINANCE. To obtain precise information about spreads and commissions, clients would need to refer to the company's website or contact their customer support for a detailed fee schedule.

It's crucial for clients to fully understand the fee structure and trading costs associated with any brokerage firm before engaging in trading activities to make informed decisions about their investments.

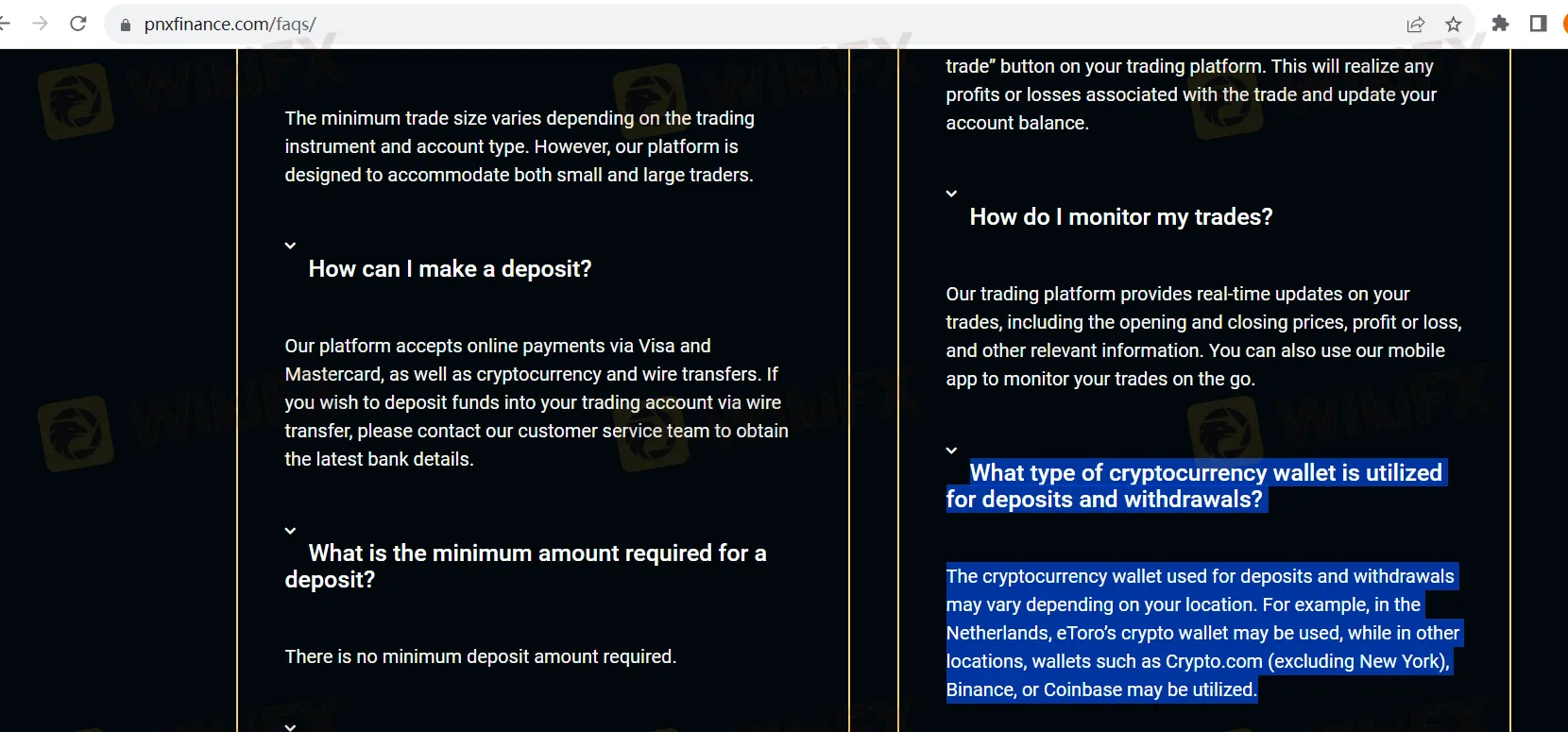

PNX FINANCE offers several options for depositing and withdrawing funds, as outlined in the provided information:

Deposits:

You can make deposits using various methods, including:

Visa and Mastercard: Online payments via these credit/debit cards are accepted.

Cryptocurrency: You have the option to deposit funds using cryptocurrencies.

Wire Transfers: If you prefer to deposit funds via wire transfer, you need to contact the customer service team to obtain the latest bank details.

Withdrawals:

PNX FINANCE charges a standard withdrawal fee, which amounts to 2% of the withdrawal amount. This fee is deducted from the withdrawn funds.

To withdraw funds from your trading account, you can follow these steps:

Log in to your account.

Select the withdrawal option.

Follow the provided instructions.

Withdrawals are typically processed within 24 hours.

Withdrawn funds are transferred to your designated bank account or e-wallet.

Cryptocurrency Wallet for Deposits and Withdrawals:

The type of cryptocurrency wallet used for deposits and withdrawals may vary depending on your location. Some examples mentioned include:

In the Netherlands, eToro's crypto wallet may be used.

In other locations, you may use wallets such as Crypto.com (excluding New York), Binance, or Coinbase for cryptocurrency transactions.

These options provide flexibility for clients to deposit and withdraw funds using methods that suit their preferences and locations. However, it's important to be aware of any associated fees, such as the 2% withdrawal fee, and to follow the provided instructions carefully when making transactions to ensure a smooth process. Additionally, cryptocurrency users should verify the wallet options available in their specific region to facilitate their deposits and withdrawals.

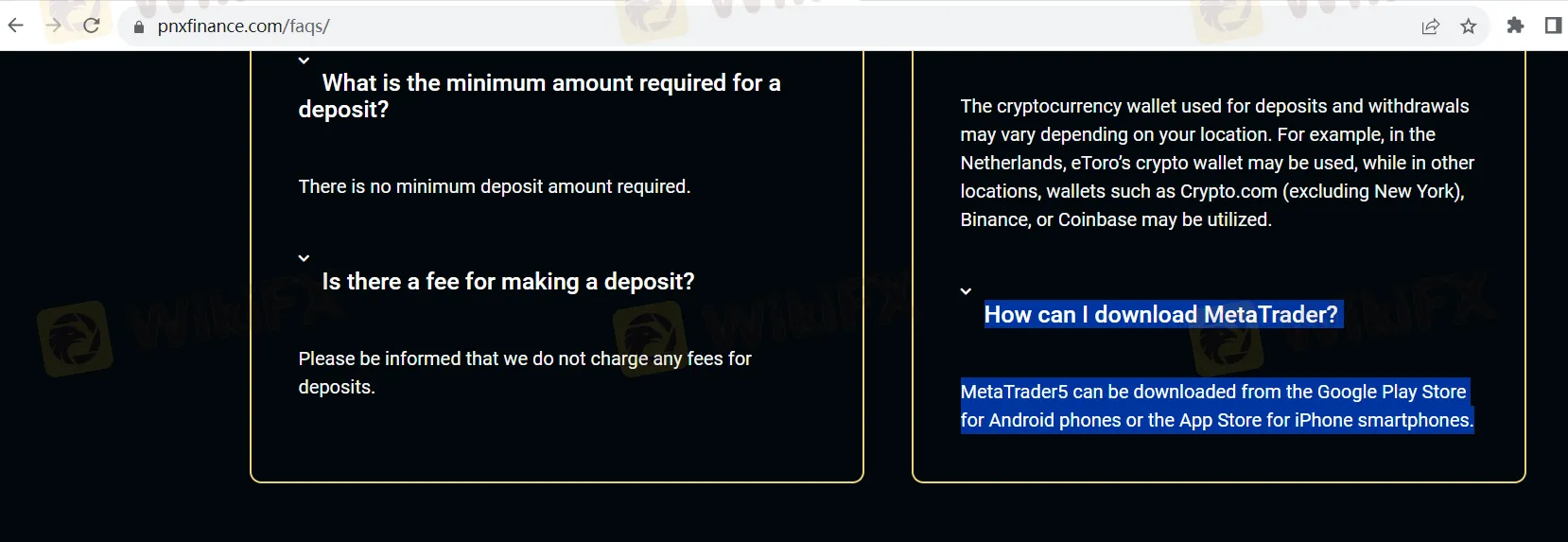

PNX FINANCE provides the MetaTrader 5 (MT5) trading platform, a powerful and versatile tool for traders. MT5 offers a user-friendly interface, advanced charting tools, technical indicators, and customizable features that cater to both novice and experienced traders. It supports trading across a wide range of financial instruments, including forex, cryptocurrencies, stocks, and commodities, providing access to various markets. Additionally, MT5 allows for automated trading through expert advisors (EAs) and algorithmic strategies, enhancing the trading experience for those seeking automation and advanced analytical capabilities.

PNX FINANCE has a range of communication channels for customer support, including email (service@pnxfinance.pro) and a website (www.pnxfinance.com) where customers can likely find additional information and potentially access a support portal. They also have a presence on social media platforms like Twitter, Facebook, Telegram, and YouTube, which can be used for inquiries and updates.

The provided contact form suggests a straightforward way for customers to get in touch, allowing them to input their name, email address, and subject, and then send their message directly to the company. While the specific responsiveness and quality of customer support can vary, the availability of multiple communication channels and a contact form typically indicates an effort to provide accessible and responsive customer assistance to address inquiries, concerns, or issues.

Based on the information provided, it appears that PNX FINANCE may not offer educational resources as part of its services. Educational resources typically include materials such as articles, tutorials, webinars, or courses designed to help traders and investors improve their knowledge and skills in the financial markets.

The absence of educational resources may be a limitation for traders, especially those who are new to trading and would benefit from learning and educational materials. Traders who value educational content to enhance their trading capabilities may need to consider seeking such resources from external sources or exploring alternative brokers that provide comprehensive educational support.

PNX FINANCE is a brokerage firm operating under a non-forex business license, and there are concerns about whether it complies with its regulatory scope. The broker offers a diverse range of trading instruments, including cryptocurrencies, forex currency pairs, gold, and indices, catering to various trading preferences. However, specific details about account types and leverage are unclear, which may pose challenges for potential clients. Additionally, information on spreads and commissions is not provided, so traders should refer to the company's website for precise fee details. PNX FINANCE facilitates deposits and withdrawals through various methods, including credit/debit cards, cryptocurrencies, and wire transfers, with a 2% withdrawal fee. The broker utilizes the MetaTrader 5 platform for trading, offering a versatile tool with advanced features. Customer support is available through multiple communication channels. However, educational resources do not appear to be a part of their offering, which could be a drawback for traders seeking educational materials.

Q1: How can I deposit funds into my PNX FINANCE trading account?

A1: PNX FINANCE accepts deposits through Visa and Mastercard, as well as cryptocurrency and wire transfers. You can choose the method that suits you best for funding your account.

Q2: What is the standard withdrawal fee at PNX FINANCE?

A2: The standard withdrawal fee is 2% of the withdrawal amount, deducted from the withdrawn funds.

Q3: What trading platform does PNX FINANCE offer?

A3: PNX FINANCE provides the MetaTrader 5 (MT5) trading platform, known for its user-friendly interface and advanced features for various financial instruments.

Q4: Are there educational resources available for traders on the PNX FINANCE platform?

A4: It appears that PNX FINANCE does not offer educational resources. Traders seeking educational materials may need to explore external sources.

Q5: How long does it typically take for withdrawals to be processed?

A5: Withdrawals are typically processed within 24 hours by PNX FINANCE, after which the funds are transferred to your designated bank account or e-wallet.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment