User Reviews

More

User comment

6

CommentsWrite a review

2023-10-16 17:14

2023-10-16 17:14

2023-02-17 16:01

2023-02-17 16:01

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 4

Exposure

Score

Regulatory Index0.00

Business Index7.42

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

Globex360 (PTY)LTD

Company Abbreviation

Globex360

Platform registered country and region

South Africa

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Information | Details |

| Company Name | Globex360 |

| Registered Country/Region | South Africa |

| Founded in | 2017 |

| Regulation | Not regulated |

| Tradable Instruments | Forex, commodities, equities, and indices |

| Trading Platforms | MetaTrader4 |

| Minimum Deposit | $20 |

| Maximum Leverage | 1:500 |

| Account Types | Standard, Premium, Premium+, Private Wealth |

| Spreads | From 0.03 pips |

| Commission | Not mentioned |

| Deposit & Withdrawal Methods | Paygate, Visa, and MasterCard |

| Education | Economic Calendar, News, and Traders Academy |

| Customer Support | Phone, email, and social media |

| Bonus Program | Yes |

| FAQs | Yes |

Founded in 2017, Globex360 is an online forex broker based in South Africa. The platform offers a variety of tradable instruments, including forex, commodities, equities, and indices through the popular MetaTrader4 trading platform. The broker offers low minimum deposit requirement of $20 and maximum leverage of up to 1:500. Globex360 provides different account types to cater to varying trader needs, including Standard, Premium, Premium+, and Private Wealth accounts. The broker claims to offer competitive spreads starting from 0.03 pips, while information regarding commission fees is not explicitly mentioned.

For deposit and withdrawal transactions, Globex360 supports popular methods such as Paygate, Visa, and MasterCard. Traders can contact its customer support team via phone, email, and social media channels. It is worth noting that Globex360 offers a bonus program.

Traders interested in using Globex360 should consider the aforementioned factors and conduct thorough research to determine if the broker aligns with their trading requirements and risk tolerance.

Globex360 is a registered and regulated financial services provider authorized by the Financial Sector Conduct Authority (FSCA) in South Africa. However, it is important to note that the FSCA license for Globex360 may currently be exceeded or expired. As a regulated entity, Globex360 is subject to certain standards and regulations aimed at protecting investors.

It is crucial to understand that online trading carries significant risks, and there is a possibility of losing all of your invested capital. Trading in financial markets is not suitable for all traders or investors. It requires a thorough understanding of the risks involved, including market volatility, potential losses, and the impact of economic events.

Please note that the regulatory status and licensing of brokers can change over time. It is essential to verify the current licensing and regulatory information of Globex360 or any broker before engaging in any trading activities.

Here is a concise and neutral description of Globex360s strengths and weaknesses.

Globex360 provides a wide range of trading instruments and multiple account types, providing flexibility for traders with different preferences and trading strategies. It provides generous leverage options up to 1:500, a low minimum deposit requirement of $20, user-friendly MT4 trading platform, multiple customer support channels, and free educational materials, catering to both beginner and experienced traders. Traders can benefit from bonuses offered by Globex360. It also enables fast deposit and withdrawal processes, ensuring efficient transactions for traders.

While Globex360 is licensed by the FSCA (Financial Sector Conduct Authority), there have been instances where the license has been exceeded, raising concerns about regulatory compliance.

The commission fees charged by Globex360 are not explicitly specified, and its customer support is not available 24/7, which may cause delays in receiving assistance during off-hours or in different time zones. Globex360's educational resources are limited, which may not fully cater to the educational needs of traders seeking in-depth market analysis or advanced trading strategies.

| Pros | Cons |

| Wide range of trading instruments available | FSCA license is exceeded |

| Multiple account types | Commission fees not specific |

| Generous leverage up to 1:500 | Not 7/24 customer support |

| Low minimum deposit requirement of $20 | Limited educational resources |

| Multiple customer support channels offered | |

| User-friendly MT4 trading platform | |

| Free education materials for traders | |

| Bonus available | |

| Fast deposit & withdrawals |

Globex360 provides investors with a wide range of financial trading instruments, including forex, commodities, equities, and indices in the Forex market.

Forex With Globex360 offers several benefits to traders. With over 50 spot Forex CFDs available, traders have a wide range of currency pairs to choose from. Globex360 offers leverage up to 1:500 and spreads from zero pips. With ultra-fast execution and no re-quotes, traders can enjoy efficient trade execution.

For trading commodities, with access to 6 market sectors and over 20 CFDs (Contract for Difference), Globex360 offers an alternative investment option that can hedge against traditional asset classes, leverage up to 1:500, attractive spreads, no re-quotes to traders.

Globex360s equity CFDs enable individuals to use the power of leverage to increase their purchasing power. Equity CFDs allow clients to invest in large companies around the world, such as TELSA, Microsoft and many more, ensuring that trading portfolios are diversified.

Trading indices With Globex360 is accessible to over 20 major indices, with leverage Up to 1:500, deep liquidity, no re-quotes, and tight spreads.

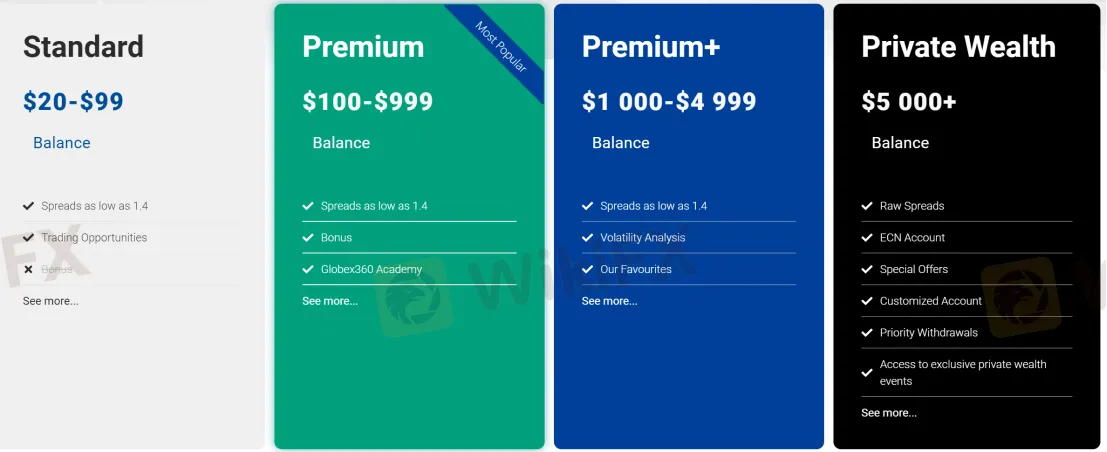

Globex360 offers four different account types on its platform: Standard, Premium, Premium+, and Private Wealth. The Standard account requires a minimum opening amount of $20, while the Premium account requires $100, the Premium+ account requires $1,000, and the Private Wealth account requires $5,000. These initial deposit requirements are relatively affordable for most regular traders, catering to a wide range of budgets. Additionally, Globex360 provides Islamic accounts for traders who follow Islamic principles, offering an alternative option that adheres to specific religious requirements.

To open an account with Globex360, you can follow these general steps:

1. Visit the official website of Globex360: https://globex360.co.za/. On the website, locate the “OPEN AN ACCOUNT” button. Click on it to begin the account registration process.

2. You will be redirected to the account registration page. Fill in the required information accurately, including your personal details such as your full name, email address, phone number, and country of residence.

3. Choose the type of account you wish to open. Globex360 typically offers different account types to cater to varying trader needs, such as Standard, Premium, Premium+, and Private Wealth accounts.

4. Read and accept the terms and conditions of Globex360. Complete any additional verification steps that may be required. Once you have provided all the necessary information, submit your account registration form.

5. You may receive a confirmation email from Globex360 containing further instructions or a verification link to activate your account. Follow the instructions provided to complete the account activation process.

6. After your account is activated, you can proceed to fund your account. Globex360 typically supports various deposit methods, including Paygate, Visa, and MasterCard.

7. Once your account is funded, you can download and install the MetaTrader4 trading platform provided by Globex360.

Globex360 offers a maximum trading leverage of up to 1:500, which is considered to be high compared to industry standards. It is important to note that high leverage levels can significantly amplify both potential profits and losses. Therefore, inexperienced traders are advised to exercise caution and carefully consider their risk tolerance before utilizing such high leverage levels. It is recommended for new traders to start with lower leverage options and gradually increase it as they gain experience and a deeper understanding of the market dynamics.

Globex360 offers floating spreads that are tailored to different account types. The Standard, Premium, and Premium+ accounts have spreads starting from 1.4 pips, while the Private Wealth account allows for raw spreads.

On the Globex360 platform, traders can benefit from competitive spreads. For instance, the EURUSD pair has a spread of 0.2 pips, GBPUSD has a spread of 0.1 pips, XAUUSD (Gold) has a spread of 0.09 pips, US30 (Dow Jones) has a spread of 2 pips, Brent Oil has a spread of 0.03 pips, and Corn has a spread of 0.34 pips.

These tight spreads contribute to cost-effective trading and enhance the potential profitability for traders across various instruments.

Globex360 offers bonuses for Premium, Premium+, and Private Wealth accounts, while the Standard account does not qualify for a bonus. However, it is essential to exercise caution when dealing with bonuses.

Traders should prioritize the transparency and reliability of a broker's services rather than solely focusing on bonus incentives. Making informed decisions based on the overall quality of the broker's offerings and regulatory compliance is crucial for a secure and trustworthy trading experience.

Globex360 provides traders with a range of trading platforms, including MT4, MT4 desktop terminal, MT4 mobile terminal for MT4 Windows, and MT4 OS terminal. MT4 is widely recognized as one of the most popular trading platforms globally, offering features such as automated monitoring, advanced charting capabilities, and real-time analysis tools.

As one of the providers of MT4, Globex360's extensive experience in utilizing this platform can assist traders in their trading endeavors. These resources can provide traders with valuable insights and assistance in making informed trading decisions.

Upon reviewing the logos displayed at the bottom of the home page on Globex360's official website, it appears that the broker accepts deposits and withdrawals through popular payment gateways such as Paygate, Visa, and MasterCard. This provides traders with convenient and widely recognized options for managing their funds.

Globex360 has a low minimum initial deposit requirement of just $20, allowing traders with various budgets to start trading on the platform. Deposits are stated to be processed instantly, ensuring that funds are available for trading promptly.

When it comes to withdrawals, Globex360 aims to provide a quick and efficient process. Withdrawal requests are typically processed within 24 hours, allowing traders to access their funds in a timely manner.

Globex360 offers multiple channels for customer support. You can contact their support team via email at support@globex360.co.za or reach them by telephone at +27 10 009 0512. Additionally, you can stay updated with the broker by following them on popular social networks like Twitter, Facebook, Instagram, and WhatsApp.However, it is important to note that Globex360 does not provide live chat support, which may be disappointing for users who prefer the convenience and real-time interaction offered by this communication method. For any physical correspondence or visits, the company's address is Ground floor, Building 3 Waterford Office Park, Fourways, Johannesburg.Educational Resources

Globex360 offers a range of educational resources; however, it is important to note that the platform's offerings may be limited compared to some other brokers. Traders can access resources such as an Economic Calendar, News updates, and Traders Academy for learning purposes.

The Economic Calendar provides important dates and events related to economic indicators, central bank meetings, and other market-moving announcements. This can help traders stay informed about potential market impacts and plan their trading strategies accordingly.

The News section provides relevant market news and analysis, keeping traders updated on the latest developments in the financial world. This information can be valuable for making informed trading decisions and staying ahead of market trends.

Globex360's Traders Academy is a learning platform designed to provide educational materials and resources for traders. While the extent of the academy's content may be limited, it still offers valuable information and insights to assist traders in improving their knowledge and skills.

In summary, Globex360 is a trading broker that offers a wide range of trading instruments and multiple account types. It provides generous leverage of up to 1:500 and has a low minimum deposit requirement of $20. The broker offers a user-friendly MT4 trading platform and multiple customer support channels. It also provides free educational materials for traders and bonuses. However, the commission fees are not specific, and customer support is not available 24/7. Additionally, educational resources are limited, despite the fast deposit and withdrawal options. It is important to note that the FSCA license for Globex360 may currently be exceeded or expired.

Q: Is Globex360 regulated?

A: No. It has been verified that the FSCA license is exceeded.

Q: At Globex360, are there any regional restrictions for traders?

A: Yes. Globex360 products and services are not intended for Belgium, US, and Canadian residents.

Q: Does Globex360 offer the industry-standard MT4 & MT5?

A: Yes. Globex360 supports MT4.

Q: What is the minimum deposit for Globex360?

A: The minimum initial deposit at Globex360 to open an account is only $20.

Q: Is Globex360 a good broker for beginners?

A: No. Globex360 is not a good choice for beginners. We dont advise any traders to trade with unregulated brokers.

The three prizes were given to the firm for demonstrating the highest level of CX satisfaction while leveraging innovative online trading technologies and providing the best services in global trading.

WikiFX

WikiFX

The Central Bank of Nigeria (CBN) has established the RT200 FX Program, which aims to boost foreign currency revenues.

WikiFX

WikiFX

Forex trading has become increasingly popular in Nigeria today. With the recent ban placed on all deposit Money Banks (DMBs) in Nigeria not to permit any form of crypto transactions; many Nigerians have resorted to forex trading which is in itself a legal business in Nigeria. To this end, most forex brokers operating in Nigeria have deemed it necessary to provide multiple account types for the Nigerian trader to choose from. Hence this work has elaborated on the five different types of accounts that Nigerian traders could choose after they have registered with their chosen broker.

WikiFX

WikiFX

More

User comment

6

CommentsWrite a review

2023-10-16 17:14

2023-10-16 17:14

2023-02-17 16:01

2023-02-17 16:01