User Reviews

More

User comment

3

CommentsWrite a review

2024-03-28 11:50

2024-03-28 11:50

2023-02-17 16:02

2023-02-17 16:02

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Self-developed

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.51

Risk Management Index0.00

Software Index5.37

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

FlatexDEGIRO Bank AG

Company Abbreviation

flatex

Platform registered country and region

Germany

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| flatex Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Germany |

| Regulation | Unregulated |

| Products & Services | Savings plans, ETFs, Fund, Bonds, Certificates & Leveraged Products, CFDs, Sustainable investing: flatex green, Securities loans, Crypto, flatex wealth |

| Trading Platforms | flatex next, flatex classic, flatex-Trader 2.0, stock3, Product finder |

| Customer Support | Phone, live chat, social media |

Flatex, a brand under the umbrella of the publicly listed flatexDEGIRO AG, commenced its operations in 2006 within the German market landscape already dominated by major online providers. Leveraging over 30 years of profound expertise in financial IT, coupled with holding its own full banking license and boasting a fully integrated business model, flatex stands out in offering clients a distinctive suite of services for professional securities trading.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

| Pros | Cons |

|

|

|

|

|

|

|

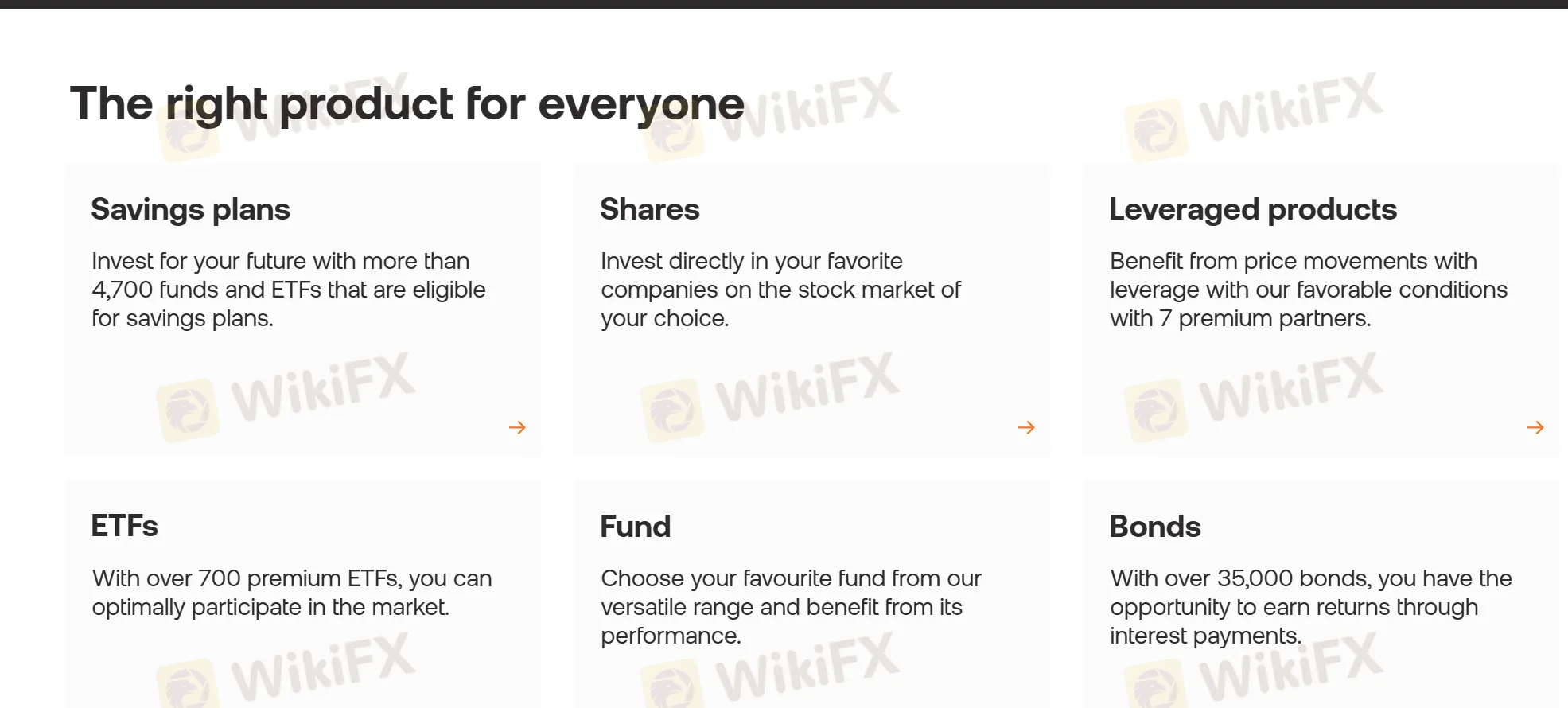

- Wide Range of Products: flatex offers one of the widest ranges of products in Europe, including savings plans, ETFs, funds, bonds, certificates & leveraged products, CFDs, sustainable investing options, securities loans, crypto, and wealth management solutions. This variety allows investors to diversify their portfolios according to their preferences and risk tolerance.

- Integrated Business Model: With over 30 years of expertise in financial IT and holding its own full banking license, flatex boasts a fully integrated business model. This enables the platform to offer professional securities trading services efficiently and effectively.

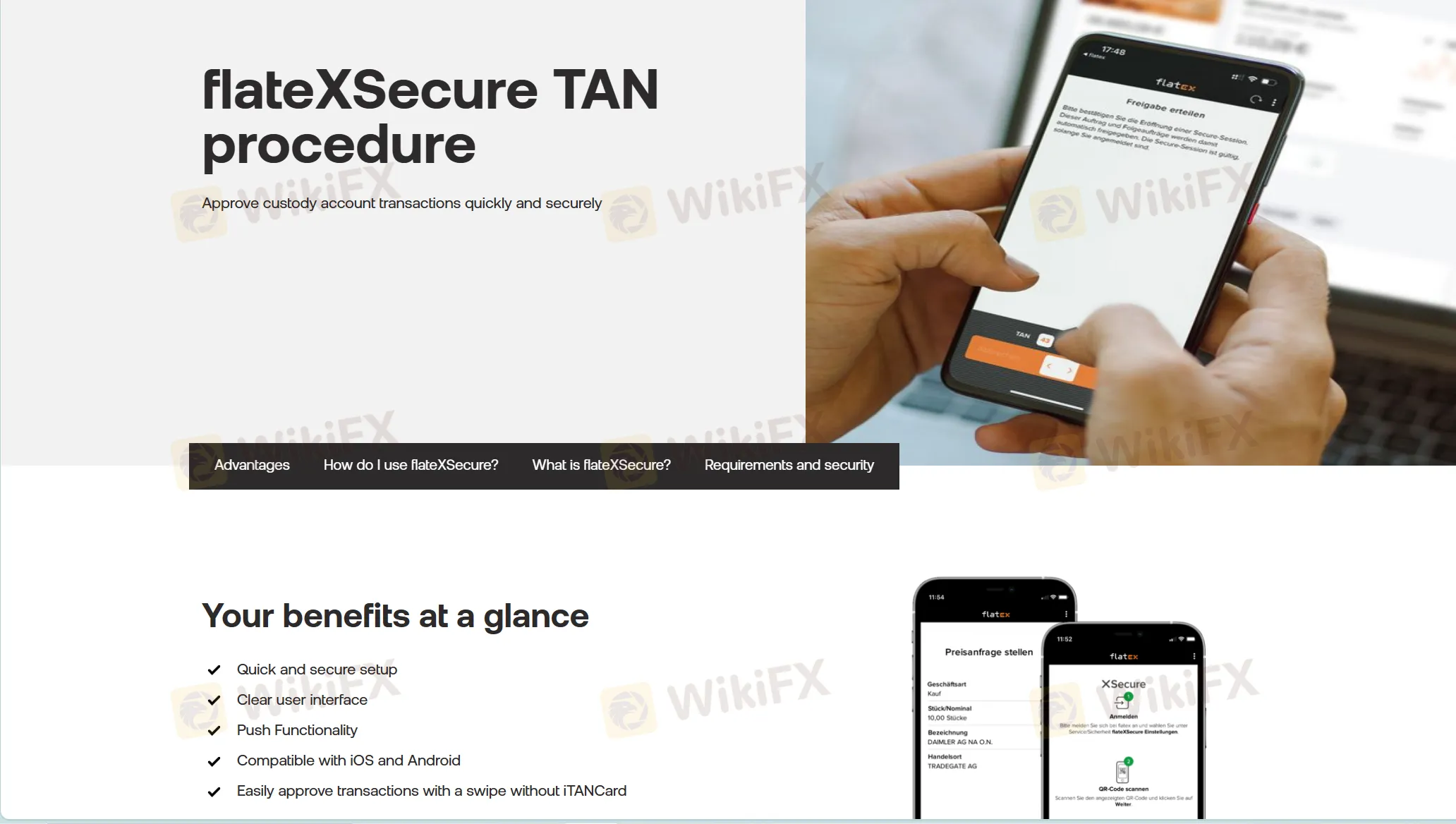

- Security Measures: flatex prioritizes the security of investors' assets by considering securities held in custody accounts as special assets, providing protection in the event of broker insolvency. Additionally, the platform offers deposit insurance coverage for clearing account balances up to EUR 100,000 and employs modern TAN procedures for transaction security.

- User-Friendly Trading Platforms: flatex provides multiple trading platforms such as flatex next, flatex classic, flatex-Trader 2.0, stock3, and Product finder, catering to different trading preferences and expertise levels. These platforms are designed to offer a convenient and seamless trading experience.

- Unregulated Regulation: flatex operates in an unregulated regulatory environment, which may raise concerns regarding investor protection and oversight. Investors should be cautious and conduct thorough research before engaging with the platform.

- Complexity for Novice Traders: Despite offering user-friendly trading platforms, navigating through the wide range of products and services offered by flatex may still be complex for novice traders. This complexity could potentially deter inexperienced investors from utilizing the platform effectively.

- Potential for High Costs: While flatex aims to provide reasonable prices for its services, the costs associated with trading, such as fees and commissions, could still be relatively high compared to other platforms, especially for frequent traders or those dealing with complex financial instruments like CFDs.

Flatex provides security measures to safeguard investors' assets. Securities such as shares, funds, and ETFs held in your custody account are considered special assets and are protected in the event of the broker's insolvency. Moreover, the balance on your clearing account is also shielded by flatex through deposit insurance, offering coverage up to EUR 100,000. As flatexDEGIRO Bank AG falls under the statutory deposit insurance scheme, your custody account balance enjoys comprehensive protection.

To enhance transaction security, flatex offers flatexSecure, a modern TAN procedure replacing the iTANCard. This method enables users to conveniently approve transactions via a dedicated app on their smartphones or tablets.

However, flatex currently lacks valid regulation, posing inherent risks to investors. Without government or financial authority oversight, investing with flatex carries uncertainties. The absence of regulation means that the platform operators can potentially misuse investors' funds without being held accountable for their actions. This absence of oversight exposes investors to the risk of financial loss, as the platform could cease operations abruptly, leaving investors vulnerable to potential fraudulent activities.

flatex offers a diverse range of trading products and services to cater to various investment preferences and strategies:

- Shares: flatex allows users to trade shares of publicly listed companies on various stock exchanges. This includes buying and selling individual stocks of companies across different sectors and industries.

- Savings Plans: Customers can set up savings plans to regularly invest a fixed amount of money into selected financial instruments such as stocks, ETFs, or funds. This helps in building a portfolio over time through systematic investments.

- ETFs (Exchange-Traded Funds): ETFs are investment funds that trade on stock exchanges, mirroring the performance of a particular index, sector, commodity, or asset class. flatex provides access to a wide range of ETFs, allowing investors to diversify their portfolios efficiently.

- Funds: Investors can access various mutual funds or investment funds managed by professional portfolio managers. These funds pool money from multiple investors to invest in diversified portfolios of assets such as stocks, bonds, or commodities.

- Bonds: flatex offers trading in bonds, which are fixed-income securities issued by governments, municipalities, or corporations. Bonds typically pay periodic interest payments and return the principal amount upon maturity.

- Certificates & Leveraged Products: These are structured investment products that may offer exposure to underlying assets such as stocks, indices, or commodities. Certificates and leveraged products can provide opportunities for enhanced returns or hedging strategies but involve higher risk due to leverage.

- CFDs (Contracts for Difference): CFDs allow traders to speculate on the price movements of various financial instruments without owning the underlying asset. flatex offers CFD trading on a range of assets including stocks, indices, currencies, and commodities.

- Sustainable Investing (flatex green): This feature allows investors to focus on environmentally and socially responsible investment opportunities. flatex green may include investment options aligned with sustainability criteria or ESG (Environmental, Social, and Governance) principles.

- Securities Loans: Investors can potentially earn additional income by lending out their securities to other traders or institutions. Securities lending involves temporarily transferring ownership of securities in exchange for a fee.

- Crypto: flatex offers trading in cryptocurrencies, allowing investors to buy and sell digital assets such as Bitcoin, Ethereum, or other cryptocurrencies available on the platform.

- flatex Wealth: This may refer to flatexs wealth management services, which could include portfolio management, financial planning, and advisory services tailored to the individual needs and goals of clients.

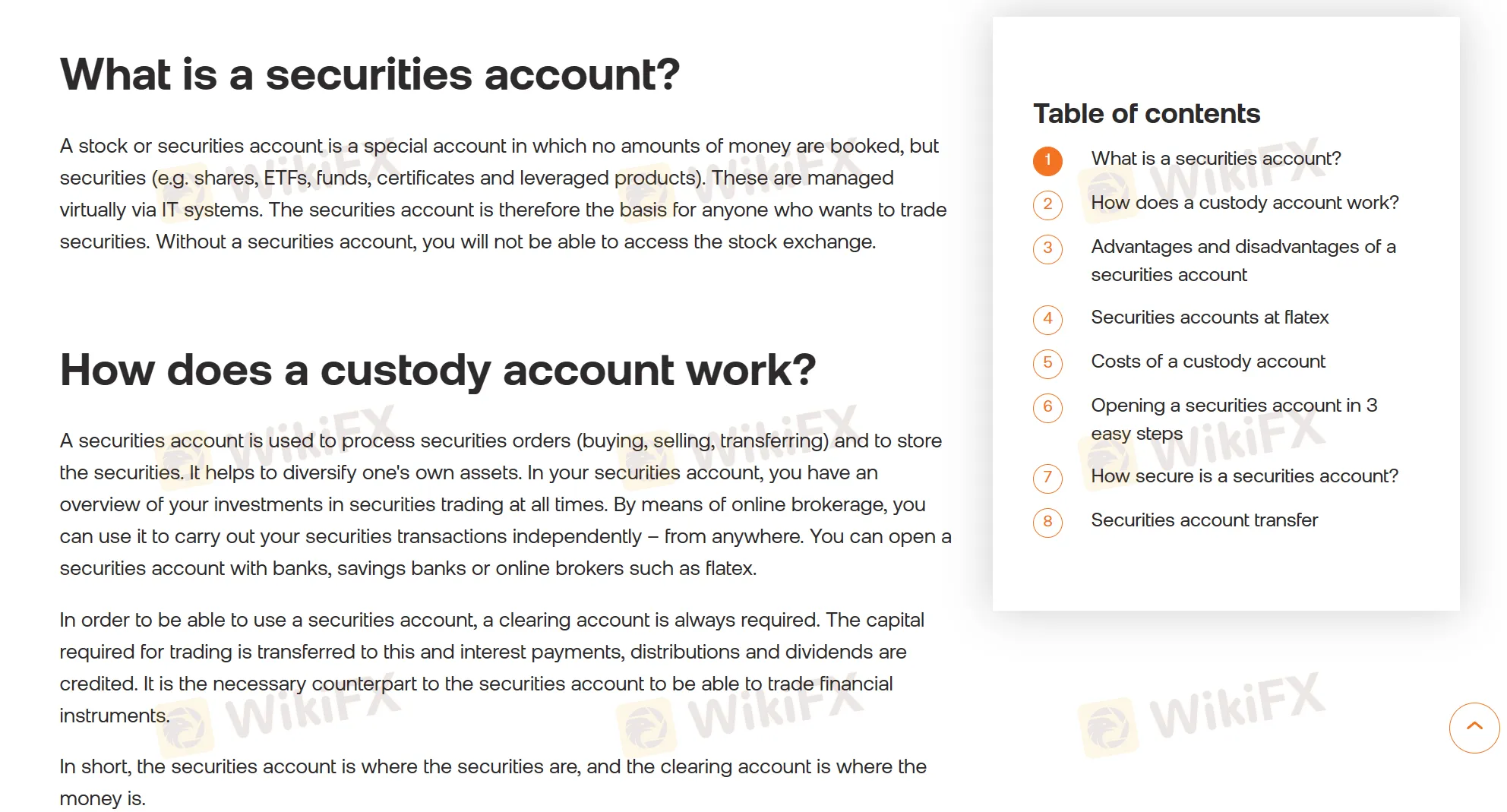

flatex offers security accounts. A securities account, also known as a stock account, is a distinct type of account where monetary transactions aren't recorded; instead, it holds various securities like stocks, ETFs, funds, certificates, and leveraged products. These assets are managed digitally through IT systems. Essentially, the securities account serves as a fundamental platform for individuals involved in securities trading. It's indispensable for accessing the stock market; without it, participation in trading activities would be impossible.

The cost of a securities account varies depending on the provider. The focus is on:

- Custody fees

- The order commission

- Other fees such as e.g. Third-party costs, spreads and grants

To open an account with flatex, please follow these steps:

| Step | |

| 1. Online Application | Fill out the application form to open a securities account on the flatex website. |

| 2. Video Legitimation | Complete the video legitimation process to verify your identity. |

| 3. Receive Access Data | Once verified, you‘ll receive your initial access data for your online securities account via SMS. |

| 4. Account Activation | Use the access data to activate your account, and it’s ready for use. |

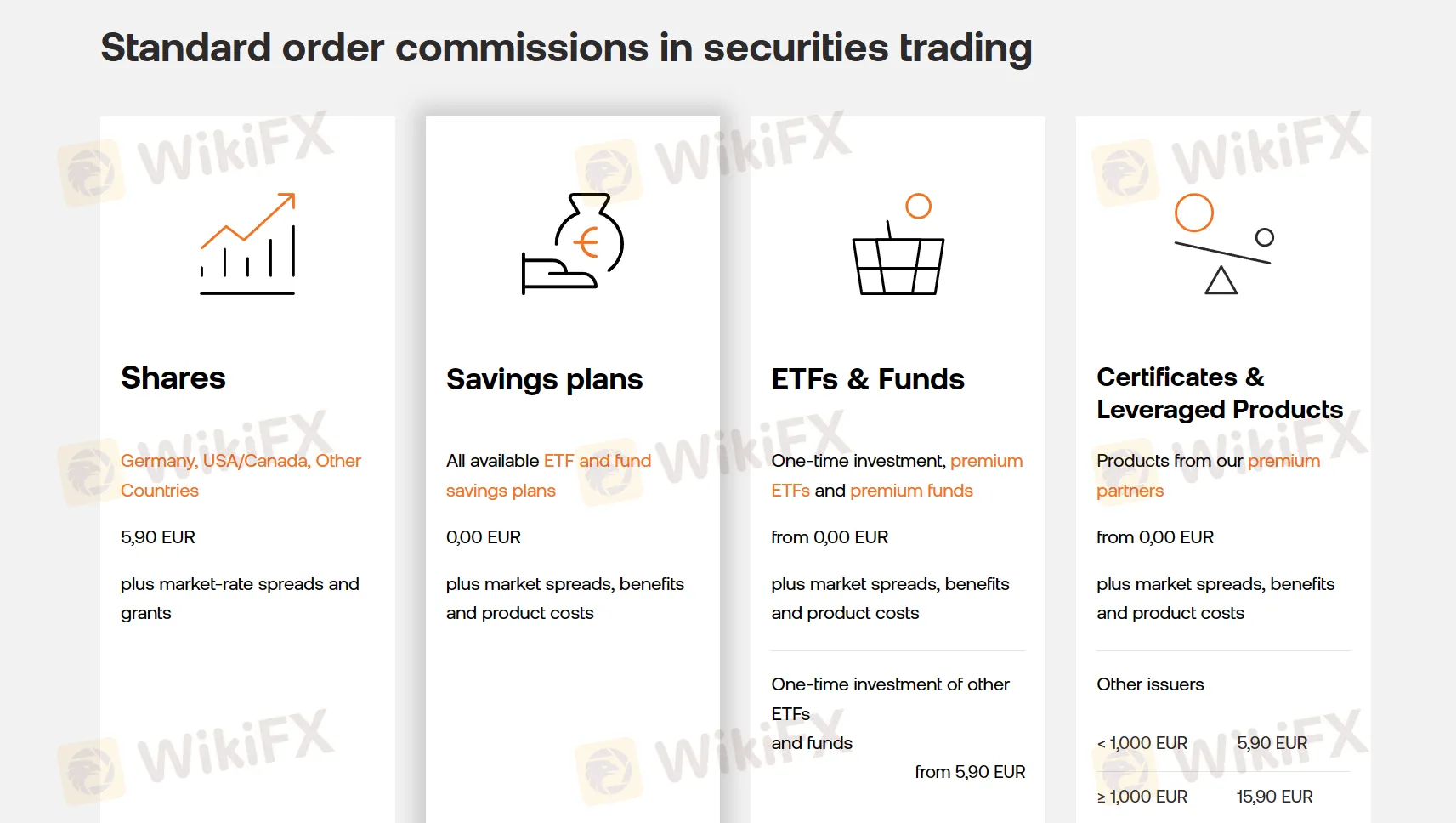

These commissions cover the costs associated with executing trades and may vary depending on factors such as the type of financial instrument, the amount invested, and the issuer. flatex charges commissions for trading various financial instruments as follows:

| Financial Instrument | Commission | Additional Costs |

| Shares | Germany, USA/Canada, Other Countries: €5.90 EUR | Market-rate spreads and grants |

| Savings Plans | All available ETF and fund savings plans: €0.00 EUR | Market spreads, benefits, and product costs |

| ETFs & Funds | One-time investment in premium ETFs and premium funds: Starting from €0.00 EUR | Market spreads, benefits, and product costs |

| One-time investment in other ETFs and funds: Starting from €5.90 EUR | Market spreads, benefits, and product costs | |

| Certificates & Leveraged Products | Products from premium partners: Starting from €0.00 EUR | Market spreads, benefits, and product costs |

| Other issuers: Less than €1,000 EUR: €5.90 EUR€1,000 EUR or more: €15.90 EUR | - |

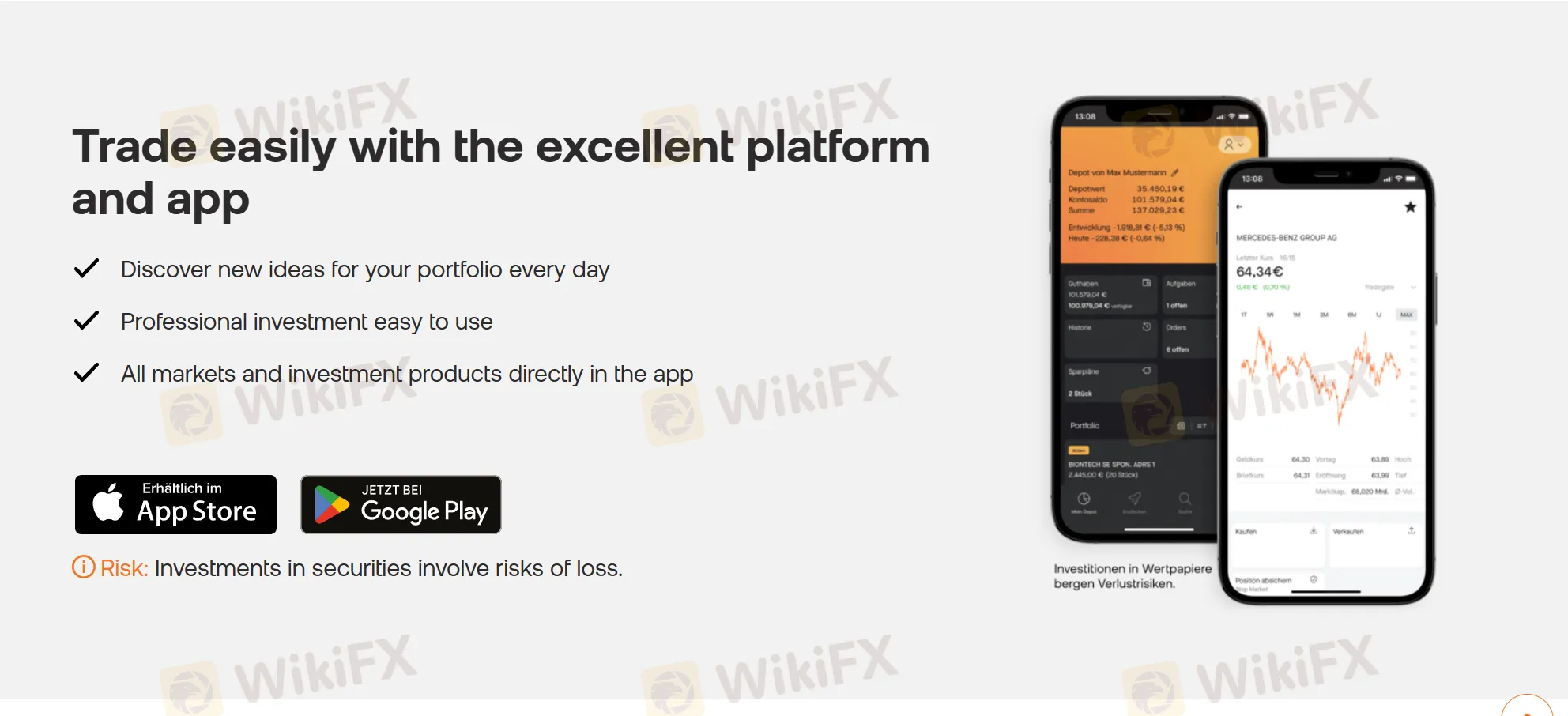

flatex offers its clients a range of trading platforms tailored to suit different trading styles and preferences. Among these platforms are flatex next, flatex classic, flatex-Trader 2.0, and stock3.

flatex next is a modern and user-friendly web-based platform designed for traders who prefer intuitive navigation and accessibility. It provides a streamlined interface with customizable features, allowing users to easily execute trades, manage their portfolios, and access real-time market data. With flatex next, clients can trade a variety of financial instruments efficiently and stay updated on market trends through advanced charting tools and analysis capabilities.

For more experienced traders, flatex classic offers a comprehensive trading platform with advanced functionalities. It provides access to a wide range of trading tools and research resources, empowering traders to conduct in-depth analysis and make informed investment decisions. flatex classic is suitable for active traders who require advanced charting features, technical indicators, and order types to execute complex trading strategies.

flatex-Trader 2.0 is another trading platform offered by flatex, catering to the needs of professional traders and institutional investors. This platform is highly customizable and feature-rich, offering advanced charting tools, real-time data streams, and sophisticated order management capabilities. flatex-Trader 2.0 is ideal for traders who demand high performance and robust functionality to execute large volumes of trades efficiently.

stock3 is a specialized platform designed specifically for trading stocks and equities. It offers a user-friendly interface with access to comprehensive market data, news, and analysis tools tailored to stock trading. With stock3, clients can execute trades seamlessly and stay informed about market developments that may impact their investment decisions.

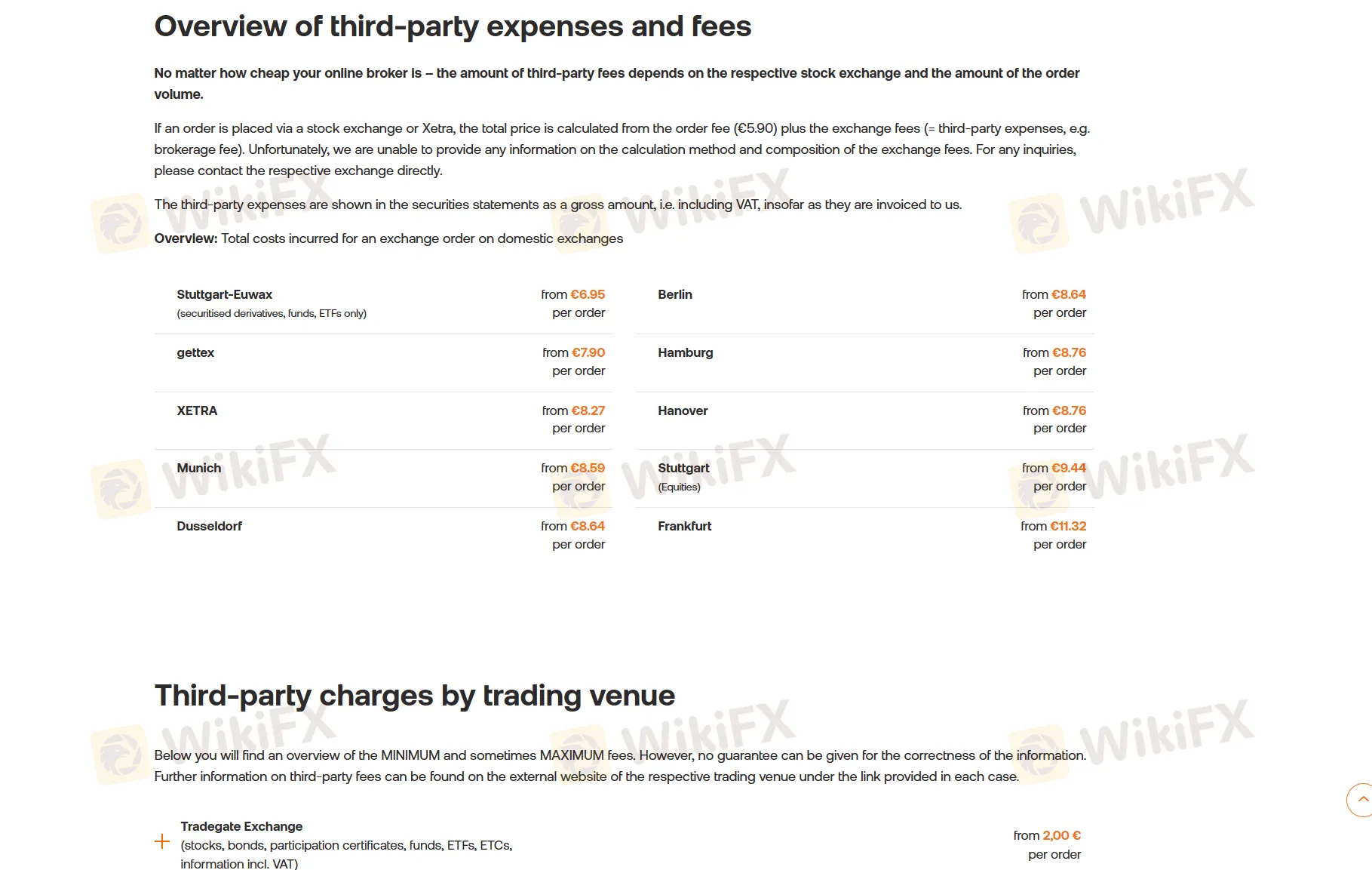

The fees charged by flatex can be summarized as follows:

These are charges levied for executing trades on various stock exchanges. The fees vary depending on the trading venue and the type of security being traded. For example:

- For orders placed via stock exchanges or Xetra, the total price is calculated from the order fee (€5.90) plus exchange fees, also known as third-party expenses.

- Minimum and maximum fees apply for different trading venues, such as Stuttgart-Euwax, gettex, XETRA, Munich, Dusseldorf, Berlin, Hamburg, Hanover, Stuttgart, and Frankfurt.

These are additional fees charged by the trading venues themselves. They vary depending on the venue and the type of security being traded. Some examples include:

- Tradegate Exchange

- Quotrix

- Lang & Schwarz and Lang & Schwarz Exchange (LSX)

- Baader Bank and gettex

- Deutsche Börse fees in Xetra trading and Frankfurt

- Vienna Stock Exchange

- Swiss Stock Exchange

For Contract for Difference (CFD) trading, the following costs apply:

- Financing costs, which include overnight funding costs for all positions.

- Margin percentages, which determine the amount of margin required for trading various CFD instruments.

- Spreads, which can vary based on liquidity fluctuations, especially for Share CFDs.

flatex offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have. It's a convenient and effective communication channel that can improve customer satisfaction and increase sales.

Customers can get in touch with customer service line using the information provided below:

Telephone: +49 9221 - 7035 897

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

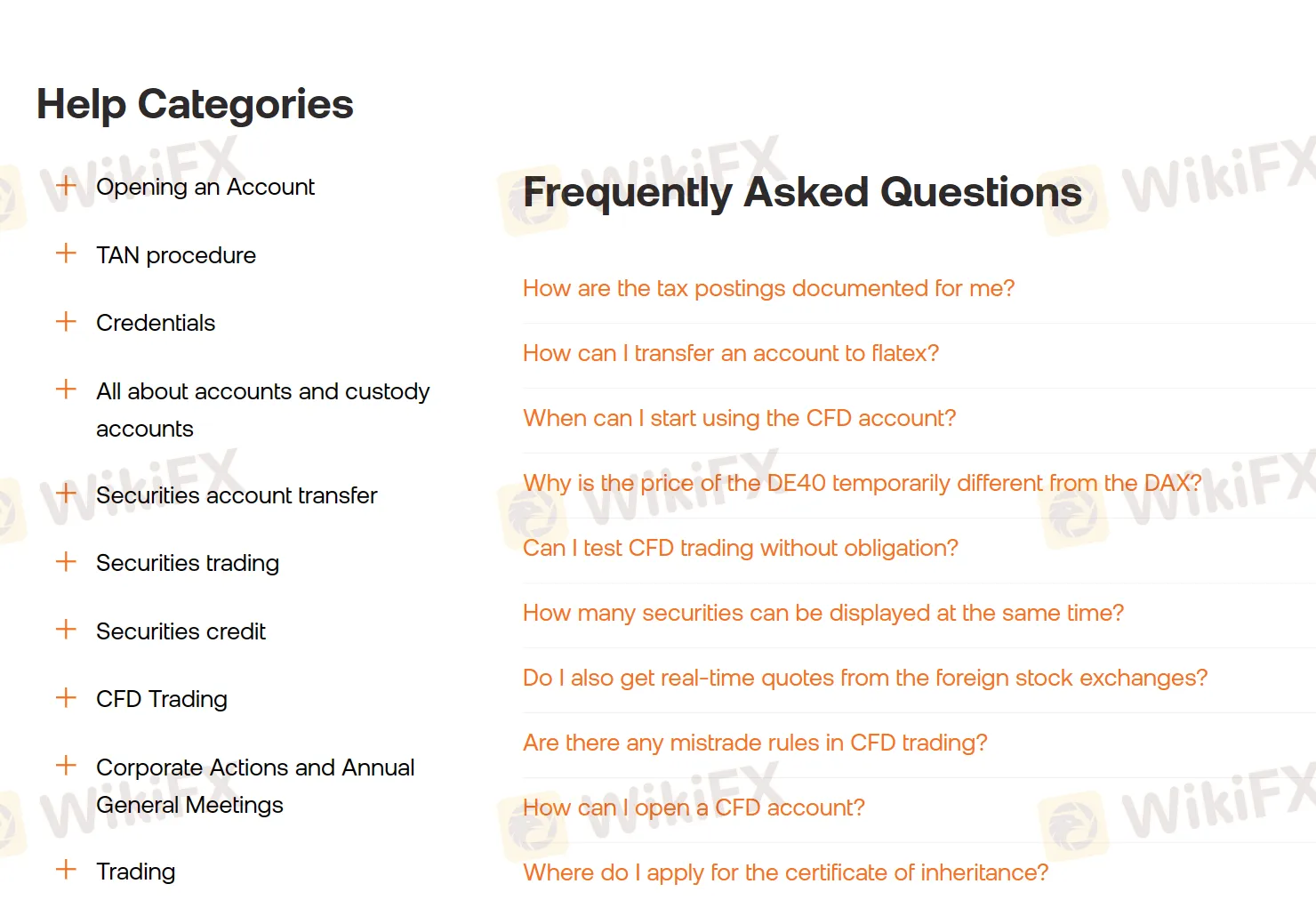

Whats more, flatex provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information. The FAQ section aims to address common queries and concerns that investors may have regarding the company's services, processes, and investment opportunities. By offering this resource, flatex aims to provide transparency and clarity to their clients, helping them make informed decision.

flatex is a comprehensive platform offering a wide array of financial products and services, making it an attractive option for investors seeking diversification and professional trading capabilities. With offerings ranging from savings plans to crypto trading and wealth management solutions, flatex caters to various investment preferences and objectives.

However, flatex operates in an unregulated regulatory environment. While the platform prioritizes security measures such as custody account protection and deposit insurance coverage, every investor should do thorough research and consider the risks associated with unregulated operations.

| Q 1: | Is flatex regulated by any financial authority? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at flatex? |

| A 2: | You can contact via telephone: +49 9221 - 7035 897, live chat, Twitter, Facebook, Instagram, YouTube and Linkedin. |

| Q 3: | What platform does flatex offer? |

| A 3: | It offers flatex next, flatex classic, flatex-Trader 2.0, stock3, Product finder. |

| Q 4: | What services and products flatex provides? |

| A 4: | It provides Savings plans, ETFs, Fund, Bonds, Certificates & Leveraged Products, CFDs, Sustainable investing: flatex green, Securities loans, Crypto, and flatex wealth. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

More

User comment

3

CommentsWrite a review

2024-03-28 11:50

2024-03-28 11:50

2023-02-17 16:02

2023-02-17 16:02