User Reviews

More

User comment

3

CommentsWrite a review

2023-11-27 19:14

2023-11-27 19:14

2023-02-16 17:50

2023-02-16 17:50

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.51

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

LQD LLC

Company Abbreviation

LQDFX

Platform registered country and region

Saint Lucia

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Quick LQDFX Review Summary | |

| Founded | 2015 |

| Registered Country/Region | Saint Lucia |

| Regulation | No license |

| Market Instruments | CFDs on forex, commodities, indices, metals, cryptocurrencies, stocks |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Min Deposit | $20 |

| Max Leverage | 1:500 |

| EUR/USD Spread | From 0.1 pips |

| Trading Platform | MT4 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Established in late 2015, LQDFX is an online Forex and CFD broker registered in the United Kingdom that provides access to a wide range of financial instruments, including currencies, commodities, indices, metals, cryptocurrencies, and stocks. The company offers several account types with low minimum deposit requirement on MT4 platform, as well as a variety of trading tools and educational resources. However, LQDFX is currently not licensed or regulated by any financial institution.

LQDFX has several advantages and disadvantages.

On the positive side, LQDFX offers a wide range of market instruments and account types, including demo and Islamic accounts, and have low minimum deposit requirements. Additionally, LQDFX provides traders with access to several trading tools and supports MT4 trading platform from various devices.

On the negative side, LQDFX currently does not hold any valid regulatory licenses, which may raise concerns for some traders regarding the safety and security of their funds.

Overall, traders should carefully weigh the pros and cons of LQDFX before deciding whether to trade with this broker.

| Pros | Cons |

| • Segregated accounts and balance protection offered | • Unregulated |

| • Wide range of trading instruments offered | • Clients from North Korea, UK, Syria, United States, Canada, EEA are not accepted |

| • variety of account types including demo and Islamic accounts | • Withdrawal fees for Visa and MasterCard |

| • Low minimum deposit requirement | • No 24/7 customer support |

| • Competitive spreads and low commission fees | |

| • Offers trading calculators and economic calendar |

LQDFX says that their customers funds are held in segregated accounts in top-tier European banks, and in the event where the market may be volatile and cause a traders balance to enter into negative territory, LQD alongside it's liquidity providers will ensure the trader is fully covered.

However, the lack of valid regulatory licenses raises concerns about the safety and legitimacy of LQDFX. Without proper oversight and regulation, there is a higher risk of fraudulent activities or unfair trading practices. Therefore, it is advisable to exercise caution and thoroughly research the broker before considering any investments.

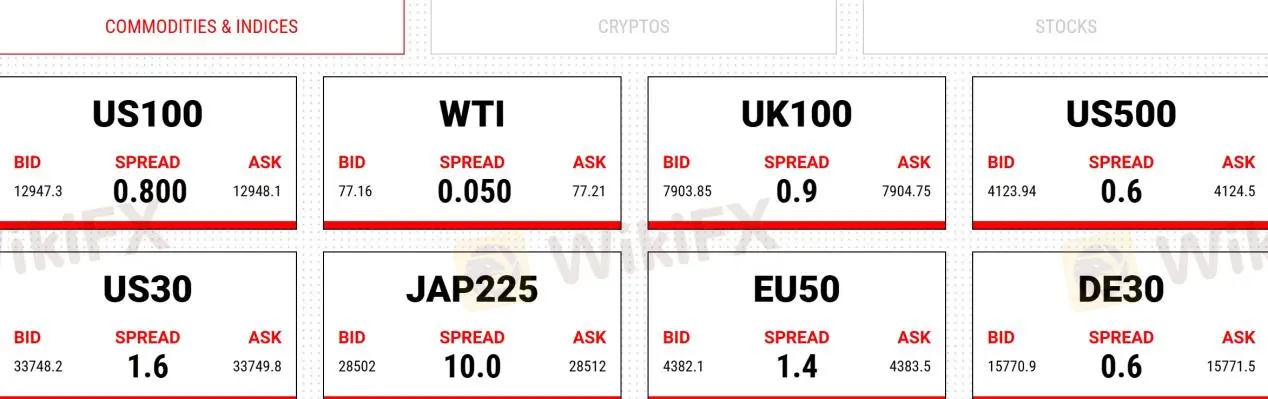

LQDFX is a forex and CFD broker that offers its clients a variety of trading instruments, including CFDs on forex, commodities, indices, metals, cryptocurrencies, and stocks.

| Tradable Assets | Available |

| CFDs | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Apart from demo accounts, LQDFX offers its clients a range of live account types to choose from, including Micro, Gold, ECN, VIP, and Islamic accounts. Each account type has its own minimum deposit requirement, with the Micro and Islamic accounts having the lowest minimum deposit requirement of just $20. Although the minimum initial deposit of $20 is the reasonable amount, traders are still not advised to start real trading here, given the fact that LQDFX is not regulated.

| Account Type | Min Deposit |

| Micro | $20 |

| Gold | $500 |

| ECN | |

| VIP | $25,000 |

| Islamic | $2 |

Meanwhile, the Gold, ECN, and VIP accounts have a significantly higher minimum deposit requirement of $500, $500 and $25,000 respectively.

The Islamic account is a type of account designed specifically for clients who follow the Islamic faith and comply with Sharia law, and it is available upon request. However, the client may be required to provide proof of their eligibility for the account.

LQDFX offers flexible leverage up to 1:500 for the Micro account. However, leverage on other accounts is capped at 1:300, except for the VIP account, which offers rates up to 1:100. Leverage can amplify gains as well as losses, so be sure to understand the risks before you sign up for leveraged trading.

| Account Type | Max Leverage |

| Micro | 1:500 |

| Gold | 1:300 |

| ECN | |

| VIP | 1:100 |

| Islamic | 1:300 |

The spreads offered by LQDFX are different for each account type and vary with market conditions. The Micro account has the widest spreads, with spread from 1 pip. The Gold and Islamic accounts have tighter spreads, with spread from 0.7 pips. The ECN and VIP accounts have the most competitive spreads, coming in at 0.1 pips. The Micro, Gold and Islamic accounts are commission-free; however, the ECN and VIP accounts have an unspecified commission.

| Account Type | Spread | Commission |

| Micro | From 1 pip | ❌ |

| Gold | From 0.7 pips | ❌ |

| ECN | From 0.1 pips | ✔ |

| VIP | ✔ | |

| Islamic | From 0.7 pips | ❌ |

LQDFX offers clients the well-rounded MT4 for Windows, Android, iOS and Web Trader. MT4 marries a rich selection of features with an intuitive design, making it great for traders of all levels. The trading platform supports 30 different languages, more than 50 customisable technical indicators, 30 charting options and 9 timeframes.

| Trading Platform | Available | Supported Devices | Suitable for |

| MT4 | ✔ | Windows, Android, iOS, Web Trader | Beginners |

| MT5 | ❌ | / | Experienced traders |

LQDFX provides several trading tools.

Their economic calendar shows the scheduled economic events that may affect the markets, such as GDP releases or interest rate decisions.

Additionally, their trading calculators include the Pivot Calculator, Fibonacci Calculator, and Deal Size Calculator, which help traders calculate key levels and determine the appropriate position size for their trades.

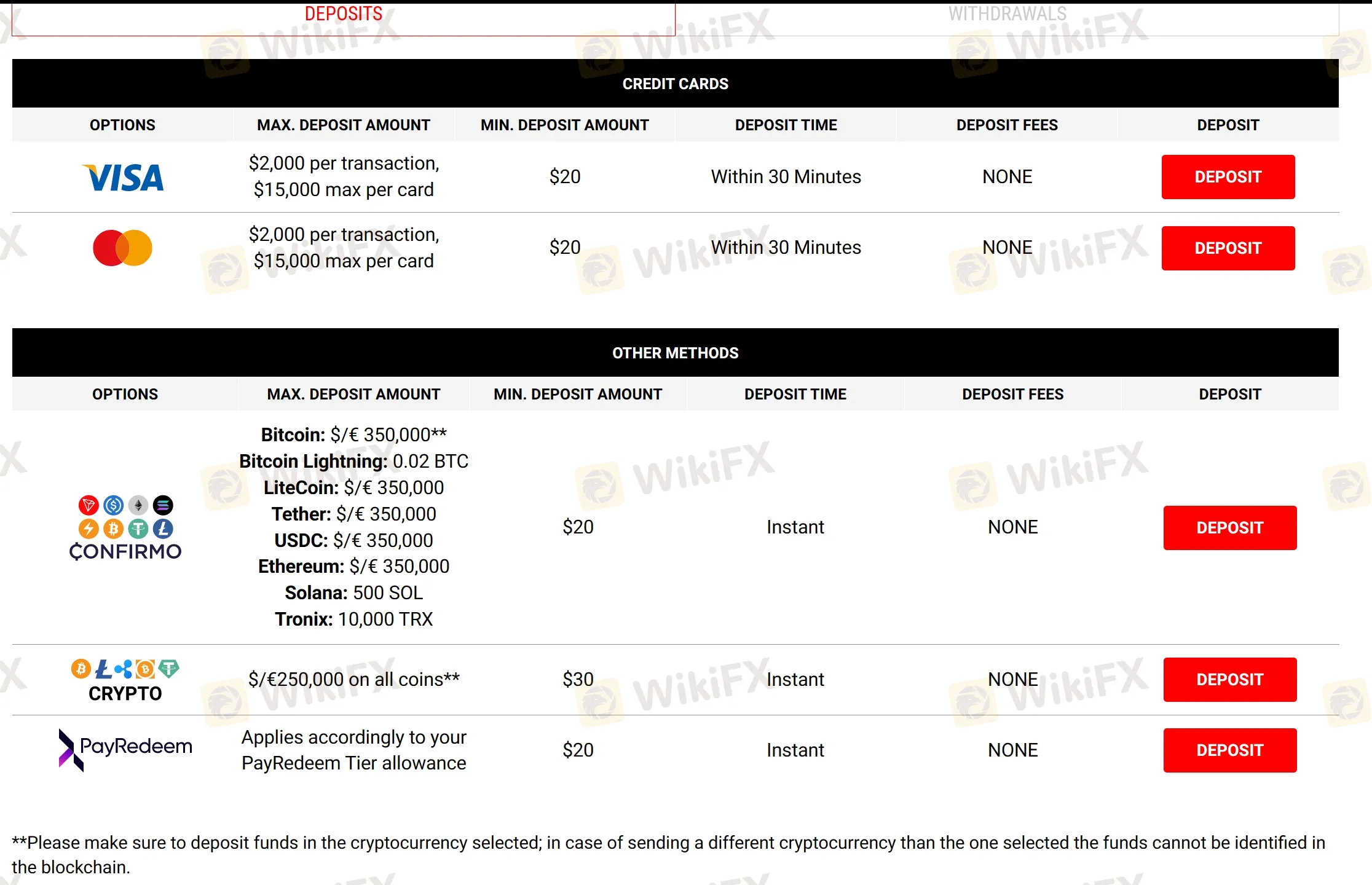

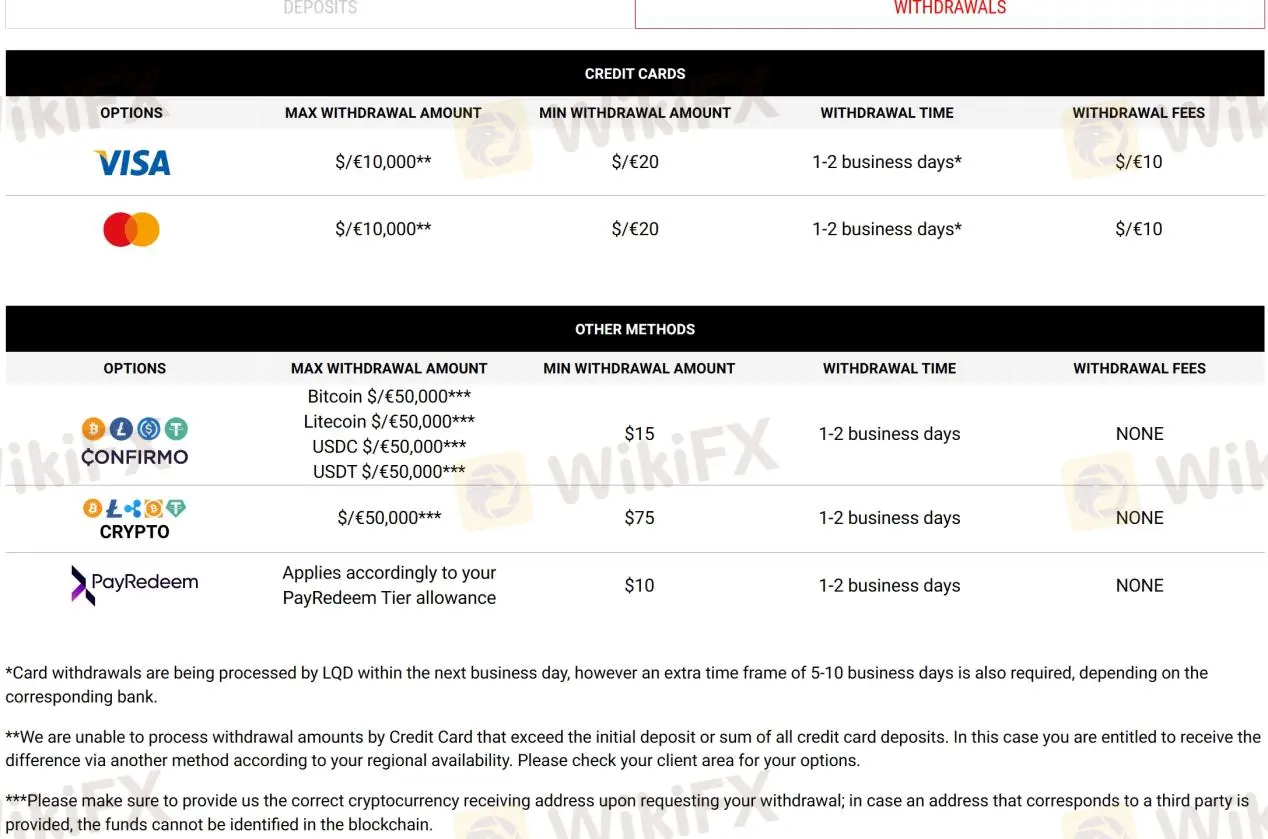

Several payment methods can be used to fund LQDFX trading accounts. Visa, MasterCard, cryptocurrencies, and PayRedeem are all available. Minimum deposit requirement is $20-30 and minimum withdrawal amount is $10-75, which vary on the payment method.

LQDFX minimum deposit vs other brokers

| LQDFX | Most other | |

| Minimum Deposit | $20 | $100 |

No deposit fees are charged, while $/€10 withdrawal fees for Visa and MasterCard, and no fees for other withdrawals. Cryptocurrencies and PayRedeem deposits are processed instantly, but Visa and MasterCard take up to 30 minutes. All withdrawals can be processed within 1-2 business days.

LQDFX charges a variety of fees, including spreads and commissions that we have mentioned above, swap rates, withdrawal fees and inactivity fees. Swap rates are applied to positions held overnight and can be either positive or negative depending on the position held and the interest rate differential between the two currencies being traded.

LQDFX does not charge any fees for deposits, but $/€10 withdrawal fees for Visa and MasterCard. Inactivity fees may also be charged on accounts that have been dormant for more than 60 days.

LQDFX offers rich educational resources for traders of all levels of experience. These resources include books, trading courses, and video tutorials. The books cover a variety of trading topics, from technical analysis to market psychology. The trading courses are designed to provide traders with a comprehensive understanding of the markets, and cover topics such as chart analysis, risk management, and trading strategies. The video tutorials are a great resource for beginners, and cover topics such as how to place trades, how to use trading platforms, and how to interpret market data.

The LQDFX customer support team can be reached though telephone: +44208064 1038, +35924904462 and email: support@1qdfx.com. Surprisingly, LQDFX also offers 24/5 multilingual live chat. Additionally, you can request a callback and follow this broker on some social networks such as Facebook, Instagram, YouTube and LinkedIn.

Overall, LQDFX's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

Based on the information provided, LQDFX appears to offer a wide range of market instruments and trading accounts with competitive spreads and commissions on MT4 platform, along with useful trading tools and educational resources.

However, it is important to note that LQDFX currently does not hold any valid regulatory licenses, which may be a concern for some traders. While LQDFX offers segregated accounts and balance protection, traders should carefully weigh the risks and benefits before deciding to trade with this broker.

Is LQDFX regulated?

No. It has been verified that LQDFX currently has no valid regulation.

At LQDFX, are there any regional restrictions for traders?

Yes. LQDFX does not offer services to citizens or residents of North Korea, UK, Syria, United States, Canada, EEA or any other jurisdiction that would be contrary to local law or regulation.

Does LQDFX offer demo accounts?

Yes.

Does LQDFX offer the industry-standard MT4 & MT5?

Yes. It supports MT4.

What is the minimum deposit for LQDFX?

The minimum initial deposit to open an account is $20.

Is LQDFX a good broker for beginners?

No. It is not a good choice for beginners. We dont advise any traders trade or invest with unregulated brokers.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

While legitimate brokers boost your chances of success, opening an account with a shabby broker can make your trading journey no less than a nightmare.

WikiFX

WikiFX

However, although opening an account with a legitimate broker can boost your chances of success, opening an account with a dishonest broker might turn your trading experience into a nightmare. Numerous accounts have surfaced detailing victims who lost thousands to con artists. Scam brokers like LQDFX are out to make a quick buck, and this article will teach you how to protect yourself from becoming a statistic.

WikiFX

WikiFX

More

User comment

3

CommentsWrite a review

2023-11-27 19:14

2023-11-27 19:14

2023-02-16 17:50

2023-02-16 17:50