User Reviews

More

User comment

4

CommentsWrite a review

2023-12-13 15:47

2023-12-13 15:47

2022-11-27 11:11

2022-11-27 11:11

Score

5-10 years

5-10 yearsRegulated in United Kingdom

Inst Market Making (MM)

Suspicious Scope of Business

Medium potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.67

Business Index7.27

Risk Management Index8.90

Software Index6.00

License Index6.70

Single Core

1G

40G

Danger

Sanction

More

Company Name

Sigma Broking Limited

Company Abbreviation

Sigma

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Company Name | Sigma |

| Registered Country/Area | United Kingdom |

| Founded year | 2008 |

| Regulation | Regulated by United Kingdom FCA,United Arab Emirates DFSA and United States NFA(exceeded) |

| Minimum Deposit | $1,000 |

| Maximum Leverage | 1:400 |

| Spreads | Start from 0.1 pips |

| Trading Platforms | MetaTrader 4 (MT4),webTrader and mobile apps |

| Tradable assets | Currency pairs and CFDs on indices, commodities, precious metals, stocks and futures. |

| Account Types | Standard Account, Professional Account and Institutional Account |

| Customer Support | Phone: +44 (0) 20 7011 9696,Email: info@sigma-broking.com |

| Deposit & Withdrawal | Credit/debit cards like VISA and MasterCard,wire transfer,cheque and bank draft |

| Educational Resources | Webinars,tutorials, market Analysis |

Founded in 2008, Sigma Broking Limited, a subsidiary of Sigma Group, initially specialized in Interest Rate Futures and Options Brokerage. Over time, it diversified its offerings to encompass Fixed Income, Commodities, and Energy. With its headquarters in the heart of London and registration in England and Wales, Sigma has strategically established a presence in North America and Dubai International Financial Centre in the UAE. Notably, Sigma holds multiple licenses: an Investment Advisory License from the UK's FCA (license no. 485362), a Common Financial Service License issued by NFA in the US, and a general finance license granted by Dubai DFSA (license number: F004667).

The regulatory situation of Sigma involves three regulatory authority: United Kingdom FCA,United Arab Emirates DFSA and United States NFA. As of now, Sigma has exceeded the regulatory requirements set by all of them.

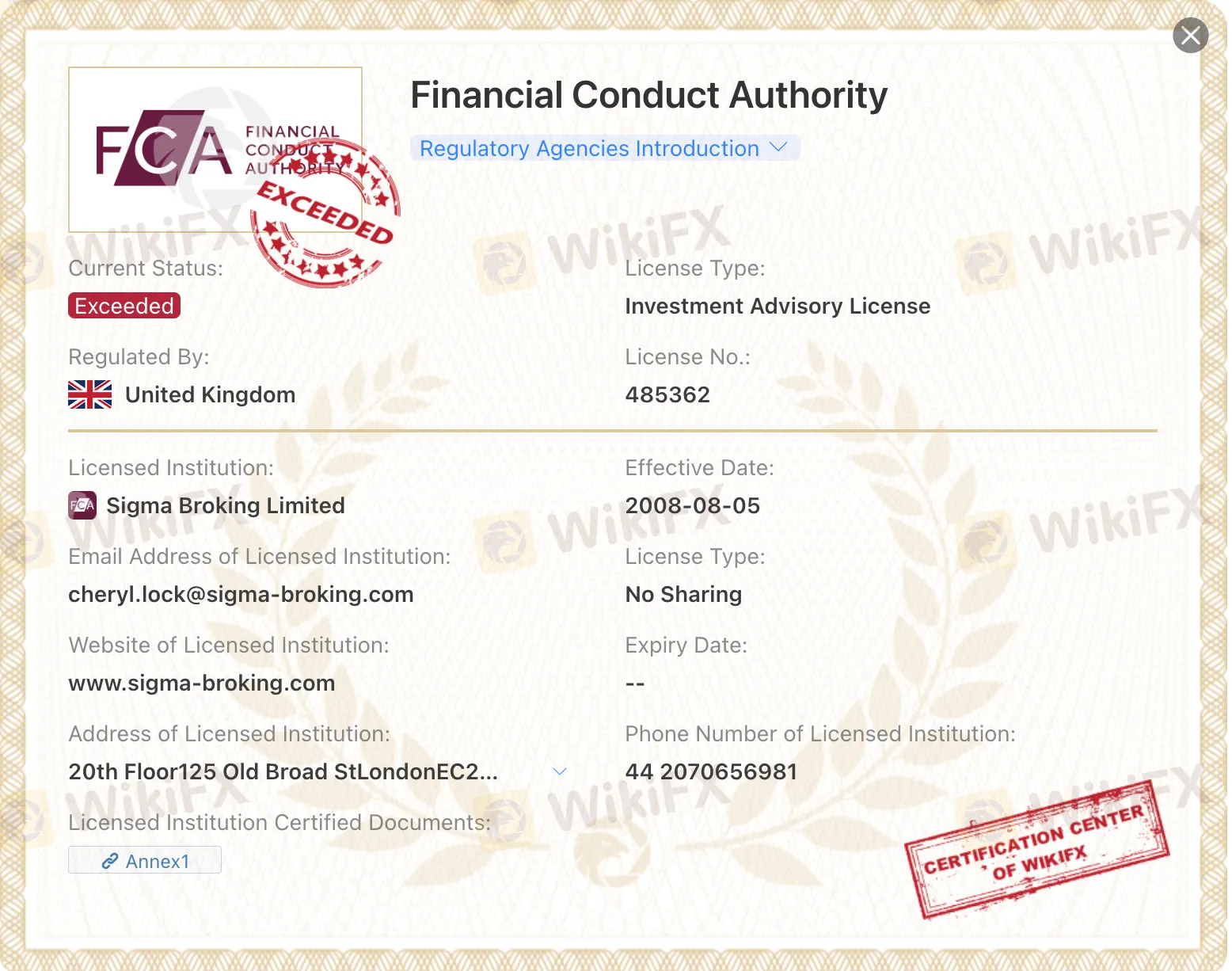

United Kingdom FCA :

Current Status: Exceeded

License Type: Investment Advisory License

Regulated by: Financial Conduct Authority (FCA)

License No.: 485362

Licensed Institution: Sigma Broking Limited

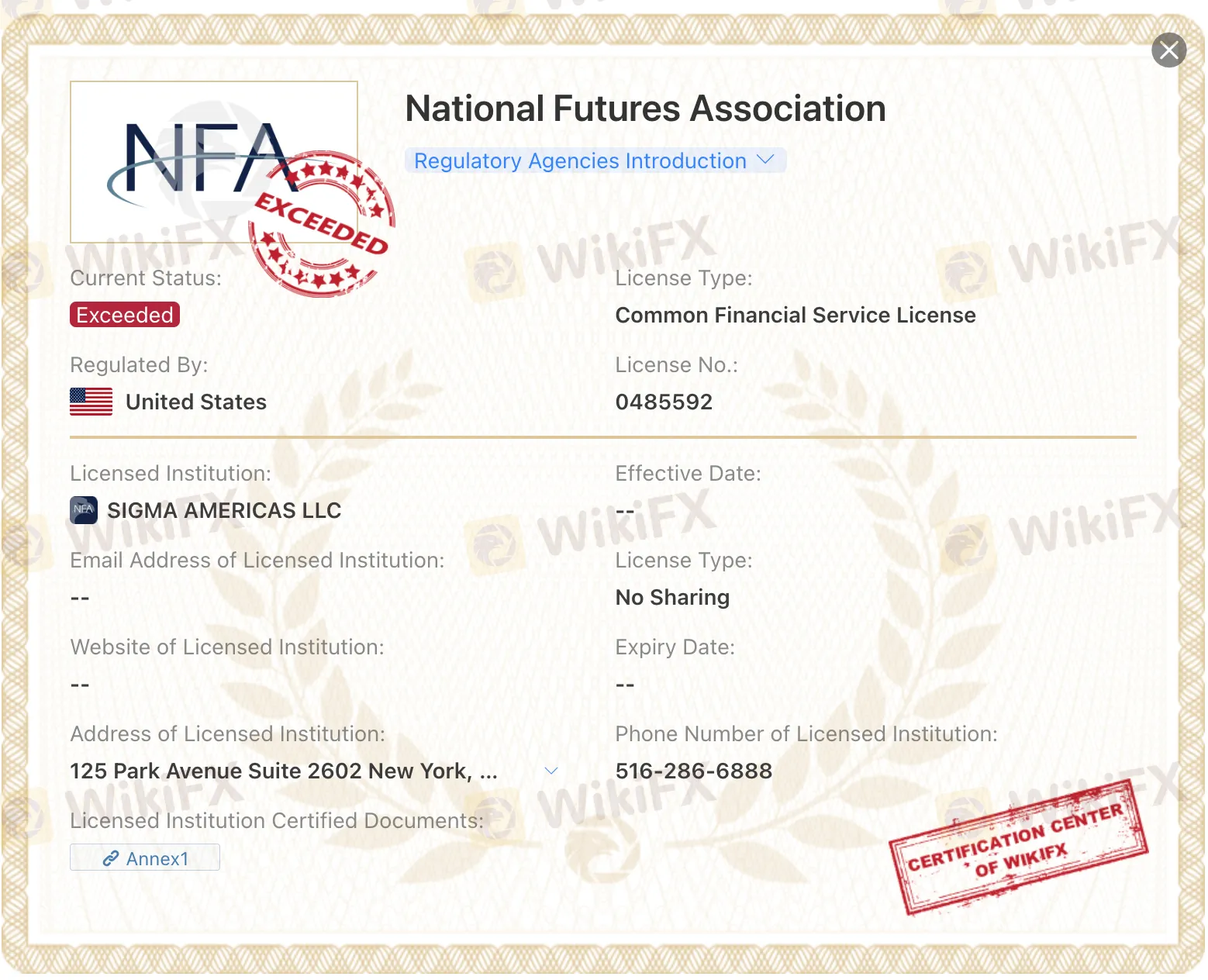

United States (US Regulation):

Current Status: Exceeded

License Type: Common Financial Service License

Regulated by: United States authorities

License No.: 0485592

Licensed Institution: SIGMA AMERICAS LLC

United Arab Emirates (DFSA Regulation):

Current Status: Exceeded

License Type: Common Financial Service License

Regulated by: Dubai Financial Services Authority (DFSA)

License No.: F004667

Licensed Institution: Sigma Capital Partners MENA Limited

Sigma offers an extensive range of market instruments, including stocks, forex, commodities, cryptocurrencies, and more, providing traders with ample opportunities for diversification. Additionally, Sigma offers various account types, catering to traders with different needs and experience levels.

However, one drawback of Sigma is customer support response time. In peak trading hours, customer support response times may be longer than desired, causing inconvenience for traders seeking immediate assistance.

| Pros | Cons |

| Diverse Market Instruments | Limited Cryptocurrency Selection |

| User-Friendly Trading Platform | Higher Spreads on Certain Instruments |

| Multiple Account Types | Customer Support Response Times |

| Competitive Leverage | |

| Educational Resources |

Sigma offers an impressive array of market instruments, including currency pairs and CFDs on indices, commodities, precious metals, stocks and futures.

Forex: Major, minor, and exotic currency pairs.

Stocks: A vast selection of global stocks from various exchanges.

Commodities: Precious metals, energy commodities, and agricultural products.

Cryptocurrencies: Popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Indices: A diverse range of global indices representing different markets.

Options and Futures: Derivative products for traders looking for more advanced strategies.

Sigma offers three types of trading accounts: Standard Account, Professional Account and Institutional Account. All the accounts offer attractive trading conditions and provide a wide range of base currencies to suit the preferences of different traders.

Traders can select the account type that aligns with their trading strategy and enjoy competitive spreads and high leverage for enhanced trading opportunities.

| Account Type | Standard | Professional | Institutional |

| Leverage | 100:1 | 200:1 | 400:1 |

| Spread | Variable | Variable | Variable |

| Commission | 0.02% per side | 0.01% per side | 0.005% per side |

| Minimum Deposit | $1,000 | $5,000 | $10,000 |

| Withdrawal Time | 24 hours | 24 hours | 24 hours |

| Demo Account | Yes | Yes | Yes |

| Trading Tools | Full suite of trading tools | Full suite of trading tools | Full suite of trading tools |

| Customer Support | 24/5 customer support | 24/5 customer support | 24/5 customer support |

Visit the SIGMA Website: Start by accessing the official SIGMA website https://sigma-broking.com/

Click on “Open an Account”: Look for the “Open an Account” or similar option on the website's homepage.

Provide Personal Information: You will be prompted to enter your personal information, including your full name, date of birth, residential address, and contact details.

Complete Financial Information: SIGMA may require you to provide financial information, such as your income, employment status, and source of funds.

Identity Verification: To comply with regulatory requirements and enhance security, you will likely need to verify your identity.

Fund Your Account: After successfully completing the registration process and identity verification, you can fund your trading account.

Sigma offers varying leverage options to suit different trader profiles. Leverage ratios include 100:1 for Standard accounts, 200:1 for Professional accounts, and an impressive 400:1 for Institutional accounts, providing traders with flexibility to amplify their positions according to their account type.

| Account Type | Standard | Professional | Institutional |

| Leverage | 100:1 | 200:1 | 400:1 |

Sigma Broking also offers a variety of other asset classes, such as fixed income, options, and futures. Spreads and commissions for these asset classes can vary.

Forex: Sigma Broking's spreads for forex pairs typically range from 0.1 pips to 0.5 pips. The commission fee for forex trades is 0.02% per side.

Commodities: Sigma Broking's spreads for commodities typically range from 0.5 pips to 1 pip. The commission fee for commodity trades is 0.03% per side.

Indices: Sigma Broking's spreads for indices typically range from 1 pip to 2 pips. The commission fee for index trades is 0.04% per side.

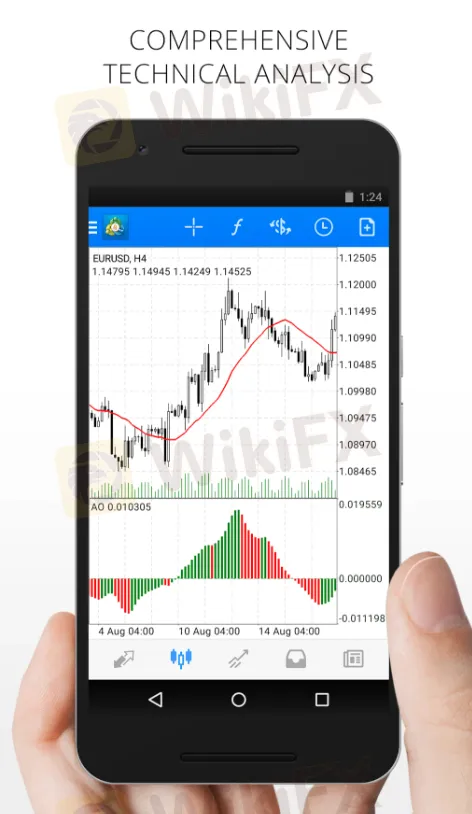

Sigma's trading platform stands out as a user-friendly and feature-rich solution tailored to meet the diverse needs of traders. Here, we highlight the key components that make Sigma's platform a valuable asset for traders:

MetaTrader 4 (MT4): Sigma's platform is anchored by MetaTrader 4, a highly acclaimed and trusted platform for trading various assets, with a primary focus on forex. MT4 is renowned for its robust charting capabilities, advanced technical analysis tools, and algorithmic trading options, making it an indispensable tool for traders.

WebTrader: For traders seeking flexibility and accessibility, Sigma offers WebTrader, a web-based platform accessible directly through your web browser. This feature ensures that you can engage in trading activities from anywhere with an internet connection, without the need for software downloads or installations.

Mobile Apps: Sigma recognizes the importance of on-the-go trading. To cater to this need, the platform provides mobile apps for both iOS and Android devices. These mobile apps empower traders to execute trades, monitor market movements, and stay informed about their portfolios using their smartphones or tablets, ensuring that trading remains accessible and convenient.

Sigma accepts payments with major credit or debit cards like VISA and MasterCard, as well as e-wallets like Skrill, Neteller, MegaTransfer and bank wire.

Sigma Broking offers a variety of payment methods for its clients, including major credit or debit cards like VISA and MasterCard, as well as wire transfer,cheque and bank draft

Wire transfer: This is the most common payment method used by Sigma Broking clients. Clients can wire funds from their bank account to Sigma Broking's bank account.

Cheque: Clients can mail a cheque to Sigma Broking's office.

Bank draft: Clients can purchase a bank draft from their bank and mail it to Sigma Broking's office.

Online payment: Clients can make online payments using a variety of methods, including credit cards, debit cards, and net banking.

Sigma's account types come with different minimum deposit requirements to cater to a range of traders. The Standard account requires a minimum deposit of $1,000, the Professional account has a minimum deposit of $5,000, while the Institutional account demands a higher minimum deposit of $10,000, accommodating traders with varying levels of capital.

| Account Type | Standard | Professional | Institutional |

| Minimum Deposit | $1,000 | $5,000 | $10,000 |

Sigma Broking charges a variety of fees for its services, including:

Brokerage fees: Sigma Broking charges a brokerage fee for each trade that is executed. The brokerage fee varies depending on the asset class and the market that the trade is executed on.

Commission fees: Sigma Broking charges a commission fee for each trade that is executed. The commission fee varies depending on the asset class and the market that the trade is executed on.

Account fees: Sigma Broking charges an account fee for each account that is opened. The account fee varies depending on the type of account and the level of service that is provided.

Other fees: Sigma Broking may also charge other fees, such as deposit fees, withdrawal fees, and inactivity fees.

Sigma offers customer support via multiple channels, including email, live chat, and phone. However, it's essential to note that response times may be longer during peak trading hours.

Phone: +44 (0) 20 7011 9696

Email: info@sigma-broking.com

Sigma demonstrates a robust commitment to trader education, ensuring traders have access to a variety of resources to enhance their skills and knowledge:

Webinars: Sigma regularly hosts webinars that cover a broad spectrum of trading topics. These live sessions are conducted by experts and provide traders with opportunities to gain insights into market dynamics, strategies, and trading techniques. Attendees can engage in discussions and pose questions, enriching their understanding of the subject matter.

Tutorials: Sigma offers comprehensive tutorials designed to guide traders through the platform's functionalities and assist in the implementation of effective trading strategies. These step-by-step guides cater to traders at all experience levels, aiding them in navigating the platform with ease and confidence.

Market Analysis: Staying well-informed about market trends is crucial for successful trading. Sigma provides timely market analysis reports that serve as valuable resources for traders. These reports offer impartial insights into current market conditions, enabling traders to make informed decisions based on accurate and up-to-date information.

Sigma is a legitimate trading platform that offers a wide range of market instruments and account types to suit various trader profiles. While it boasts numerous advantages, including a user-friendly platform and competitive leverage. However, one drawback of Sigma is customer support response time. In peak trading hours, customer support response times may be longer than desired, causing inconvenience for traders seeking immediate assistance.

Is Sigma a regulated trading platform?

Yes, Sigma operates under the regulatory framework of United Kingdom FCA,United Arab Emirates DFSA and United States NFA.

What types of accounts does Sigma offer?

Sigma offers Standard Account, Professional Account and Institutional Account, catering to traders with different needs and experience levels.

Can I trade cryptocurrencies on Sigma?

Yes, Sigma offers a selection of popular cryptocurrencies for trading.

How do I contact Sigma's customer support?

You can contact Sigma's customer support via email, live chat, or phone.

Are there educational resources available for traders on Sigma?

Yes, Sigma provides a variety of educational resources, including webinars, tutorials, and market analysis reports to help traders enhance their skills.

More

User comment

4

CommentsWrite a review

2023-12-13 15:47

2023-12-13 15:47

2022-11-27 11:11

2022-11-27 11:11