User Reviews

More

User comment

8

CommentsWrite a review

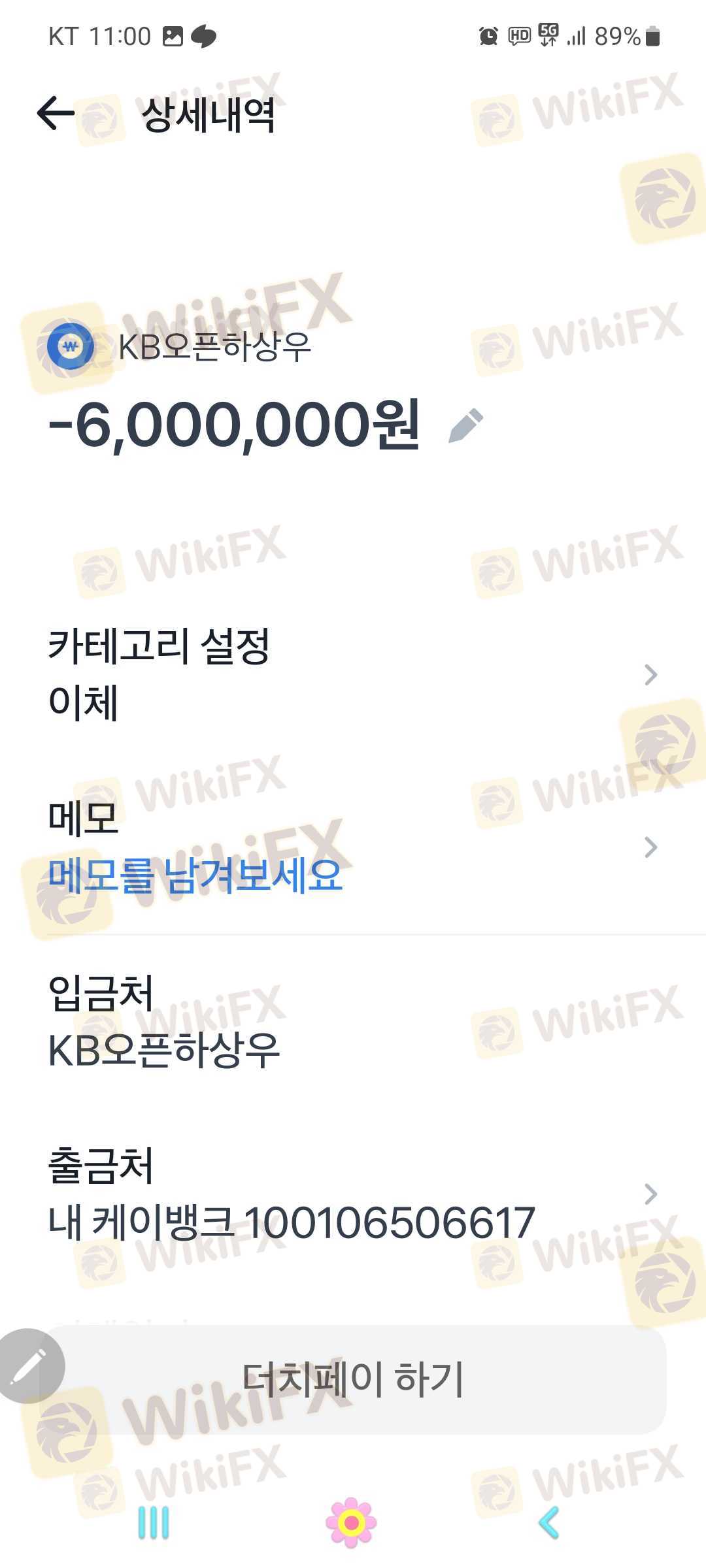

2024-03-22 17:04

2024-03-22 17:04

2024-03-08 11:23

2024-03-08 11:23

Score

2-5 years

2-5 yearsRegulated in Seychelles

Derivatives Trading License (EP)

Suspicious Scope of Business

Medium potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 4

Exposure

Score

Regulatory Index1.76

Business Index6.42

Risk Management Index7.63

Software Index4.00

License Index1.76

Single Core

1G

40G

More

Company Name

Modmount Services Limited

Company Abbreviation

Modmount

Platform registered country and region

Seychelles

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | Seychelles |

| Founded year | N/A |

| Company Name | ModMount |

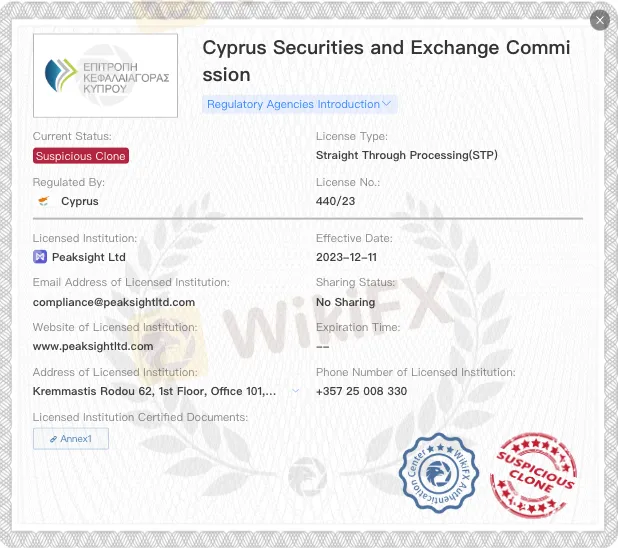

| Regulation | FSA(Offshore regulation) and CYSEC suspicious clone |

| Minimum Deposit | 250 EUR/USD/JPY |

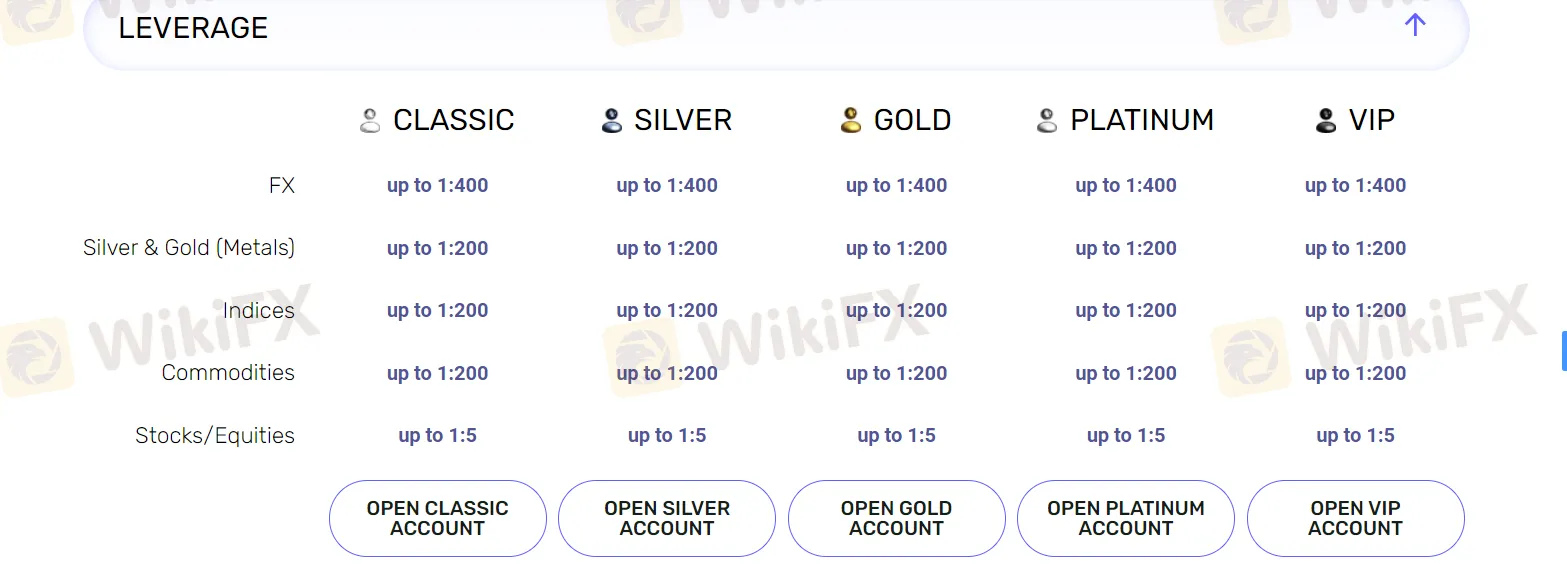

| Maximum Leverage | Up to 1:400 for Forex trading; varying levels for other instruments |

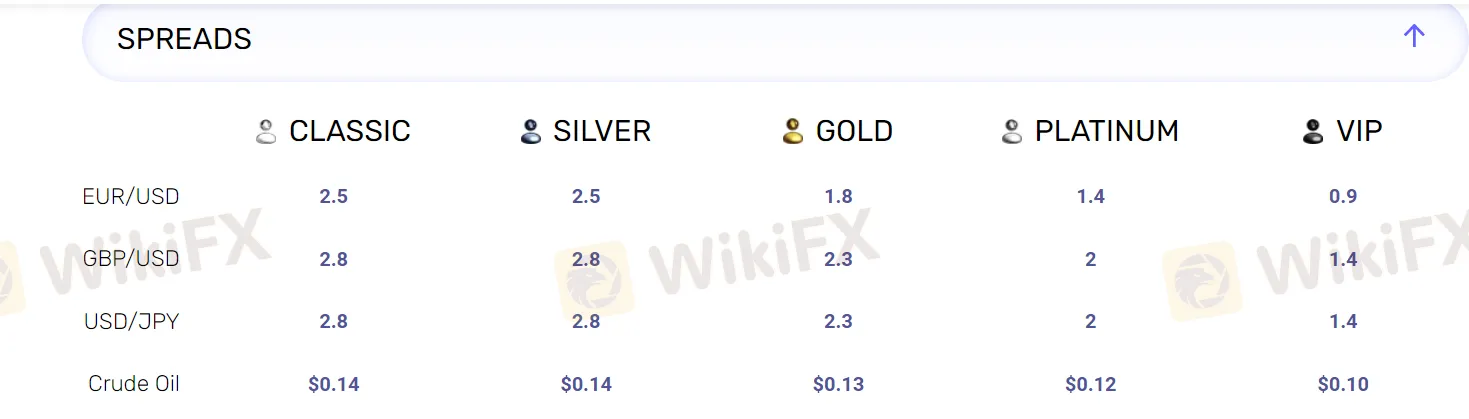

| Spreads | Vary based on account type and trading instrument |

| Trading Platforms | ModMount WebTrader |

| Tradable assets | Indices CFDs, Forex, Cryptocurrency CFDs, Stocks CFDs, Commodities CFDs |

| Account Types | Classic Account, Silver Account, Gold Account, Platinum Account, VIP Account |

| Demo Account | Available |

| Customer Support | Email, Live Chat, Phone (Monday to Friday, 12:00 - 21:00 GMT) |

| Payment Methods | Credit/Debit Cards, Wire Transfer, Alternative Payment Methods (APMs) |

| Educational Tools | ModMount Economic Calendar, Chart Analysis Widget |

ModMount is a brokerage firm offering a range of trading services and account types. They provide access to various trading instruments, including indices CFDs, Forex trading, cryptocurrency CFDs, stocks CFDs, and commodities CFDs. Traders can utilize advanced analytical tools, customizable market alerts, and trading history analysis. ModMount offers multiple account types with different features, leverage, spreads, and commissions. The broker emphasizes customer support through email, live chat, and phone. They provide the ModMount WebTrader platform, which offers a user-friendly interface and access to over 350 CFDs. Additional trading tools include the ModMount Economic Calendar and the Chart Analysis Widget.

The Seychelles Financial Services Authority (FSA) is the regulatory body responsible for overseeing financial services in the Seychelles. The regulation associated with license number SD119 is considered an offshore regulation. It also has a CYSEC suspicious clone license.

ModMount offers a variety of trading instruments to cater to different investment preferences and strategies. Here is a description of the market instruments available:

| Trading Instrument | Description |

| Indices CFDs | Speculate on the price movements of stock indices |

| Forex Trading | Trade currency pairs in the foreign exchange market |

| Cryptocurrency CFDs | Trade cryptocurrencies without owning the assets |

| Stocks CFDs | Trade CFDs on stocks of well-known companies |

| Commodities CFDs | Trade CFDs on various commodities |

Classic Account

The Classic Account offered by the broker provides traders with unmatched trading flexibility. It offers zero commissions on deposits, allowing traders to maximize their investment. With access to over 350 CFDs on various assets, traders can diversify their portfolio and explore different market opportunities. The account also offers a maximum Forex leverage of up to 1:400, enabling traders to amplify their trading positions. Dedicated multilingual support ensures that traders receive assistance in their preferred language. The account features an average execution speed of 0.08, allowing traders to react quickly to market movements. Flexible spreads and advanced analytical instruments further enhance the trading experience. The Classic Account supports popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more.

Silver Account

The Silver Account provides traders with a flexible trading environment in the vast international arena. Similar to the Classic Account, it offers zero commissions on deposits and access to a wide range of CFDs on various assets. With a maximum Forex leverage of up to 1:400, traders can take advantage of market opportunities with increased trading power. Dedicated multilingual support ensures that traders receive prompt assistance. The account offers an average execution speed of 0.08, allowing for quick order execution. Traders can benefit from flexible spreads and utilize advanced analytical instruments to make informed trading decisions. The Silver Account supports popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more.

Gold Account

The Gold Account is designed for experienced traders who want to hit the international market with confidence. It provides access to over 350 CFDs on assets, allowing traders to diversify their investment portfolio. With a maximum Forex leverage of up to 1:400, traders can optimize their trading positions. The account features an average execution speed of 0.06, ensuring fast order execution. Flexible spreads starting from 0.05 pips provide competitive trading conditions. Traders can utilize the advanced analytical instruments to conduct comprehensive market analysis. The Gold Account supports popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more.

Platinum Account

The Platinum Account offers premium trading conditions for traders who want to confront the market's challenges. It provides access to over 350 CFDs on various assets, enabling traders to diversify their portfolio. With a maximum Forex leverage of up to 1:400, traders can take advantage of increased trading power. The account offers a deposit commission of 0% and dedicated support, ensuring a high level of service. Traders can enjoy an average execution speed of 0.08 for quick order execution. Advanced analytical instruments assist in making informed trading decisions. The Platinum Account supports popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more.

VIP Account

The VIP Account is tailored for traders who seek to seize the market's obstacles with the aid of VIP trading terms. It offers low commissions on deposits, enabling traders to optimize their trading costs. With access to over 350 CFDs on assets, traders can diversify their investment portfolio. The account provides a maximum Forex leverage of up to 1:400, allowing traders to amplify their trading positions. Dedicated multilingual support ensures personalized assistance. The account offers an average execution speed of 0.08 and flexible spreads. Advanced analytical instruments assist in making informed trading decisions. The VIP Account supports popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more.

The broker offers various leverage levels for different trading instruments. Here is a description of the maximum trading leverage provided by the broker:

The broker offers a variety of trading accounts with different spreads and commissions to cater to the diverse needs of traders. For the popular currency pair EUR/USD, the spreads range from 2.5 pips in the Classic and Silver Accounts to as low as 0.9 pips in the VIP Account. This means that traders can choose an account type that aligns with their trading preferences and budget.

Similarly, for GBP/USD, the spreads vary from 2.8 pips in the Classic and Silver Accounts to 1.4 pips in the VIP Account. Traders can select the account that suits their trading style and desired trading costs. The USD/JPY currency pair also presents different spreads, ranging from 2.8 pips in the Classic and Silver Accounts to 1.4 pips in the VIP Account.

In addition to currency pairs, the broker also provides opportunities for trading commodities such as Crude Oil. The commission for Crude Oil trading is $0.14 per contract in the Classic and Silver Accounts, decreasing to $0.10 per contract in the VIP Account.

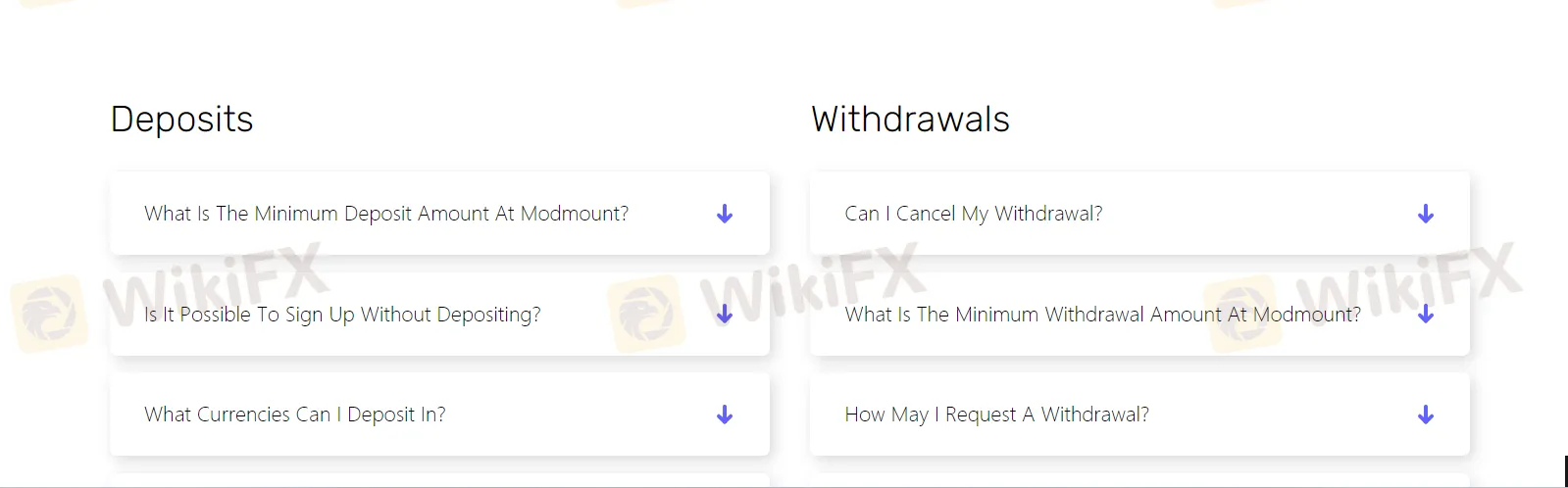

Deposits

At ModMount, the minimum deposit amount is 250 EUR/USD/JPY. This minimum deposit requirement allows traders to fund their accounts and start trading. Signing up without depositing is possible, but traders will only be able to trade using a demo account. This allows individuals to familiarize themselves with the platform and practice trading strategies without risking real money.

ModMount accepts deposits in three currencies: EUR, USD, and JPY. Traders can choose the currency that is most convenient for them when depositing funds into their accounts.

The broker offers multiple deposit methods to accommodate traders' preferences. Traders can deposit funds using Credit/Debit Cards, Wire Transfer, or APMs (Alternative Payment Methods).

Withdrawals

Traders have the option to cancel a withdrawal request as long as the transfer has not been processed yet. This allows flexibility in managing withdrawal requests.

The minimum withdrawal amount from a ModMount account is 10 EUR/USD/JPY for Credit Card withdrawals and 100 EUR/USD/JPY for Wire Transfer withdrawals. If traders use e-wallets, they may withdraw any amount as long as it covers the applicable fee.

To request a withdrawal, traders need to sign in to their ModMount account and follow the simple instructions provided on the withdrawal page. The process is designed to be user-friendly and efficient.

The withdrawal process typically takes about 8 to 10 business days to complete. However, it is important to note that the actual processing time may vary depending on the trader's local bank or financial institution.

Traders can withdraw funds from their ModMount account even if they have open positions. However, it is crucial to ensure that there is sufficient margin in the account to cover the withdrawal amount and any associated fees that may apply.

WebTrader

Trade anytime, anywhere with ModMount WebTrader. Access 160+ CFDs on global assets, utilize 60+ advanced analytical tools, and refine your strategies using detailed trading history.

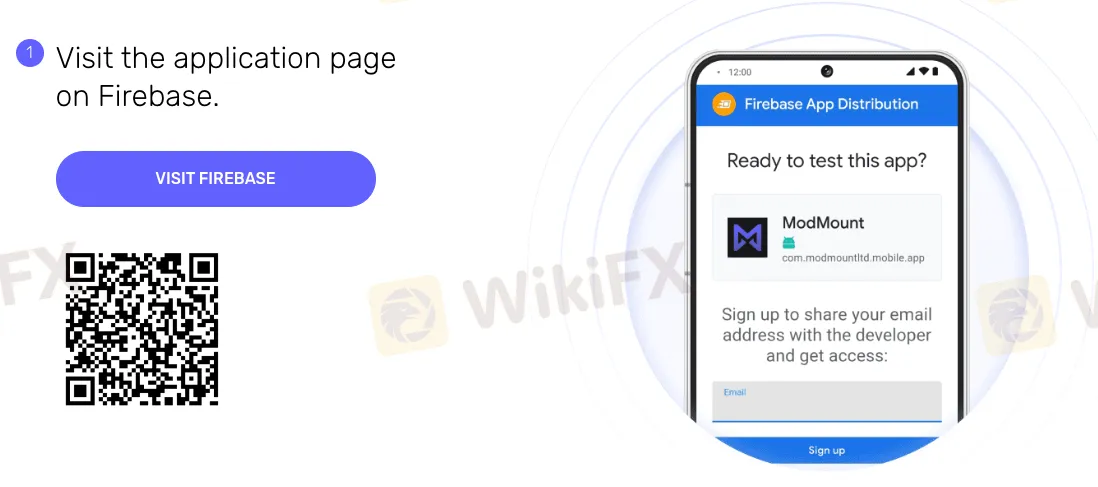

Firebase Test App

Explore and test ModMounts features in a secure environment with the Firebase Test App. Visit the app page on Firebase to experiment and provide feedback for continuous improvement.

ModMount offers a range of trading tools designed to assist traders in their market analysis and decision-making process. These tools provide valuable insights and help traders stay informed about key economic events and price movements. Here are two notable trading tools provided by ModMount:

ModMount provides customer support services to assist traders with their inquiries and concerns. The customer support team is available during regular business hours, Monday to Friday, from 12:00 till 21:00 GMT.

Traders can reach out to the customer support team via email at support@modmountltd.com. Email communication allows traders to articulate their questions or issues in detail and receive a written response from the support team.

Live Chat is also available as a customer support option. Traders can engage in real-time text-based conversations with a representative from the support team. Live Chat offers a convenient and efficient way to seek immediate assistance or resolve any urgent matters.

For those who prefer direct communication, ModMount provides a phone support option. Traders can contact the customer support team by dialing +2484632002 during the specified business hours.

FAQs

What is the regulatory authority overseeing ModMount?

ModMount is regulated by the Seychelles Financial Services Authority (FSA) under license number SD119.

What are the available account types at ModMount?

ModMount offers the following account types: Classic Account, Silver Account, Gold Account, Platinum Account, and VIP Account.

What is the maximum leverage offered by ModMount?

ModMount offers maximum leverage of up to 1:400 for Forex trading across all account types.

What are the deposit and withdrawal options at ModMount?

Traders can deposit funds using Credit/Debit Cards, Wire Transfer, or Alternative Payment Methods (APMs). The minimum deposit is 250 EUR/USD/JPY. Withdrawals can be made via Credit Card or Wire Transfer, with specific minimum withdrawal amounts depending on the method chosen.

More

User comment

8

CommentsWrite a review

2024-03-22 17:04

2024-03-22 17:04

2024-03-08 11:23

2024-03-08 11:23