User Reviews

More

User comment

2

CommentsWrite a review

2024-02-23 16:47

2024-02-23 16:47

2023-03-22 16:40

2023-03-22 16:40

Score

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.27

Risk Management Index0.00

Software Index4.58

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

ООО «Компания БКС»

Company Abbreviation

BCS

Platform registered country and region

Russia

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

| BCS Broker Review Summary | |

| Company Name | BCS World of Investment |

| Founded | 1996 |

| Registered Country/Region | Russia |

| Regulation | No Regulation |

| Market Instruments | Stock, Mutual Funds BCS, Currencies, Bonds, Futures |

| Demo Account | Yes |

| Leverage | N/A |

| Spread | N/A |

| Commission | 0.01% (Tariff Trader), Remuneration of 299 ₽/month (Tariff Traders), Storage Fees (1% per month), Turnover Fees Charged |

| Trading Platform | Web Trader and BCS App |

| Minimum Deposit | N/A |

| Customer Support | 24/7 - Tel: 8 800 500 55 45/8 800 100-55-44, Email: hd@bcs.ru, Social Media: Facebook, YouTube, X, etc. |

| Company Address | Moscow, 129110, Moscow, Prospect Mira, 69, page 1, 3rd entrance |

BCS Broker, operating under BCS World of Investment since its establishment in 1996, is a brokerage based in Russia. Despite its long history in the industry, BCS Broker operates without regulatory oversight. While the company offers trading services, the absence of regulation raises concerns about the safety and security of client funds and deters some traders from engaging with the platform.

| Pros | Cons |

|

|

|

|

|

Demo Account Available: BCS Broker offers a demo account, allowing clients to practice trading strategies and familiarize themselves with the platform before committing to real funds.

Support On-the-go Trading: Clients can access trading services on the go, providing flexibility and convenience for active traders who need to manage their investments from anywhere.

24/7 Customer Service: BCS Broker provides round-the-clock customer support, enhancing assistance for clients.

No Regulation: BCS Broker operates without regulatory oversight, which raises concerns about investor protection and adherence to industry standards.

Storage Fees Charged: BCS Broker imposes storage fees of 1% per month applied to amounts exceeding $10,000 USD or its equivalent in other currencies. This impacts the overall profitability of clients' investment portfolios and should be considered when choosing the broker.

Regulatory Sight: BCS Broker is currently operating without regulatory oversight, which means it does not fall under the jurisdiction or supervision of any financial regulatory bodies. It also does not hold any licenses that would enable it to conduct its operations in the financial market. This lack of regulation poses numerous risks to investors, such as a lack of transparency, security concerns, and no guarantee of adherence to industry standards and practices.

User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

Security Measures: So far we haven't found any information about the security measures for this broker.

Stocks: Clients can trade stocks of companies listed on major stock exchanges, allowing them to invest in individual companies and benefit from potential price appreciation and dividends.

Mutual Funds (BCS): BCS Broker offers access to mutual funds, providing clients with professionally managed portfolios of assets such as stocks, bonds, and other securities. Investing in mutual funds allows for diversification and professional management of investment funds.

Currencies: Clients can trade in the forex market, which involves buying and selling currency pairs to speculate on changes in exchange rates. Currency trading offers opportunities for profit through fluctuations in exchange rates.

Bonds: BCS Broker facilitates trading in bonds, allowing clients to invest in fixed-income securities issued by governments, municipalities, and corporations. Bonds provide regular interest payments and the return of principal at maturity.

Futures: Clients can engage in futures trading, which involves agreements to buy or sell assets at predetermined prices and dates in the future. Futures contracts are available for various underlying assets such as commodities, currencies, and stock market indices.

Non-Financial Services: Clients can enjoy exclusive non-financial services such as real estate, legal consulting, residence permits, and citizenship assistance.

BCS Ultima: Premium account holders have access to BCS Ultima, offering personalized banking services with extensive privileges, including investment services with a boutique approach and lifestyle management.

Personal Broker: Premium account holders benefit from a personal broker who manages their investment portfolio, provides professional market analytics, and selects investment solutions tailored to their goals.

Free Portfolio Audit: Clients receive a complimentary audit of their investment portfolio to ensure alignment with their financial objectives.

Wide Range of Investment Instruments: Clients can utilize a variety of exchange instruments for short-term, medium-term, and long-term investments, including securities, currencies, and ruble-denominated assets.

Brokerage Services: Business account holders have access to brokerage services on Russian and foreign exchanges, along with consultation on investment strategies.

Secured Financing: Clients can secure financing by withdrawing rubles against currency and securities held in their accounts, providing flexibility for short-term and medium-term investments.

Personal Broker: Business account holders receive personalized investment portfolio management from a dedicated broker, catering to their risk preferences and investment goals.

Currency and Eurobonds: The account allows for investments in eurobonds to protect against ruble devaluation and earn regular interest in US dollars or Euros.

Rubles Placement: Clients can place free rubles for short-term or long-term investments through REPO or SWAP transactions on the Moscow Exchange, with consultation provided to optimize investment decisions.

Besides these two account types, BCS Broker also provides users with demo accounts, which provide access to virtual funds and allow users to trade under real market conditions without risking their capital. In this way, traders can experience the trading environment, test different instruments, and hone their skills before participating in real trade.

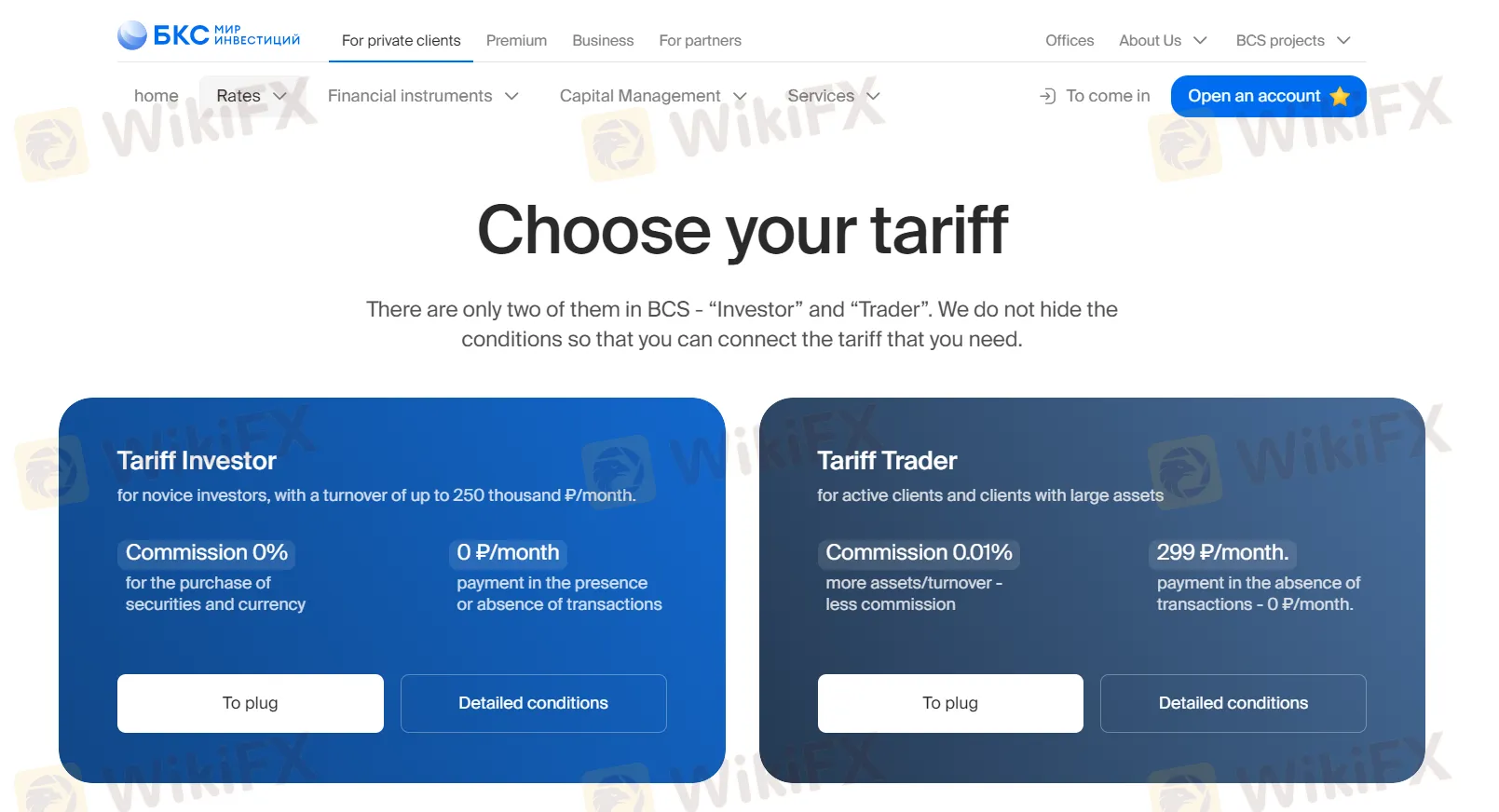

Simple Tariff: Under the Investor tariff, clients enjoy a straightforward structure where one bet on all sites is made without incurring additional commissions.

Fixed Remuneration: There are no fixed remunerations associated with the Investor tariff.

Turnover Fee: Clients are charged a turnover fee of 0.1% for each transaction.

Suitability: This tariff is designed for clients who make a small number of transactions, typically with a monthly turnover of up to 500,000 ₽.

Fixed Remuneration: Clients on the Trader tariff are charged a fixed remuneration of 299 ₽ per month if there are operations.

Turnover Fee: Additionally, clients are charged a turnover fee ranging from 0.01% to 0.03% per day based on the total trading turnover across all platforms.

Suitability: The Trader tariff caters to active clients who trade on multiple platforms simultaneously. The commission rate varies depending on the total trading turnover, with lower commissions applied to higher turnovers.

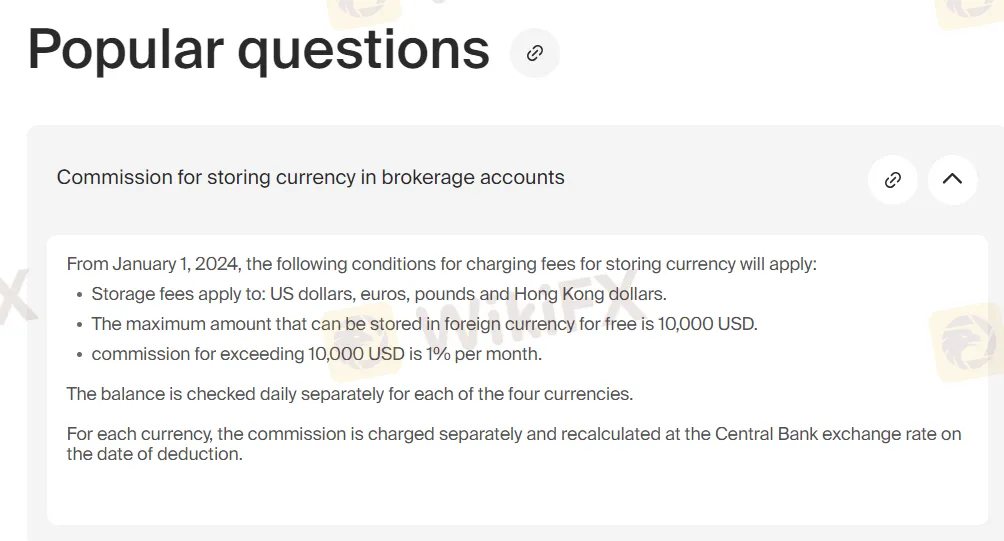

Storage Fees: BCS Broker imposes an additional fee for storing currency in brokerage accounts. The fee applies to US dollars, euros, pounds, and Hong Kong dollars, with a maximum free storage limit of $10,000 or its equivalent in other currencies. If the stored amount exceeds this limit, a commission of 1% per month is charged on the excess amount for each currency separately, with the balance checked daily. The commission is recalculated based on the Central Bank exchange rate on the date of deduction for each currency individually.

BCS Broker offers two main trading platforms: Web Trader and the BCS App.

The Web Trader platform allows clients to access their accounts and trade directly through a web browser, providing convenience and flexibility without the need for additional software installation. It offers a user-friendly interface and essential trading features for executing trades, managing positions, and conducting analysis.

On the other hand, the BCS App caters to clients who prefer to trade on the go using their mobile devices. Available for both iOS and Android platforms, the BCS App provides access to real-time market data, advanced charting tools, and the ability to execute trades from anywhere with an internet connection. These platforms enable clients to stay connected to the markets and manage their investments efficiently, whether they are at home or on the move.

BCS Broker provides multiple customer support channels to its clients. They claim their support is available 24/7, so clientscan get help whenever they need it. Clients can reach out via telephone at 8 800 500 55 45 or 8 800 100-55-44 for immediate assistance. Additionally, clients can communicate with the support team via email at hd@bcs.rufor inquiries or assistance with their accounts. BCS Broker also maintains an active presence on social media platforms such as Facebook, YouTube, X,and others, where clients can connect, ask questions, and stay updated on the latest news and developments. Furthermore, the company's physical address in Moscow, located at 129110, Prospect Mira, 69, page 1, 3rd entrance, provides clients with the option for in-person support or consultations if needed.

BCS Broker offers various market instruments, demo accounts, mobile apps and round-the-clock customer support. However, the absence of regulatory oversight and the imposition of storage fees pose concerns for some investors.

Q: Is there a commission charged?

A: Yes, there are storage fees for currencies exceeding $10,000, 1% per month, turnover fees, and a fixed remuneration of 299 ₽ per month for tariff traders.

Q: Is BCS Broker regulated or not?

A: No, it is not regulated.

Q: Does BCS Broker offer a demo account?

A: Yes, it does.

Q: What trading platforms are available on BCS Broker?

A: BCS Broker offers two main trading platforms: Web Trader and the BCS App.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

More

User comment

2

CommentsWrite a review

2024-02-23 16:47

2024-02-23 16:47

2023-03-22 16:40

2023-03-22 16:40