User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

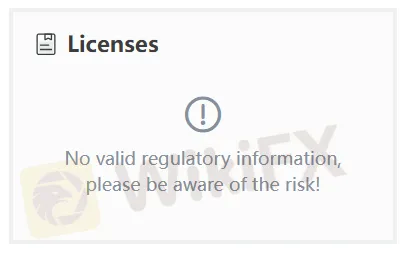

Regulatory Index0.00

Business Index7.40

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

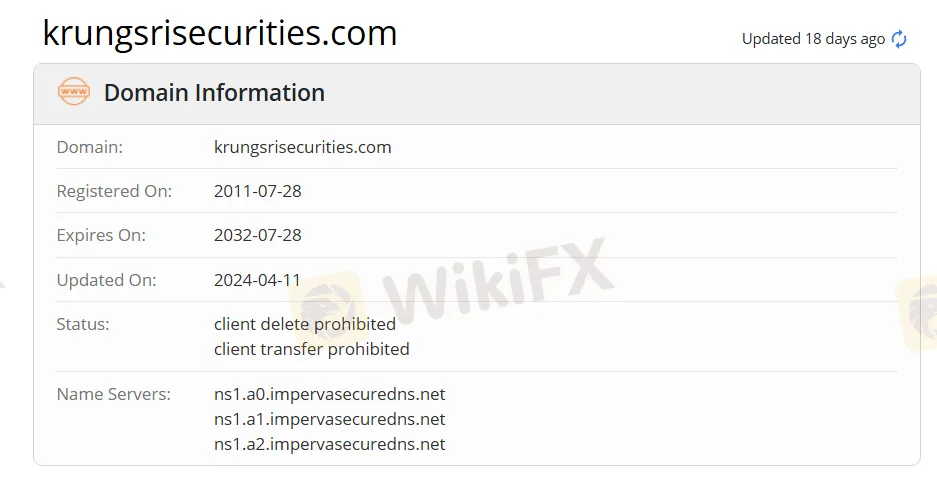

| Krungsri SecuritiesReview Summary | |

| Founded | 2011 |

| Registered Country/Region | Thailand |

| Regulation | No Regulation |

| Products and Services | Equities, derivatives, fixed income, offshore fund, overaseas investment, securities, margin loan, omnibus account service |

| Demo Account | ✅ |

| Leverage | \ |

| Spread | \ |

| Trading Platform | \ |

| Minimum Deposit | \ |

| Customer Support | Email: customer.care@krungsrisecurities.com |

| Phone: 0 2638 5500; 0 2659 7777 | |

| Social Media: Facebook, YouTube, Line, Twitter, Telegram | |

Krungsri Securities is a Thai securities company that offers diversified investment services and is committed to meeting the risk appetite and investment needs of different investors. The firm offers a variety of account types, including credit balance/margin accounts, derivatives accounts, mutual fund accounts, overseas investment accounts, and fixed income accounts. Its products cover block trades, overseas investments, derivatives, structured notes, automated trading functions, and offshore funds, and support deposit and withdrawal operations through the bank's automated transfer system (ATS). In addition, Krungsri Securities also offers a demo account for clients to practice trading. However, it is important to note that the company is not regulated by the relevant financial regulators, and traders should be cautious before trading to ensure the safety of their funds.

| Pros | Cons |

| Demo account available | Unregulated |

| Diverse products and services | Lack of Transparency |

| Various account types | Fees charged |

| Limited payment options |

Although Krungsri Securities claims to be regulated, it is actually unregulated. Traders should exercise caution when trading.

Krungsri Securities offers a wide range of products and services, including block trades, overseas investments, derivatives trading, integrated account services, fixed income securities trading, structured notes, margin loans, and securities lending. In addition, the company offers features such as automated trading, conditional orders, offshore funds, Krungsri Securities My iFUND, and Krungsri Securities DCA.

| Products and Services | Available |

| Equities | ✔ |

| Derivatives | ✔ |

| Fixed Income | ✔ |

| Offshore Fund | ✔ |

| Overseas Investment | ✔ |

| Securities | ✔ |

| Margin Loan | ✔ |

| Omnibus Account Service | ✔ |

Krungsri Securities offers a demo account where clients can practice trading with no actual loss of funds.

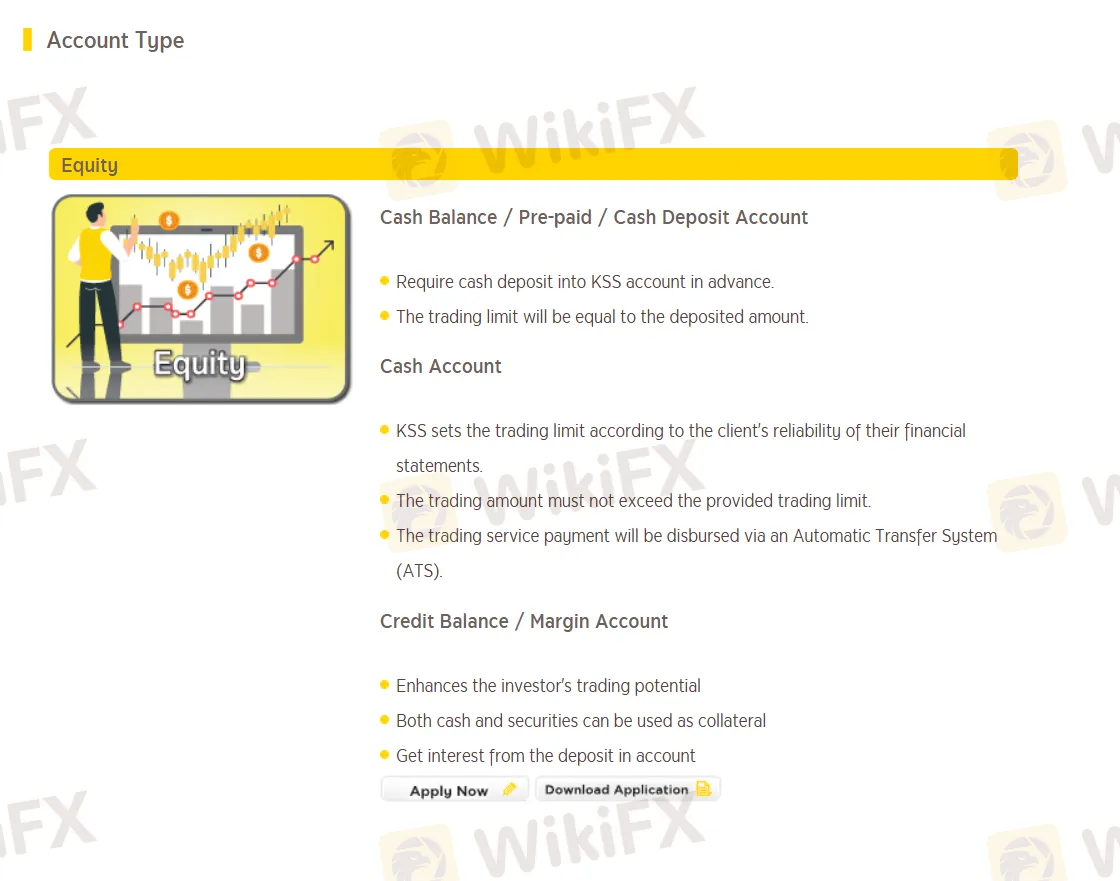

Krungsri Securities offers a range of live account types, including credit balance/margin accounts, derivatives accounts, mutual fund accounts, overseas investment accounts, and fixed income accounts, to cater to the diverse risk appetites and investment needs of various investors.

| Account Type | Key Features |

| Credit Balance / Margin Account | Enhances the investor's trading potential. |

| Both cash and securities can be used as collateral. | |

| Earn interest from the deposit in the account. | |

| Derivatives Account | Diversification tool for alleviating equity trading risk. |

| High risk, high return. | |

| Daily profit and loss summary (mark-to-market). | |

| Mutual Fund Account | Easy to buy, sell, and switch units with mutual funds. |

| Convenient and free of charge. | |

| Real-time portfolio tracking. | |

| Quality mutual funds are selected weekly, with recommendations provided to clients. | |

| Overseas Investment Account | Diversification opportunities. |

| Access to leading global companies like Apple, Coca-Cola, Toyota, Samsung, etc. | |

| Gain exposure to external/global growth. | |

| Enhance investment returns. | |

| Fixed Income Account | Low-risk, high-return alternative investment service. |

| Diversification across both primary and secondary markets. |

Commission: An application fee is payable when opening a credit balance account, which is limited to 1 baht per 2,000 baht; Securities borrowing fees are charged at the rate published by the company.

Other fees: 14.98 baht when paying securities transaction fees through the ATS system; Withdrawal of securities is subject to a fee of 50 baht per security; There is a fee of 65 baht per security for the issuance of share certificates.

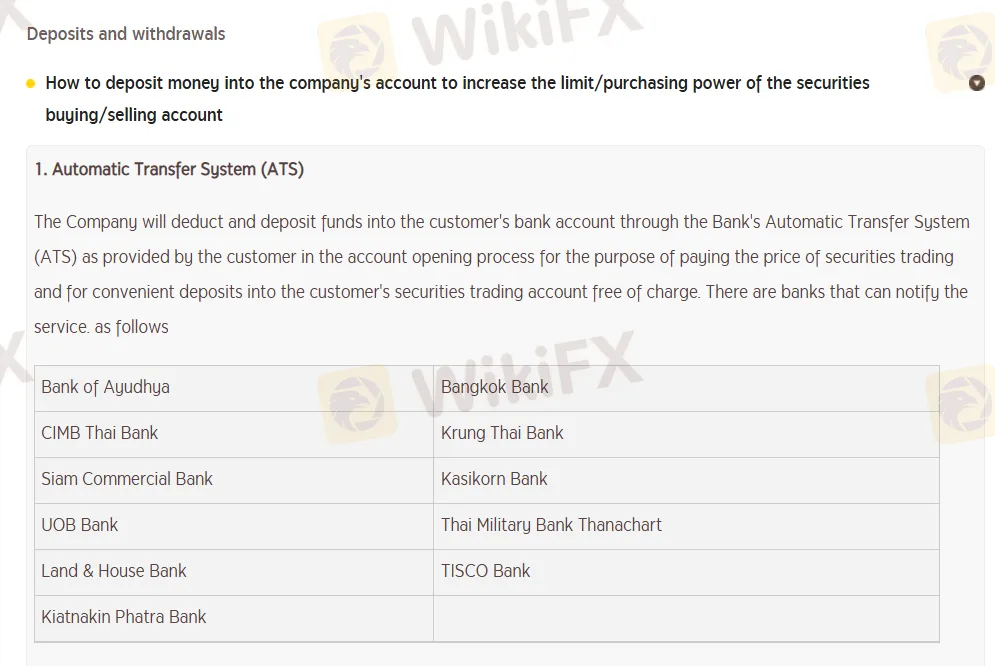

Krungsri Securities offers the service of depositing funds through the bank's Automatic Transfer System (ATS), and customers can transfer funds to their securities accounts for free through several Thai banks that support the service, such as Ayudhya Bank, Bangkok Bank, etc., to increase the trading limit or purchasing power.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment