User Reviews

More

User comment

1

CommentsWrite a review

2022-12-13 17:25

2022-12-13 17:25

Score

5-10 years

5-10 yearsRegulated in Hong Kong

Derivatives Trading License (AGN)

Suspicious Scope of Business

Hong Kong Derivatives Trading License (AGN) Revoked

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.54

Business Index7.77

Risk Management Index0.00

Software Index5.89

License Index6.14

Single Core

1G

40G

More

Company Name

Ever-Long Securities Company Limited

Company Abbreviation

Ever-long

Platform registered country and region

Hong Kong

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

| Ever-longReview Summary | |

| Founded | 1999 |

| Registered Country/Region | China Hong Kong |

| Regulation | SFC (Suspicious Clone) |

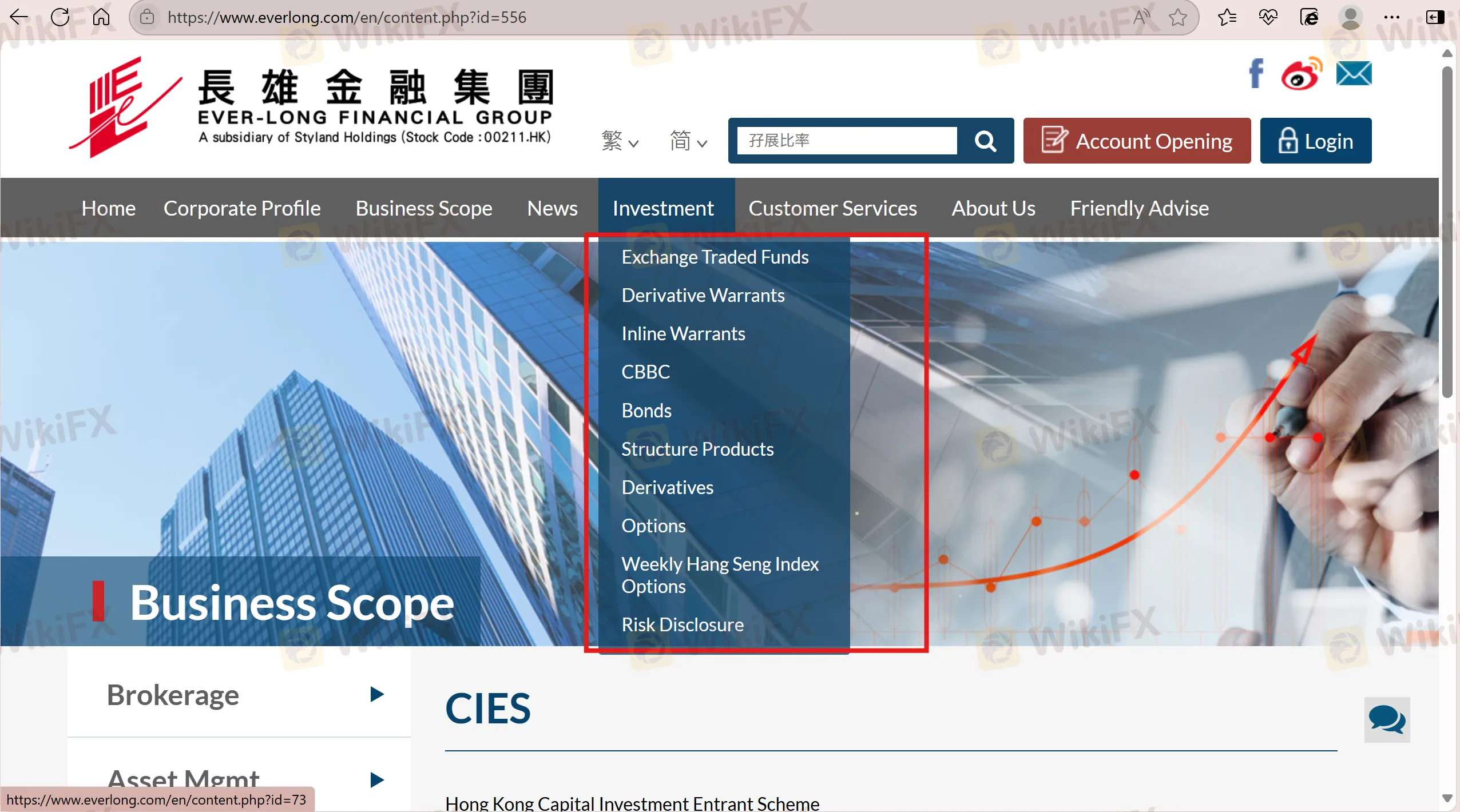

| Products & Services | Stocks, derivatives, bonds, options, structure products, asset management, fintech |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Email: cs@everlong.com |

| Tel: (852) 3975-7303, (852) 3975-7301, (852) 2959-7298 | |

| Fax: (852) 2581-0638 | |

| Social Media: Messenger/YouTube | |

| Address: Room 301-303, 3/F., 12 Taikoo Wan Road, Taikoo Shing, Quarry Bay, Hong Kong | |

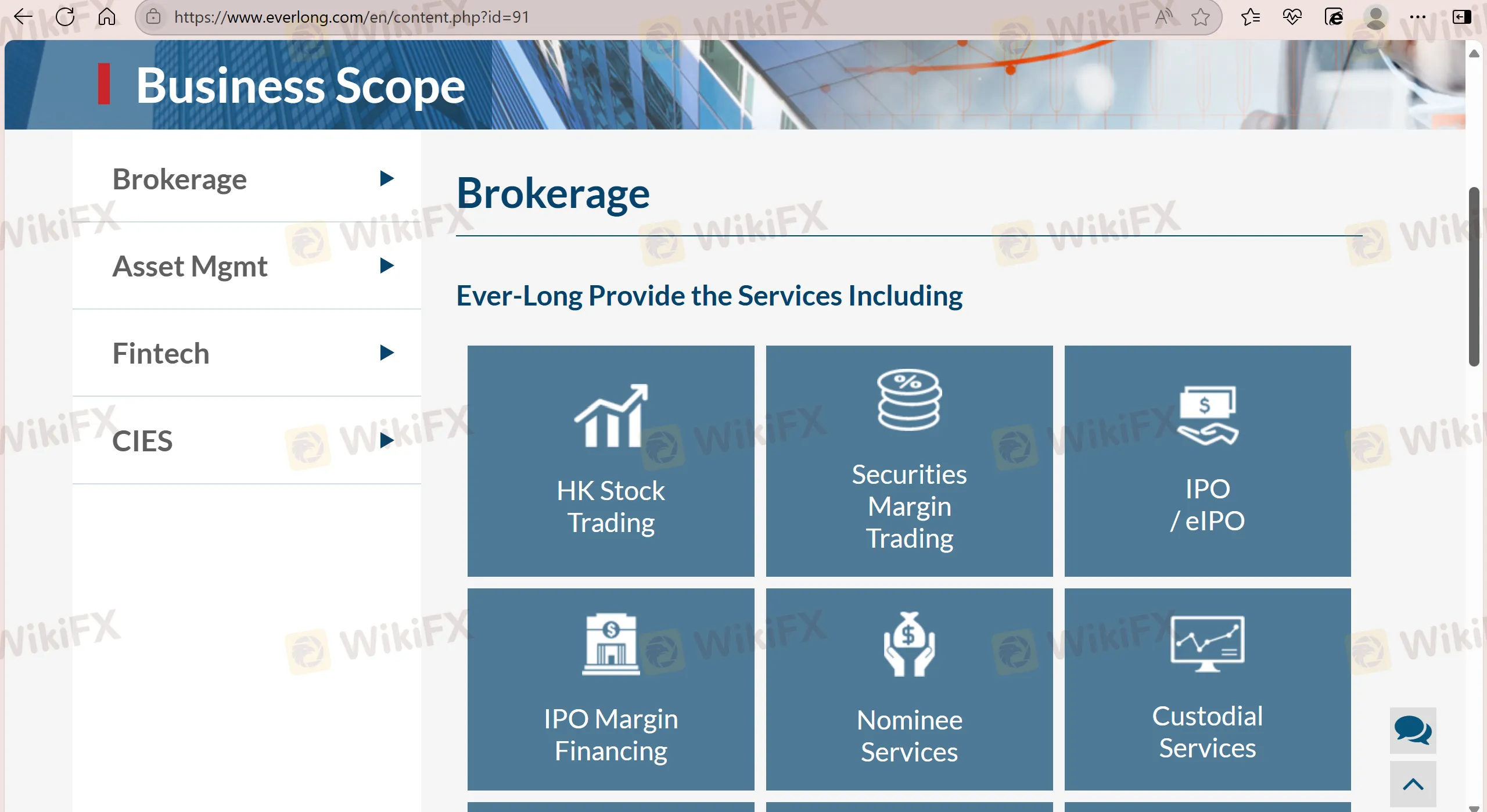

Ever-long is a broker that was registered in Hong Kong. The tradable services include stocks, derivatives, bonds, options, and structure products. Besides, it also offers asset management services and fintech services. Ever-long is still risky due to its suspicious clone status.

| Pros | Cons |

| Long establishment time | Suspicious clone license |

| Various products and services | Demo account unavailable |

| Multiple contact channels | Lack of transparency |

| Service fees charged |

Ever-long's SFC license has been suspicious clone, making it less safe than regulated brokers.

| Regulated Country | Current Status | Regulated Authority | Regulated Entity | License Type | License Number |

| China (Hong Kong) | Suspicious Clone | Securities and Futures Commission of Hong Kong | Ever-Long Futures Limited | Dealing in futures contracts | BIL619 |

| Products & Services | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Options | ✔ |

| Structure Products | ✔ |

| Derivatives | ✔ |

| Asset Management | ✔ |

| Fintech Services | ✔ |

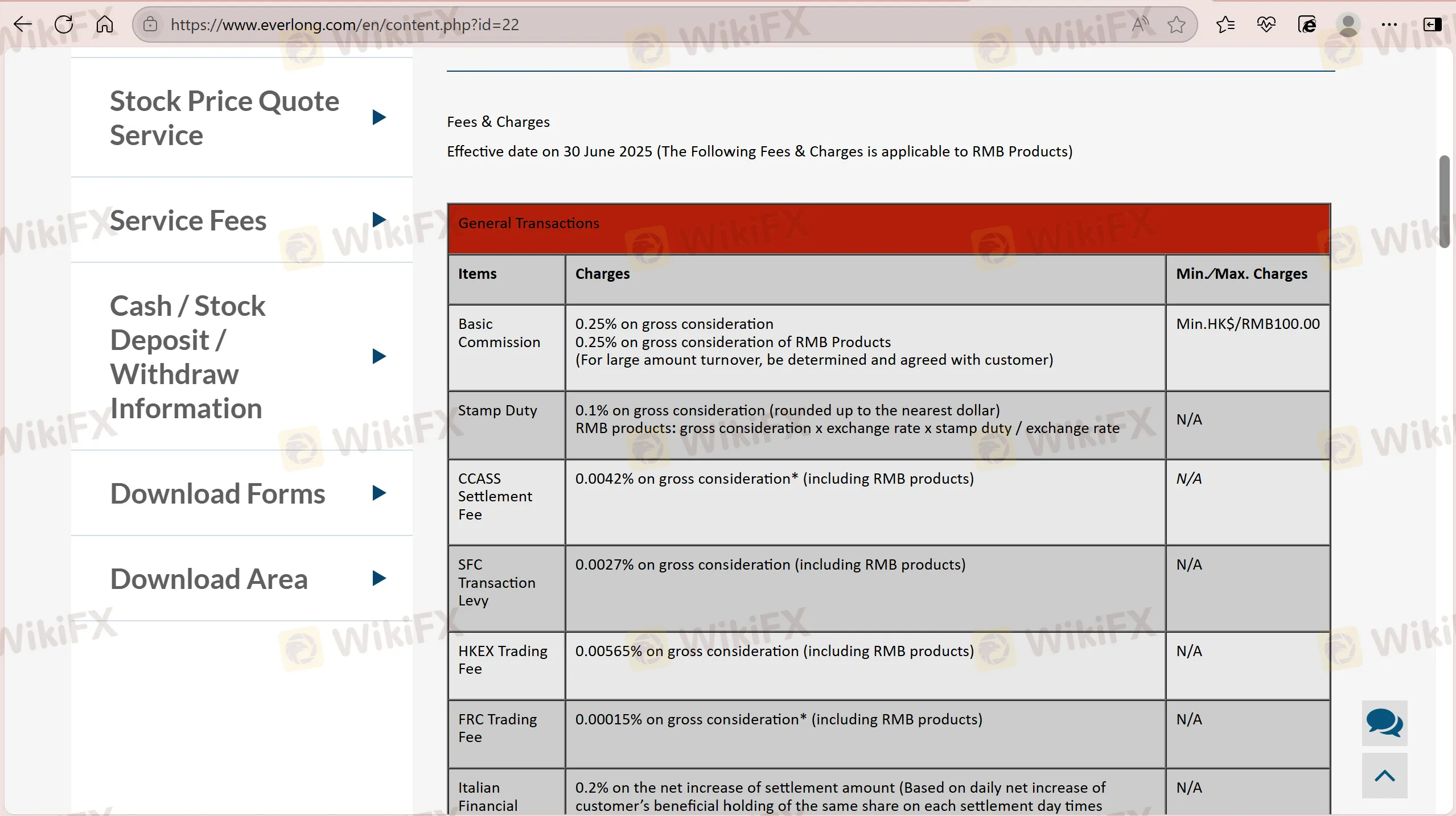

| Type | Fee | Minimum Fee |

| General Transactions | 0.25% on gross consideration | HK$/RMB100.00 |

| 0.25% on gross consideration of RMB Products | ||

| Hong Kong IPO Grey Market Trading | 0.125% on top of Transaction amount payable | HKD 100.00 |

| Shanghai Shenzhen Stocks Trading | 0.25% on gross consideration | RMB100.00 |

| Global Markets | 0.25% - 1.00% on gross consideration | / |

| IPO Margin | HK$/RMB100.00 per transaction | / |

| Telegraph Transfer/Chats | HK$/RMB100.00 per remittance (does not include bank charges) | / |

| Bonds Trading | Be determined and agreed with customer | / |

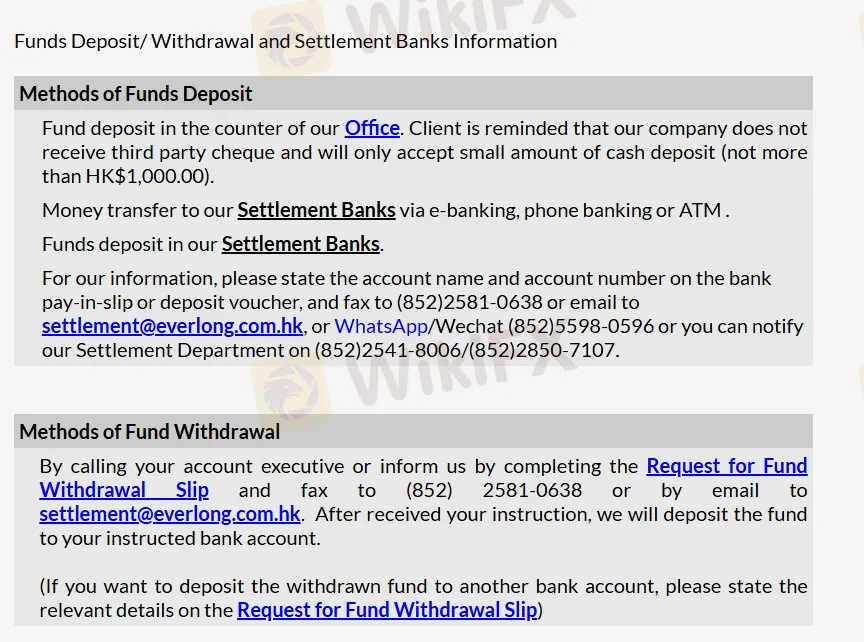

Ever-long only accept a small amount of cash deposit (not more than HK$1,000.00). Money transfers to Settlement Banks via e-banking, phone banking, and ATM.

Ever-Long will offer special discounts to all new/existing clients very soon.

More

User comment

1

CommentsWrite a review

2022-12-13 17:25

2022-12-13 17:25