User Reviews

More

User comment

1

CommentsWrite a review

2024-07-10 10:26

2024-07-10 10:26

Score

1-2 years

1-2 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.29

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

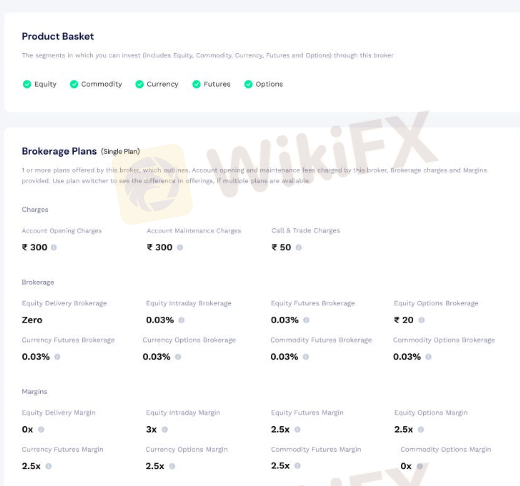

| Broker Name | Fidelity Market |

| Founded in | 2023 |

| Registered in | United States |

| Regulated by | Not regulated |

| Market Instruments | Forex, Commodities, Stocks, Indices |

| Maximum Leverage | 1:1000 for forex |

| Spreads | True ECN spreads from 0.0 pips |

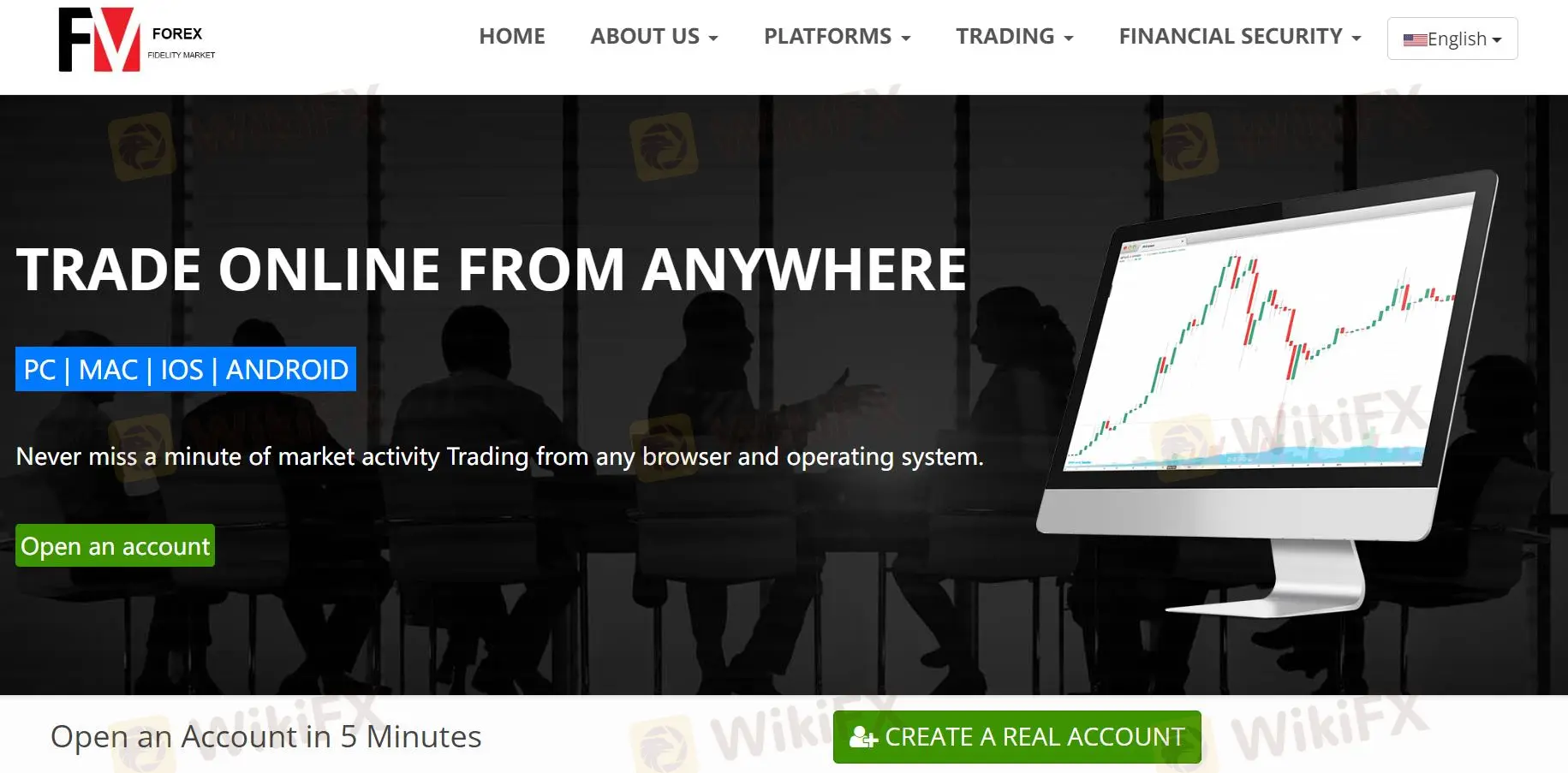

| Trading Platform | Web, Andord, IOS |

| Customer Support | support@fxinf.net |

Fidelity Market, founded in 2023 and based in the United States, offers a variety of trading options for investors. Although not directly subject to explicit regulations, they facilitate trading in forex, commodities, stocks, and indices via a user-friendly web and mobile platform (Android & iOS).Leverage options vary by instrument, reaching up to 1:100 for indices. Spreads are claimed to be tight with True ECN spreads from 0.0 pips, but commission structures are not explicitly mentioned. Customer support is available via email (support@fxinf.net).

Fidelity Market appears to operate without regulatory oversight. Regulatory bodies typically ensure financial markets adhere to standards that protect investors and maintain market integrity.

| Pros | Cons |

| • Various trading instruments to trade | • Operates without regulatory oversight |

| • User-friendly web platform accessible on various devices (desktop, mobile, tablet) | • Lack of information for account types |

| • Streamlined online application process | • Limited customer support options, primarily through email |

Fidelity Market offers many market instruments including forex, commodities, stocks, and indices. These instruments cater to diverse investment preferences, allowing clients to engage in currency trading, invest in commodities like precious metals and energies, trade equities in global markets, and track performance across various indices.

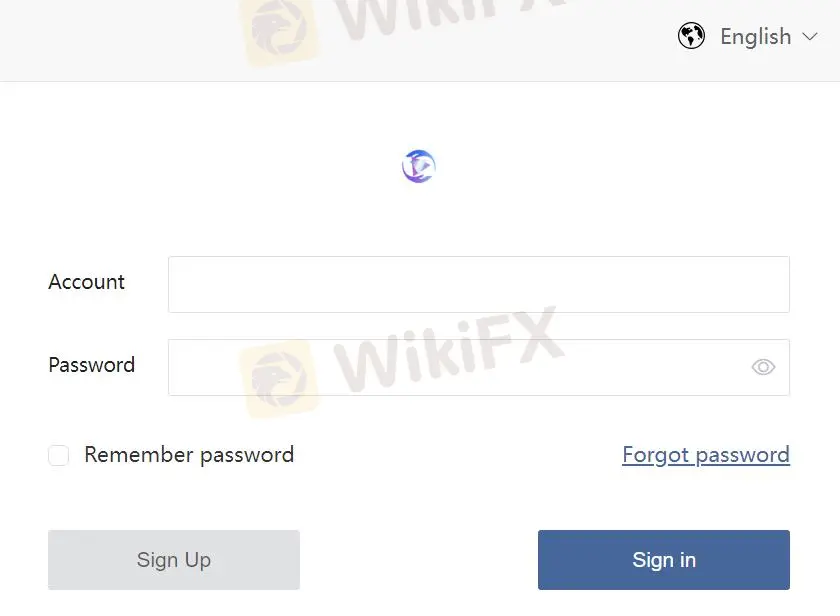

Fidelity Market offers a streamlined account opening process accessible through their website. They cater to both new and existing customers. Here's a simplified breakdown:

Fidelity Market offers varying leverage ratios across different asset classes to enhance trading opportunities for its clients. Specifically, they provide leverage up to 1:1000 for forex trading,1:500 for commodities, 1:100 for stocks, and 1:100 for indices. Leverage enables traders to control larger positions with a smaller initial investment, amplifying both potential profits and risks.

Fidelity Market offers a web-based trading platform accessible on various devices including desktops, laptops, tablets and mobile phones. The image showcases versions for iPhone & iPad, Android and a separate web platform.

Fidelity Market's customer support, as indicated by their provided email address (support@fxinf.net), suggests a direct channel for customer inquiries and assistance. The email contact implies a method for users to seek guidance or resolve issues related to their services. However, the quality and responsiveness of their support cannot be fully assessed without direct interaction or additional information regarding their service standards and response times.

Physical Address: 3609 Austin Bluffs Pkwy Ste 31, Colorado Springs ,80918,United States

Fidelity Market offers a diverse range of tradable instruments (forex, commodities, stocks, indices) through a user-friendly web and mobile platform. The minimum deposit is low ($100) and leverage options provide flexibility (up to 1:100 for indices).

Is Fidelity Market safe?

Fidelity Market is not regulated, which means there's no government oversight to ensure fair practices and investor protection.

What are the account types offered by Fidelity Market?

Information regarding account types is not readily available on Fidelity Market's website.

How can I contact Fidelity Market for support?

Customer support appears limited to email (support@fxinf.net). This may limit options for obtaining prompt assistance with inquiries or resolving issues.

Trading online carries inherent risks, including the potential loss of your entire investment.

More

User comment

1

CommentsWrite a review

2024-07-10 10:26

2024-07-10 10:26