User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.39

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| DFSReview Summary | |

| Founded | 2016 |

| Registered Country/Region | Argentina |

| Regulation | No regulation |

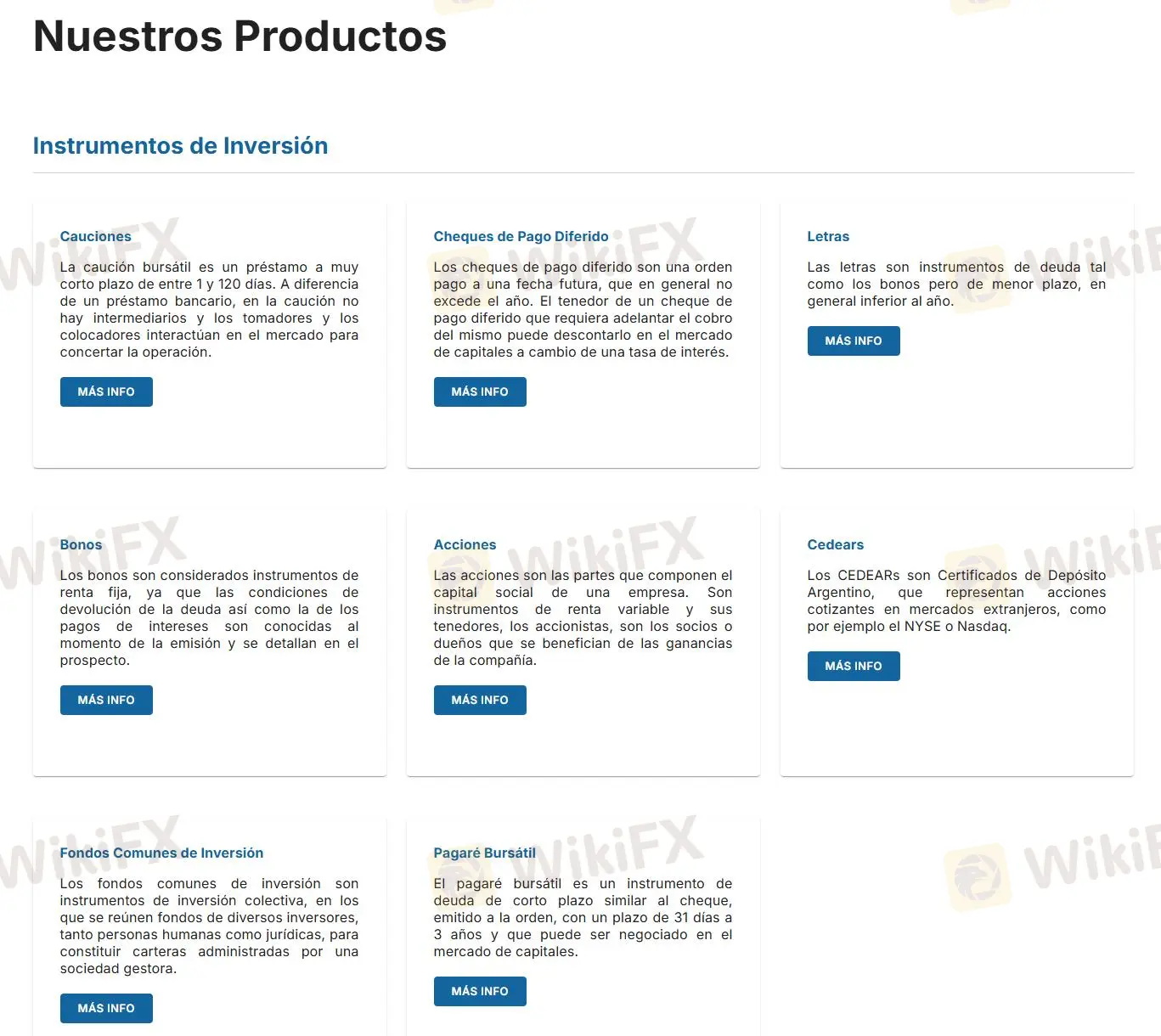

| Products & Services | Guarantees, Deferred payment checks, Bills, Bonds, Shares, CEDEARS, Mutual Funds, Stock Promissory Note |

| Demo Account | ❌ |

| Trading Platform | / |

| Min Deposit | / |

| Customer Support | Phone: +54 11 5275 6390 |

| Email: contacto@dealfs.com.ar | |

| Address: Carlos Pellegrini 989, piso 10. CABA 1009 | |

| Contact form | |

Established in 2016 and headquartered in Argentina, Deal Financial Services (DFS) operates in the financial market without formal regulatory oversight. DFS offers an array of financial instruments, including sureties, deferred payment checks, bills, bonds, shares, CEDEARS, mutual funds, and promissory notes. Despite its wide range of services, DFS is characterized by a notable lack of transparency regarding account types, trading platforms, and trading condition details.

| Pros | Cons |

| Various markets and services | Not regulated |

| Multiple contact channels | Unclear trading conditions |

No, DFS is not regulated by any reputable financial body. The absence of regulation may indicate questions about the legitimacy and safety of their investments.

DFS offers various services and products. The products include Guarantees, Deferred payment checks, Bills, Bonds, Shares, CEDEARS, Mutual Funds, Stock Promissory Note.

| Tradable Instruments | Supported |

| Guarantees | ✔ |

| Deferred payment checks | ✔ |

| Bills | ✔ |

| Shares | ✔ |

| CEDEARS | ✔ |

| Stock Promissory Note | ✔ |

| Bonds | ✔ |

| Mutual Funds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

The services provided include personalized advice, asset management, sales & trading, business financing, and research/reports.

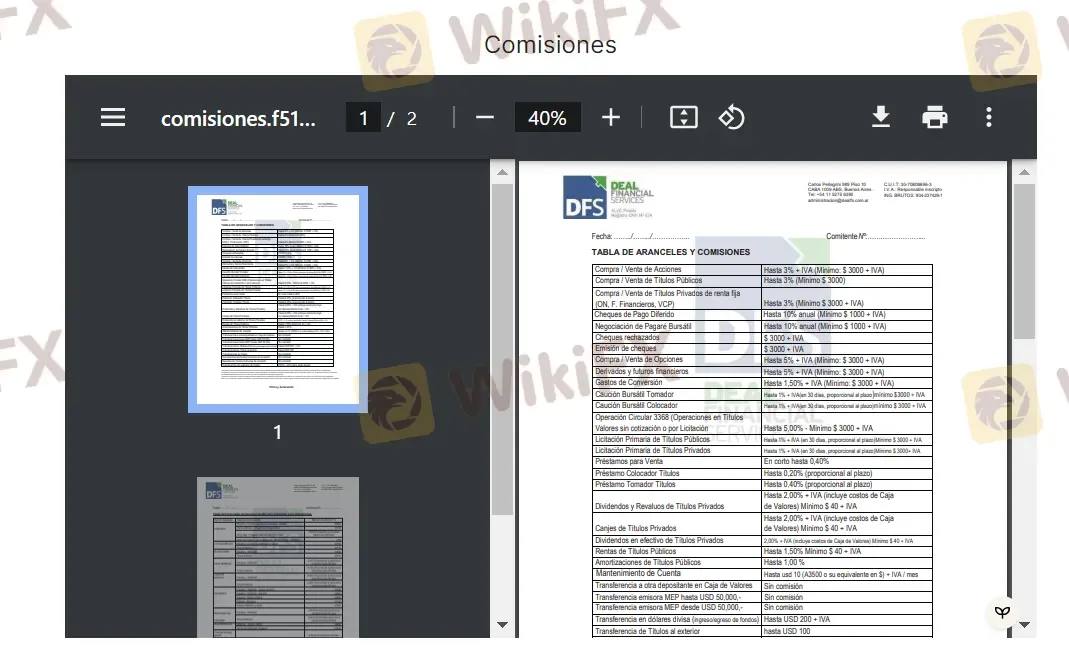

Deal Financial Services (DFS) showcases a multifaceted fee structure appealinging to a wide array of financial transactions.

The brokerage imposes fees up to 3% + IVA for trading public and private securities, with defined minimum charges.

Fees for deferred payment checks and negotiable promissory notes can ascend to 10% annually + IVA, starting from $100 + IVA.

Options, derivatives, and financial futures trading are subject to fees up to 5% + IVA.

Conversion and securities lending tasks, including for collateral provision and acquisition, come with varied rates, peaking at 150% + IVA for conversion expenditures.

The firm stipulates charges up to 500% for primary tender offers of securities, alongside specific minimum fees.

Charges for short selling and securities lending align with the transaction's duration, enforcing certain minimum fees.

Furthermore, the brokerage enforces considerable charges for dividends, income amortizations, account maintenance, and mutual fund activities, with some transactions facing up to 200% + IVA.

DFS reserves the right to adjust these fees and commissions as necessary, underlining a dynamic pricing strategy.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment