User Reviews

More

User comment

2

CommentsWrite a review

2025-10-29 11:46

2025-10-29 11:46

2024-01-10 17:34

2024-01-10 17:34

Score

2-5 years

2-5 yearsRegulated in Hong Kong

Dealing in futures contracts

Suspicious Scope of Business

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index6.54

Business Index6.41

Risk Management Index9.49

Software Index5.89

License Index6.54

Single Core

1G

40G

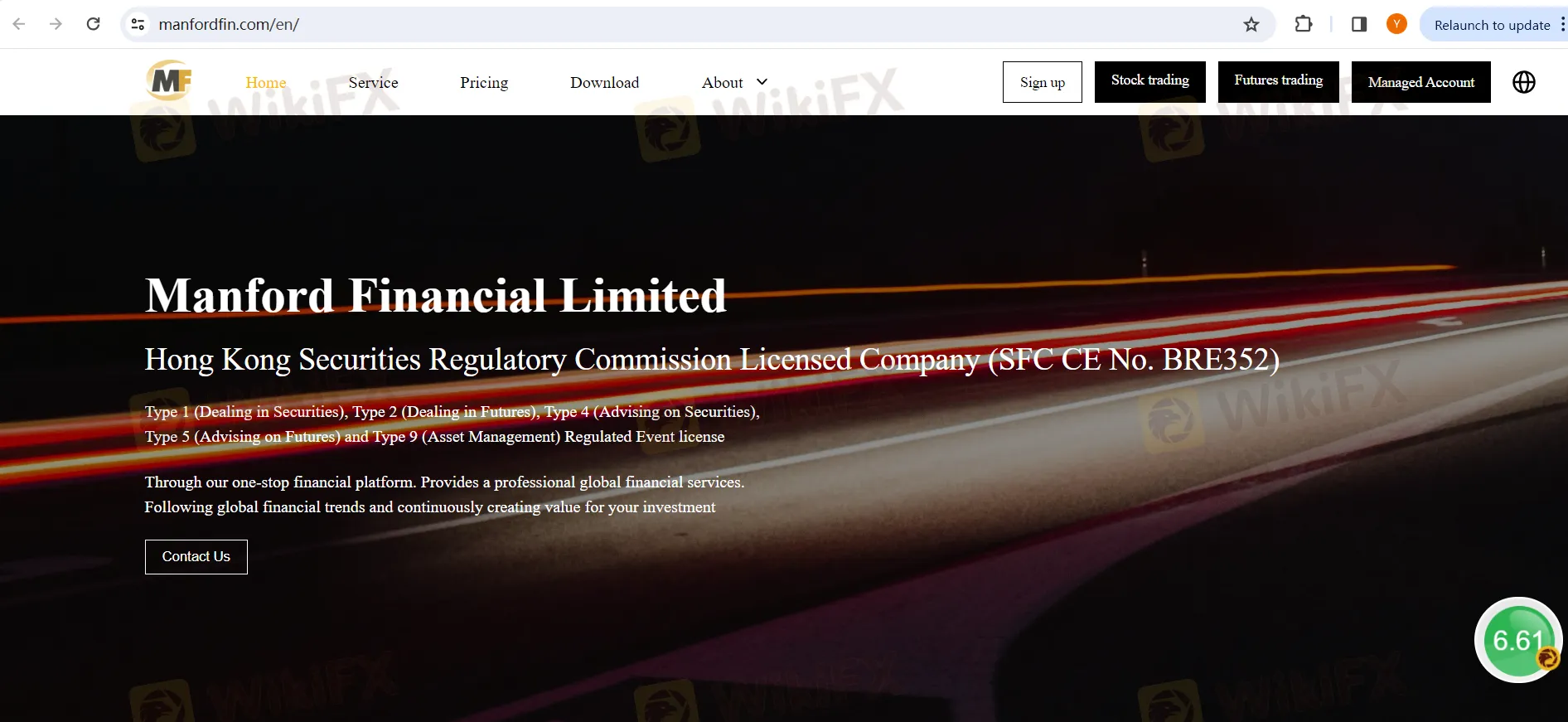

| Name | Manford Financial Limited |

| Registered in | Hong Kong |

| Regulatory Authority | Securities and Futures Commission (SFC) in Hong Kong |

| Services Offered | Stock Market Services, Futures & Options Trading, Asset Management |

| Trading Fee Structure | Varies for HK and US stocks, includes commissions, various fees (CCASS, SEC, etc.) |

| Customer Support | cs@manfordin.com |

| (852) 3755 3088 | |

| (852) 3755 3089 |

Manford Financial Limited, located at Unit 3403, 34/F, 118 Connaught Road West, Hong Kong, operates under the regulatory framework of the Securities and Futures Commission (SFC) in Hong Kong. The company offers a range of financial services including stock market services, futures and options trading, and asset management. Their trading fee structure varies for Hong Kong and US stocks and includes various commissions and fees like CCASS and SEC. Clients can reach them via email at cs@manfordin.com, telephone at (852) 3755 3088, or fax at (852) 3755 3089. Manford Financial has partnerships with major banks such as Bank of Communications, DBS Bank, and China Construction Bank. While the company is known for being regulated by the SFC, providing diverse financial services, and having professional customer support, it also faces challenges such as complex fee structures, geographical limitations, and inherent market risks.

Manford Financial operates under the regulatory oversight of the Securities and Futures Commission (SFC). The SFC is a key financial regulatory authority in Hong Kong, responsible for ensuring the integrity and stability of the financial markets within the region. As a regulated entity, Manford Financial is subject to compliance with SFC's stringent regulations and guidelines, designed to protect investors' interests, maintain market transparency, and uphold the highest standards of financial integrity. This regulatory framework helps instill confidence in Manford Financial's clients and the broader financial community by ensuring that the company operates in accordance with the established rules and regulations, contributing to the overall trustworthiness of the financial services it provides.

Manford Financial's strong regulatory framework and diverse service offerings are notable advantages, while the complexity of their fee structure and focus on a specific geographic location might be seen as drawbacks by some clients.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Manford Financial Limited offers three primary types of financial services to its clients:

Stock Market Services:

Manford Financial facilitates clients' participation in the stock market by offering a wide range of services. These services may include:

Market Research and Analysis: They provide comprehensive market research reports, technical and fundamental analysis, and insights into specific stocks and industries to assist clients in making informed investment decisions.

Stock Trading and Execution: The company offers a platform for clients to execute stock trades efficiently. They may provide access to local and international stock exchanges, allowing clients to buy and sell equities.

Portfolio Diversification: Manford Financial helps clients build diversified stock portfolios tailored to their risk tolerance and financial goals, spreading risk across different asset classes and sectors.

Investment Advice: Experienced professionals may offer personalized investment advice, recommending specific stocks or strategies based on clients' individual financial situations and objectives.

Future & Option Trading:

Manford Financial specializes in futures and options trading services, providing clients with opportunities in derivatives markets. These services can encompass:

Derivatives Market Insights: They offer insights into the futures and options market, including analysis of pricing trends, volatility, and strategies to leverage derivatives for hedging or speculative purposes.

Risk Management: Clients receive guidance on managing risk in derivatives trading, helping them understand and mitigate potential losses while maximizing profit potential.

Options Strategies: Manford Financial may assist clients in crafting options trading strategies, such as covered calls, straddles, or butterfly spreads, tailored to their investment goals.

Execution Services: The company provides a platform for clients to execute futures and options trades efficiently and swiftly, taking advantage of market opportunities.

Asset Management:

Manford Financial offers comprehensive asset management services, ensuring clients' investment portfolios are professionally managed. This involves:

Risk Assessment: Advisors assess clients' risk tolerance, investment horizon, and financial goals to design a customized asset allocation strategy.

Portfolio Construction: Utilizing their market expertise, the company constructs diversified portfolios consisting of various asset classes, such as stocks, bonds, and alternative investments, aiming for optimal returns while managing risk.

Continuous Monitoring: Manford Financial continuously monitors clients' portfolios, making necessary adjustments based on changing market conditions and clients' evolving financial situations.

Discretionary Account Management: For clients seeking a hands-off approach, they offer discretionary account management, where their experts make investment decisions on behalf of the client to maximize returns within the predefined parameters.

Manford Financial offers various financial services, and their fee structure is detailed across different types of financial products and services. Here's a summary of their fees:

Hong Kong Stocks

Trading Fees:

Commission: 0.2% of trade value with a minimum charge of 80 HKD.

CCASS Fee: 0.002% of the amount of executed trade, with a minimum of 2 HKD and a maximum of 100 HKD.

Stamp Duty: 0.13% of the trade value, with a minimum of 0.01 HKD.

Trading Fee: 0.00565% of the trade value, with a minimum of 0.01 HKD.

Transaction Levy: 0.0027% of the trade value, with a minimum of 0.01 HKD.

FRC Transaction Levy: 0.00015% of the trade value, with a minimum of 0.01 HKD.

Margin Fees:

HKD Interest: Charged at an annual interest rate of 6.5%. The interest is subject to periodic adjustments, calculated daily on negative balances, and collected monthly.

IPO Subscription Fees:

Ordinary Subscription Service Fee: 49 HKD.

Margin Subscription Service Fee: 99 HKD.

Winning Lot Fee: 1.00785% of the winning lot amount, charged only upon awarding of the IPO lot.

Pre-IPO Market Pricing:

Commission: 0.03% of the total trading amount, with a minimum of 3 HKD per trade.

Other fees similar to regular HK stocks trading.

Asset Management Service Fees:

Deposit Funds: Free of charge.

Withdraw Funds: Free of charge.

Transfer In Stocks: Free of charge.

Transfer Out Stocks: 500 HKD per stock each time.

Currency Exchange: Based on Long Bridge's comprehensive exchange rate quotations.

Other Fees:

Charges for services like cash dividend collection, equity interest collection, corporate actions, and others, often with a minimum and maximum limit.

US Stocks

Trading Fees:

Commission: Negotiable, with a minimum of 60 USD.

CCASS Fee: 0.003 USD per stock trade.

SEC Fee: 0.0000229 of the trading amount, with a minimum of 0.01 USD.

Trading Activity Fee: 0.000145 of the sell amount, with a minimum of 0.01 USD and a maximum of 7.27 USD.

Margin Fees:

USD Interest: Charged at an annual rate of 4.8%, with similar conditions as for HK stocks.

Asset Management Service Fees:

Similar to HK stocks, including fees for depositing and withdrawing funds, stock transfers, and currency exchange.

US Options

Trading Fees:

Commission: 0.5 USD per contract, with a minimum of 1.6 USD.

Additional fees like SEC Fee, Trading Activity Fee (TAF), Options Regulatory Fees (ORF), and OCC Fees.

Futures

Fees vary for different futures contracts, including LME metals, HKEx indices, US and other global futures markets. These fees are specific to each contract type and market.

Funds

Subscription and Redemption Fees: Generally free, but an administrative fee may apply based on the specific fund.

Contact Information:

Telephone: (852) 3755 3088

Fax: (852) 3755 3089

Email: cs@manfordfin.com

Notes: These fees are subject to change based on market conditions and other factors, so it's essential to consult Manford Financial or the relevant exchange for the most current fee structure.

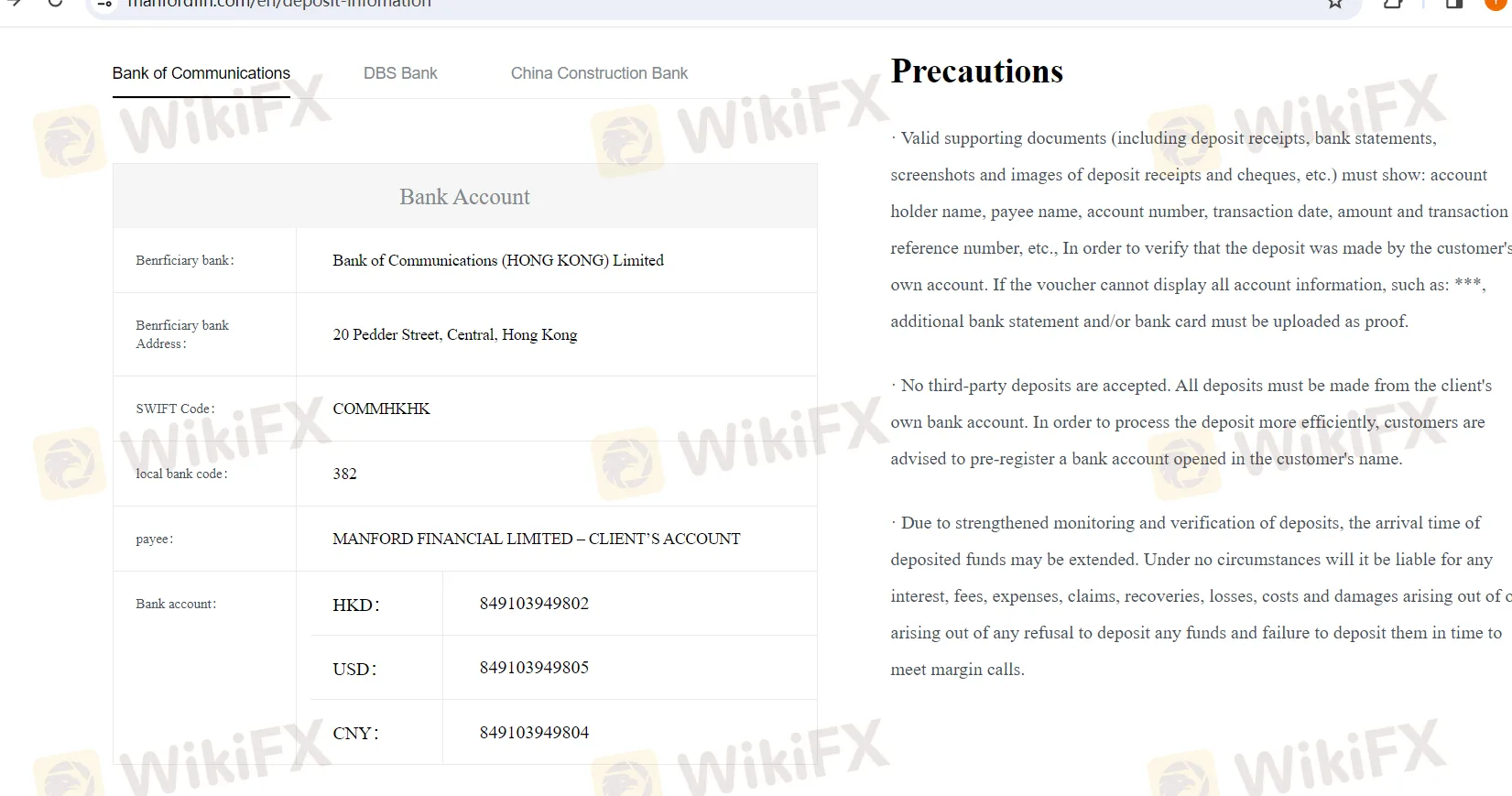

The deposit information for Manford Financial Limited involves three banks, each with specific details for HKD, USD, and CNY currency accounts. Here is the breakdown:

Bank of Communications (Hong Kong) Limited

Beneficiary Bank Address: 20 Pedder Street, Central, Hong Kong.

SWIFT Code: COMMHKHK.

Local Bank Code: 382.

Payee: MANFORD FINANCIAL LIMITED – CLIENTS ACCOUNT.

Bank Accounts:

HKD Account: 849103949802.

USD Account: 849103949805.

CNY Account: 849103949804.

DBS Bank (Hong Kong) Limited

Beneficiary Bank Address: 16th Floor, The Center, 99 Queens Road Central, Hong Kong.

Fax: +852 2806 5482.

SWIFT Code: DHBKHKHH.

Local Bank Code: 016.

Payee: MANFORD FINANCIAL LIMITED-CLIENTS ACCOUNT.

Bank Accounts:

HKD Account: 001839791.

USD Account: 001839807.

CNY Account: 001839782.

China Construction Bank (Asia) Corporation Limited

Beneficiary Bank Address: Floor 20, CCB Centre, 18 Wang Chiu Road Kowloon Bay, Kowloon, Hong Kong.

SWIFT Code: CCBQHKAX.

Local Bank Code: 009.

Payee: MANFORD FINANCIAL LIMITED – CLIENTS ACCOUNT.

Bank Accounts:

HKD Account: 846210116774.

USD Account: 846210116782.

CNY Account: 846210116790.

Notes for Deposits:

When making a deposit, it's crucial to use the correct SWIFT code and local bank code, along with the specific account number for the currency being deposited.

The payee name should be exactly as listed to ensure the deposit is credited correctly.

Double-check all details before initiating the transfer to avoid any issues with the deposit.

For international transfers, additional details like beneficiary bank addresses are important.

It's recommended to consult with Manford Financial Limited or the respective bank if there are any uncertainties or specific instructions needed for the deposit.

Manford Financial's customer support appears to be well-structured and equipped to handle a range of client inquiries and services. Here is a detailed description based on the provided contact information:

Address

Location: Unit 3403, 34/F, 118 Connaught Road West, Hong Kong, Hong Kong.

This address suggests a centrally located office in a major financial district, which is typically accessible and convenient for clients.

Contact Details

Email: cs@manfordin.com

Suitable for non-urgent inquiries, detailed questions, and when written records of communication are preferred or required.

Good for sending documents or forms digitally.

Telephone: (852) 3755 3088

Ideal for immediate assistance and direct interaction with customer support representatives.

Useful for quick queries, clarifications, and real-time problem resolution.

Telephone support is often the first point of contact for many clients.

Fax: (852) 3755 3089

An option for sending documents that may require a physical signature or cannot be sent via email.

Still relevant for certain types of financial transactions or where digital communication is not sufficient.

Nature of Customer Support

Range of Services: Manford Financial's customer support team likely handles a variety of client needs, including account management, transaction inquiries, technical support for online platforms, and general information about their services.

Professional Approach: Given the nature of the financial industry, their customer support team is expected to be professional, knowledgeable, and capable of handling confidential information securely.

Multi-channel Support: Offering support via email, telephone, and fax indicates a multi-channel approach, catering to different client preferences and requirements.

Additional Considerations

Operating Hours: While not specified, the customer support center likely operates during standard business hours, which is important to consider when planning calls or visits.

Language Support: In a cosmopolitan city like Hong Kong, multilingual support might be available, especially in English and Cantonese or Mandarin.

Response Time: For email communications, there might be a standard response time (e.g., 24-48 hours), while telephone inquiries are typically addressed immediately.

Recommendations for Clients

Determine the Best Contact Method: Depending on the urgency and nature of the query, choose the most appropriate contact method (email, phone, or fax).

Prepare Necessary Information: Before contacting support, have relevant account information or details about your inquiry ready to ensure efficient and effective assistance.

Follow-Up: If the issue is not resolved in the first interaction, dont hesitate to follow up for further assistance or clarification.

Overall, Manford Financial's customer support setup suggests a focus on accessibility and professionalism, key aspects in the financial services sector.

Manford Financial Limited, operating under the regulatory oversight of the Securities and Futures Commission (SFC) in Hong Kong, offers a range of financial services including stock market access, futures and options trading, and comprehensive asset management. Their fee structure is detailed and varied, encompassing trading fees for Hong Kong and US stocks, margin fees, IPO subscription fees, and more, reflecting their commitment to transparency. They support these services with a robust customer support system, including contact via email, phone, and fax from their centrally located office in Hong Kong. Additionally, for client convenience, Manford Financial provides detailed deposit information for transactions through major banks like the Bank of Communications, DBS Bank, and China Construction Bank. This multi-faceted approach underlines their commitment to providing accessible, professional financial services and support to their clients.

Q: What types of financial services does Manford Financial Limited offer?

A: Manford Financial Limited provides a variety of financial services including stock market trading, futures and options trading, and asset management. They cater to both individual and institutional clients, offering market research, portfolio diversification, and investment advice.

Q: Is Manford Financial Limited regulated?

A: Yes, Manford Financial operates under the regulatory oversight of the Securities and Futures Commission (SFC) in Hong Kong. This ensures compliance with stringent regulations and guidelines, focusing on investor protection, market transparency, and financial integrity.

Q: What are the trading fee structures for Manford Financial?

A: Manford Financial's trading fees vary depending on the market. For Hong Kong stocks, they charge a commission, CCASS fee, stamp duty, trading fee, and transaction levy. For US stocks, fees include commission, CCASS fee, SEC fee, and trading activity fee.

Q: How can clients contact Manford Financial for support?

A: Clients can contact Manford Financial via email at cs@manfordin.com, call them at (852) 3755 3088, or send a fax to (852) 3755 3089. Their customer support team is equipped to handle a range of queries related to their services.

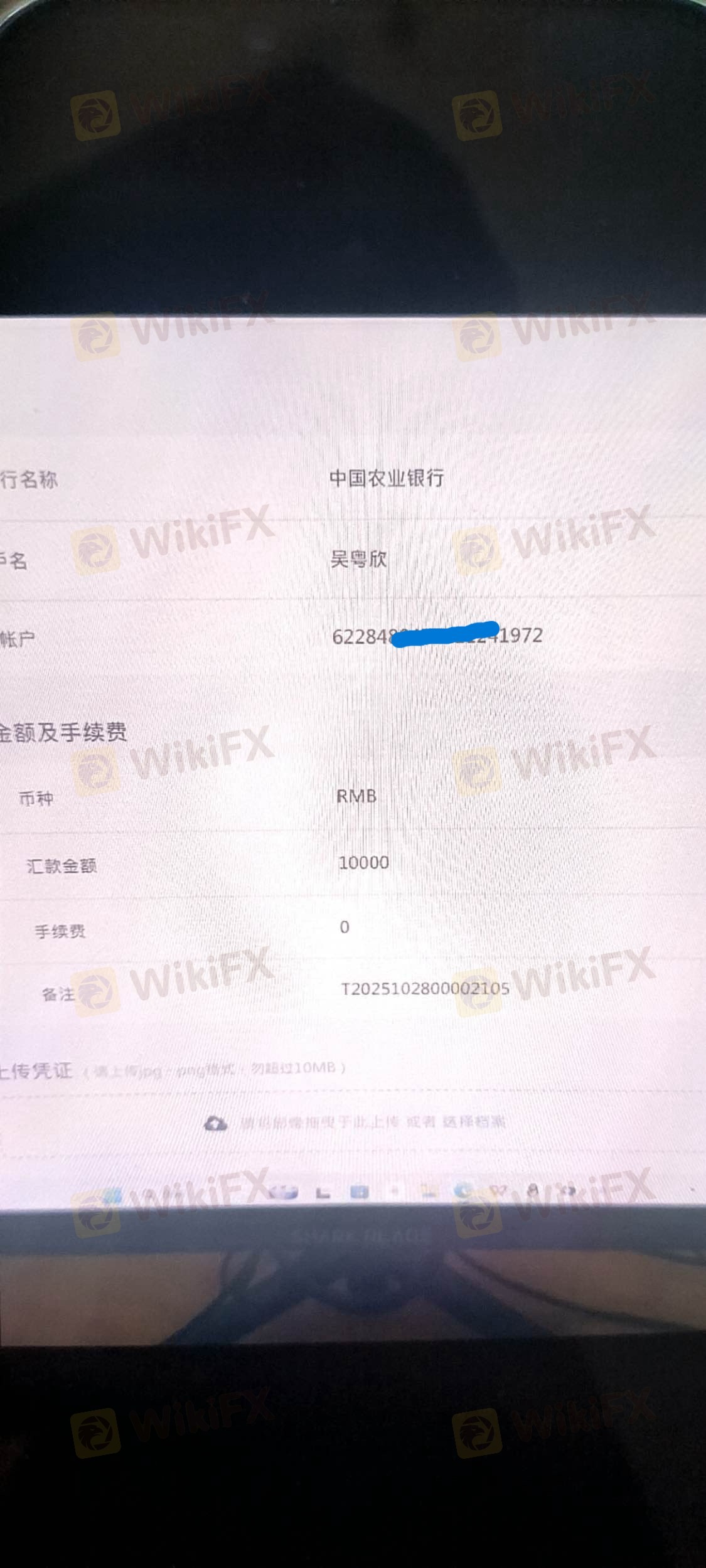

Q: How can clients make deposits to their Manford Financial accounts?

A: Deposits can be made through banks such as the Bank of Communications, DBS Bank, and China Construction Bank, using specific account details for HKD, USD, and CNY currencies. Its important to use the correct SWIFT code, local bank code, and the account number provided by Manford Financial.

More

User comment

2

CommentsWrite a review

2025-10-29 11:46

2025-10-29 11:46

2024-01-10 17:34

2024-01-10 17:34