User Reviews

More

User comment

2

CommentsWrite a review

2023-03-24 09:42

2023-03-24 09:42

2023-02-23 13:39

2023-02-23 13:39

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.50

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

TradeFTM Limited

Company Abbreviation

TradeFTM

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

Note: TradeFTM's official website - https://tradeftm.com/ is currently inaccessible normally.

| TradeFTM Review Summary | |

| Founded | / |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

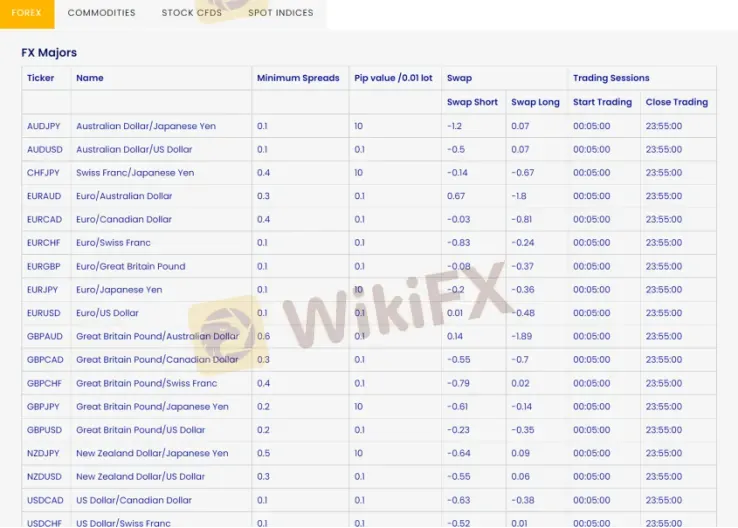

| Market Instruments | Forex, commodities, stock CFDs, spot indices |

| Demo Account | / |

| Leverage | Up to 1:500 |

| Spread | From 2.4 pips (Micro account) |

| Trading Platform | cTrader |

| Min Deposit | $200 |

| Customer Support | 24/5 support |

| Contact form | |

| Tel: +44 20 8144 1010 | |

| Email: support@tradeftm.com,info@tradeftm.com | |

| Address: 180, Whitton Road, Hounslow, London, England, TW3 2ES | |

| 130 Old Street, London, England, EC1V 9BD | |

TradeFTM is an unregulated broker registered in the United Kingdom, offering trading in forex, commodities, stock CFDs, and spot indices with leverage up to 1:500 and spread from 2.4 pips on the Micro account via cTrader platform. The minimum deposit requirement is $200.

| Pros | Cons |

| Diverse tradable assets | Inaccessible website |

| Various account types | Unregulated |

| Flexible leverage rat | Wide spreads on basic accounts |

| Commission-free accounts offered | No MT4/5 |

| cTrader platform | High minimum deposit |

| Multiple payment options | Withdrawal fee charged |

No, TradeFTM is not regulated. Traders should carefully consider the risks it brings when choosing to trade with it.

TradeFTM advertises that it offers more than 140 trading products, including forex, commodities (metals, etc.), stock CFDs and spot indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stock CFDs | ✔ |

| Spot indices | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Account Type | Min Deposit |

|---|---|

| Micro | $200 |

| Mini | $500 |

| Gold | $2,000 |

| Professional | $5,000 |

| ECN Classic | $10,000 |

| ECN Gold | $25,000 |

| ECN VIP | $50,000 |

| ECN Elite | $100,000 |

Traders holding different account types can enjoy different maximum leverage ratios, from 1:200 to 1:400. Inexperienced traders are advised not to use too much leverage since leverage magnifies gains and losses.

| Account Type | Max Leverage |

|---|---|

| Micro | 1:300 |

| Mini | 1:400 |

| Gold | |

| Professional | |

| ECN Classic | |

| ECN Gold | 1:200 |

| ECN VIP | |

| ECN Elite |

| Account Type | Spread | Commission (Forex) |

|---|---|---|

| Micro | From 2.4 pips | ❌ |

| Mini | From 2 pips | ❌ |

| Gold | From 1.8 pips | ❌ |

| Professional | From 1.1 pips | ❌ |

| ECN Classic | From 1 pip | $25 per lot |

| ECN Gold | From 1 pip | $15 per lot |

| ECN VIP | From 1 pip | $10 per lot |

| ECN Elite | From 0.6 pips | $15 per lot |

| Trading Platform | Supported | Available Devices | Suitable for |

| cTrader | ✔ | Windows, Mac OS, Web, Mobile devices | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

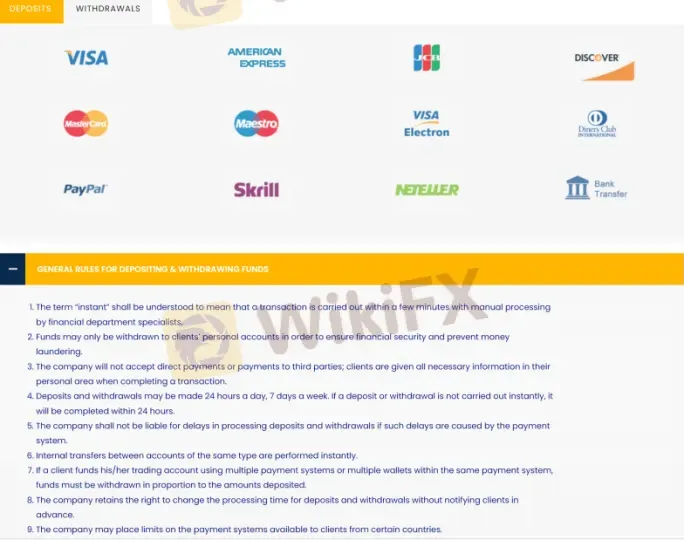

| Deposit Option | Visa, American Express, JCB, DISCOVER, MasterCard, Maestro, Visa Electron, Diners International, PayPal, Skrill, Neteller, Bank Transfer |

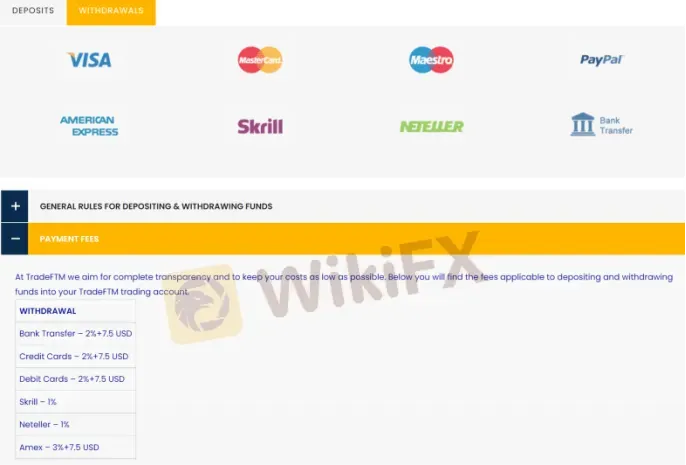

| Withdrawal Option | Visa, MasterCard, Maestro, PayPal, American Express, Skrill, Neteller, Bank Transfer |

| Min Deposit | $200 |

| Withdrawal Fee - Bank Transfer and credit/debit card | 2% + $7.5 |

| Withdrawal Fee - American Express | 3% + $7.5 |

| Withdrawal Fee - Skrill and Neteller | 1% |

More

User comment

2

CommentsWrite a review

2023-03-24 09:42

2023-03-24 09:42

2023-02-23 13:39

2023-02-23 13:39