User Reviews

More

User comment

1

CommentsWrite a review

2023-12-22 14:17

2023-12-22 14:17

Score

15-20 years

15-20 yearsRegulated in Japan

Market Making License (MM)

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index8.00

Risk Management Index8.90

Software Index7.05

License Index7.85

Single Core

1G

40G

More

Company Name

Marukuni

Company Abbreviation

Marukuni

Platform registered country and region

Japan

Company website

Company summary

Pyramid scheme complaint

Expose

| Marukuni Review Summary | |

| Founded | 1938 |

| Registered Country | Japan |

| Regulation | FSA |

| Products and Services | Domestic and foreign stocks, ETFs, ETNs, REITs |

| Demo Account | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Email: info@marukuni.co.jp |

The Financial Services Agency regulates Marukuni, a licensed securities firm that started in Japan in 1938. It mostly helps people trade stocks on the US stock market and buy exchange-traded funds (ETFs), exchange-traded notes (ETNs), and real estate investment trusts (REITs). Compared to other companies in the same field, the company's fees are thought to be exorbitant and complicated.

| Pros | Cons |

| Long-established (since 1938) | Higher than average fees |

| Regulated by FSA | Limited information about trading platforms |

| Offers a wide range of listed products | Limited information about deposit and withdrawal |

Yes, Marukuni is regulated. It holds a Retail Forex License issued by the Financial Services Agency (FSA) of Japan. The specific license number is 関東財務局長(金商)第166号, and it has been effective since September 30, 2007.

Marukuni offers a range of domestic stock-related products and exchange-listed investment instruments.

| Trading Products | Supported |

| Stocks | ✔ |

| ETFs (Exchange Traded Funds) | ✔ |

| ETNs (Exchange Traded Notes) | ✔ |

| REITs (Real Estate Investment Trusts) | ✔ |

| Forex | × |

| Commodities | × |

| Indices | × |

| Cryptocurrencies | × |

| Bonds | × |

| Options | × |

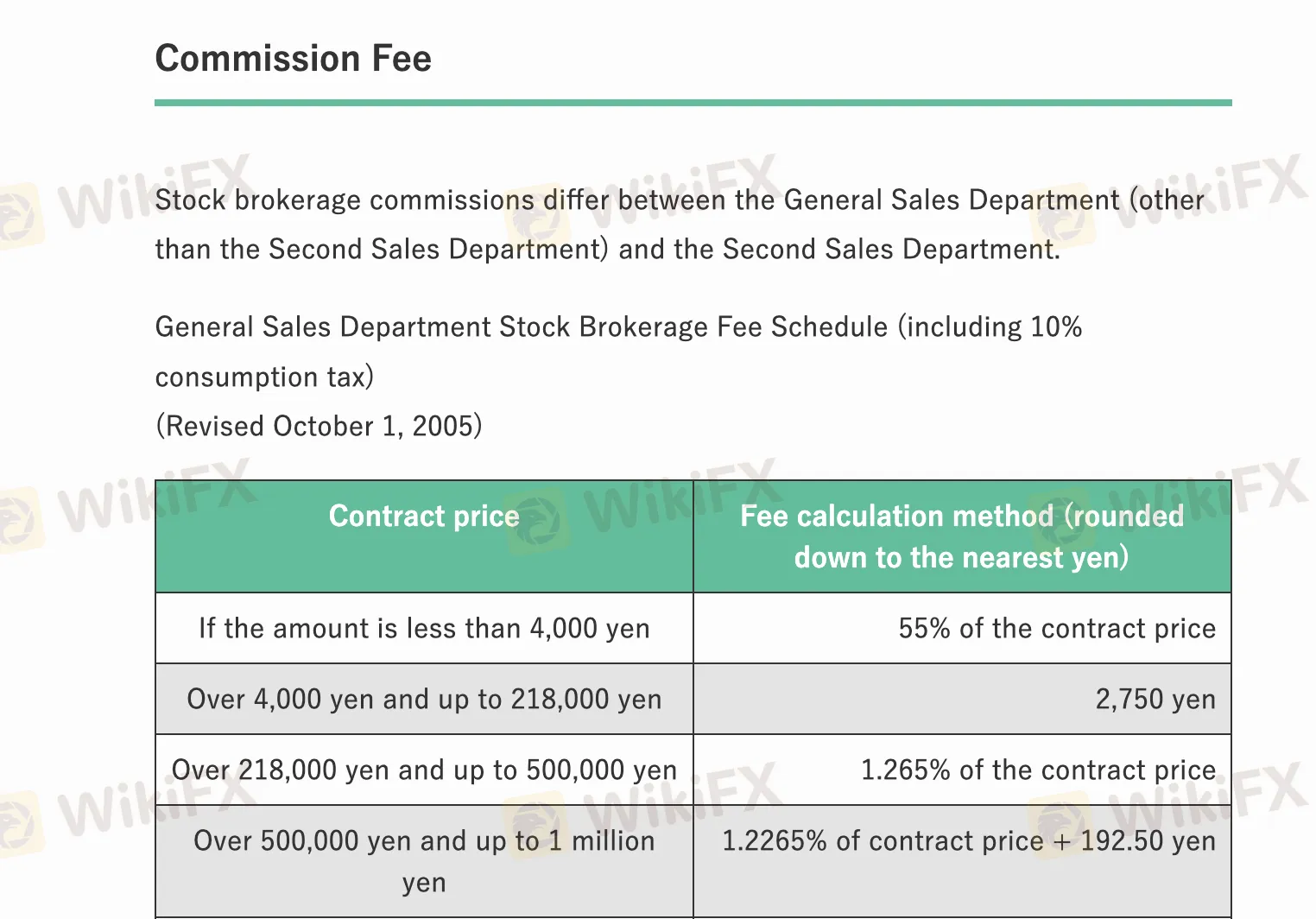

Most people think that Marukuni's prices are more than average for the industry, notably for stock brokerage commissions, which are based on a complicated tiered system.

| Trading Fees (Stock Brokerage) | Amount |

| <4,000 yen | 55% of contract price |

| 4,000–218,000 yen | 2,750 yen |

| 218,000–1 million yen | ~1.26% of contract price |

| 1–5 million yen | ~0.95–0.99% + fixed fee |

| 5–10 million yen | ~0.71–0.77% + fixed fee |

| 10–30 million yen | ~0.53–0.63% + fixed fee |

| 30–50 million yen | ~0.33–0.41% + fixed fee |

| Over 50 million yen | Fixed, over ~264,000–299,750 yen |

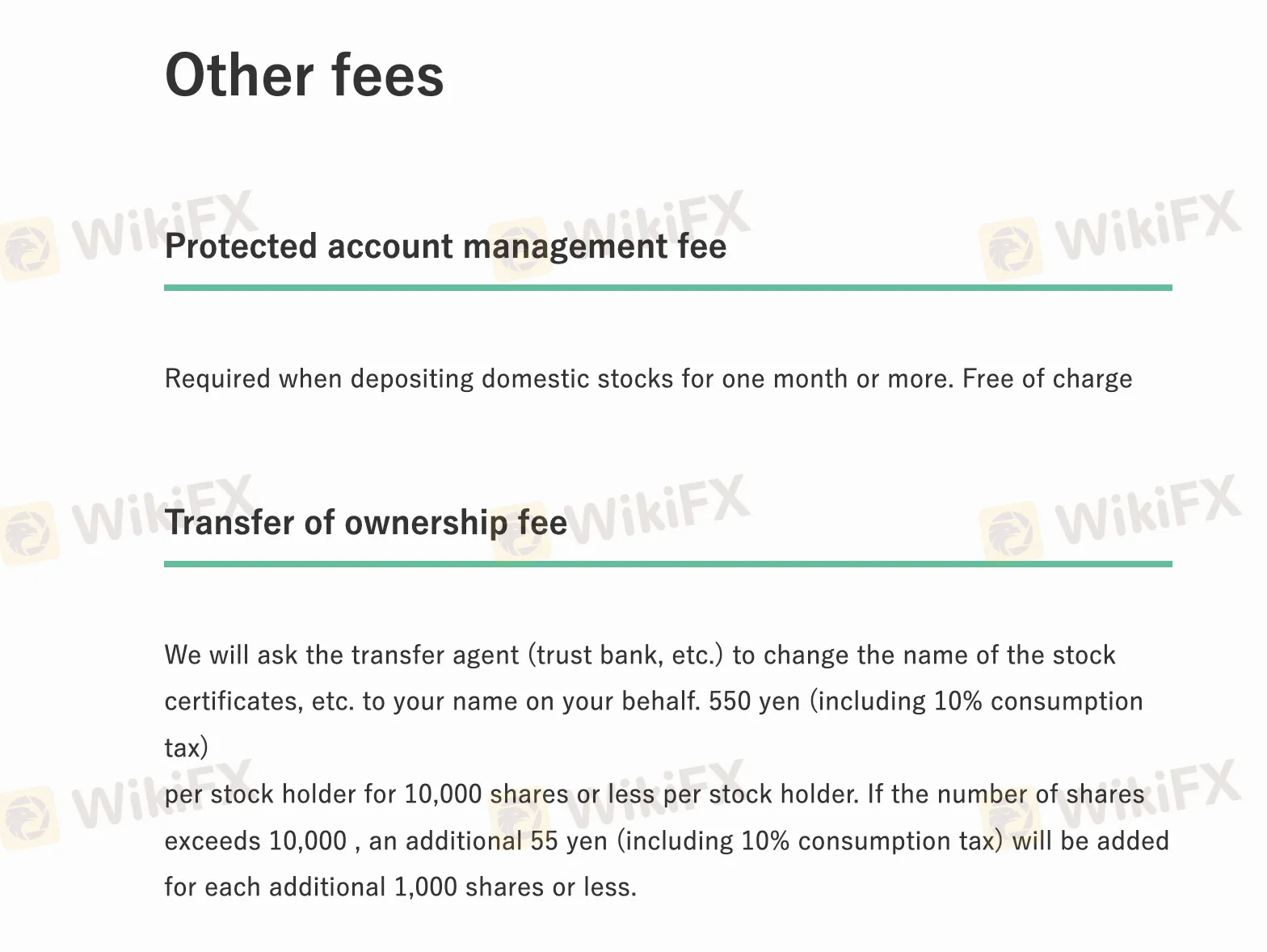

Non-Trading Fees

| Non-Trading Fees | Amount |

| Deposit Fee | 0 |

| Withdrawal Fee | 0 |

| Inactivity Fee | 0 |

| Protected Account Management Fee | 0 |

| Transfer of Ownership Fee | 550 yen (≤10,000 shares) + 55 yen per extra 1,000 shares |

| Odd Lot Purchase Request Fee | 550 yen per stock |

| Transfer Fee | 3,300 yen (≤5 units), 6,600 yen (>5 units) |

| Documentation Request Fee | 1,100 yen per request |

More

User comment

1

CommentsWrite a review

2023-12-22 14:17

2023-12-22 14:17