User Reviews

More

User comment

2

CommentsWrite a review

2023-03-30 10:20

2023-03-30 10:20 2023-02-16 10:10

2023-02-16 10:10

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.51

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Go Futures

Company Abbreviation

Go Futures

Platform registered country and region

United States

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Company name | Ironbeam |

| Registered in | United States |

| Regulated by | unregulated |

| Years of establishment | 2-5 years |

| Trading instruments | Futures, commodities, indices |

| Account Types | Micro Contracts, Standard Contracts |

| Minimum Initial Deposit | $500 |

| Maximum leverage | 1:100 |

| Minimum spread | 1 pip |

| Trading platform | Ironbeam Platform, TradingView, Sierra Chart, CQG, Rithmic, Bookmap, MultiCharts, Jigsaw, MotiveWave |

| Deposit and withdrawal method | Wire transfer, ACH, check |

Go Future has changed its name to Ironbeam. The company's operations remain the same.

Based in the United States, Ironbeam is an unregulated brokerage with 2-5 years of industry presence. They specialize in trading futures, commodities, and indices, offering both Micro Contracts and Standard Contracts account types. The minimum deposit required is $500, and they provide a maximum leverage of 1:100. Ironbeam boasts competitive spreads, with an average spread of 1 pip. Traders can access their services through a variety of platforms, including the Ironbeam Platform, TradingView, Sierra Chart, CQG, Rithmic, Bookmap, MultiCharts, Jigsaw, and MotiveWave. Deposits can be made via wire transfer, ACH, or check, providing multiple funding options for traders.

Ironbeam is a futures trading broker that claims to be regulated by the United States Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). However, there is some suspicion that the NFA license number that Ironbeam claims is actually a clone. This means that the broker may not be regulated by the NFA, which could pose a risk to traders.

It is important to note that the NFA does not regulate all futures trading brokers. Only brokers that are members of the NFA are regulated by the organization. If you are considering trading with Ironbeam, it is important to do your research to verify the broker's regulatory status.

Ironbeam offers several advantages to traders. They provide competitive spreads, making trading cost-effective, and their low commissions structure further contributes to favorable trading conditions. The availability of various account types caters to diverse trading preferences. Additionally, the 24/7 customer support ensures that traders have assistance around the clock.

However, there are some considerations to keep in mind. Ironbeam is unregulated, which might raise concerns about the oversight and accountability of the broker. While they offer competitive features, their trading platform might not be as user-friendly as some other brokers, potentially impacting the trading experience. The minimum deposit required to start trading with Ironbeam is relatively high compared to some other brokerage options, which could be a hurdle for traders with limited initial capital.

| Pros | Cons |

| Competitive spreads | Unregulated |

| Low commissions | Trading platform may not be as user-friendly as some other brokers |

| Variety of account types | Minimum deposit is relatively high |

| 24/7 customer support |

Ironbeam offers a variety of futures trading instruments, including:

Commodities: crude oil, natural gas, gold, silver, corn, soybeans, wheat, etc.

Currencies: EUR/USD, USD/JPY, GBP/USD, AUD/USD, etc.

Indices: S&P 500, Dow Jones Industrial Average, Nasdaq Composite, etc.

Ironbeam provides two account types, catering to different trading preferences and contract sizes.

Micro Contracts Account: Tailored for traders preferring micro contracts, this account offers a referral code “IRON” for a competitive 39-cent per contract commission rate. It provides lower margins starting at $50 for popular micro contracts and eliminates platform or inactivity fees, making it a cost-effective option.

Standard Contracts Account: Geared towards standard contract sizes, this account, with the “IRON” code, offers a 99-cent per contract commission rate. Popular standard contracts require margins starting at $500. Just like the Micro Contracts Account, it comes with no platform or inactivity fees, appealing to traders who favor standard contract sizes.

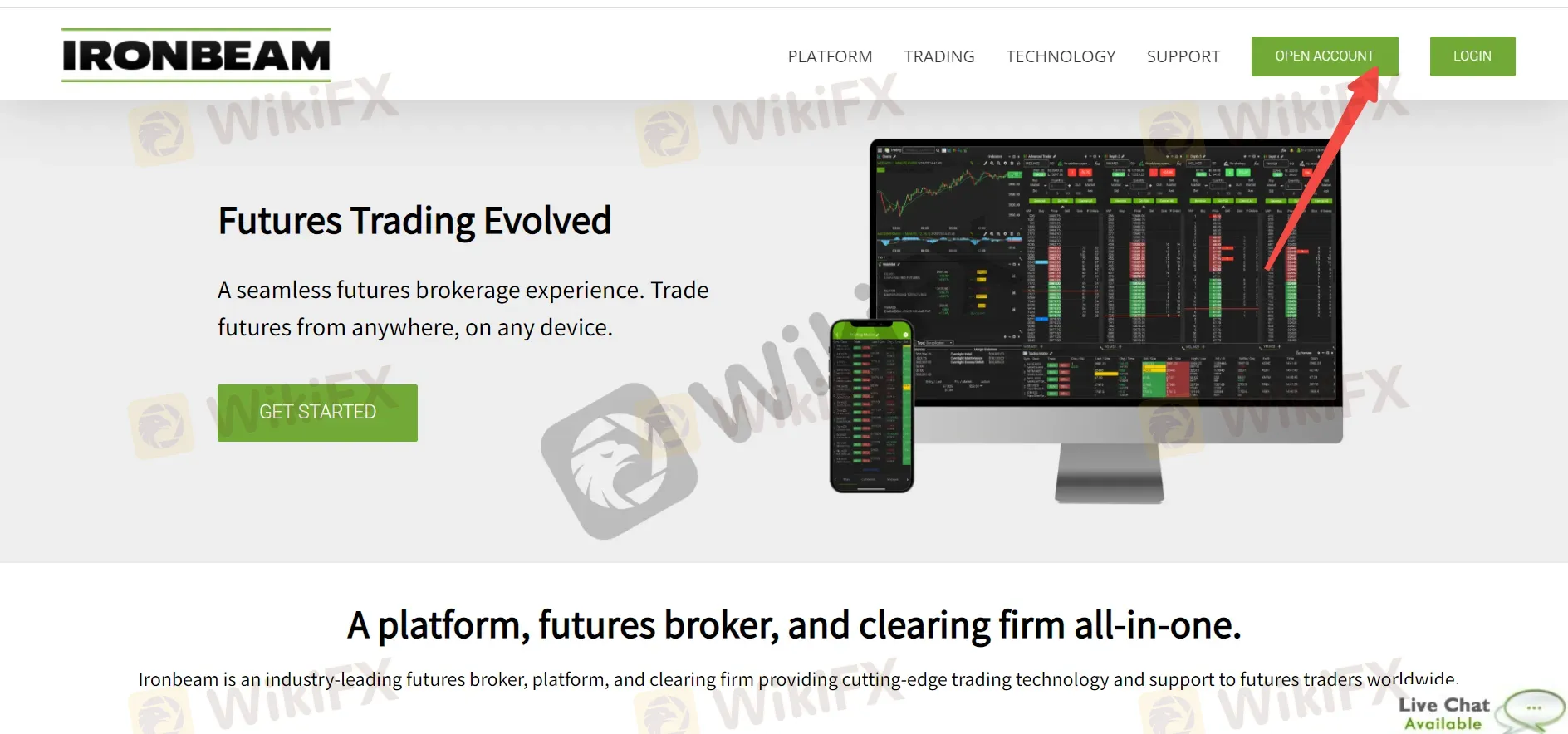

Opening an account with Ironbeam is a straightforward process that can be completed in five simple steps:

Visit the Website: Go to the Ironbeam website at https://www.ironbeam.com/ to initiate the account opening procedure.

Choose Account Type: Select the account type that suits your trading needs. Ironbeam offers options for both Micro Contracts and Standard Contracts accounts.

Use Referral Code: If applicable, enter the referral code “IRON” to benefit from special commission rates.

Provide Information: Fill out the required information accurately, which typically includes personal details, contact information, and any necessary documentation.

Submit Application: Review your provided information, ensure accuracy, and submit your account application. Once submitted, you'll receive further instructions on the subsequent steps to finalize your account setup.

Ironbeam provides traders with a significant leverage option, allowing for a maximum leverage of 1:100. This level of leverage permits traders to manage a position valued at $100,000 while holding a margin of just $1,000. This potential amplification of trading power can enhance opportunities for profit, but it's essential to approach leveraged trading with a comprehensive understanding of its risks.

Ironbeam's competitive spreads contribute to an efficient trading experience. The EUR/USD pair, for instance, boasts an average spread of approximately 1 pip. Furthermore, the company implements a commission structure wherein traders are charged $2 per round turn, ensuring a transparent approach to costs.

These favorable spread rates and straightforward commission fees can positively impact trading profitability, aligning with Ironbeam's commitment to providing traders with accessible and cost-effective trading solutions.

Ironbeam offers a flagship trading platform that caters to the needs of modern futures traders. This platform is designed with key features like speed, customization, and cross-platform functionality as its cornerstones. Traders can access the platform through desktop applications, web browsers, and fully-featured mobile apps, providing the flexibility to trade from anywhere while enjoying consistent and powerful functionalities across all devices. Additionally, Ironbeam has partnered with various popular trading platforms to offer a diverse range of options to its clients.

One of the notable partnerships is with TradingView, allowing traders to seamlessly connect their Ironbeam accounts to the TradingView platform. TradingView offers robust charting capabilities along with a unique social community for traders to share insights. Ironbeam has also developed its own cloud-based trading platform, the Ironbeam App, which is tailored for modern futures trading.

This platform includes native applications for desktop, web, iOS, and Android devices, ensuring that traders can access their accounts and execute trades regardless of their preferred device. Moreover, Ironbeam extends support to other established platforms like Sierra Chart, CQG, Rithmic, Bookmap, MultiCharts, Jigsaw, and MotiveWave, providing a wide array of choices to suit different trading strategies and preferences.

Ironbeam offers multiple options for funding your trading account. You can deposit funds via wire transfer, ACH, or check. Among these options, wire transfers are the fastest method for funding your account. Checks typically take around three business days to clear, while ACH transfers take approximately five business days to clear.

For wire transfers, you'll need to provide the necessary details, including BMO Harris Bank's ABA number (071-000-288), SWIFT code for foreign wires (HATRUS44), Ironbeam's account details, and your account information. For checks, you should send them to Ironbeam's address with the relevant instructions. ACH deposits can be initiated from within the Ironbeam account portal, simplifying the process for both existing and new customers.

To withdraw funds from your trading account, you can log in to ironbeam.com and submit a withdrawal request. Ironbeam provides two withdrawal options: checks or wire transfers.

Ironbeam, a brokerage firm specializing in futures and commodities trading, seems to offer comprehensive customer support to cater to the needs of their clients. Here's a breakdown of their customer support offerings based on the provided information:

Phone Support: Ironbeam provides a direct phone line (312-765-7200) for sales inquiries. Clients can call this number to get in touch with the sales team and discuss any questions they might have about the brokerage's services.

Email Support: Clients can reach out to the sales team via email at sales@ironbeam.com. This provides a written communication channel for clients who prefer to convey their queries or concerns through email.

24-Hour Trade Desk Support: Ironbeam offers a dedicated 24-hour trade desk support line (312-765-7250). This indicates that clients can receive assistance related to their trades around the clock. This support is likely to cover issues like order placement, trade execution, and any trade-related inquiries.

24-Hour Technology Support: For technical matters, clients can contact Ironbeam's 24-hour technology support team via trading@ironbeam.com. This support is likely to address technical issues clients might encounter with the trading platform, software, or other technology-related aspects of trading.

Ironbeam provides a comprehensive suite of educational resources designed to empower traders and enhance their understanding of the futures market. Their offerings include a 24-hour support system, ensuring that traders have access to assistance whenever needed. Additionally, their Knowledge Base serves as a valuable repository of information, guiding traders through various aspects of trading, platform usage, and market dynamics.

The User Forum encourages a sense of community by enabling traders to exchange insights, strategies, and tips. Lastly, the News section keeps traders informed about the latest market developments and trends, contributing to a well-rounded educational experience that equips traders with the knowledge needed for successful futures trading.

Ironbeam stands as a notable player in the trading industry, based in the United States and operating for a span of 2-5 years. While the brokerage operates in an unregulated capacity, they offer a diverse range of trading options, including futures, commodities, and indices. Traders can choose between Micro Contracts and Standard Contracts, with a reasonable minimum deposit of $500. The leverage offered at 1:100 provides potential for amplified trading positions.

Competitive spreads, as low as 1 pip, contribute to favorable trading conditions. Ironbeam further enhances their appeal by supporting a variety of trusted trading platforms and facilitating convenient deposits through wire transfer, ACH, and check. While weighing these aspects, traders should also be mindful of the unregulated status and carefully assess the compatibility of their trading strategies with the available platforms and account options.

Q: Is Ironbeam regulated?

A: No, Ironbeam operates as an unregulated brokerage.

Q: What's the minimum deposit at Ironbeam?

A: The minimum deposit requirement is $500.

Q: What's the maximum leverage offered?

A: Ironbeam offers a maximum leverage of 1:100.

Q: How competitive are Ironbeam's spreads?

A: Spreads are competitive, with an average of 1 pip.

Q: Which platforms can I trade on with Ironbeam?

A: Ironbeam supports platforms like Ironbeam Platform, TradingView, Sierra Chart, and more.

More

User comment

2

CommentsWrite a review

2023-03-30 10:20

2023-03-30 10:20 2023-02-16 10:10

2023-02-16 10:10