User Reviews

More

User comment

3

CommentsWrite a review

2024-02-07 16:10

2024-02-07 16:10

2023-03-22 12:11

2023-03-22 12:11

Score

5-10 years

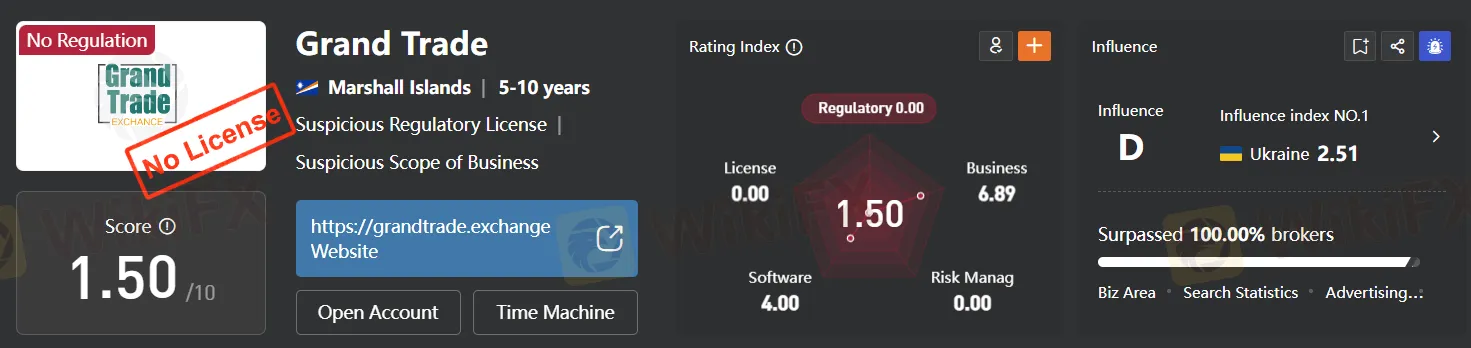

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.44

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

Grand Marshall LTD

Company Abbreviation

Grand Trade

Platform registered country and region

Marshall Islands

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Broker Name | Grand Trade Exchange |

| Registered Country | Marshall Islands |

| Tradble Instruments | Forex, Indices, Commodities |

| Regulation | Unregulated |

| Leverage | Maximum leverage of 1:500 across all account types. |

| Trading Platforms | Offers Sirix and Activ8 platforms, but lacks MetaTrader. |

| Spreads | From 0.6 pips |

| Customer Support | Telephone: +44 203 808 9575Email: compliance@grandtrade.exchange |

Grand Trade Exchange presents a concerning profile for potential traders. The broker operates without regulatory oversight, raising serious doubts about its transparency and security measures. Despite offering a high leverage ratio of 1:500 and access to trading platforms like Sirix and Activ8, the absence of MetaTrader and unclear commission structure further adds to the skepticism surrounding the platform. Additionally, the lack of regulation exposes traders to significant risks, including potential fraud and inadequate protection of assets. Overall, Grand Trade Exchange's unregulated nature and limited transparency undermine its credibility and reliability as a trading platform. Traders should exercise extreme caution when considering engagement with this broker.

Grand Trade operates in a regulatory gray area, lacking comprehensive oversight and regulation. This lack of regulation exposes traders and consumers to various risks, including fraud, market manipulation, and inadequate protection of assets. Without proper oversight, there is limited recourse for individuals in case of disputes or malpractices within the platform. Additionally, the absence of regulatory frameworks may hinder the establishment of fair market practices and standards, potentially undermining trust in the platform. As such, the unregulated nature of Grand Trade raises concerns about its transparency, security, and overall reliability for participants in the trading ecosystem.

Grand Trade Exchange offers a variety of advantages, including access to Sirix and Activ8 platforms, high leverage options, and a wide range of tradeable assets spanning forex, indices, commodities, precious metals, stocks, and cryptocurrencies. However, the absence of financial regulation poses a risk to traders, and the high spreads may affect profitability. Additionally, the lack of MetaTrader and limited availability of automated trading features on certain accounts may be drawbacks for some traders. It's important for individuals to carefully consider these factors when choosing a brokerage.

| Pros | Cons |

|

|

|

|

|

|

|

Grand Trade Exchange has five trading accounts available: Silver, Gold, Platinum, Algo Fund, and VIP. To open a most basic account, the Silver account, you need only fund $100 into your account, while minimum deposit for other four accounts are absurdly high, from $5,000, $10,000, $10,000 and $100,000, respectively.

The Silver Account serves as an entry-level option, requiring a modest minimum deposit of $100. With a maximum leverage of 1:500 and spreads starting from 2.4 pips, this account is well-suited for novice traders or those with limited capital who are seeking to venture into the forex market.

For traders seeking improved trading conditions, the Gold Account offers tighter spreads starting from 2.1 pips, requiring a minimum deposit of $5,000. With the same leverage as the Silver Account, this option caters to intermediate traders looking for enhanced profitability and reduced trading costs.

Moving up the ladder, the Platinum Account requires a minimum deposit of $10,000 and provides traders with even tighter spreads starting from 1.8 pips. This account type appeals to traders who prioritize favorable trading conditions and are willing to commit a higher initial investment.

For traders employing algorithmic trading strategies, the Algo Account offers spreads starting from 1.8 pips, with a minimum deposit of $20,000. With the same leverage as the Platinum Account, this option caters to those who rely on automated trading systems, providing an optimal environment for algorithmic trading.

Lastly, the VIP Account, requiring a substantial minimum deposit of $50,000, offers traders the lowest spreads starting from 0.6 pips. With the same maximum leverage as the other accounts, the VIP Account is tailored for advanced traders seeking the most favorable trading conditions and aiming for maximum profitability.

Grand Trade Exchange offers a maximum trading leverage of 1:500 across all of its trading account types. This leverage ratio signifies that traders can control positions in the market that are up to 500 times the amount of their initial investment. While high leverage can amplify potential profits, it also increases the level of risk, as losses can likewise be magnified. Traders should exercise caution and employ proper risk management strategies when utilizing leverage to ensure they can navigate the market effectively and protect their capital from excessive exposure to market volatility.

The spread is typically determined by trading accounts. The more account balance you hold, the more competitive spreads you are offered. As a result, spreads offered by these five accounts start from 2.4 pips, 2.1 pips, 1.8 pips, 1.8 pips, 0.6 pips, respectively

Grand Trade Exchange offers two robust trading platforms developed by Leverate, catering to diverse trading preferences and strategies. The Sirix platform provides an all-in-one solution for social trading, empowering users to configure their preferred lots and instruments, engage in one-click and copy trading, access analysis tools and charts, and stay informed with news and economic calendars. With mobile applications available for both Android and iOS devices, Sirix ensures traders can conveniently manage their portfolios anytime, anywhere. On the other hand, Activ8 boasts advanced charting capabilities and a comprehensive selection of EA/bots under its 'Strategies' category, providing traders with an extensive array of tools to enhance their trading experience across an extensive range of markets, including forex, indices, commodities, precious metals, stocks, and cryptocurrencies.

Traders with any inquiries or trading related issues can get access to Grand Trade Exchanges customer support through the following contact channels:

Telephone: +44 203 808 9575

Email: compliance@grandtrade.exchange

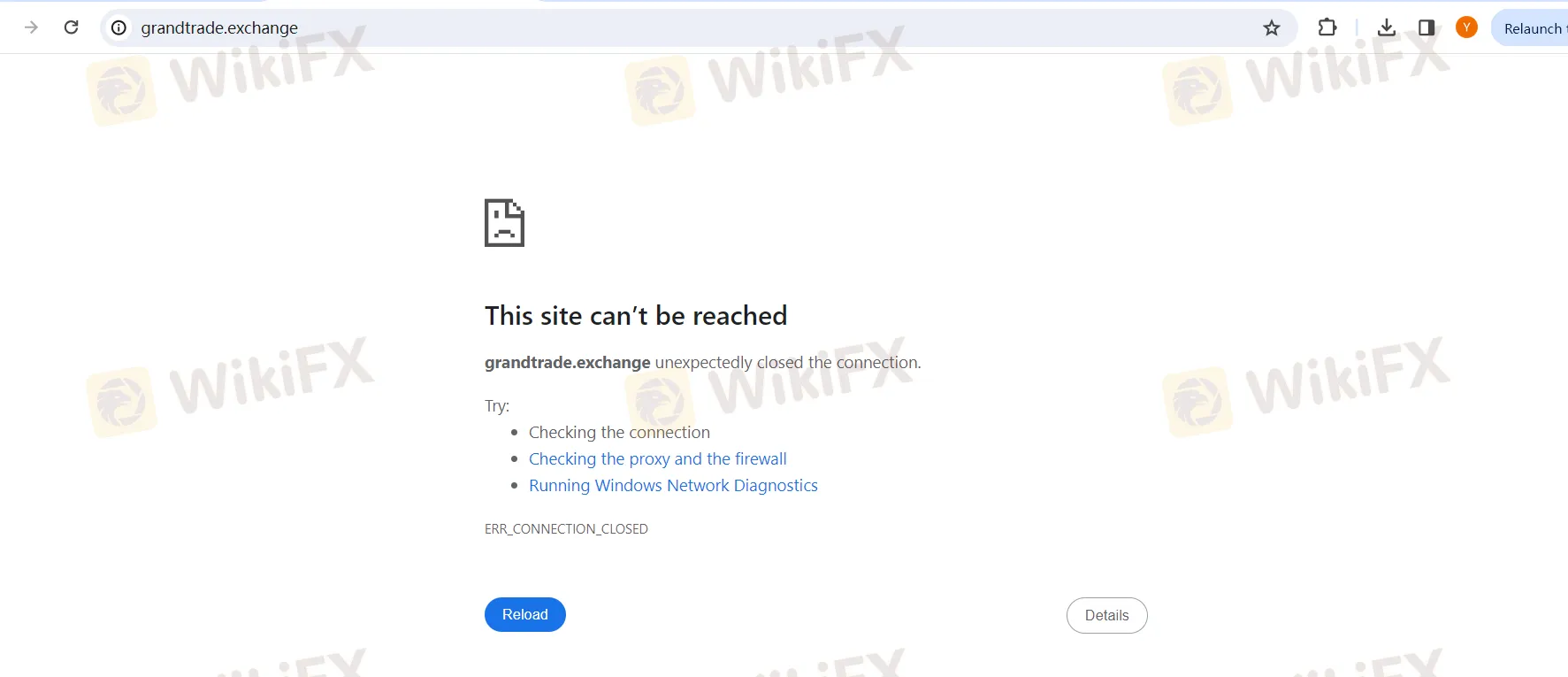

Grand Trade Exchange presents a mixed picture for potential traders. On one hand, it offers a diverse range of account types, leveraging options, and access to multiple trading platforms, including Sirix and Activ8, developed by Leverate. However, significant concerns arise due to its lack of financial regulation, potentially exposing traders to various risks such as fraud and inadequate protection of assets. Additionally, high spreads, absence of MetaTrader, and limited availability of automated trading features may deter some traders. Furthermore, the fact that its website is down adds to the uncertainty surrounding the reliability of the platform. Traders should carefully consider these factors and exercise caution before engaging with Grand Trade Exchange.

Q1: Is Grand Trade Exchange regulated?

A1: No, Grand Trade operates in an unregulated environment, lacking comprehensive oversight.

Q2: What is the maximum leverage offered by Grand Trade Exchange?

A2: Grand Trade offers a maximum trading leverage of 1:500 across all account types.

Q3: What trading platforms are available on Grand Trade Exchange?

A3: Grand Trade offers Sirix and Activ8 platforms, providing diverse trading options and tools.

Q4: Are there commissions charged on trades with Grand Trade Exchange?

A4: While Grand Trade does not explicitly mention commissions, they may be incorporated into the spread markup.

Q5: What assets can I trade on Grand Trade Exchange?

A5: Grand Trade Exchange offers a wide range of tradable assets including forex, indices, commodities, stocks, and cryptocurrencies.

More

User comment

3

CommentsWrite a review

2024-02-07 16:10

2024-02-07 16:10

2023-03-22 12:11

2023-03-22 12:11