User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index6.86

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Warning

More

Company Name

TD Ameritrade

Company Abbreviation

TD Ameritrade

Platform registered country and region

China

Company website

Company summary

Pyramid scheme complaint

Expose

Note: At present, the official website of TD Ameritrade, located at https://ameritrade.tdamr.com, is experiencing issues and is unavailable. Consequently, obtaining accurate information about the broker directly from their website is difficult.

| TD Ameritrade Review Summary | |

| Founded | 2-5 years |

| Registered Country/Region | China |

| Regulation | Unregulated |

| Market Instruments | Stocks, ETFs, mutual funds, options, fixed income, futures and forex, as well as margin lending and cash management services |

| Leverage | 1:50 |

| Demo Account | Unavailable |

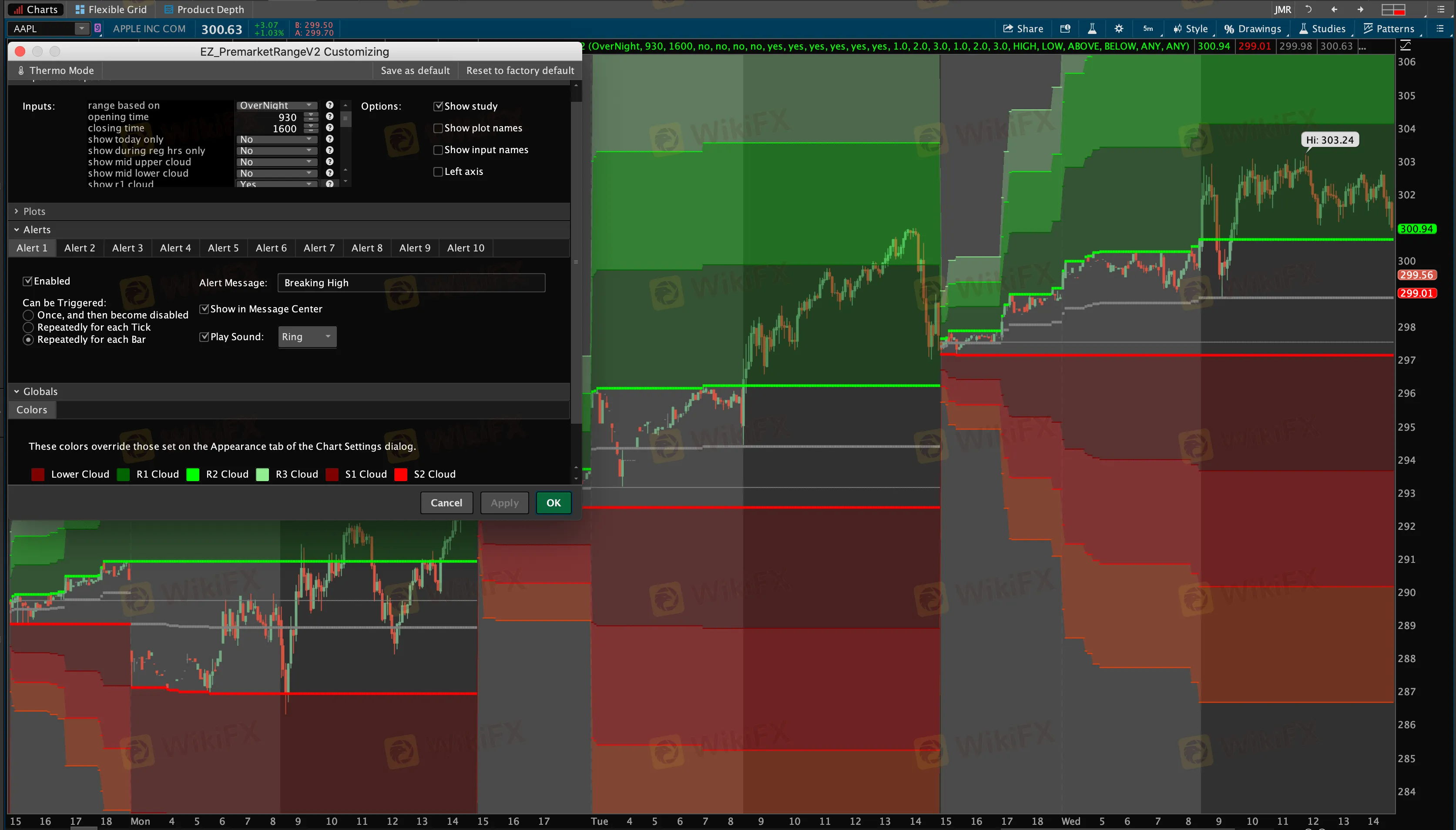

| Trading Platforms | Thinkorswim |

| Minimum Deposit | $2000 |

| Customer Support | N/A |

TD Ameritrade is a brokerage firm that has developed a proprietary trading platform called thinkorswim. It offers a wide range of trading instruments across various asset classes. However, it is important to note that TD Ameritrade lacks proper regulation.Furthermore, the fact that their official website is currently inaccessible raises additional concerns about the reliability of TD Ameritrade as a trading platform. It is important to consider these factors when contemplating investing with them.

In the upcoming article, we will thoroughly assess and analyze the features of the broker from various angles, providing you with well-organized and concise information. If you have any inquiries or interest, we encourage you to read on. In the conclusion of the article, we will offer a concise summary to help you easily understand the broker's characteristics.

| Pros | Cons |

|

|

|

|

|

|

|

- Offers a variety of trading instruments for users to choose from.

- Currently, their website is not accessible, making it challenging to access information about their services.

- TD Ameritrade is not regulated by any governmental or financial authority, which increases the risk of investing with them.

- They do not provide any ways to contact them, which can be frustrating for users who need assistance.

- TD Ameritrade does not offer support for the popular trading platform MT4.

TD Ameritrade's lack of proper regulation means that they are not supervised by any governmental or financial authority. Moreover, the inaccessibility of their official website raises doubts about the reliability of their trading platform. These factors significantly increase the risk associated with investing with TD Ameritrade.

If you are considering investing with TD Ameritrade, it is crucial to conduct thorough research and weigh the potential risks against the benefits before making a final decision. It is generally recommended to choose brokers who are well-regulated in order to safeguard your funds.

TD Ameritrade offers a wide range of trading instruments across various asset classes.

- Stocks: TD Ameritrade allows trading in stocks of various companies listed on major exchanges, giving investors the opportunity to buy and sell shares in individual companies.

- ETFs (Exchange-Traded Funds): ETFs are investment funds that trade on stock exchanges, representing a diversified portfolio of securities. TD Ameritrade offers a selection of ETFs, providing investors with broad market exposure or targeting specific sectors or asset classes.

- Mutual Funds: TD Ameritrade provides access to a wide range of mutual funds, including index funds, actively managed funds, and target-date retirement funds. Mutual funds allow investors to pool their money together, providing diversification across multiple securities.

- Options: TD Ameritrade offers options trading, giving investors the opportunity to buy or sell options contracts on underlying securities. Options provide potential flexibility and can allow for strategies such as hedging or leverage.

- Fixed Income: TD Ameritrade provides access to a variety of fixed income products, including bonds, treasury securities, certificates of deposit (CDs), and municipal bonds. These instruments can provide income and diversification to a portfolio.

- Futures: TD Ameritrade offers futures trading for investors interested in commodities, currencies, interest rates, and stock indices. Futures contracts allow investors to speculate on the future price movements of these assets.

- Forex: TD Ameritrade provides access to the foreign exchange market, allowing investors to trade currencies. Forex trading can involve buying one currency while selling another, taking advantage of fluctuations in exchange rates.

Additionally, TD Ameritrade offers margin lending services, allowing investors to borrow funds to potentially increase their trading activity, as well as cash management services to help manage and invest idle cash in their brokerage accounts.

TD Ameritrade offers a maximum leverage of 1:50, which means that traders can trade with up to 50 times their account balance. For example, if a trader has a $1,000 account balance, they can trade up to $50,000 in the market. Leverage is a popular tool that allows traders to make large profits with smaller investments. However, it is important to note that it also increases the risk levels.

To ensure that traders are aware of the risks associated with using leverage, TD Ameritrade requires all traders to acknowledge the risks and sign a waiver before they can start trading with leverage. They also provide educational materials and resources to help traders understand how leverage works and the risks involved. Traders are advised to use leverage carefully and not to expose themselves to more risk than they can afford to lose.

TD Ameritrade has developed a proprietary trading platform called thinkorswim, which offers a comprehensive range of trading options from a single account. This platform is known for its advanced analysis tools, educational resources, real-time data, customizable strategies, live chat support, and statistical information. With over 400 technical studies and 20 drawing tools, including Fibonacci tools, traders have ample resources to analyze the markets. Additionally, thinkorswim allows users to create their own trading algorithms using thinkScript.

While thinkorswim is a powerful and versatile platform, it may be complex and overwhelming for inexperienced traders. However, it offers synchronization across all devices and mobile applications for convenient trading on smartphones and tablets.

It is worth noting that TD Ameritrade does not provide other popular trading platforms like MetaTrader. In comparison, one of its competitors, FXCM, offers both MetaTrader 4 and its own Trading Station platform to cater to different traders' preferences.

TD Ameritrade offers multiple options for depositing and withdrawing funds. One of the primary methods they provide is the use of their own Automated Clearing House (ACH) services, which facilitate electronic funding. This allows clients to transfer money between their bank account and TD Ameritrade account seamlessly. Utilizing ACH services ensures fast and convenient transactions for both deposits and withdrawals.

In addition to ACH transfers, TD Ameritrade also supports bank transfers for depositing and withdrawing funds. Clients can initiate a bank transfer from their personal bank account directly to their TD Ameritrade account. This method may take a bit longer compared to ACH transfers, as it depends on the processing time of the involved banks. However, it remains a reliable option for users who prefer the traditional approach.

Furthermore, TD Ameritrade also accepts check deposits. Clients can deposit checks by mailing them to the designated address provided by the company. Once the check is processed, the funds will be credited to the client's account. This option may take longer compared to electronic methods, as it relies on physical mail and processing time. However, it offers an alternative for clients who prefer paper-based transactions or for those who do not have access to electronic banking services.

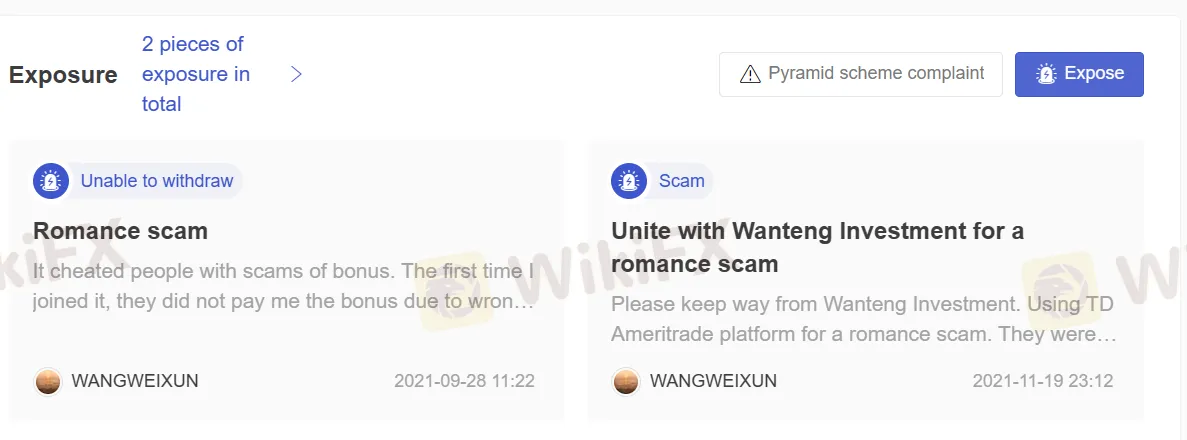

Please take the time to thoroughly review the information available on our website, where you will find reports related to issues such as inability to withdraw funds and potential scams. We strongly advise traders to carefully consider the risks associated with trading on an unregulated platform. Before engaging in any trading activities, it is essential to consult our platform for comprehensive information.

In the event that you come across any fraudulent brokers or have fallen victim to such practices, we encourage you to notify us through our Exposure section. We greatly appreciate your cooperation, and our team of experts will make every effort to assist you in resolving the issue.

In conclusion, TD Ameritrade is a brokerage firm that offers a proprietary trading platform called thinkorswim and a wide range of trading instruments.

However, investing with TD Ameritrade carries a higher level of risk due to the lack of regulation and potential issues with reliability. It is important to conduct thorough research and carefully consider the potential risks before making any investment decisions. It is generally advisable to choose brokers that are well-regulated to ensure the safety of your funds.

| Q 1: | Is TD Ameritrade regulated? |

| A 1: | No. TD Ameritrade is not regulated. |

| Q 2: | Does TD Ameritrade offer demo accounts? |

| A 2: | No. |

| Q 3: | What platform does TD Ameritrade offer? |

| A 3: | It supports thinkorswim. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

TD Ameritrade is a forex broker with trading experience of 2-5 years. We explore the basic details and trading information about TD Ameritrade in this TD Ameritrade review. We take a closer look at the broker registered in China to assess whether it is a reliable trading platform or a potential risk.

WikiFX

WikiFX

Experienced both highs and lows with TD Ameritrade in terms of trading experience and customer support? You’re not alone! From humble beginnings to losses and poor experiences, TD Ameritrade has turned out to be a shocking surprise for traders trusting it for wealth creation. The fraudulent broker has moved into the bad books of traders, quickly erasing pleasant memories they had at the beginning. Read on to learn more about it.

WikiFX

WikiFX

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment