User Reviews

More

User comment

2

CommentsWrite a review

2025-07-28 10:29

2025-07-28 10:29

2025-07-26 10:12

2025-07-26 10:12

Score

1-2 years

1-2 yearsRegulated in South Africa

Financial Service Corporate

MT5 Full License

Regional Brokers

Suspicious Overrun

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index3.51

Business Index5.05

Risk Management Index0.00

Software Index9.13

License Index3.51

Single Core

1G

40G

More

Company Name

Midori FX (Pty) Ltd

Company Abbreviation

Midori FX

Platform registered country and region

South Africa

Company website

Company summary

Pyramid scheme complaint

Expose

| Midori FX Review Summary | |

| Founded | 2023 |

| Registered Country/Region | South Africa |

| Regulation | Exceeded |

| Market Instruments | currency pairs, stock index, and commodities |

| Demo Account | Yes |

| Leverage | Up to 1:2000 |

| Spread | From 0.0 pips |

| Trading Platform | MT5 |

| Min Deposit | $0 |

| Customer Support | support@midorifx.com |

| +27120043084 | |

Midori FX, based in South Africa, is an online trading broker that provides access to over 57 FX currency pairs, stock indices, and commodities via the MT5 platform. They offer three account types: Standard, Raw, and Bull, with leverage up to 1:2000. Spreads start from 0.0 pips on the Raw account, and transaction fees vary. The minimum deposit is $0, and both deposits and withdrawals are free, with options including cryptocurrencies and credit/debit cards.

| Pros | Cons |

|

|

|

|

|

|

Midori FX once had a Financial Service Corporate license regulated by the Financial Sector Conduct Authority (FSCA) in South Africa with a license number 53077. But it has exceeded currently.

| Regulatory Status | Exceeded |

| Regulated by | South Africa |

| Licensed Institution | The Financial Sector Conduct Authority (FSCA) |

| Licensed Type | Financial Service Corporate |

| Licensed Number | 53077 |

Midori FX offers trading in over 57 FX currency pairs (Major, Minor, Exotic), stock indices, and commodities like metals and energy.

| Tradable Instruments | Supported |

| Currency Pairs | ✔ |

| Commodities | ✔ |

| Metals | ✔ |

| Stock Indices | ✔ |

| Bonds | ❌ |

| Shares | ❌ |

| Futures | ❌ |

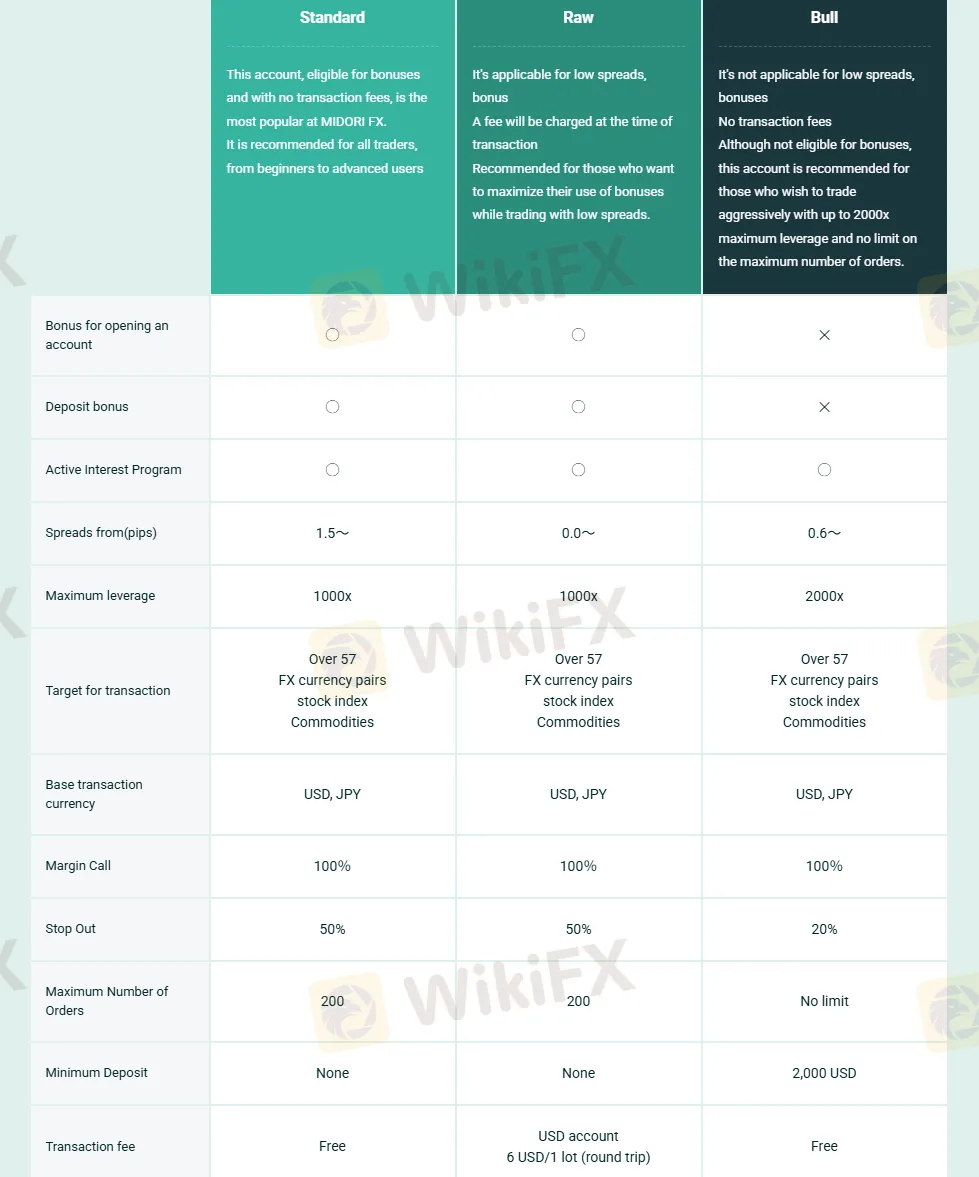

Midori FX offers three account types: Standard (bonus-eligible, no transaction fees), Raw (low spreads, commission-based, bonus-eligible), and Bull (lowest spreads, no bonus, high leverage, no order limit, higher minimum deposit). Besides, they also offer demo accounts.

| Feature | Standard Account | Raw Account | Bull Account |

| Description | Eligible for bonuses, no transaction fees, popular for all trader levels. | Applicable for low spreads, bonus available, fee charged per transaction, recommended for bonus users. | Not applicable for low spreads, no transaction fees, not eligible for bonuses, high leverage, no order limit. |

| Bonus for opening an account | Yes | Yes | No |

| Deposit bonus | Yes | Yes | No |

| Active Interest Program | Yes | Yes | Yes |

| Spreads from (pips) | 1.5~ | 0.0~ | 0.6~ |

| Maximum leverage | 1:1000 | 1:1000 | 1:2000 |

| Target for transaction | Over 57 FX currency pairs, stock index, Commodities | Over 57 FX currency pairs, stock index, Commodities | Over 57 FX currency pairs, stock index, Commodities |

| Base Transaction Currency | USD, JPY | USD, JPY | USD, JPY |

| Margin Call | 100% | 100% | 100% |

| Stop Out | 50% | 50% | 20% |

| Maximum Number of Orders | 200 | 200 | No Limit |

| Minimum Deposit | None | None | 2,000 USD |

| Transaction fee | Free | USD account: 6 USD/lot (round trip) | Free |

Midori FX provides a maximum leverage of 1:1000 for its Standard and Raw accounts, and a higher maximum leverage of 1:2000 for its Bull account.

| Feature | Standard Account | Raw Account | Bull Account |

| Maximum leverage | 1:1000 | 1:1000 | 1:2000 |

Spreads and commissions:

Midori FX offers spreads starting from 1.5 pips on the Standard account and from 0.0 pips on the Raw and 0.6 pips on the Bull account, with maximum leverage of 1:1000 for Standard and Raw, and 1:2000 for Bull; transaction fees are free for Standard and Bull accounts, while the Raw account charges 6 USD per lot (round trip) for USD-based accounts.

| Feature | Standard Account | Raw Account | Bull Account |

| Spreads from (pips) | 1.5~ | 0.0~ | 0.6~ |

| Transaction fee | Free | USD account: 6 USD/lot (round trip) | Free |

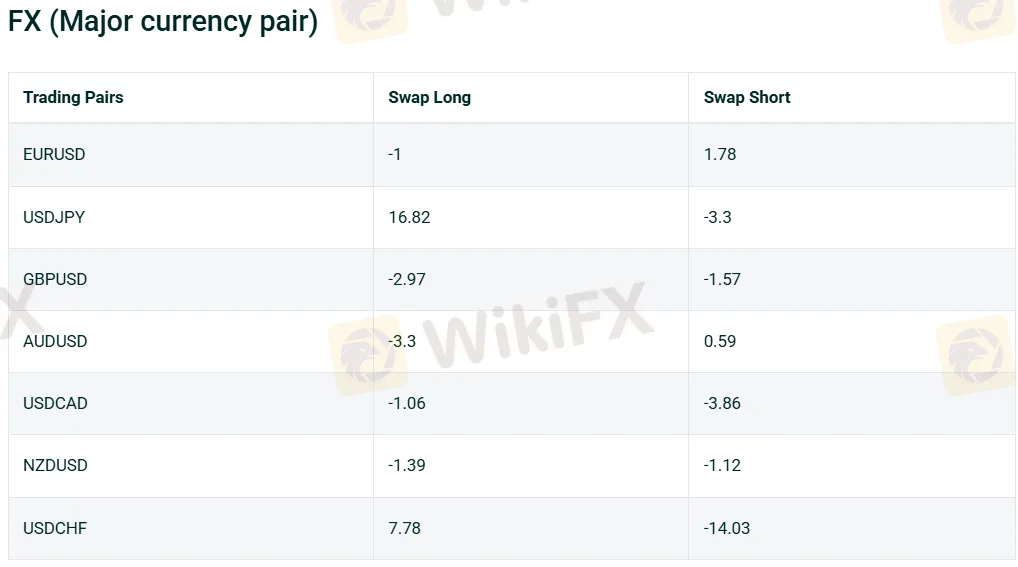

Swap points:

Midori FX's swap points for major currency pairs vary, with some pairs like EURUSD and AUDUSD having negative swap values for long positions and positive for short, while others like USDJPY and USDCHF show positive swap for long and negative for short positions.

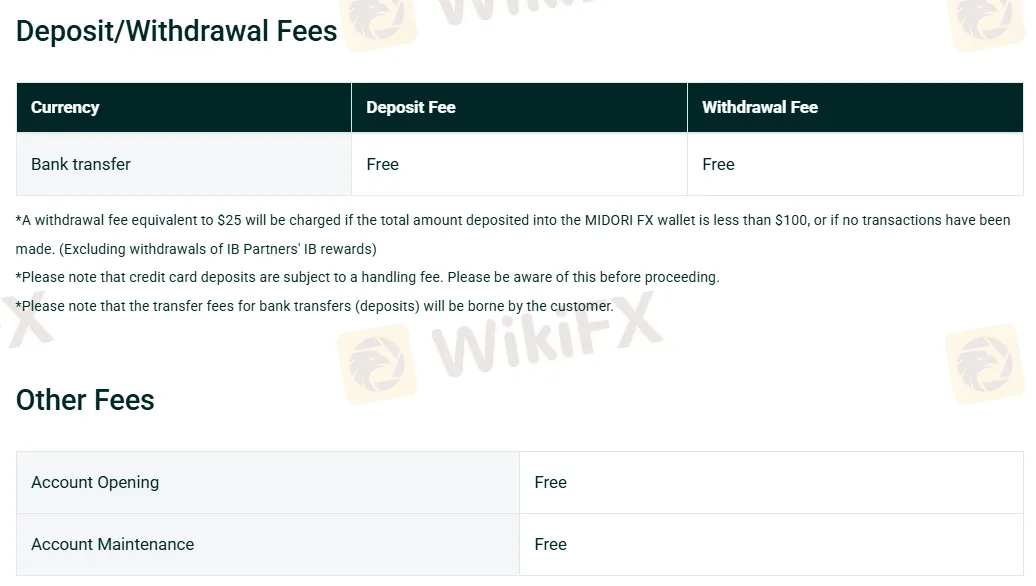

Non-Trading Fees:

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Account Opening | Free |

| Account Maintenance | Free |

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC and Mobile | Investors of all experience levels |

Midori FX charges no fees for deposits and withdrawals. The minimum deposit is $0.

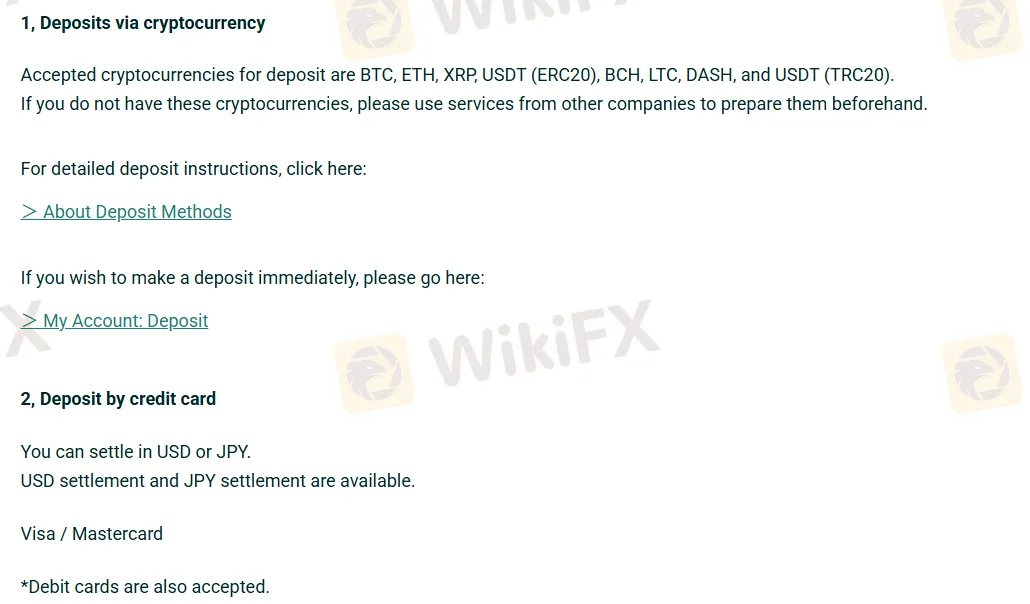

Deposit Options

Midori FX allows deposits via various cryptocurrencies (BTC, ETH, XRP, USDT, BCH, LTC, DASH) and credit/debit cards (Visa/Mastercard) in USD or JPY.

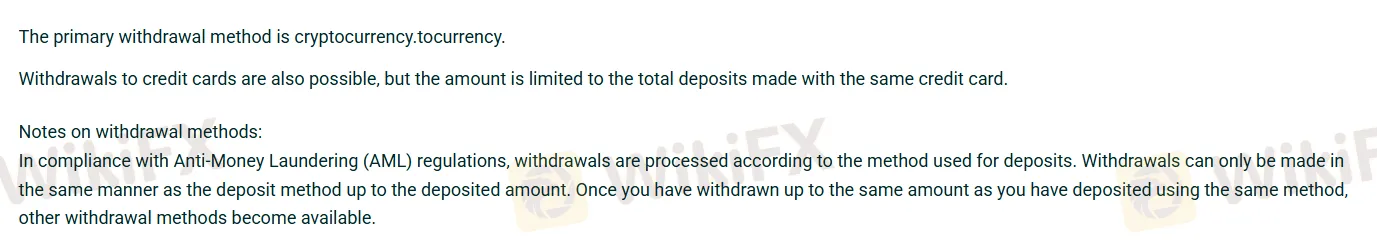

Withdrawal Options

Midori FX primarily uses cryptocurrency for withdrawals, with credit card withdrawals also possible up to the deposited amount.

More

User comment

2

CommentsWrite a review

2025-07-28 10:29

2025-07-28 10:29

2025-07-26 10:12

2025-07-26 10:12