User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

MT5 Full License

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.05

Risk Management Index0.00

Software Index9.46

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Admirals | Basic Information |

| Founded in | 2-5 years ago |

| Registered Country | Jordan |

| Regulation | Not regulated |

| Tradable Assets | Forex, precious Metals, CFDs on Futures |

| Trading Platform | MT5 (available on PC, IOS, Andriod), Amman Exchange |

| Minimum Deposit | $10 |

| Demo account | Yes |

| Maximum Leverage | Not specified |

| Spreads | From 0.0 pips |

| Commission | Vary depending on account types |

| Payment Methods | Visa, MasterCard, Bank Transfer, Safe to pay |

| Customer Support | Phone: +962799400077 Email: support@salaminv.com |

Al Salam Inv. is an unregulated forex and CFD broker that was founded 2-5 years ago and was registered in Jordan. They provide trading access to forex, precious metals, and CFDs on futures through the MT5 platform and the Amman Exchange. Al Salam Inv. offers a low $10 minimum deposit, with five types of trading accounts to choose from. Demo accounts are also available.Spreads starting from 0.0 pips and commissions varying depending on the account type.

Al Salam Inv is not regulated by any financial authority. Brokers that are not regulated can operate with fewer oversight and rules, which can pose higher risks for investors.

Al Salam Inv. offers some enticing features like a very low $10 minimum deposit requirement and a choice of five different account types, including the provision of the widely used MetaTrader 5 platform across devices and demo accounts for practice. However, the lack of regulatory oversight raises concerns about potential risks, transparency issues regarding leverage offerings and trading costs, as well as the absence of popular e-wallet payment methods like Skrill and Neteller. While the low deposit threshold and varied account options may appeal to certain traders, the heightened risks stemming from the unregulated nature of the broker necessitate careful evaluation and consideration of one's individual risk appetite before committing funds.

| Pros | Cons |

|

|

|

|

|

|

|

|

When it comes to market instruments, Al Salam Inv. offers the does not provide access to extensive markets. Major tradable assets on this platform include the following:

Forex

Spot Metals

CFDs (Contracts for Difference) on Futures

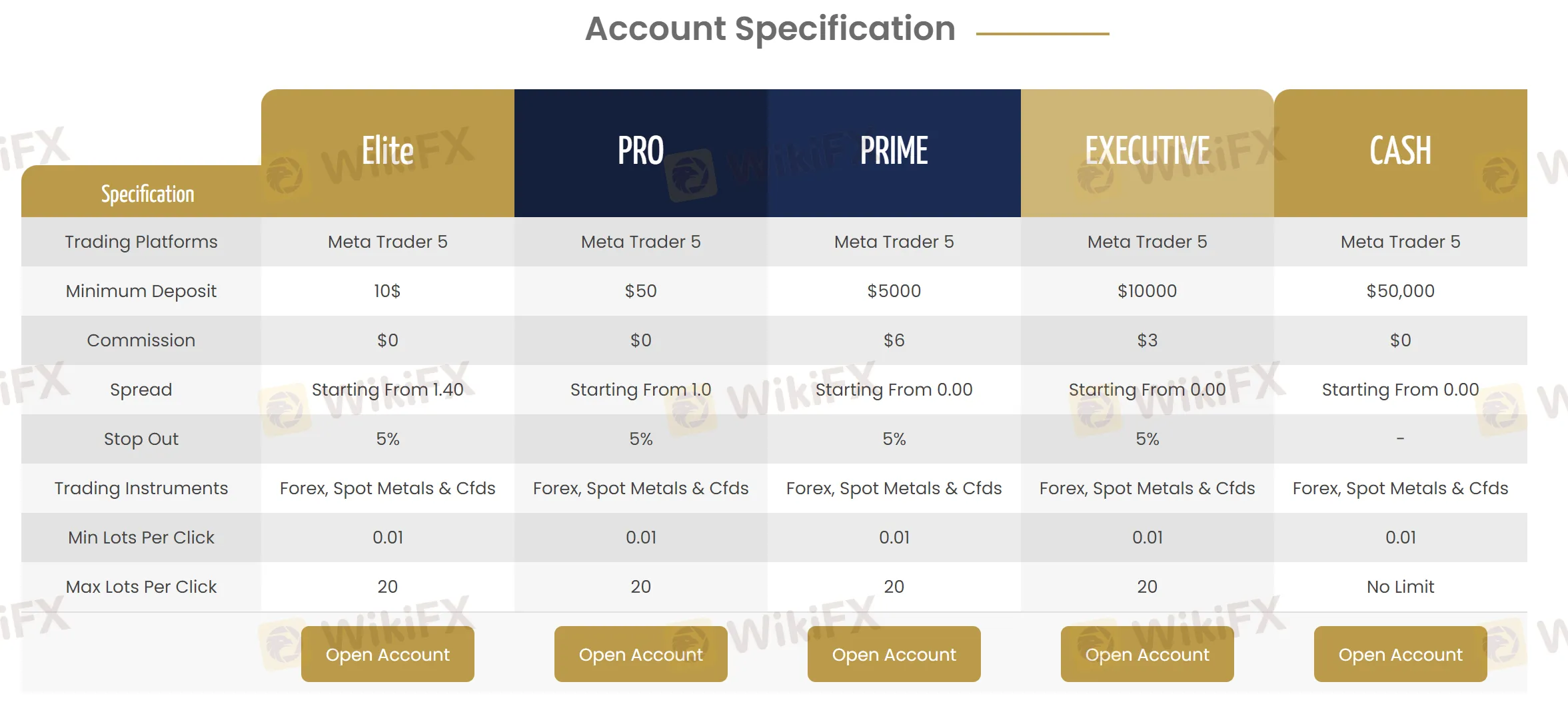

Al Salam Inv. offers several different account types to cater to traders with varying needs and capital. All account types provide access to trade forex, spot metals, and CFDs through the MetaTrader 5 platform.

The Elite account has the lowest minimum deposit requirement of $10. It has a starting spread of 1.4 pips with no commissions charged. Traders can open positions from 0.01 lots up to a maximum of 20 lots per click. The stop out level for this account is 5%.

For traders with more capital, the PRO account requires a $50 minimum deposit. It offers tighter spreads starting from 1.0 pip, still with no commissions. The trading size, stop out level and available instruments are the same as the Elite account.

The higher-tier accounts like PRIME, EXECUTIVE and CASH are designed for larger traders and institutions. The PRIME has a $5000 minimum deposit but offers zero spread trading while charging a $6 commission per lot round turn. The EXECUTIVE requires $10,000 minimum with zero spreads and a $3 commission. The top-tier CASH account demands a hefty $50,000 minimum deposit but charges no commissions and offers no limit on maximum trade size.

All the higher accounts allow 0.01 lot minimum size up to 20 lots maximum per click. They provide access to the same product range of forex, metals and CFDs, with the CASH account having no stop out level specified.

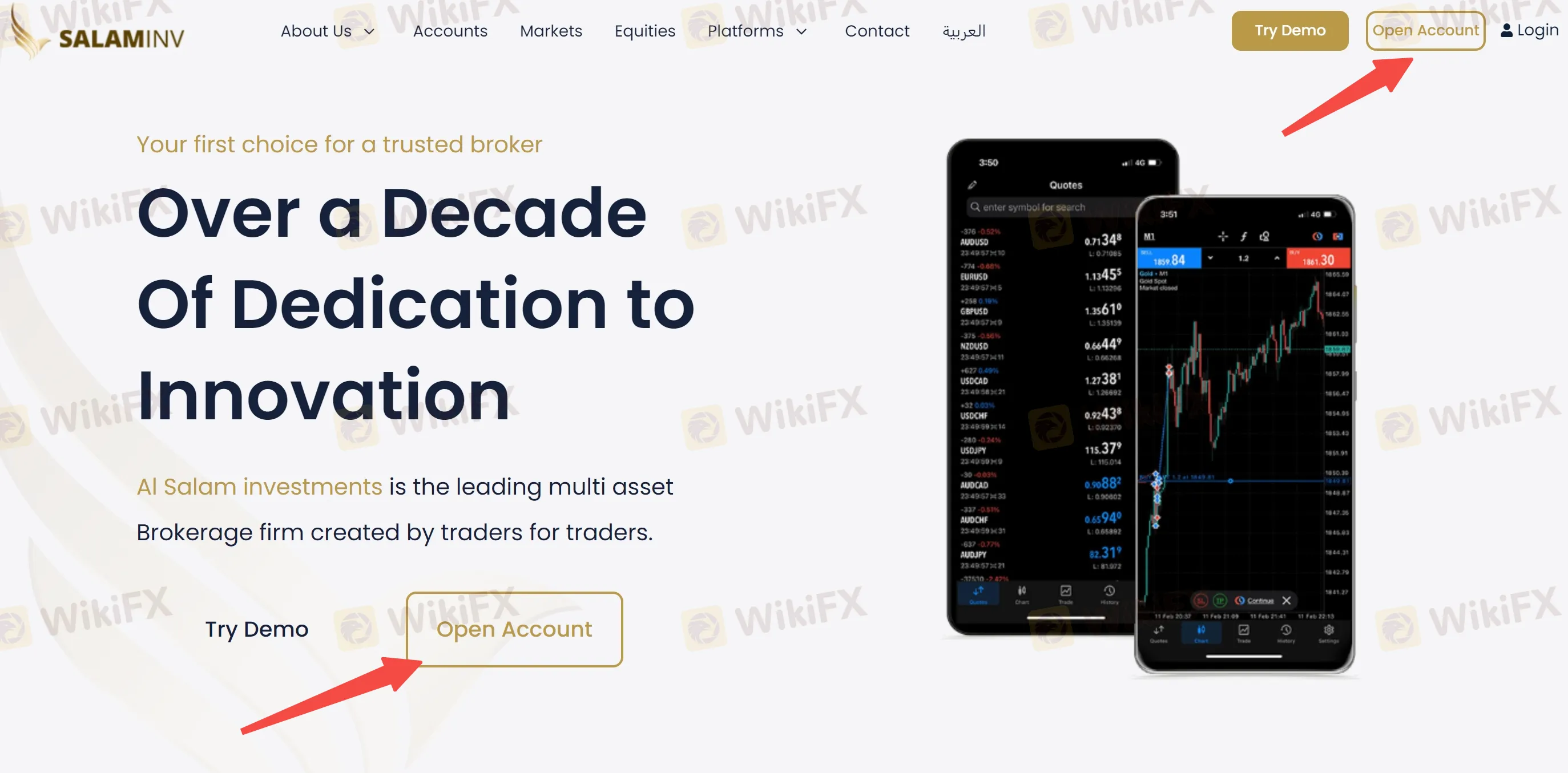

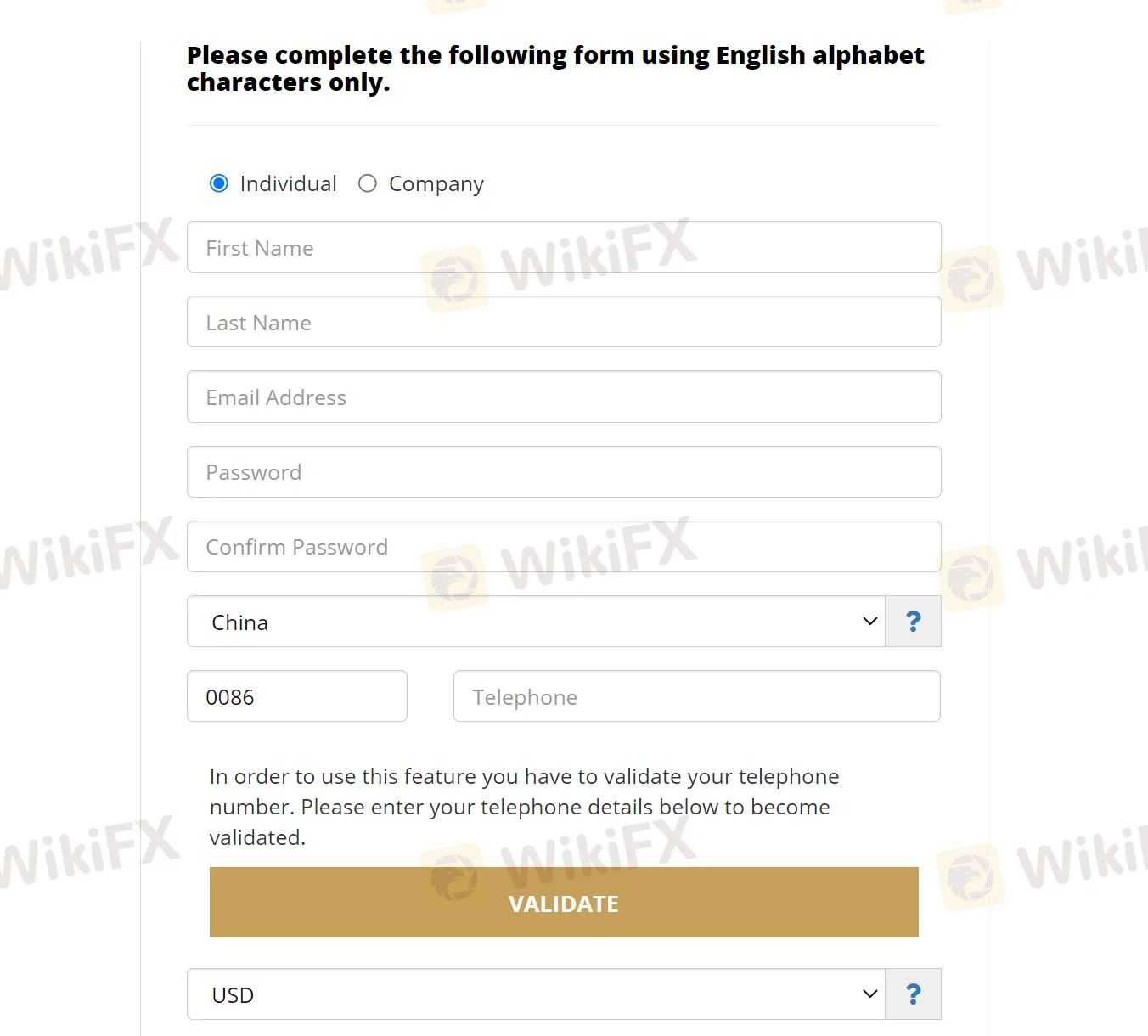

, here are 5 typical steps one might expect when opening a new trading account with them:

Visit their website (salaminv.com) and locate the “Open Account” button or section.

Complete the online account opening form by providing personal information, contact details, and identification documents as required.

Choose the desired account type (Elite, PRO, PRIME, EXECUTIVE or CASH) based on your trading needs and deposit amount.

Accept the terms and conditions, as well as any risk disclosure documents presented during the application process.

Fund your new trading account using one of the accepted payment methods like credit/debit card, bank wire transfer or SafeToPay e-wallet.

After completing these steps successfully, your trading account should be approved and activated, granting you access to Al Salam Inv's trading platforms and enabling you to start live trading.

Al Salam Inv. offers different spread and commission structures across its account types. The Elite and PRO accounts follow a spread-based model, with the Elite having spreads starting from 1.4 pips and the PRO from 1.0 pip, but neither charges any additional commissions.

Conversely, the PRIME, EXECUTIVE, and CASH accounts provide zero spread trading but incur fixed commissions per lot traded round turn. The PRIME commands the highest commission at $6 per lot, while the EXECUTIVE is $3 per lot, and the CASH account charges no commissions. Traders with higher volumes may find the commission-based accounts more cost-effective despite their larger minimum deposits, as the lack of spreads can translate to lower overall trading costs. Whereas the spread-based Elite and PRO may suit traders with lower volumes who prefer avoiding fixed commissions.

| Accounts | Spreads | Commissions |

| Elite | 1.4 pips | No |

| PRO | 1.0 pip | No |

| PRIME | From 0.00 pips | $6 per lot |

| EXECUTIVE | From 0.00 pips | $3 per lot |

| CASH | From 0.00 pips | No |

Al Salam Inv. provides its clients with access to the MetaTrader 5 (MT5) trading platform, which is available across multiple devices and operating systems. Traders can use the MT5 platform on their Windows PCs as well as on mobile devices running iOS (for Apple iPhones/iPads) and Android (for Android smartphones/tablets). The multi-device availability of MT5 allows Al Salam Inv.'s clients to monitor and trade their accounts seamlessly from their preferred devices, whether they are using a desktop computer, a mobile phone, or a tablet. This cross-platform compatibility ensures traders can stay connected to the markets and manage their positions conveniently, regardless of their location or the device they are using at any given time.

Al Salam Inv. offers a low minimum deposit of just $10 , making it accessible for traders with smaller capital. To fund their accounts, clients can choose from several payment methods including Visa and MasterCard credit/debit cards, bank wire transfers, as well as the SafeToPay e-wallet service. However, the broker does not provide the option to use other popular online payment solutions like Skrill and Neteller, which may be a drawback for traders who prefer or rely on those e-payment methods.

Al Salam Inv. provides multiple avenues for its clients to reach out and get assistance from their customer support team. Traders can contact support via telephone by calling the provided number or through email correspondence. The specific contact details mentioned are a phone number +962799400077 and an email addresssupport@salaminv.com. In addition to these direct support channels, Al Salam Inv. also maintains an active presence on several popular social media platforms like Facebook, LinkedIn, and Instagram. Clients can follow the broker's accounts on these sites to receive updates, news, and potentially engage with the support team through those mediums as well.

Phone: +962799400077

Email: support@salaminv.com

Social Media:

https://www.facebook.com/SalamInv

https://www.instagram.com/salam.inv/

https://www.linkedin.com/company/al-salam-investments

Overall,Al Salam Inv. is an online broker that operates without any regulation. It, indeed, has some appealing features, such as low minimum deposit, providing access to the MT5 trading platform, five types of trading accounts. However, the fact that this broker is not regulated can make traders who want to engage with it think twice.

Q: Is Al Salam Inv. a regulated broker?

A: No, Al Salam Inv. is not regulated by any financial authority. It is an unregulated broker registered in Jordan.

Q: What trading platforms does Al Salam Inv. offer?

A: Al Salam Inv. provides access to the MetaTrader 5 (MT5) trading platform, which is available on PC, iOS, and Android devices.

Q: What account types are available at Al Salam Inv.?

A: Al Salam Inv. offers several account types including Elite, PRO, PRIME, EXECUTIVE, and CASH accounts with varying minimum deposits, spreads, and commission structures.

Q: What payment methods can I use to deposit and withdraw funds?

A: Al Salam Inv. accepts deposits via Visa, MasterCard, bank wire transfers, and the SafeToPay e-wallet. Common withdrawal methods are likely the same as deposit options used.

Q: Does Al Salam Inv. offer a demo account?

A: Yes, according to the information provided, Al Salam Inv. does offer demo accounts to its clients, allowing them to practice trading risk-free.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment