User Reviews

More

User comment

7

CommentsWrite a review

2023-11-17 11:05

2023-11-17 11:05

2023-08-24 20:09

2023-08-24 20:09

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.41

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

CCF GROUP (HK) CO.,LIMITED

Company Abbreviation

CCF

Platform registered country and region

Australia

Company website

Company summary

Pyramid scheme complaint

Expose

CCF, regulated by the United States through the National Futures Association (NFA), offers a wide range of market instruments for trading, including foreign exchange, precious metals, crude oil, indices, and cryptocurrencies. With various account types, including Comprehensive, Finance, and Financial STP accounts, traders can diversify their trading strategies. CCF provides the FX6 trading platform, which offers powerful charting tools, a demo account for practice trading, and access to multiple asset classes. Clients can benefit from competitive spreads and leverage options ranging from 1:100 to 1:500. Additionally, CCF provides news updates and an economic calendar to keep traders informed, and customer support is available via email.

| Aspect | Information |

| Registered Country/Area | Australia |

| Founded Year | 2-5 years |

| Company Name | CCF GROUP (HK) CO.,LIMITED |

| Regulation | Regulated in United States through the National Futures Association (NFA) |

| Minimum Deposit | Not specified |

| Maximum Leverage | Ranges from 1:100 to 1:500 |

| Spreads | Floating spreads, can be as low as zero points |

| Trading Platforms | FX6 trading platform |

| Tradable Assets | Foreign Exchange (Forex), Precious Metals, Crude Oil, Indices, Cryptocurrency |

| Account Types | Comprehensive Account, Finance Account, Financial STP Account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | 24/7 trading, Customer Service Email Address, Company Address |

| Trading Tools | News Updates, Economic Calendar |

CCF is a regulated trading platform that offers a diverse range of market instruments for trading, including foreign exchange, precious metals, crude oil, indices, and cryptocurrencies. It operates under the oversight of the National Futures Association (NFA) in the United States, ensuring compliance with regulatory standards and client protection measures. Traders can choose from different account types, such as Comprehensive, Finance, and Financial STP accounts, to suit their trading preferences and goals.

The FX6 trading platform provided by CCF is widely used and offers powerful charting tools, allowing traders to analyze the markets and make informed decisions. A demo account option is available for practice trading, providing traders with a risk-free environment to learn and test their strategies. The platform supports trading in multiple asset classes, including forex, synthetic indices, stocks, stock indices.

CCF provides spreads starting from zero, ensuring clients can access favorable pricing and trade at direct market rates. Leverage options are also available, allowing traders to control larger positions with a smaller amount of capital. Traders can stay informed about market developments through news updates and an economic calendar provided by CCF.Customer support is available through email, and traders can access the platform and trade 24/7, even on weekends.

CCF offers several advantages to traders. The platform provides various account types, including Comprehensive, Finance, and Financial STP accounts, catering to diverse trading preferences. Traders can access a wide range of market instruments, including forex, precious metals, crude oil, indices, and cryptocurrencies, allowing for diversified trading strategies. The availability of the FX6 trading platform, with its powerful charting tools and demo account option.

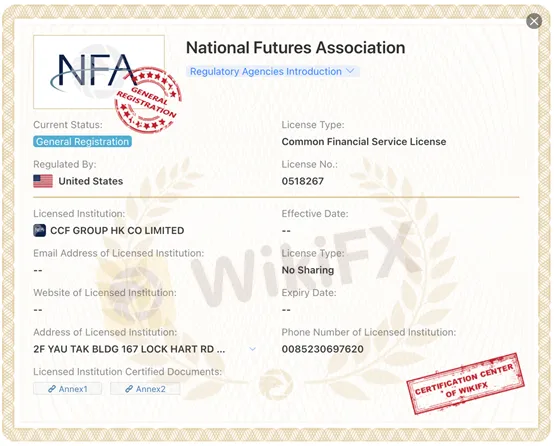

On the downside, one potential concern is the lack of detailed information about the company's regulation. While it is mentioned that CCF is regulated by the United States through the National Futures Association (NFA), specific regulatory details, such as license numbers and the level of oversight, are not provided. This lack of transparency may raise questions about the security and regulatory compliance of the brokerage. Additionally, the absence of regulatory oversight means that traders may not have the same level of protection and recourse as they would with regulated brokers, which could be a potential drawback.

| Pros | Cons |

| Multiple account options for diverse needs | Lack of detailed regulatory information |

| Access to the FX6 trading platform | Potential security and transparency concerns |

| Support for multiple payment methods | Limited trader protection |

| Variety of market instruments available | Limited information on deposit and withdraw methods |

| Demo account for practice trading |

Based on the available information, CCF is regulated by the United States through the National Futures Association (NFA). The regulatory license number provided is 0518267. The licensed institution associated with CCF is CCF GROUP HK CO LIMITED, located at 2F YAU TAK BLDG 167 LOCK HART RD WANCHAI HONGKONG, 00852 HK. The phone number provided for the licensed institution is 0085230697620.

Regulation by the NFA signifies that CCF operates under the oversight and compliance requirements set by this regulatory authority. It indicates that CCF has met certain regulatory standards and is subject to ongoing monitoring and supervision to ensure compliance with industry regulations and client protection measures.

CCF offers a wide range of market instruments for clients to trade and invest in. These instruments cover various asset classes and provide opportunities for diversification. Here are some of the market instruments available:

1. Foreign Exchange (Forex): CCF offers trading in numerous currency pairs, including popular pairs like EUR/USD, USD/CAD, GBP/USD, and more. Clients can participate in the dynamic forex market and take advantage of fluctuations in exchange rates.

2. Precious Metals: CCF provides spot trading for precious metals such as gold (XAUUSD) and silver (XAGUSD). Clients can engage in trading these valuable metals, which are often sought after for their perceived intrinsic value and as a safe-haven investment during uncertain economic times.

3. Crude Oil: CCF offers trading opportunities in US crude oil (USOIL). Clients can speculate on the price movements of crude oil, which is a globally traded commodity with significant economic importance.

4. Indices: CCF allows clients to trade popular stock market indices, such as the Hong Kong Hang Seng Index (HK50), German Index (GER30), and S&P 500 Index (US500). Trading indices provides exposure to the overall performance of a specific stock market, allowing clients to take positions based on their market outlook.

5. Cryptocurrency: CCF provides access to the cryptocurrency market, enabling clients to trade various digital currency pairs. This includes popular cryptocurrencies like Bitcoin (BTC/USD), Ether (ETH/USD), Ripple (XRP/USD), and more. Cryptocurrencies offer a unique and rapidly evolving market, allowing clients to potentially benefit from price volatility and technological advancements in the digital asset space.

These market instruments offered by CCF allow clients to diversify their trading strategies and capitalize on different market opportunities. It's important to note that availability and specific offerings may vary, and clients should refer to CCF's platform or website for an accurate and comprehensive list of tradable instruments..

| Pros | Cons |

| Wide range of market instruments available | Potential risks associated with volatile cryptocurrency market |

| Opportunities for diversification | Fluctuations in exchange rates may pose trading challenges |

| Access to dynamic forex market | Limited availability of certain niche or exotic instruments |

| Trading opportunities in precious metals | Dependence on global economic conditions for commodity trading |

| Exposure to popular stock market indices | Potential impact of geopolitical events on indices trading |

| Access to the growing cryptocurrency market | Regulatory uncertainties and risks in the cryptocurrency space |

CCF offers different account types to cater to the diverse trading preferences of its clients. Here are the account types provided by CCF:

1. COMPREHENSIVE ACCOUNT: This account type allows traders to trade CFD contracts across various asset classes around the clock. The account provides access to CCF's unique and proprietary composite index, which simulates real market movements. Traders can engage in comprehensive trading activities, taking advantage of the diverse opportunities available in the financial markets.

2. FINANCE ACCOUNT: The Finance account is designed for traders who want to trade in forex, commodities, cryptocurrencies (both large and microtransactions), and microcurrency pairs with high leverage.

3. FINANCIAL STP ACCOUNT: The Financial STP account caters to traders who are interested in major and minor currency pairs, as well as markets where the trade volume of currency pairs with smaller spreads has increased significantly.

In addition to these account types, CCF also offers a demo account option. The demo account allows traders to practice trading using virtual funds in a simulated environment. It serves as a valuable learning tool, enabling traders to familiarize themselves with the trading platform, test different trading strategies, and gain experience without risking real money.

| Pros | Cons |

| Access to comprehensive trading activities across asset classes | Lack of additional specialized account options |

| Valuable tool for familiarizing with the platform and testing strategies | Potential complexity in selecting the most suitable account type |

| Availability of a unique and proprietary composite index | Limited customization options for individual trading strategies |

| Opportunity to trade various asset classes and leverage levels | Possible confusion in understanding the differences between account types |

| Demo account option for practice and learning | Potential limitations in account features or benefits |

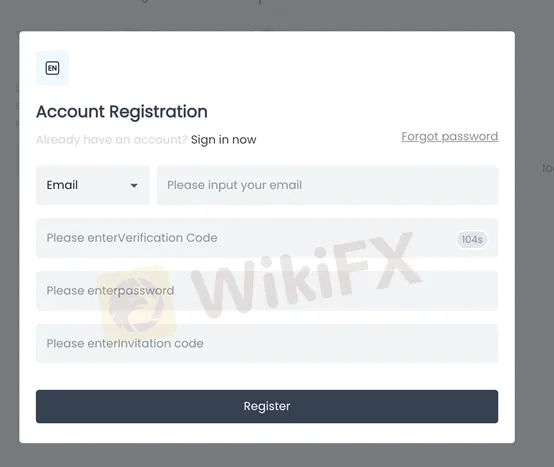

To open an account with CCF, follow these simple steps:

1. Visit the CCF website or trading platform.

2. Look for the “Register”. Click on it to start the account creation process.

3. You will be directed to a registration form. Fill out the required information accurately and completely. The information typically includes your name, email address, phone number, and other personal details.

4. Ensure that you provide a valid email address as you will receive important account information and login details via email.

5. Double-check all the information you have entered to make sure it is correct.

6. Read and understand any terms and conditions or agreements presented during the account creation process. If you agree to them, proceed to the next step.

7. Submit the completed registration form.

8. After submitting the form, you should receive an email from CCF in your inbox. This email will contain your login information, such as your username and password.

9. Access your email inbox and locate the email from CCF. If you can't find it in your inbox, check your spam or junk folder as well.

10. Open the email and take note of the login information provided.

11. Return to the CCF website or trading platform and look for the login section.

12. Enter your username and password in the respective fields.

13. Once you have successfully logged in, you should have access to your newly created account with CCF.

CCF provides leverage options to its clients, allowing them to amplify their trading positions. The leverage offered by CCF ranges from 1:100 to 1:500. Leverage enables traders to control larger positions in the market with a smaller amount of capital. For example, with a leverage of 1:100, a trader can control a position that is 100 times larger than their invested capital. For specific details on the leverage ratios offered for different instruments or account types, it is advisable to consult CCF directly or refer to their website for comprehensive information.

CCF provides clients with floating spreads that can be as low as ZERO point. These spreads are not fixed and vary in response to the market conditions, allowing clients to benefit from competitive pricing. The absence of double quotes signifies that clients have access to direct market prices, ensuring they can trade at favorable rates.

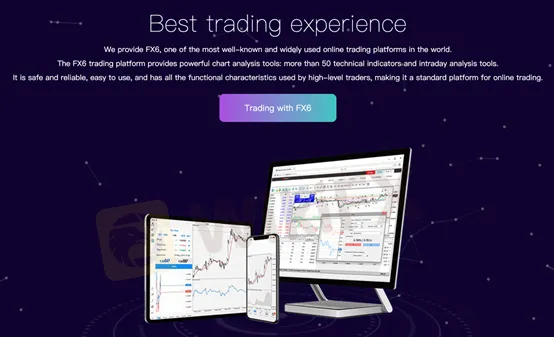

CCF offers the FX6 trading platform, which is an all-in-one CFD trading platform widely used by traders around the world. The platform provides a range of features and benefits, making it a popular choice for online trading. Here are some key points about the FX6 trading platform:

1. Powerful Charting Tools: The FX6 platform offers more than 50 technical indicators and intraday analysis tools, allowing traders to perform in-depth chart analysis and make informed trading decisions.

2. Demo Account: Traders can quickly sign up for a demo account on the FX6 platform. This allows them to practice trading using virtual funds, gaining hands-on experience and familiarizing themselves with the platform's functionalities before trading with real money.

3. Multiple Asset Classes: The FX6 platform supports trading in various asset classes, including forex, synthetic indices, stocks, stock indices, and cryptocurrencies. Traders can access and trade these different assets from a single platform.

To start using the FX6 platform, traders can open a free demo account and choose the assets they want to trade. The platform is accessible via desktop applications, mobile apps, or web browsers. Additionally, the FX6 platform offers multiple account types to cater to different trading preferences and strategies.

Overall, the FX6 trading platform offered by CCF provides traders with a comprehensive and feature-rich trading experience, combining advanced tools and convenience to meet the diverse needs of traders in the global financial markets.

| Pros | Cons |

| Powerful charting tools with 50+ indicators | Potential learning curve for beginners |

| Availability of a demo account for practice | Limited customization options |

| Support for multiple asset classes | Platform stability and technical issues |

| Accessibility via desktop, mobile, and web | Limited educational resources and tutorials |

| Multiple account types to cater to preferences | Potential reliance on third-party plugins |

| Wide user base and popularity among traders | Potential platform-specific fees |

CCF provides clients with two essential trading tools to enhance their trading experience:

1. News Updates: CCF offers a news feature that keeps clients informed about the latest market developments, economic news, and events that can impact financial markets. By staying updated with relevant news, traders can make more informed decisions and adjust their trading strategies accordingly.

2. Economic Calendar: CCF provides an economic calendar that displays upcoming economic events, such as central bank meetings, economic data releases, and other significant announcements. The calendar helps traders anticipate potential market volatility and plan their trades accordingly, taking into account the potential impact of these events on various financial instruments.

CCF provides customer support to assist traders with their inquiries and concerns. The available customer support channels and contact information are as follows:

1. 24/7 Trading: CCF's trading platform allows clients to trade around the clock, including weekends. Traders can access the platform and execute trades at any time, taking advantage of market opportunities outside regular trading hours.

2. Customer Service Email: Clients can reach out to CCF's customer support team via email. The provided email addresses for customer support are support@ccfgb.com and support@ccfgroupam.com. Clients can send their inquiries, requests, or feedback to these email addresses, and the customer support team will respond accordingly.

3. Company Address: The headquarters of COMEX GROUP, CCF's parent company, is located in New York. The company has direct branches in the United States, Canada, and Sydney, Australia. The specific address for CCF is not mentioned in the provided information.

Please note that the provided contact information is based on the available information, and it's advisable to verify the contact details through official sources or by visiting CCF's website for the most up-to-date and accurate customer support information.

In conclusion, CCF offers a range of advantages to traders, including the account options, access to diverse market instruments, and a feature-rich trading platform. However, the lack of detailed regulatory information raises concerns about security and transparency. The absence of regulatory oversight also means that traders may have limited protection and recourse. Potential clients should carefully consider these pros and cons before deciding to engage with CCF, ensuring they are comfortable with the potential risks involved in trading with an unregulated brokerage.

Q: Is CCF a legitimate trading platform?

A: Yes, CCF is regulated by the United States through the National Futures Association (NFA). They operate under the oversight and compliance requirements set by the regulatory authority, ensuring client protection and adherence to industry regulations.

Q: What market instruments can I trade with CCF?

A: CCF offers a diverse range of market instruments, including foreign exchange (forex) currency pairs, precious metals like gold and silver, crude oil, stock market indices, and popular cryptocurrencies.

Q: How can I open an account with CCF?

A: To open an account with CCF, visit their website or trading platform, click on the registration option, fill out the required information accurately, agree to the terms and conditions, and submit the completed registration form. You will then receive an email with your login information.

Q: Does CCF offer leverage?

A: Yes, CCF provides leverage options ranging from 1:100 to 1:500, allowing traders to control larger positions in the market with a smaller amount of capital.

Q: What are the spreads offered by CCF?

A: CCF provides floating spreads that can be as low as zero points, offering competitive pricing based on market conditions and liquidity.

Q: What trading platform does CCF offer?

A: CCF offers the FX6 trading platform, which is an all-in-one CFD trading platform. It features powerful charting tools, a demo account for practice trading, and the ability to trade multiple asset classes from a single platform.

Q: What trading tools does CCF provide?

A: CCF provides news updates to keep traders informed about market developments and an economic calendar displaying upcoming economic events. These tools help traders make informed decisions and stay updated with market trends.

Q: How can I contact CCF's customer support?

A: CCF offers 24/7 trading access on their platform. For customer support, you can reach out to them via email at support@ccfgb.com and support@ccfgroupam.com. The company address for CCF is not mentioned in the provided information.

More

User comment

7

CommentsWrite a review

2023-11-17 11:05

2023-11-17 11:05

2023-08-24 20:09

2023-08-24 20:09