User Reviews

More

User comment

145

CommentsWrite a review

2026-03-13 11:58

2026-03-13 11:58

2025-11-17 00:23

2025-11-17 00:23

Score

Scam Brokers

Scam Brokers5-10 years

Regulated in Vanuatu

Forex Trading License (EP)

Suspicious Scope of Business

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 182

Exposure

Score

Regulatory Index1.76

Business Index7.75

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

HTFX VU Limited

Company Abbreviation

HTFX

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

The principal cannot be withdrawn

Unable to withdraw, the withdrawal request made on July 3rd has not been credited to date.

They're not processing the withdrawal, it's been so long. The review was approved but they just won't fulfill the final withdrawal step.

The platform is unresponsive, withdrawals are not being processed, and then they sent an email saying it's because of the National Day holiday, but many people still can't withdraw. It feels like they've absconded. I hope the platform can expedite withdrawals soon, and not betray users' trust.

Can't withdraw. The platform has disappeared with my money!

Last year's performance was acceptable, but this year, issues have started to emerge gradually.

In March 2025, deposited 100 dollars, earned 108 dollars and wanted to withdraw but the funds never arrived, customer service chatbot replies, website blocked, trading account cannot be logged in, black platform

I applied for a withdrawal back in August but was unable to complete it. I then asked customer service to return the money to my account. On September 15th, I reapplied for a withdrawal, but even after 10 days now, the funds still haven’t arrived. This scam platform is now preventing withdrawals.

Unable to withdraw, it has been over a month, causing me to lose funds.

Warning! HTFX is unable to withdraw funds, a mere $570, and even the principal is not being returned!

As of October 9th, they've completely absconded and started to delete website info, MT45 cannot connect, and there's no information available on the official website login. The next step will likely be the official website page becoming inaccessible.

Since early June, they have failed to fulfill their promise of processing withdrawals within 24 hours. The delays grew progressively worse until withdrawals stopped altogether. Currently, successful withdrawals have been pending for over two months without any resolution. Contacting the official customer service only yields robotic responses, instructing users to wait indefinitely for "financial processing.\" From mid-August, the website stopped updating its content, and email inquiries went unanswered. Now, absurdly, they’ve posted a new announcement shirking all responsibility, claiming the flood of online complaints stems from \"fake platforms." How shameless—do they really think the overwhelming number of complaints isn’t due to their own refusal to process withdrawals for users?

Can't even log in directly, it's like the website just pulled the plug on the internet.

Scam platform, unable to withdraw even $200. Withdrawals never go through, and the customer service reps are complete frauds.

Since June, withdrawals have not been processed, and customer service responses have been mechanical. The account manager is now unreachable. How should we handle this situation? Can we file a case collectively? Can mainland authorities consolidate the cases to help safeguard our funds?

I captured an announcement from the HTFX website. In the announcement, they say: 1. HTFX operates legally and in full compliance with international and local regulations. 2. The fraudulent clone websites have seriously harmed investors and damaged our brand reputation. 3. We have gathered evidence and will take strict legal action against these clone entities to protect the rights of our clients. 4. Access HTFX services only through our official website and verified communication channels. 5. Avoid trusting any non-official platforms or suspicious contacts. 6. Reach out to our official customer support if you have any doubts. However, as a client, I personally experienced it: I couldn’t even withdraw funds. When I contacted customer service, I was only told to be patient. Emails weren’t even answered. What other excuses do you have? Don’t feel like a victim.

| Company Name | HTFX |

| Founded | 2018 |

| Registered Country/Region | Vanuatu |

| Regulation | FCA, CySEC, VFSC (Offshore) |

| Tradable Assets | Forex, Commodities, Stocks, Indices, Cryptocurrencies |

| Account Types | STP Standard, Cent, ECN |

| Demo Account | Available |

| Max. Leverage | 500:1 (forex/gold) |

| Spreads | From 0.0 pips |

| Trading Platforms | MT4, MT5, and HTFX Web Trader |

| Minimum Deposit | $50 |

| Deposit & Withdrawal | Tether, ALIPAY, RediPay, THAI QR, RPNpay, Help 2 Pay, Credit Cards (CC), ChipPay, Teleport, PAYOK |

| Customer Support | Contact form |

| Phone: +678 29816 | |

| Email: support@htfx.com | |

| Address: 2 Floor, ZEO Building, Freshwater 1, Port Vila, Vanuatu | |

| Social media: Facebook, Twitter, YouTube and Instagram | |

| Regional Restrictions | Citizens/Residents of Belarus, Crimea, Cuba, Iran, Iraq, Japan, North Korea, Russia, Sudan, Syria, Turkey, United States of America, Ukraine are not allowed |

HTFX, founded in 2018 and registered in Vanuatu, is regulated by the FCA, CySEC, and VFSC (Offshore). It offers trading in Forex, Commodities, Stocks, Indices, and Cryptocurrencies with account types including STP Standard, Cent, and ECN.

The broker provides leverage up to 500:1, spreads from 0.0 pips, and supports MT4, MT5, and HTFX Web Trader platforms. Minimum deposit is $50, with various deposit/withdrawal options such as Tether, ALIPAY, and Credit Cards.

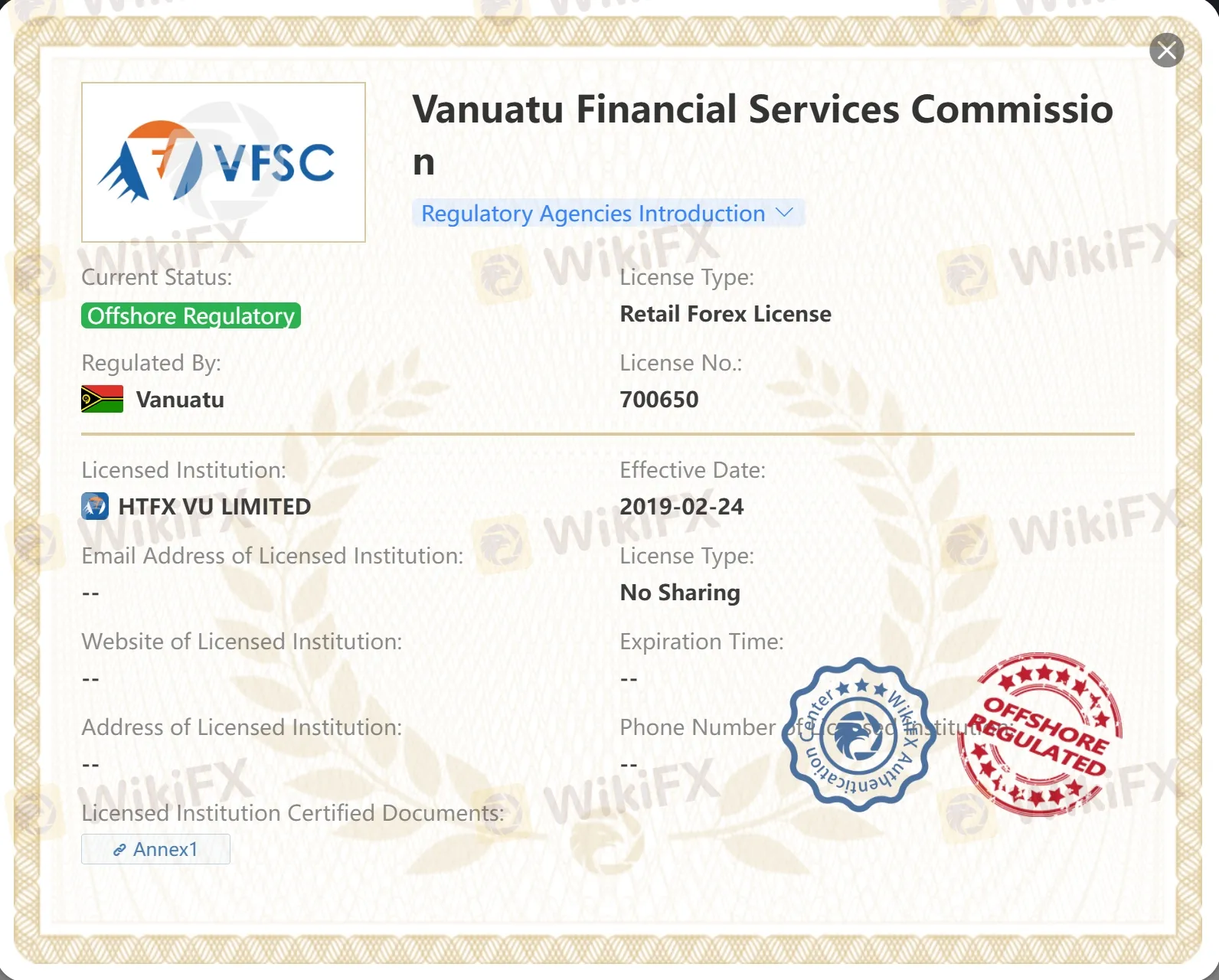

HTFX is a regulated forex broker, supervised by two regulatory agencies: the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. The broker operates under Straight Through Processing (STP) license types. HTFX's FCA license number is 822279, while its CySEC license number is 332/17.

Additionally, HTFX holds an offshore license from the Vanuatu Financial Services Commission (VFSC), which, while less stringent than FCA or CySEC, still provides a regulatory framework.

Being regulated by these reputable authorities signifies compliance with stringent financial and operational standards, providing traders with a level of confidence and security in their trading activities with HTFX.

| Pros | Cons |

| Offers leverage up to 500:1 | Restricted in several regions, including the USA and Ukraine |

| Provides multiple account types (STP Standard, Cent, ECN) | Some deposit methods may incur fees or have longer processing times |

| Low spreads starting from 0.0 pips | Offshore regulation may affect trust for some traders |

| Supports MT4, MT5, and HTFX Web Trader platforms | |

| Minimum deposit of $50, accessible for beginners | |

| Multiple deposit/withdrawal options including Tether, ALIPAY, and Credit Cards | |

| Offers demo accounts for practice | |

| 24/7 customer support available |

| Instrument | Available Products |

| Forex | 80+ Currency Pairs Worldwide |

| Commodities | Gold, Silver, Crude Oil |

| Stocks | Amazon, Apple, Tesla, and other renowned companies |

| Indices | Global Popular Indices |

| Cryptocurrencies | Bitcoin, Litecoin, Ethereum |

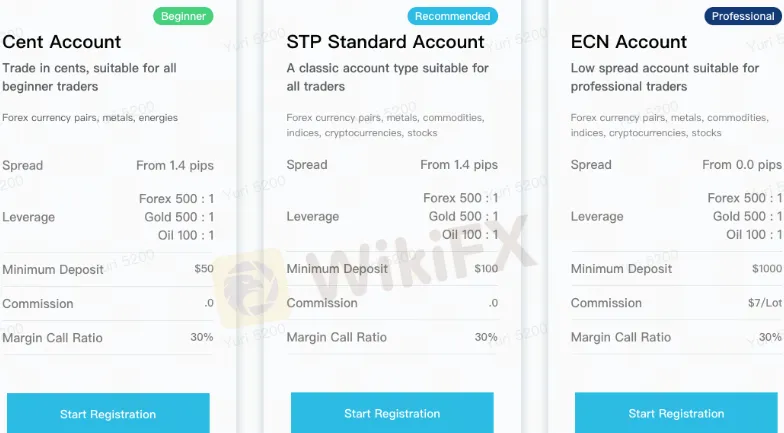

| Feature | Cent Account | STP Standard Account | ECN Account |

| Description | Trade in cents, suitable for beginners | A classic account type for all traders | Low spread account for professionals |

| Instruments | Forex currency pairs, metals, energies | Forex currency pairs, metals, commodities, indices, cryptocurrencies, stocks | Forex currency pairs, metals, commodities, indices, cryptocurrencies, stocks |

| Spread | From 1.4 pips | From 1.4 pips | From 0.0 pips |

| Leverage | Forex 500:1, Gold 500:1, Oil 100:1 | Forex 500:1, Gold 500:1, Oil 100:1 | Forex 500:1, Gold 500:1, Oil 100:1 |

| Minimum Deposit | $50 | $100 | $1,000 |

| Commission | 0 | 0 | $7/Lot |

| Margin Call Ratio | 30% | 30% | 30% |

| Registration Start | Recommended | Professional | Professional |

HTFX provides a dynamic range of leverage options tailored to various trading preferences and risk appetites, catering specifically to the asset being traded.

| Account Type | Leverage (forex/gold) | Leverage (oil) |

| Cent | 500:1 | 100:1 |

| Standard | 200:1 | |

| ECN |

HTFX offers a structured approach to spreads and commissions that caters to the needs of different types of traders through its varied account options.

| Account Type | Spread | Commission |

| Cent | From 1.4 pips | 0 |

| Standard | ||

| ECN | From 0.0 pips | $7/lot |

For those using the Cent and Standard accounts, HTFX provides a spread starting from 1.4 pips, with no commission charges, making these accounts ideal for newcomers or those who prefer straightforward trading costs.

In contrast, the ECN account is tailored for more experienced traders who can handle tighter spreads and are looking for more direct market access. This account offers spreads from as low as 0.0 pips, which can significantly enhance trading efficiency by reducing the cost of trading on price movements. However, this benefit comes with a commission cost of $7 per lot, which compensates for the ultra-low spread environment and is typical for ECN accounts that provide closer to market prices.

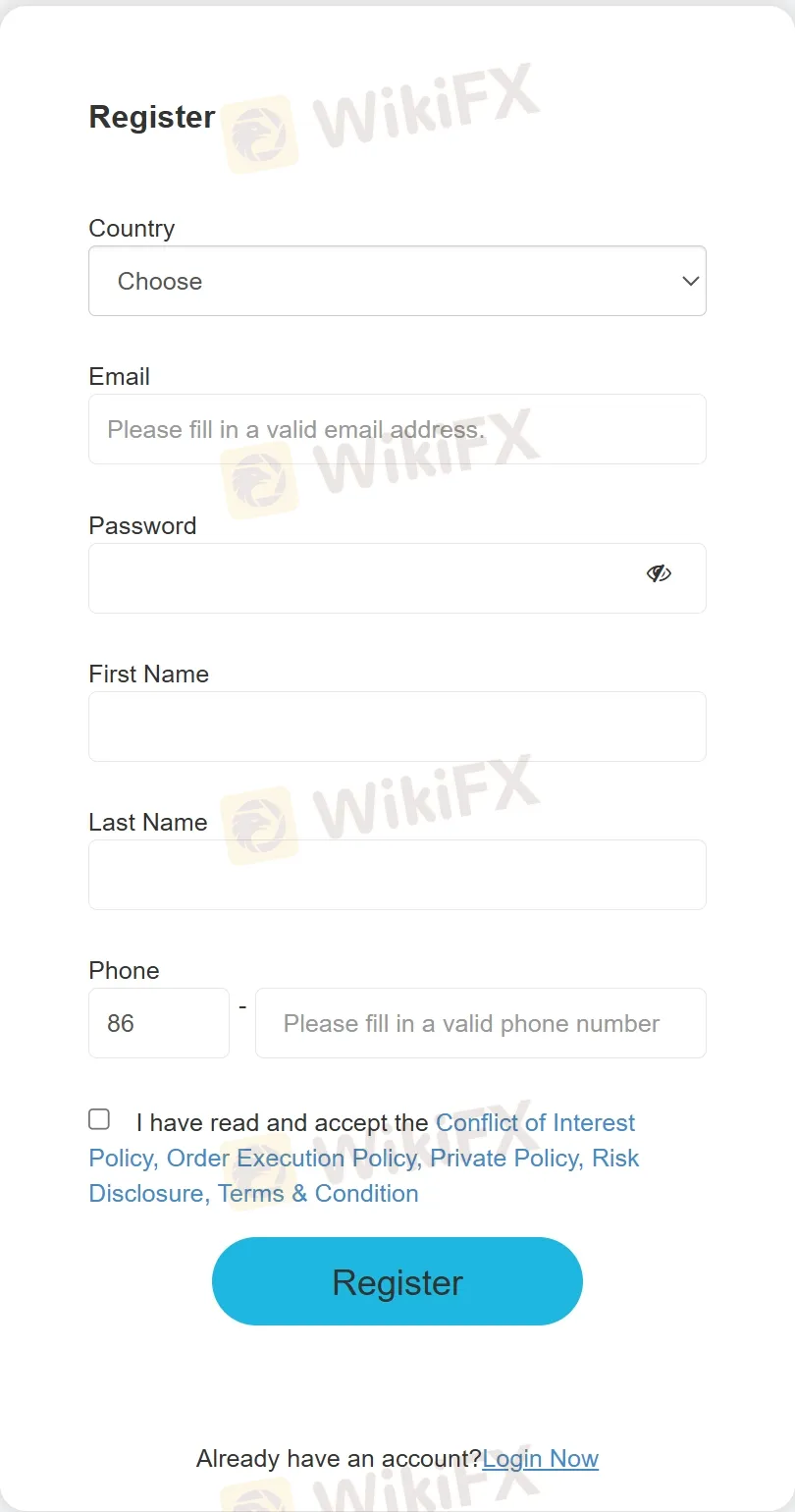

Opening an account with HTFX is a straightforward and efficient process designed to quickly integrate new users into the trading platform. To open an account with HTFX, follow these general steps:

Make sure that you have read the Conflict of Interest Policy, Order Execution Policy, Private Policy, Risk Disclosure, Terms & Condition, and then click the “Register” button.

| Platform | Details | Available |

| MT4 | MetaTrader 4, a leading trading platform | ✅ |

| MT5 | MetaTrader 5, an advanced version of MT4 | ✅ |

| HTFX WebTrader | Web-based trading platform for convenient access from any browser | ✅ |

| Mobile and Tablet | Mobile and tablet versions allow trading anytime, anywhere globally | ✅ |

HTFX offers a wide range of efficient payment methods to satisfy its clients' needs. The available payment channels include:

| Payment Method | Cost | Minimum Deposit | Processing Time |

| Wire Transfer | - | - | - |

| Local Depositor | - | - | - |

| Tether | - | - | 1-3h |

| RPNpay | 0 | 100 USD | Instant |

| ChipPay | 0 | 100 USD | Instant |

| Teleport | 0 | 500 USD | Instant |

| Alipay | 0 | 100 USD | Instant |

| CC | 0 | 200 USD | Instant |

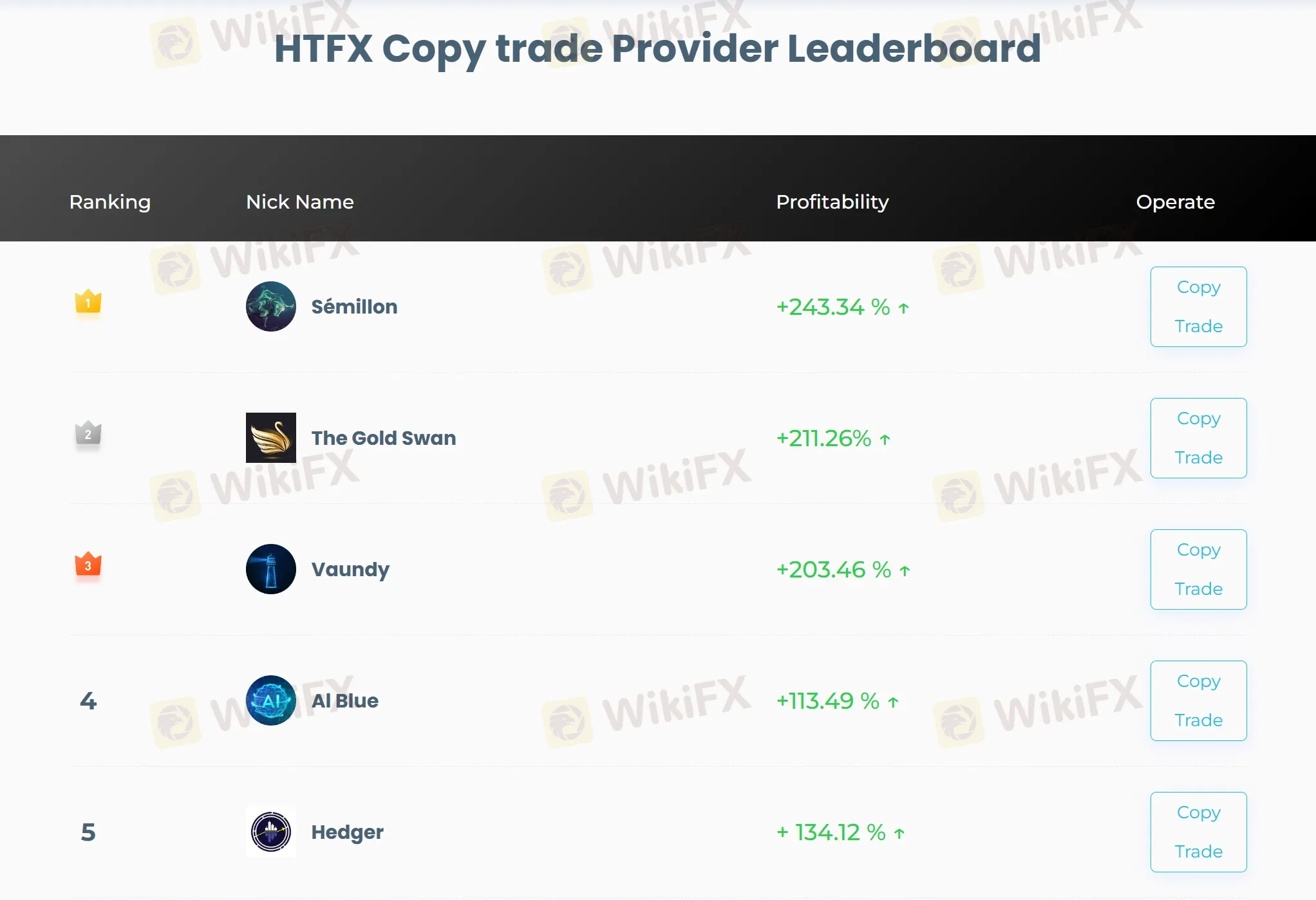

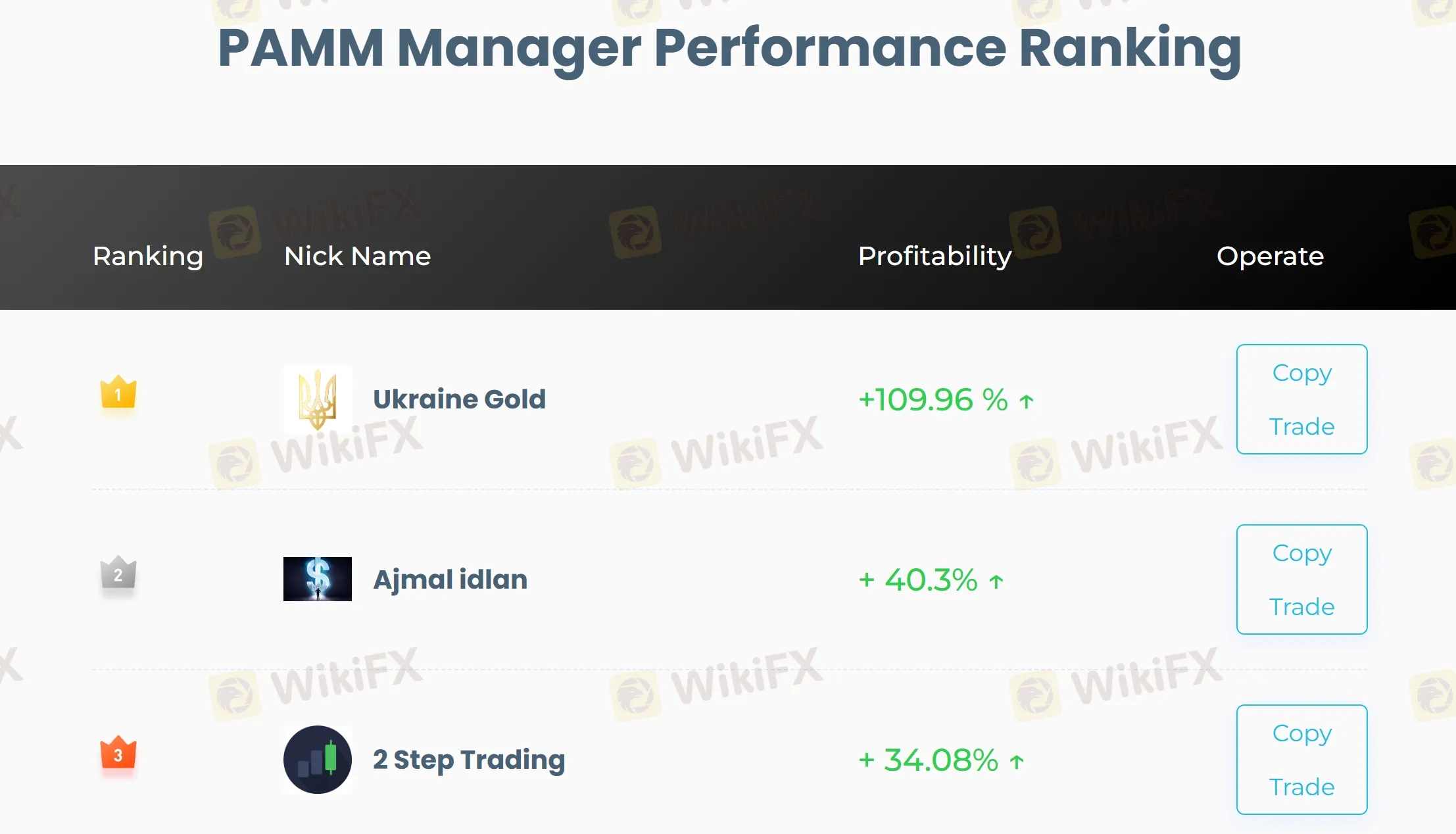

HTFX provides innovative trading solutions such as Copy Trade and PAMM (Percentage Allocation Management Module), catering to a diverse range of traders with varying levels of expertise and commitment.

The Copy Trade service allows less experienced traders or those with limited time to automatically replicate the trades of more seasoned traders. This feature not only simplifies the trading process but also provides an opportunity to learn from successful strategies.

On the other hand, the PAMM service is designed for investors interested in having their funds managed by professional traders. This system pools money from multiple investors into a single managed account, traded by a skilled manager who allocates gains, losses, and fees according to each investors share in the pool.

Both services offer robust platforms for those looking to either tap into the expertise of others or invest in a managed portfolio, thus broadening the scope of investment opportunities available through HTFX.

Additionally, HTFX maintains a strong online presence on several social media platforms including Facebook, Twitter, YouTube, and Instagram. This multi-channel approach not only facilitates easy communication but also allows HTFX to engage with their clients regularly and provide timely updates and helpful information across various platforms.

What regulatory agencies oversee HTFX?

HTFX is regulated by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and offshore regulated by Vanuatu Financial Services Commission (VFSC).

Can I trade demo with HTFX?

Yes. Demo accounts are available on the HTFX.

What is the minimum deposit required to open an account with HTFX?

$50.

At HTFX, are there any regional restrictions for traders?

Yes. HTFX does not provide services to citizens/residents of Belarus, Crimea, Cuba, Iran, Iraq, Japan, North Korea, Russia, Sudan, Syria, Turkey, United States of America, and Ukraine.

HTFX is a high-risk broker with a low WikiFX score of 1.61, currently facing severe allegations of being a Ponzi scheme and multiple reports of withdrawal failures and total website access issues.

WikiFX

WikiFX

HTFX holds a concerning safety score of 1.60, operating under offshore Vanuatu regulation while facing over 160 user complaints regarding severe withdrawal delays and platform access issues. Despite offering MT4/MT5 platforms and high leverage, the broker's low influence rank and "funding disk" allegations suggest high risk for traders.

WikiFX

WikiFX

Cyprus regulator CySEC confirms HTFX’s decision to abandon its investment firm license, joining other brokers reshaping the island’s financial sector.

WikiFX

WikiFX

Growing warnings surround HTFX after losing its European licenses and being flagged by WikiFX as a Ponzi-style platform, with repeated reports of withdrawal problems.

WikiFX

WikiFX

More

User comment

145

CommentsWrite a review

2026-03-13 11:58

2026-03-13 11:58

2025-11-17 00:23

2025-11-17 00:23