User Reviews

More

User comment

6

CommentsWrite a review

2024-03-01 18:37

2024-03-01 18:37

2023-03-01 10:48

2023-03-01 10:48

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 4

Exposure

Score

Regulatory Index0.00

Business Index7.17

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

Equinox Limited

Company Abbreviation

EQUINOX

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 2022-01-01 |

| Company Name | Equinox Markets Limited |

| Regulation | No Regulation |

| Minimum Deposit | $1,000 (Mercury Account) |

| Maximum Leverage | 1:500 |

| Spreads | Starting from 2.5 pips (Mercury) |

| Trading Platforms | cTrader (Desktop, Web, Mobile) |

| Tradable Assets | Forex, Indices, Stocks, Energy, Commodities |

| Account Types | Mercury, Saturn, Pluto |

| Demo Account | Available |

| Islamic Account | Not mentioned |

| Customer Support | Email (support@equinoxmarkets.com) |

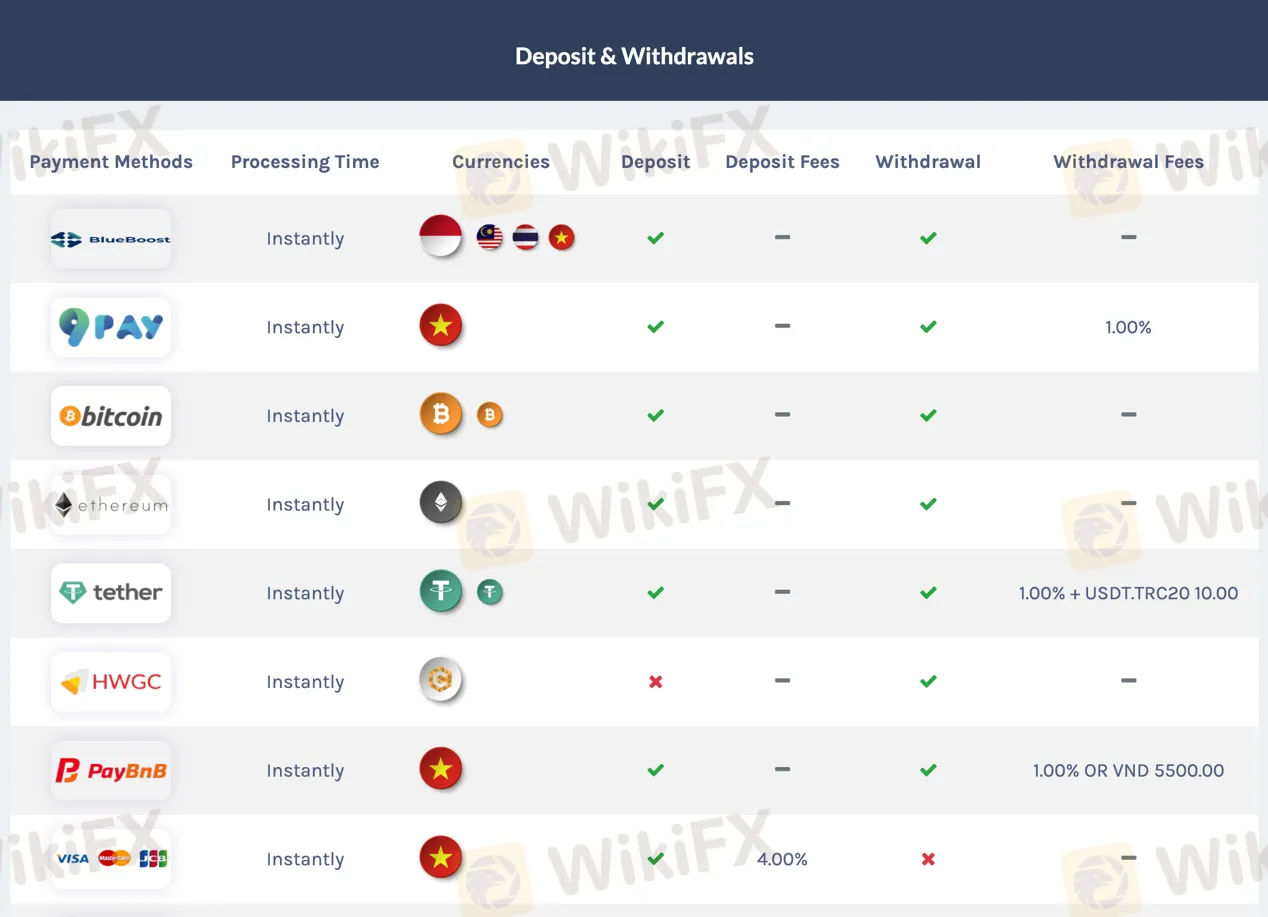

| Payment Methods | BlueBoost, 9PAY, Bitcoin, Ethereum, Tether, HWGC, PayBnB, VISA, Mastercard, JCB, FPX, PayC, and more |

| Educational Tools | Educational section, Economic calendar, Trading calculators, Widgets, Market news |

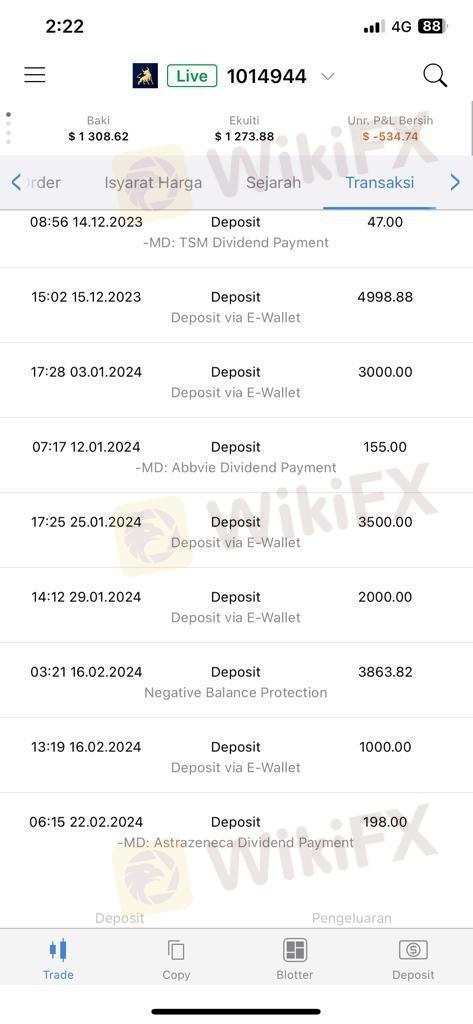

EQUINOX is a brokerage firm that operates in the United Kingdom. However, it is important to note that the company currently lacks proper regulation and its regulatory status is unauthorized. The broker has also exceeded the business scope regulated by the United States National Futures Association (NFA), raising suspicions about its operations. The NFA license number provided by EQUINOX is 0534614, but its unauthorized status suggests potential risks for investors.

EQUINOX offers a diverse selection of financial instruments, including foreign exchange (forex), indices, stocks, energy, and commodities. This allows investors to diversify their portfolios and take advantage of different asset classes. However, it is important to consider the potential risks associated with trading with an unauthorized and unregulated broker. The lack of transparency and regulatory oversight raises concerns about the safety and security of funds.

The broker offers different account types, including the Mercury, Saturn, and Pluto accounts, with varying minimum deposit requirements and trading conditions. However, limited information is provided about the specific trading conditions and additional benefits associated with these accounts.

EQUINOX provides the cTrader trading platform, known for its advanced features and low pricing. The platform offers a range of technical indicators, charting tools, and trading features. Traders can also automate their strategies using the cTrader Automate feature. However, it is important to note that the lack of regulation and potential lack of transparency in pricing and execution pose risks for investors.

EQUINOX provides customer support services 24 hours a day, 5 days a week, but limited information is available about the quality and responsiveness of their support.

Overall, while EQUINOX offers a diverse range of financial instruments and trading platforms, potential investors should exercise caution due to the lack of regulation and potential risks associated with this broker. It is recommended to carefully evaluate the pros and cons and consider alternative regulated brokers for a safer trading experience.

Equinox offers a diverse range of financial instruments, providing traders with access to global markets and investment opportunities. The platform enables users to trade popular indices, stocks, participate in the forex market, and access energy and commodity markets. Equinox supports multiple trading platforms, including cTrader and WebTrader, enhancing the trading experience. Additionally, the platform offers multiple deposit and withdrawal methods, with instant processing for most deposits and no deposit fees, commissions, or hidden charges. However, it is important to note that market volatility and currency exchange rate fluctuations can pose potential risks and lead to losses. Furthermore, limited information on specific trading conditions, potential liquidity concerns in less-traded markets, and additional fees for certain withdrawal methods may impact the overall trading experience. Traders are advised to conduct market research and analysis to make informed trading decisions, and it is recommended to seek clarification on withdrawal limits and requirements for a transparent trading experience.

| Pros | Cons |

| Diverse range of financial instruments available | Market volatility may result in potential losses |

| Access to global markets and investment opportunities | Limited information on specific trading conditions |

| Opportunities to trade popular indices and stocks | Potential liquidity concerns in less-traded markets |

| Ability to participate in the forex market | Currency exchange rate fluctuations can impact trades |

| Access to energy and commodity markets | Commodity prices can be influenced by various factors |

| Multiple trading platforms (cTrader and WebTrader) | Market research and analysis required for informed trading |

| Multiple deposit and withdrawal methods | More than half of withdrawal methods have a 1% fee |

| No deposit fees, commissions, or hidden charges | Some specific methods may have additional fees |

| Instant processing for most deposits | Limited information on currency conversion or exchange rates |

| Wide range of trading calculators | Lack of transparency on withdrawal limits and requirements |

According to the information provided, EQUINOX MARKETS LIMITED, which is mentioned as a licensed institution, does not currently have a valid regulation. It is stated that the regulatory status is unauthorized, and the broker exceeds the business scope regulated by the United States National Futures Association (NFA). The NFA license number provided is 0534614.

EQUINOX provides investors with a diverse selection of financial instruments to trade. With over 150 instruments available, investors can access various markets and investment opportunities. The market instruments offered by EQUINOX include foreign exchange (forex), indices, stocks, energy, and commodities. This broad range allows investors to diversify their portfolios and take advantage of different asset classes.

Foreign Exchange (Forex): Investors can participate in the forex market through EQUINOX. Forex trading involves the buying and selling of currencies, allowing investors to speculate on the exchange rate fluctuations between currency pairs. With EQUINOX, investors can trade major, minor, and exotic currency pairs, enabling them to access the global currency markets.

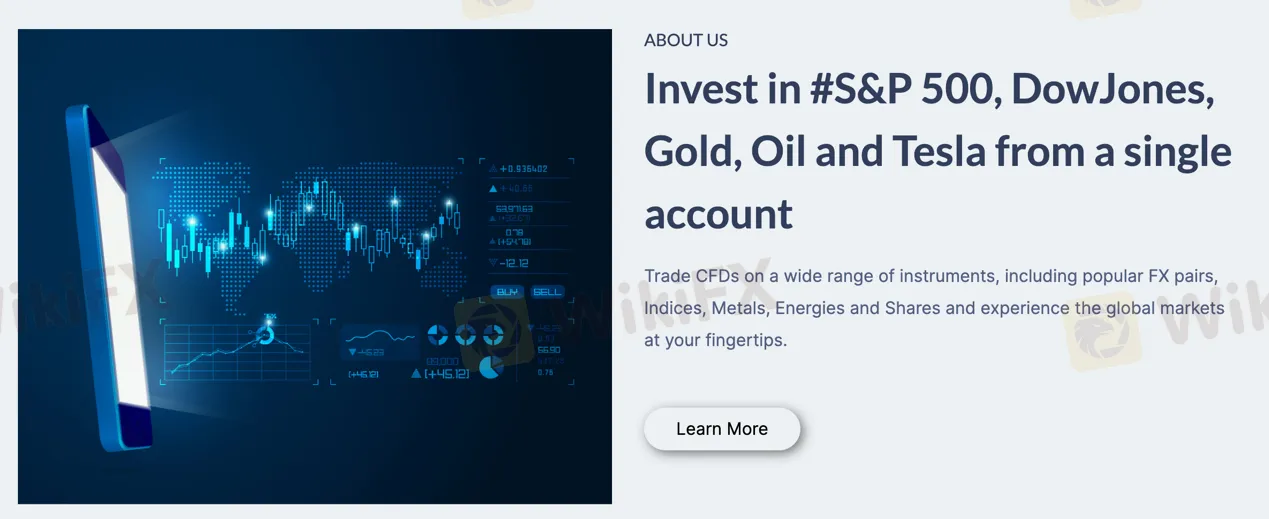

Indices: EQUINOX offers trading on various indices, providing investors with exposure to the performance of a specific stock market or sector. Popular indices like the S&P 500 and DowJones are available for trading, allowing investors to take positions based on the overall performance of the underlying companies.

Stocks: Investors can trade stocks through EQUINOX, accessing a wide range of global companies. This allows investors to invest in individual stocks and potentially benefit from the performance of specific companies. Stocks from various industries and sectors are available, including well-known companies like Tesla.

Energy: EQUINOX allows investors to trade energy instruments, such as oil and natural gas. Energy markets can be influenced by various factors, including geopolitical events and supply-demand dynamics. Trading energy instruments offers investors an opportunity to profit from price fluctuations in these markets.

Commodities: EQUINOX provides access to trading commodities like gold and other precious metals. Investing in commodities can offer a hedge against inflation and serve as a safe haven during times of market volatility. Trading commodities allows investors to speculate on the price movements of these physical assets.

| Pros | Cons |

| Diverse range of financial instruments available | Market volatility may result in potential losses |

| Access to global markets and investment opportunities | Limited information on specific trading conditions |

| Potential for diversification and portfolio growth | Regulatory risks in certain jurisdictions |

| Opportunities to trade popular indices and stocks | Potential liquidity concerns in less-traded markets |

| Ability to participate in the forex market | Currency exchange rate fluctuations can impact trades |

| Access to energy and commodity markets | Commodity prices can be influenced by various factors |

| Opportunities to hedge against inflation and volatility | Market research and analysis required for informed trading |

MERCURY:

The Mercury account type offered by Equinox requires a minimum deposit of $1,000 in USD. With a spread starting from 2.5 pips, this account provides traders with access to a maximum leverage of 1:500. The minimum volume for commodities and forex trading is set at 0.01 lot, while for stocks and indices it is 0.1 lot. The maximum volume allowed is 50 lots. The stop out level is set at 50%.

SATURN:

Equinox's Saturn account type requires a minimum deposit of $10,000 in USD. It offers a spread starting from 1.5 pips and a maximum leverage of 1:500. The minimum trading volumes for commodities, forex, stocks, and indices are the same as the Mercury account. The maximum volume remains at 50 lots, and the stop out level is also set at 50%.

PLUTO:

For the Pluto account type, Equinox requires a higher minimum deposit of $25,000 in USD. This account offers a spread starting from 0.75 pips and maintains the maximum leverage of 1:500. The minimum trading volumes for commodities, forex, stocks, and indices are the same as the previous account types. The maximum volume allowed is also 50 lots, and the stop out level remains at 50%.

Demo Account:

Equinox also provides a demo account option, allowing traders to test their strategies and skills in the Forex market without risking real funds. This account functions as a simulation, using virtual funds for risk-free trades. Traders can access exclusive educational content on Equinox Markets and test their strategies on the go using the free mobile apps.

| Pros | Cons |

| Access to different account tiers | Higher minimum deposit required for advanced account types |

| Varied spreads to cater to different needs | Limited information on additional benefits |

| High leverage options | Potential risks associated with high leverage |

| Gradual improvement in trading conditions | Lack of information on other account features |

| Tiered accounts provide a sense of progression | Lack of transparency in account requirements |

| Demo account for risk-free practice | Limited availability of educational resources |

| Access to exclusive educational content | Lack of information on platform reliability |

| Mobile app for on-the-go trading | Limited information on customer support |

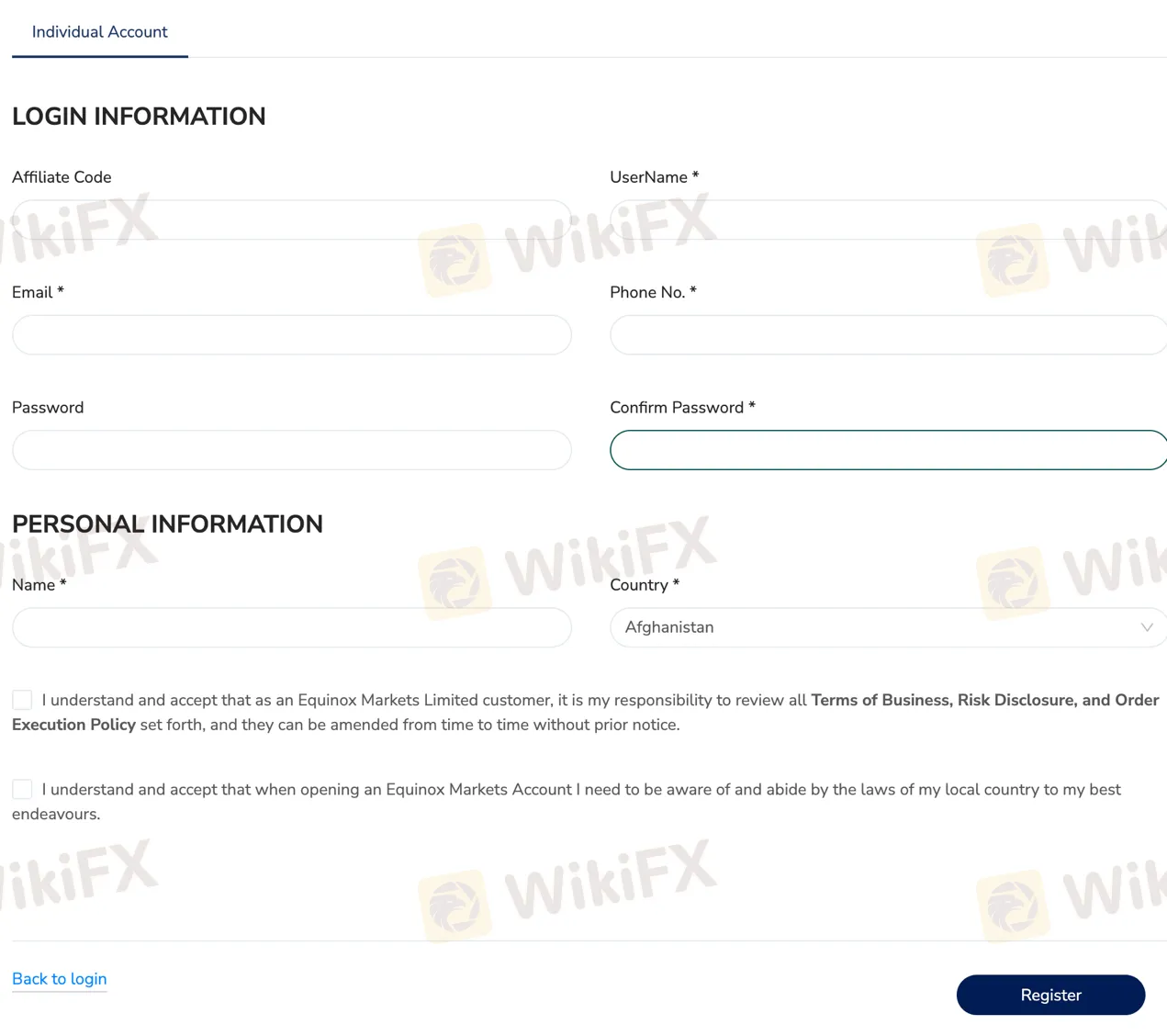

To open an account with Equinox, follow these steps:

Visit the Equinox website.

Click on the “Demo” or “Create Account” option.

3. Select the type of account you want to open (e.g., individual account).

4. Fill in the login information section, including the affiliate code (if applicable), username, email address, phone number, password, and confirm the password.

5. Provide your personal information, such as your name and country of residence.

6. Review and accept Equinox's Terms of Business, Risk Disclosure, and Order Execution Policy, understanding that they may be subject to change without prior notice.

7. Acknowledge that you need to comply with the laws of your local country to the best of your ability when opening an Equinox Markets account.

8. Click on the “Register” button to complete the account opening process.

Equinox offers different account types with a maximum leverage of 1:500. The Mercury, Saturn, and Pluto accounts all provide traders with the opportunity to amplify their trading positions and potentially increase profits. However, it's important for traders to exercise caution and implement effective risk management strategies when utilizing high leverage. Additionally, Equinox's demo account allows traders to practice and explore the platform without real money trading, eliminating the application of leverage in this simulated environment.

EQUINOX offers floating spreads for trading 49 currency pairs. The spreads vary based on the type of account, starting from 2.5 pips for Mercury, 1.5 pips for Saturn, and 0.75 pips for Pluto accounts. These spreads are subject to market conditions and may fluctuate.

EQUINOX provides its clients with a range of deposit and withdrawal methods to facilitate transactions in different national currencies. Clients can choose from options such as PayTrust, Bank Wire, HWGC, PayBnB, and more. Deposits made through these methods are not subject to any fees. However, it is important to note that more than half of the withdrawal methods offered by the broker are subject to a 1% fee.

The available payment methods for deposits and withdrawals include BlueBoost, 9PAY, Bitcoin, Ethereum, Tether, HWGC, PayBnB, VISA, Mastercard, JCB, FPX, PayC, among others. One of the advantages of using EQUINOX is that there are no commission charges or hidden fees associated with depositing or withdrawing funds. This transparency allows clients to have a clear understanding of the costs involved in their transactions.

When it comes to deposit and withdrawal processing times, EQUINOX ensures that certain methods, like eeziepay and 9pay, offer instant processing. This allows clients to have quick access to their funds without any significant delays. The broker supports a variety of currencies, including IDR, MYR, THB, VND, and INR, enabling clients from different regions to transact in their local currencies.

| Pros | Cons |

| Multiple deposit and withdrawal methods | More than half of withdrawal methods have a 1% fee |

| No deposit fees, commissions or hidden charges | Some specific methods may have additional fees |

| Instant processing for most deposits | Limited information on currency conversion or exchange rates |

| Wide range of supported currencies | Lack of transparency on withdrawal limits and requirements |

Equinox offers two trading platforms: cTrader The cTrader platform is known for its advanced features, pricing, and order execution. It provides a highly innovative trading experience, complemented by Equinox's advanced trading infrastructure. With reduced commissions of $35 per $1 million traded, the cTrader platform offers ultra-low spreads on FX and Metals. It supports a wide range of trading instruments, including CFDs on forex, metals, indices, and energies.

The cTrader desktop platform offers a variety of technical features, such as 55+ pre-installed technical indicators, six chart types, and 28 timeframes. It also includes Level 2 DoM (Depth of Market), no restrictions on stop/limit levels, and additional pending order types. Traders can enjoy features like detachable charts, 1-click trading, advanced order protection, trailing stop, customizable charts and interface, and the ability to add custom cBots and indicators. The platform also provides a news feed, integrated economic calendar, market sentiment analysis, custom time zone, and trade statistics analysis.

For automated trading, cTrader offers the cTrader Automate feature, allowing traders to automate their trading strategies. Equinox also provides a Virtual Private Server (VPS) for running cBots 24/5 with no downtime and reduced latency.

The cTrader platform is also available for mobile devices and tablets, offering a sophisticated interface and advanced mobile charting features. Traders can access their accounts on iOS or Android devices and benefit from 50+ technical indicators, 26 timeframes, quick trade options, DoM (Depth of Market), and notifications for execution and price alerts.

In addition to cTrader, Equinox offers the cTrader Web Platform, a browser-based solution that brings the same advanced functionalities as the desktop platform. It allows Mac users to access their accounts from anywhere without the need to install any software. However, cTrader Automate is not available on the web platform.

Equinox's trading platforms provide traders with a range of advantages, including access to a wide range of trading instruments, pricing, advanced technical features, and mobile trading options. However, there are also potential drawbacks to consider, such as the lack of regulation, potential lack of transparency in pricing and execution, and the high risk involved in CFD trading. It's important for traders to carefully evaluate these pros and cons before choosing Equinox's trading platforms.

| Pros | Cons |

| Wide range of trading instruments | Lack of regulation poses risks for investors |

| User-friendly interface | Potential lack of transparency in pricing and execution |

| Low spreads on FX and Metals | High risk involved in CFD trading |

| Advanced technical features and charting capabilities | Potential high minimum account size |

| Multiple trading platforms (cTrader and WebTrader) | Lack of transparency in account requirements |

| Mobile trading support | Limited information on other account features |

| Automated trading with cTrader Automate | Limited options for customization or upgrades |

| VPS services for uninterrupted automated trading | Limited educational resources and materials |

| Access to Trading Central's chart targets | Lack of clarity on platform regulation and security |

Equinox provides a range of trading tools and educational resources to support traders and investors in their trading activities.

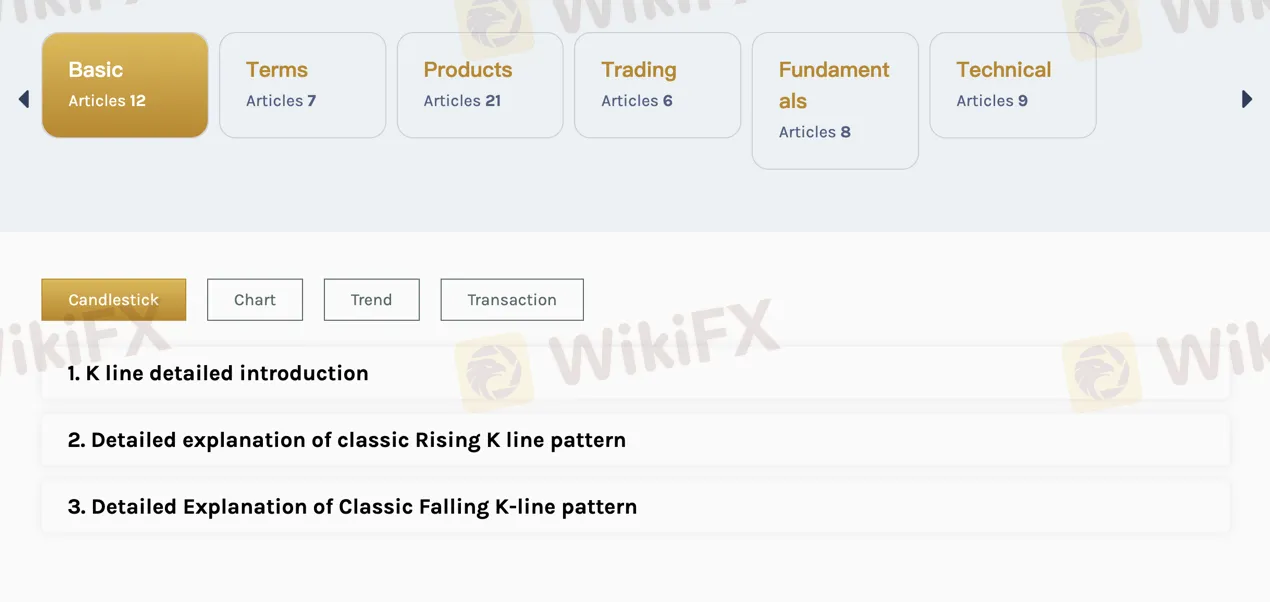

Education:

Equinox offers a comprehensive educational section where users can learn the basics of trading and investment. The educational materials cover topics such as terms, products, trading fundamentals, technical analysis, and more. This section aims to provide users with the necessary knowledge to make informed investment decisions and start their investment journey.

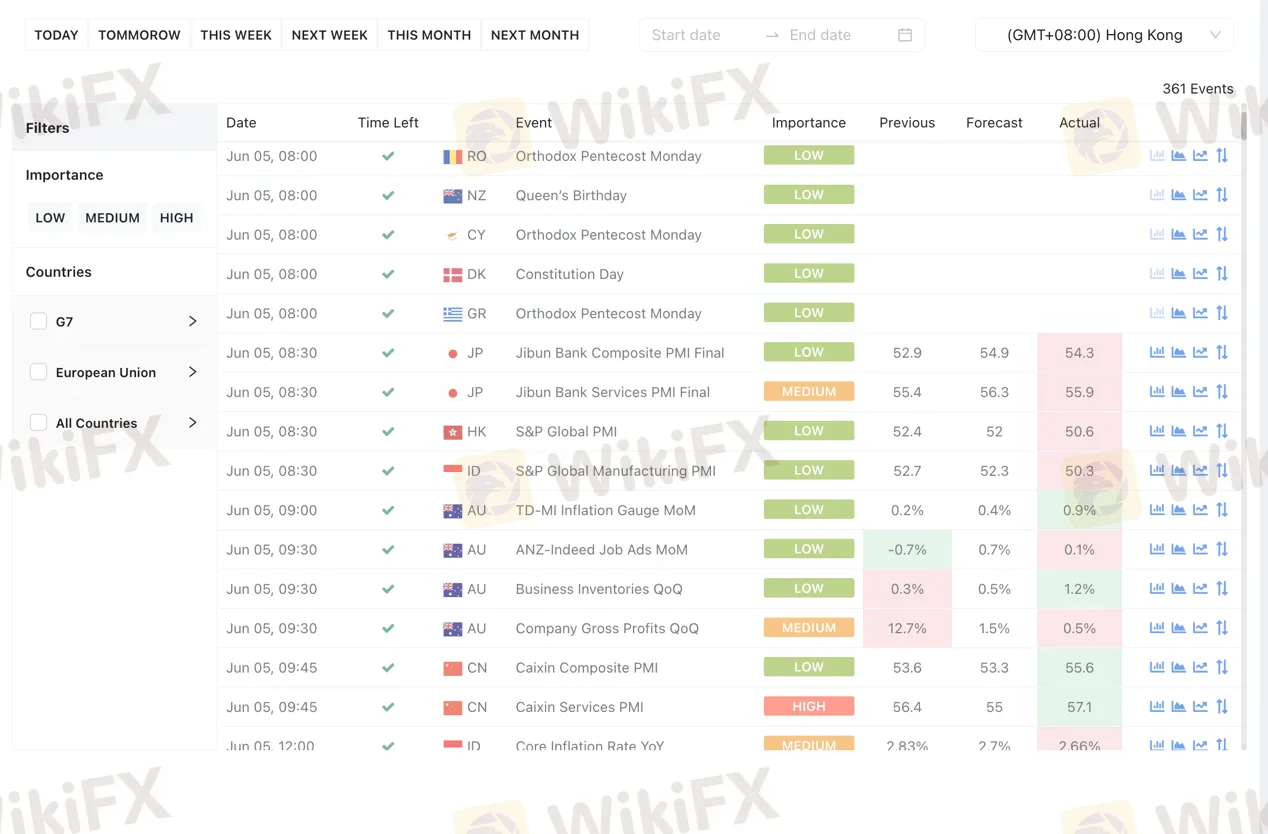

Economic Calendar:

Equinox features an economic calendar that provides users with information on important economic events, such as economic indicators, central bank announcements, and market holidays. Traders can use this calendar to stay updated on upcoming events that may impact the financial markets and make more informed trading decisions.

Trading Calculators:

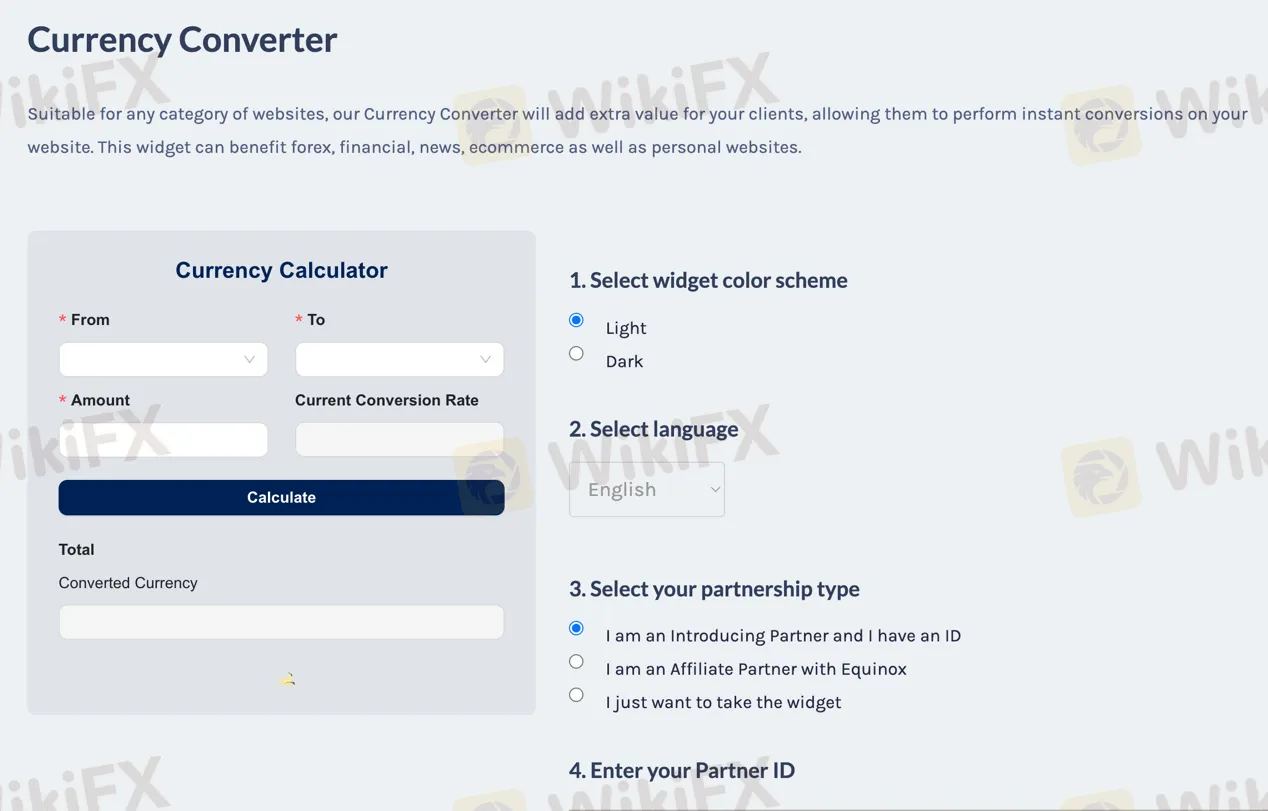

Equinox provides trading calculators that assist traders in performing various calculations related to their trades. These calculators include an all-in-one calculator, pip value calculator, currency calculator, margin calculator, swaps calculator, and profit and loss calculator. Traders can use these tools to determine position sizes, margin requirements, pip values, and potential profits or losses.

Widgets:

Equinox offers a selection of widgets that traders and investors can integrate into their websites. These widgets include a currency converter, live rates feed, profit calculator, and pip calculator. Traders can customize the appearance and functionality of these widgets to enhance their websites and provide valuable information to their visitors.

Market News:

Equinox provides market news from reputable sources such as Cointelegraph and Investing.com. Users can access the latest news articles covering a wide range of financial markets, including cryptocurrencies, stocks, and more. This allows traders to stay updated on market trends and news that may impact their trading strategies.

| Pros | Cons |

| Comprehensive educational materials | Limited in-depth educational resources |

| Economic calendar for tracking important events | Lack of advanced trading tools and indicators |

| Wide range of trading calculators | Widgets may require technical knowledge for integration |

| Customizable widgets for website enhancement | Limited customization options for widgets |

| Access to market news from vairous sources | Limited coverage of specific financial instruments |

EQUINOX offers comprehensive customer support services to ensure that traders and investors have access to assistance whenever they need it.

24/5 Service:

EQUINOX provides customer support services 24 hours a day, 5 days a week. This means that customers can reach out for assistance or ask questions about the platform, trading activities, or any other concerns during the specified operating hours.

Multilingual Support:

The official website of EQUINOX offers support in multiple languages to cater to a diverse customer base. Customers can access the website in languages such as English, Chinese, and Vietnamese. This language support enables customers to navigate the platform and access information in their preferred language, enhancing their overall experience.

Contact Information:

EQUINOX provides various channels through which customers can contact their support team. Customers can reach out via email by sending their inquiries to Support@EquinoxMarkets.com. Additionally, EQUINOX maintains a presence on social media platforms such as Facebook and LinkedIn, where customers can connect with the company and potentially find answers to their questions or receive updates.

Physical Address:

EQUINOX has a physical address listed as Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent and the Grenadines. This address serves as a point of contact for customers who prefer to communicate through traditional mail or require a physical location for any specific purposes.

Headquarters:

The headquarters of EQUINOX is located at 71-75 Shelton Street, Covent Garden, London WC2H 9JQ, ENGLAND. This address signifies the central operations and management of the company.

In conclusion, EQUINOX offers a platform for individuals and businesses to engage in cryptocurrency trading, providing access to a wide range of digital assets. The platform offers various features to enhance the trading experience. However, it is important to note that EQUINOX may have certain limitations and drawbacks that should be taken into consideration. These may include potential risks associated with cryptocurrency trading, fluctuating market conditions, and the need for users to possess a certain level of technical knowledge and understanding. Additionally, users should be aware of potential regulatory changes and ensure compliance with applicable laws. Overall, EQUINOX provides an avenue for cryptocurrency trading, but users should exercise caution and conduct thorough research before engaging in any trading activities.

Q: Is EQUINOX regulated?

A: According to the information provided, EQUINOX MARKETS LIMITED does not currently have a valid regulation. The regulatory status is unauthorized, and the broker exceeds the business scope regulated by the United States National Futures Association (NFA).

Q: What financial instruments can I trade with EQUINOX?

A: EQUINOX provides access to a diverse range of financial instruments, including foreign exchange (forex), indices, stocks, energy, and commodities.

Q: What are the different account types offered by EQUINOX?

A: EQUINOX offers different account types, including MERCURY, SATURN, PLUTO, and a demo account for risk-free practice.

Q: What leverage options are available with EQUINOX?

A: EQUINOX offers different account types with a maximum leverage of 1:500.

Q: What are the deposit and withdrawal methods provided by EQUINOX?

A: EQUINOX offers a range of deposit and withdrawal methods, including options such as PayTrust, Bank Wire, HWGC, PayBnB, BlueBoost, 9PAY, Bitcoin, Ethereum, Tether, VISA, Mastercard, JCB, FPX, PayC, and more.

Q: What trading platforms are available with EQUINOX?

A: EQUINOX offers the cTrader platform for desktop and mobile devices, as well as the cTrader Web Platform for browser-based trading. The platforms provide advanced features, and superior order execution.

Q: What trading tools and educational resources are provided by EQUINOX?

A: EQUINOX offers educational materials, an economic calendar, trading calculators, widgets for website integration, and market news to support traders and investors in their trading activities.

Q: How can I contact EQUINOX customer support?

A: EQUINOX offers comprehensive customer support services and can be contacted through email at Support@EquinoxMarkets.com.

More

User comment

6

CommentsWrite a review

2024-03-01 18:37

2024-03-01 18:37

2023-03-01 10:48

2023-03-01 10:48