A major development in Trump's Fed feud is set to happen next week in the Supreme Court

Supreme Court arguments on Jan. 21 will likely be the next big development for the central bank's quest to maintain independence.

A major development in Trump's Fed feud is set to happen next week in the Supreme Court

Supreme Court arguments on Jan. 21 will likely be the next big development for the central bank's quest to maintain independence.

December core consumer prices rose at a 2.6% annual rate, less than expected

Excluding volatile food and energy prices, the consumer price index showed a seasonally adjusted 0.2% gain on a monthly basis and 2.6% annually.

Global central bankers unite in defense of Fed Chair Jerome Powell

Global central bankers issued a statement Tuesday defending U.S. Federal Reserve Chair Jerome Powell following the launch of a criminal investigation into the central bank chief.

Core CPI Prints Cooler Than Expected In December, Near 5 Year Lows

On the heels of 'solid' labor market data from BLS (lower unemployment), ADP (weekly employment chan

Core CPI Prints Cooler Than Expected In December, Near 5 Year Lows

On the heels of 'solid' labor market data from BLS (lower unemployment), ADP (weekly employment chan

Mercedes Relocates Production To Hungary, 20,000 Germans Set To Lose Their Jobs

Inyet another major blow to the German automobile labor market,Mercedes has announced it will be rel

US Trade Deficit Collapses In October: Structural Shifts In Global Trade Revealed

The US economy managed to drastically reduce its trade deficit in October of last year. Data delayed

US Trade Deficit Collapses In October: Structural Shifts In Global Trade Revealed

The US economy managed to drastically reduce its trade deficit in October of last year. Data delayed

Trump revealed some of Friday's jobs data early in post the prior day

The president indicated that private sector payrolls had expanded by 654,000, a total that would have included Friday's jobs count for December.

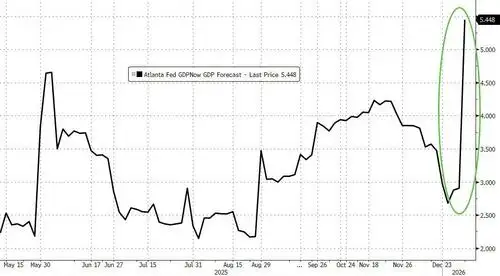

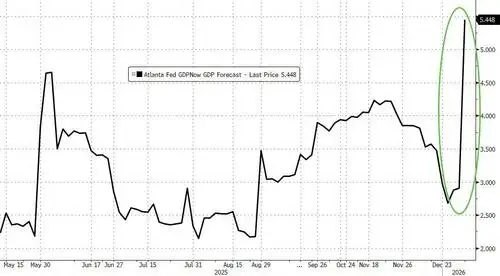

Atlanta Fed Nearly Doubles Q4 Growth Estimate To 5.4% After Strong Data

U.S. economic growth prospects received a fresh boost this week as the Atlanta Federal Reserve nearl

Atlanta Fed Nearly Doubles Q4 Growth Estimate To 5.4% After Strong Data

U.S. economic growth prospects received a fresh boost this week as the Atlanta Federal Reserve nearl

The December jobs report is due out Friday. Here's what it is expected to show

Nonfarm payrolls likely rose by 73,000 last month while the unemployment rate edged lower to 4.5%, according to the Dow Jones consensus.

Supreme Court holds off on Trump tariff ruling for now — what's at stake for economy

The decision is poised to have far-reaching impacts on not only trade policy but also the U.S. fiscal situation.

The Supreme Court may rule Friday on Trump's tariffs. Here's what's at stake for the economy

The decision is poised to have far-reaching impacts on not only trade policy but also the U.S. fiscal situation.

US Online Holiday Shopping Hits Record $257.8 Billion: Adobe

U.S. online holiday shopping was a record in 2025, fueled by a strong Cyber Week,according to new da

India Is Set To Be The G20 Growth Leader In 2026

The latest OECD Economic Outlook (December 2025) revealed that the global economy has proved resilie

India Is Set To Be The G20 Growth Leader In 2026

The latest OECD Economic Outlook (December 2025) revealed that the global economy has proved resilie

Trade deficit in October hits smallest since 2009 after Trump's tariff moves

The trade shortfall was just $29.4 billion for October, down 39% from the prior month.

Treasury Secretary Bessent says more Fed rate cuts are 'only ingredient missing' for stronger economy

Bessent on Thursday pressed the administration's desire for lower interest rates, saying they are the key to future economic growth.