BACB Spreads, leverage, minimum deposit Revealed

Abstract:BACB is an unregulated service provider of premier brokerage and financial services, which was founded in Bulgaria in 1995. It offers services for cards, loans, savings and payments.

| BACB Review Summary | |

| Founded | 1995 |

| Registered Country/Region | Bulgaria |

| Regulation | No regulation |

| Services | Cards, loans, savings, payments |

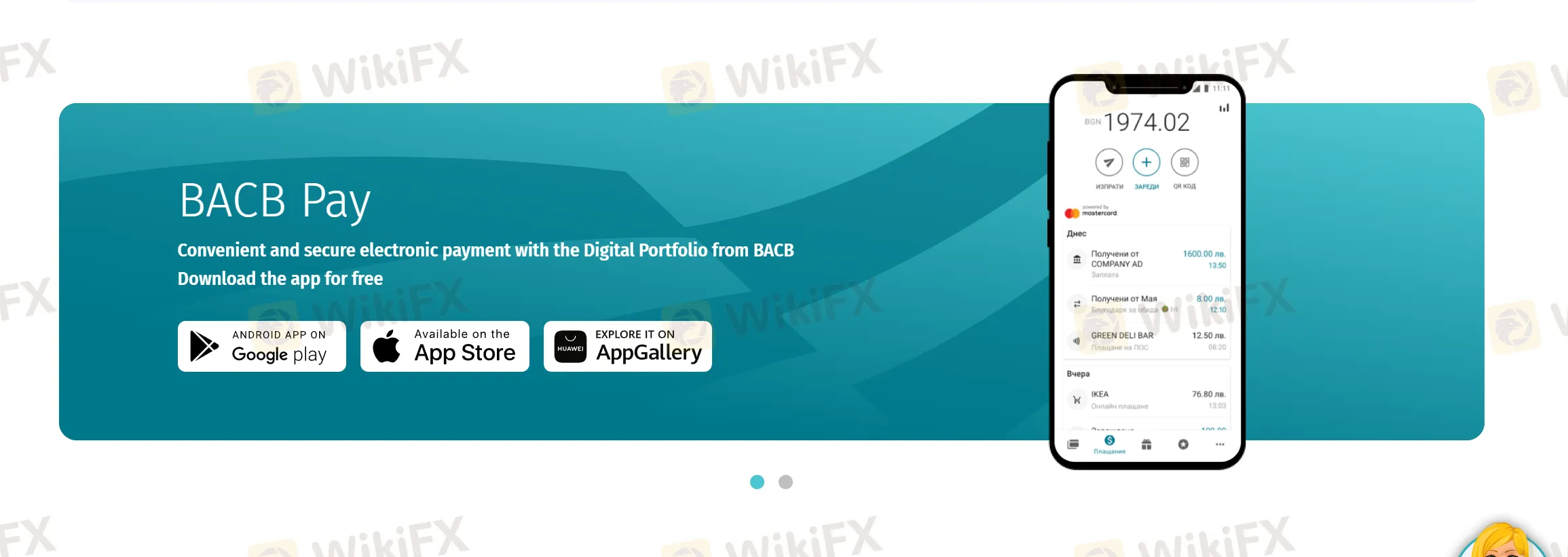

| Platform/APP | BACB Pay |

| Minimum Deposit | 5 BGN/EUR/USD |

| Customer Support | 24/7 support, live chat |

| Tel: 070014488 | |

| Facebook, Instagram, LinkedIn | |

| Address: Sofiya 2, Slavyanska Str | |

BACB Information

BACB is an unregulated service provider of premier brokerage and financial services, which was founded in Bulgaria in 1995. It offers services for cards, loans, savings and payments.

Pros and Cons

| Pros | Cons |

| Long operation time | Lack of regulation |

| No deposit fees | Complex fee structure |

| Low minimum deposit requirement | Limited payment options |

| Live chat support |

Is BACB Legit?

No. BACB currently has no valid regulations. Please be aware of the risk!

Services

| Services | Supported |

| Cards | ✔ |

| Loans | ✔ |

| Savings | ✔ |

| Payments | ✔ |

Account Type

| Account Type | Minimum Deposit |

| Leuro Account | / |

| Clean Account with VISA Card | 500 BGN |

| Current Account | 5 BGN/EUR/USD |

| Joint Current Account | 5 BGN/EUR/USD |

| Escrow Account | / |

| Escrow Account with Basic Services | 5 BGN |

BACB Fees

| Category | Product/Service | Terms & Rates | Notes |

| Deposit Accounts | Current Account (BGN/USD/EUR) | - Interest Rate: 0.01%–0.05% (varies by currency) | Fees may apply for withdrawals/transfers. |

| - Minimum Balance: 0 | |||

| Savings Account (BGN) | - Interest Rate: 0.10%–0.50% (term-dependent) | Early withdrawal penalties apply. | |

| - Term Options: 1–12 months | |||

| Fixed Deposit (USD/EUR) | - Interest Rate: 0.15%–1.20% (varies by term/currency) | No partial withdrawals allowed. | |

| - Minimum Deposit: $/€1,000 | |||

| Loans | Consumer Loans (BGN) | - Interest Rate: 4.9%–9.9% (fixed) | Secured/unsecured options available. |

| - Term: Up to 7 years | |||

| - Processing Fee: 1% of loan amount | |||

| Mortgage Loans (BGN/EUR) | - Interest Rate: 2.5%–5.5% (variable/fixed) | Property insurance required. | |

| - Term: Up to 30 years | |||

| - LTV: Up to 80% | |||

| Fees | Account Maintenance | - Monthly Fee: 5 BGN (waived for balances >5,000 BGN) | Applies to current accounts. |

| International Transfers (SWIFT) | - Outgoing: 0.1% (min. 20 BGN, max. 100 BGN) | Additional intermediary bank fees may apply. | |

| - Incoming: 10 BGN per transaction | |||

| ATM Withdrawals | - BACB ATMs: 0 | Limits may apply for daily withdrawals. | |

| - Non-BACB ATMs: 2 BGN per transaction (domestic) | |||

| Special Conditions | Student/Youth Accounts | - Interest Rate: 0.25% (BGN) | Valid for clients aged 16–25. |

| - No Maintenance Fees | |||

| Pensioner Accounts | - Interest Rate: 0.30% (BGN) | Requires proof of pension status. | |

| - Free Card Issuance |

More details can be found via https://www.bacb.bg/en/files/61-interest-rates-terms.pdf

Platform/APP

BACB uses its own platforms which are available in web, PC, and mobile devices.

| Platform/APP | Supported | Available Devices |

| BACB Pay | ✔ | Mobile, PC, web |

Deposit and Withdrawal

BACB accepts payments via pop cards, debit cards and credit cards.

Latest News

'Worse Than COVID': Weak US Manufacturing Surveys Signal Stagflation In November

Offshore Forex Brokers Ramp Up Expansion in Vietnam as Authorities Crack Down on Scams

Absolute Markets 2025: Is It Scam or Safe? Suitable for Traders in Pakistan?

UK snack brand Graze to be sold to Jamie Laing\s Candy Kittens

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

HEADWAY: The Fast Track to Financial Dead-Ends?

Plus500 Allegations Exposed in Real Trader Cases

November private payrolls unexpectedly fell by 32,000, led by steep small business job cuts, ADP reports

US Industrial Production Sees Biggest Annual Gain In 3 Years Despite Slowing Capacity Utilization

Rate Calc

USD

CNY

Current Rate: 0

Amount

USD

Available

CNY

Calculate