U.S. Bank Spreads, leverage, minimum deposit Revealed

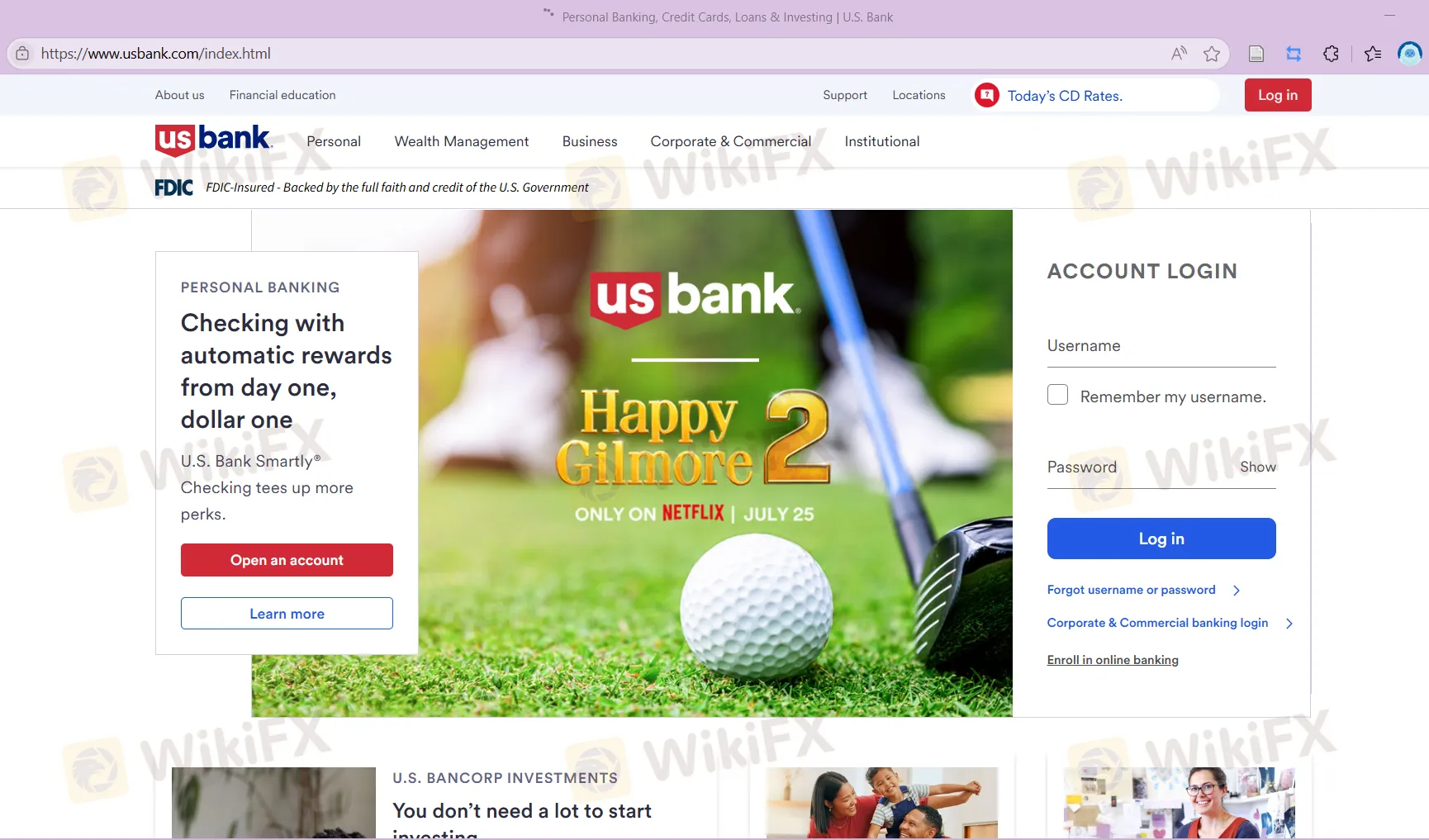

Abstract:U.S. Bank was established in 1995 and is registered in the United States. It offers a diverse range of banking services to personal, institutional, and corporate clients, including credit cards, checking accounts, savings accounts, certificates of deposit (CDs), mortgage loans, investment management, and wealth planning. Although it provides a convenient trading experience with a minimum deposit of $25, the company is not regulated, so investors need to be cautious about its legitimacy and transparency. U.S. Bank offers four main account types: commercial checking accounts, commercial savings accounts, commercial money market accounts, and commercial certificates of deposit (CDs), which meet the cash management and growth needs of different businesses.

| U.S. BankReview Summary | |

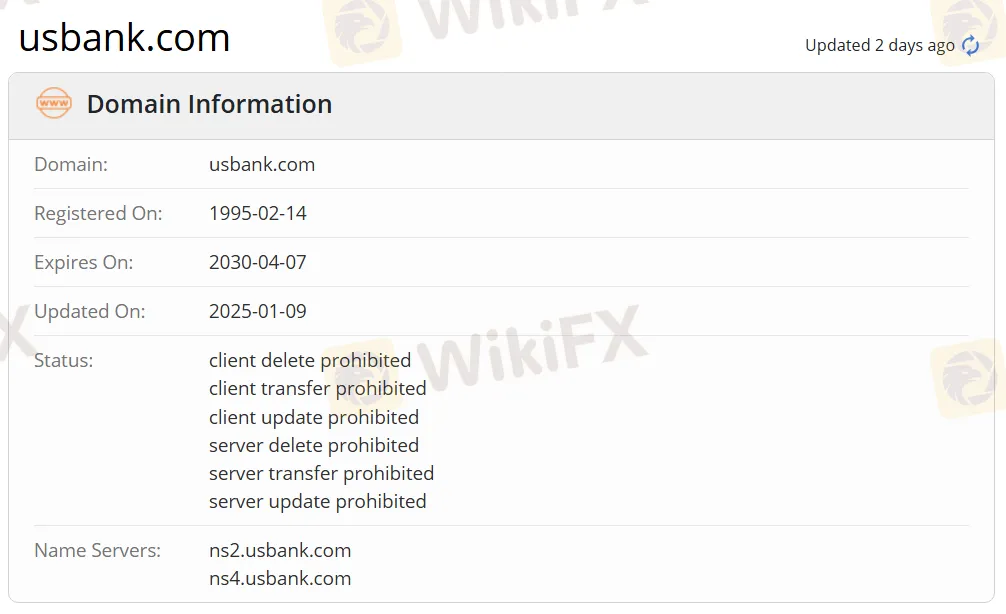

| Founded | 1995 |

| Registered Country/Region | United States |

| Regulation | No Regulation |

| Products & Services | Banking services, wealth management |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | U.S. Bank app |

| Minimum Deposit | $25 |

| Customer Support | Social Media: Facebook, Twitter, Instagram |

| Address: U.S. Bank 800 Nicollet Mall Minneapolis, MN 55402 | |

U.S. Bank Information

U.S. Bank was established in 1995 and is registered in the United States. It offers a diverse range of banking services to personal, institutional, and corporate clients, including credit cards, checking accounts, savings accounts, certificates of deposit (CDs), mortgage loans, investment management, and wealth planning. Although it provides a convenient trading experience with a minimum deposit of $25, the company is not regulated, so investors need to be cautious about its legitimacy and transparency. U.S. Bank offers four main account types: commercial checking accounts, commercial savings accounts, commercial money market accounts, and commercial certificates of deposit (CDs), which meet the cash management and growth needs of different businesses.

Pros & Cons

| Pros | Cons |

| Specialized banking services | No regulation |

| Long operation history in the US |

Is U.S. Bank Legit?

U.S. Bank is not regulated. Traders should exercise caution when trading and use funds prudently.

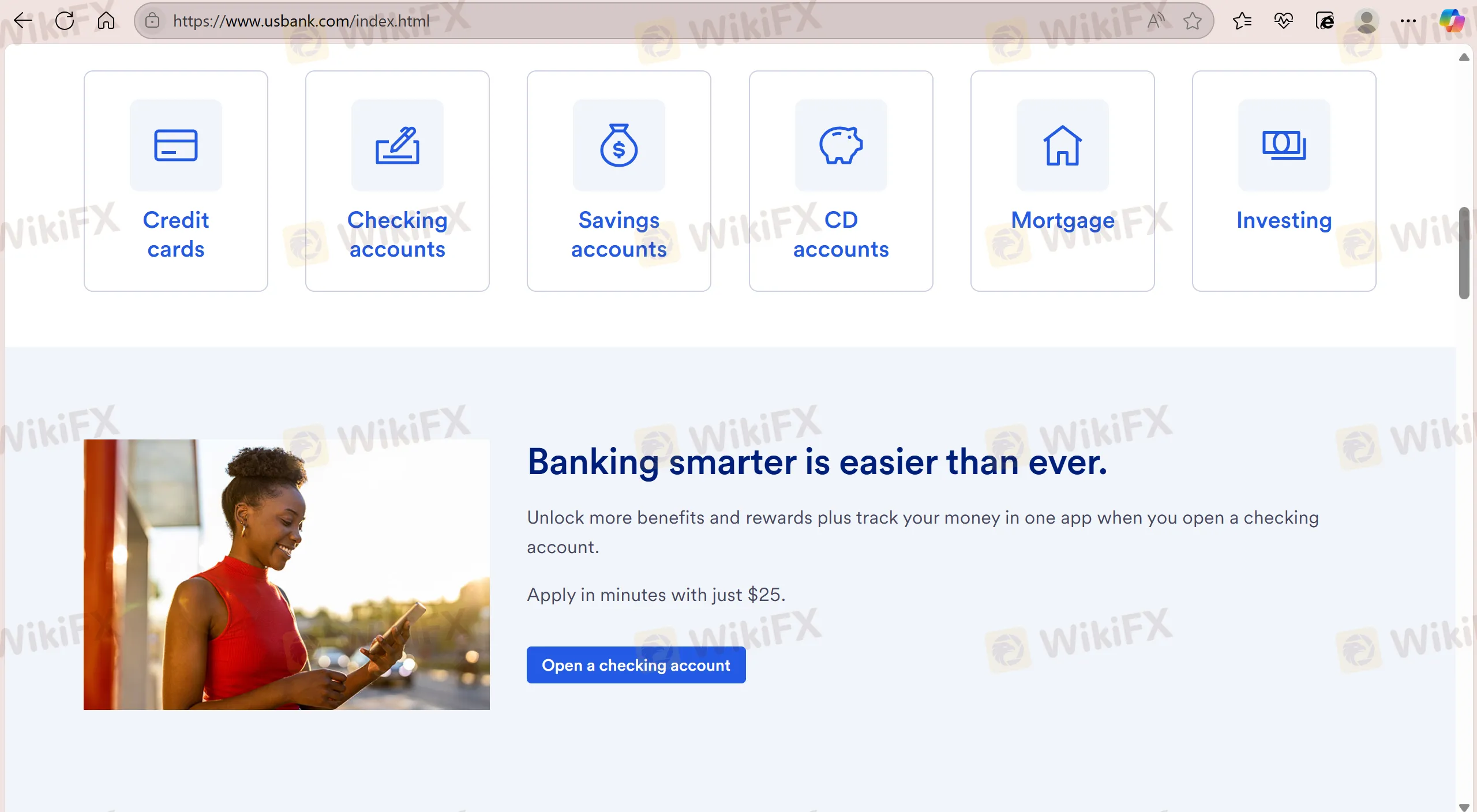

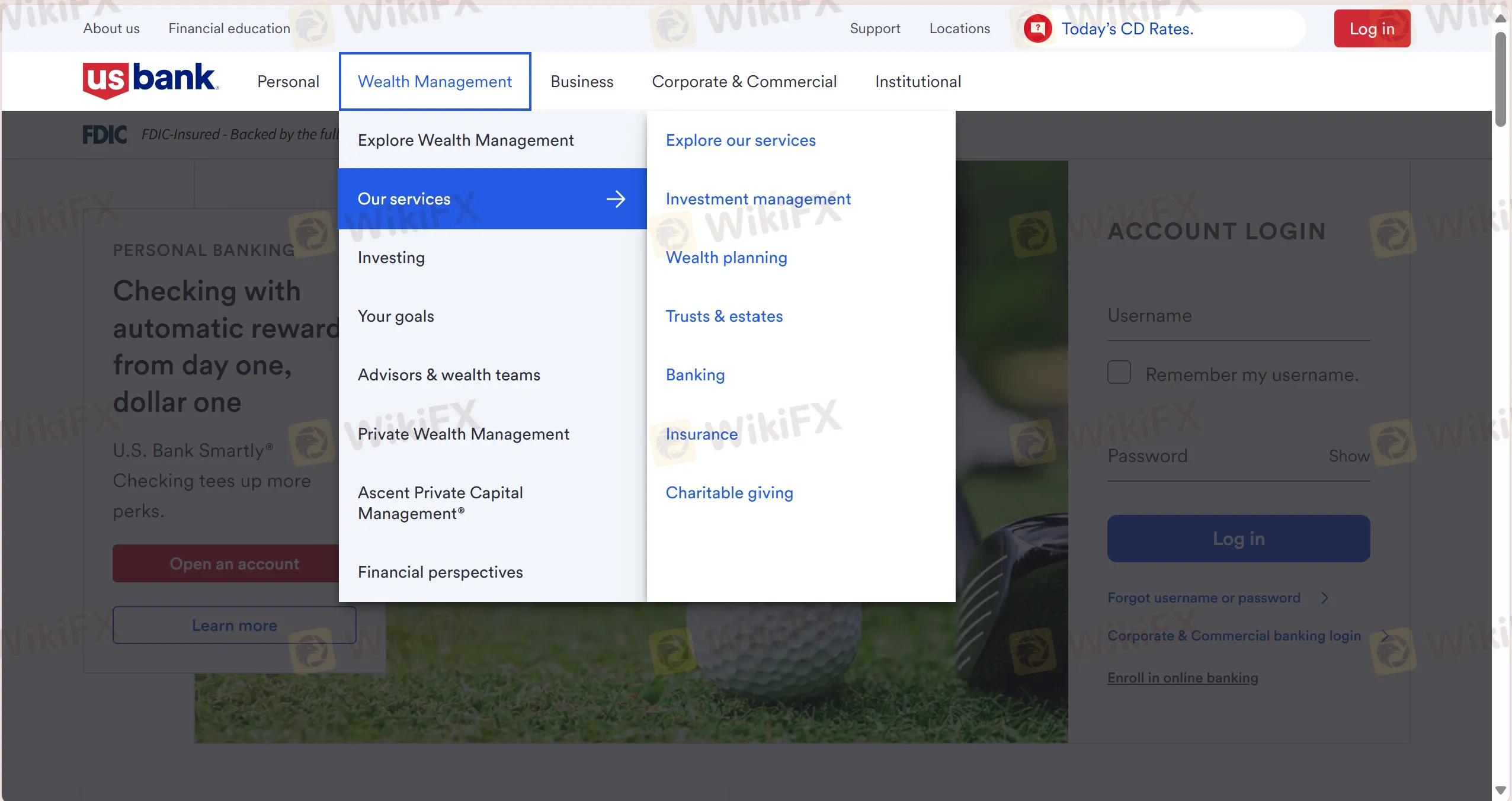

Products & Services

U.S. Bank offers a comprehensive range of financial products and services, including Credit Cards, Checking Accounts, Savings Accounts, CD Accounts, Mortgage, Investing, Home Mortgage, Auto Loan, Home Equity Line of Credit (HELOC), Investment Management, Wealth Planning, Trusts & Estates, Banking, Insurance, and Charitable Giving.

| Products & Services | Supported |

| Credit Cards | ✔ |

| Checking Accounts | ✔ |

| Savings Accounts | ✔ |

| CD Accounts | ✔ |

| Mortgage | ✔ |

| Investing | ✔ |

| Auto Loan | ✔ |

| Home Equity Line of Credit (HELOC) | ✔ |

| Investment Management | ✔ |

| Wealth Planning | ✔ |

| Trusts & Estates | ✔ |

| Banking | ✔ |

| Insurance | ✔ |

| Charitable Giving | ✔ |

Account Types

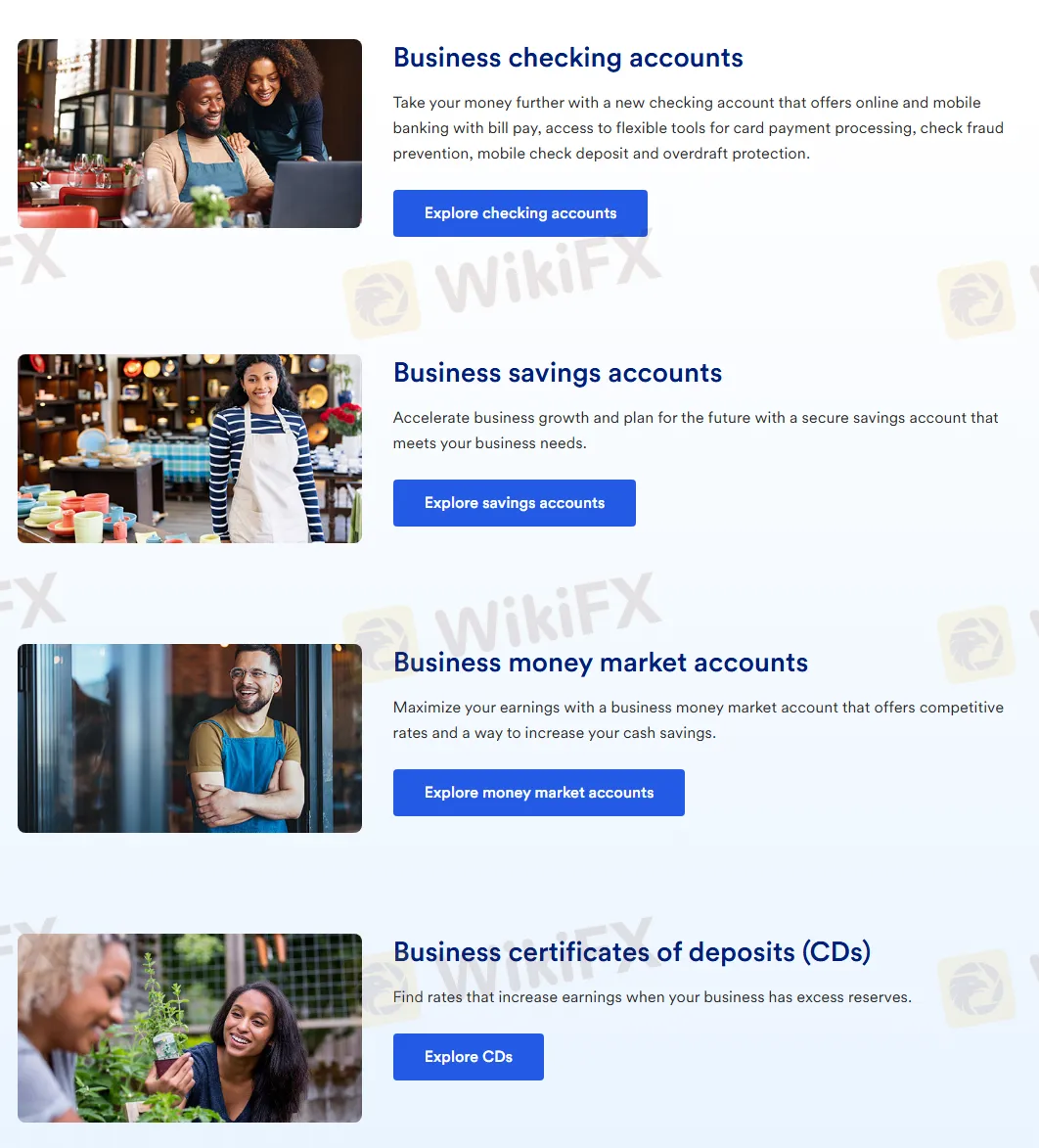

U.S. Bank offers four types of accounts, including Business Checking Accounts, Business Savings Accounts, Business Money Market Accounts, and Business Certificates of Deposit (CDs).

The following are their main features:

| Account Type | Description | Suitable for |

| Business Checking Accounts | Supports online and mobile banking features such as bill payment, card payment processing tools, check fraud prevention, mobile check deposit, and overdraft protection. | For businesses that need a comprehensive banking solution. |

| Business Savings Accounts | Offers secure savings accounts to help businesses accelerate growth and meet funding needs. | Businesses are looking to accumulate funds for future growth. |

| Business Money Market Accounts | Offer competitive interest rates to help businesses maximize returns and increase cash savings. | Businesses are seeking higher returns while maintaining liquidity. |

| Business Certificates of Deposits (CDs) | Offer interest rate options to enhance returns when businesses have excess reserves. | Businesses aim to lock in high returns over a specific term. |

Fees

Minimum deposit: The minimum deposit for U.S. Bank is $25.

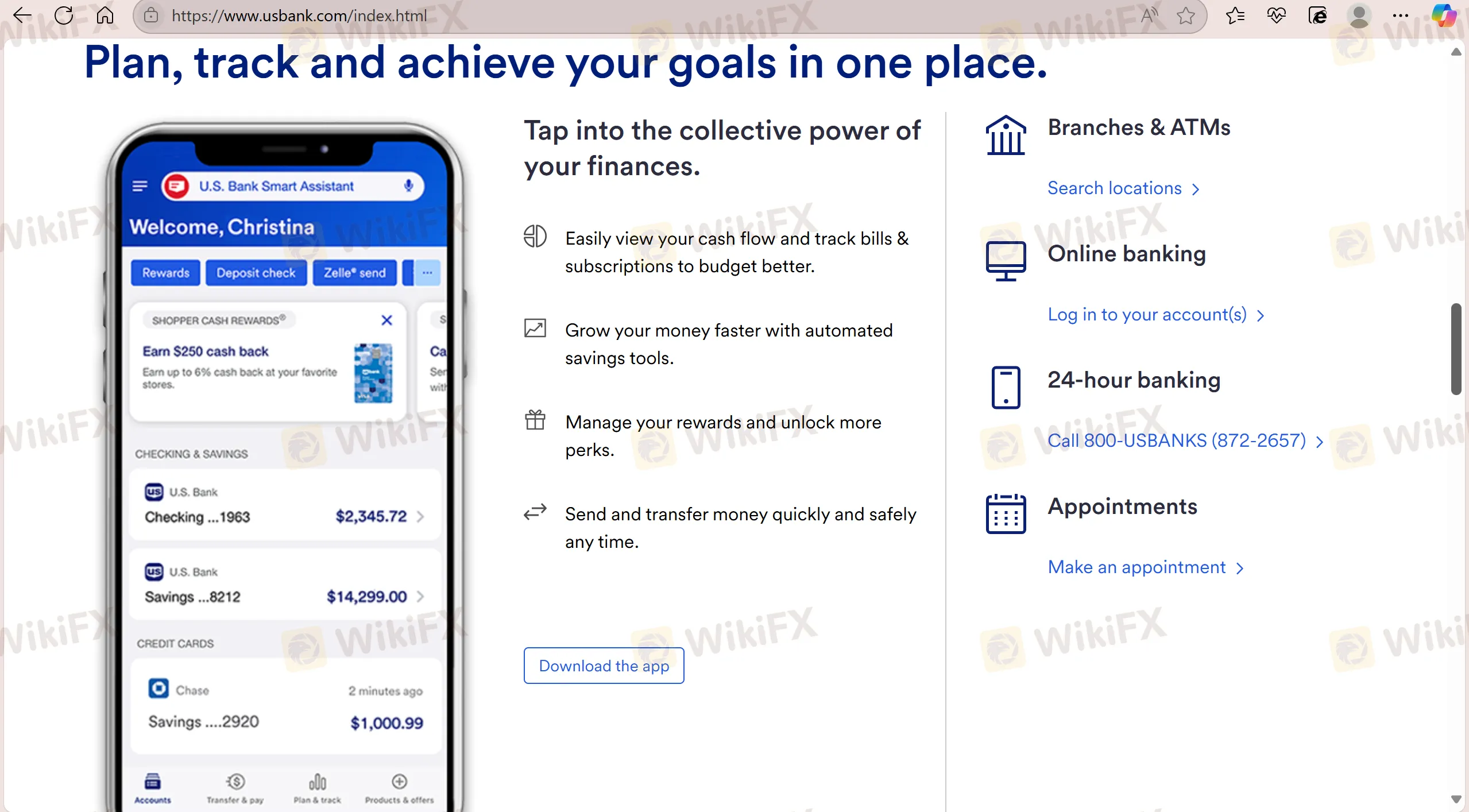

Trading Platform

U.S. Bank supports transactions through its proprietary U.S. Bank app. The app offers 24-hour service.

| Trading Platform | Supported | Available Devices | Suitable for |

| U.S. Bank APP | ✔ | Mobile | / |

Latest News

Behind the Licences: Is Pepperstone Really Safe for Malaysians?

Promised Recession... So Where Is It?

Hirose Halts UK Retail Trading Amid Market Shift

FINRA Fines United Capital Markets $25,000

CONSOB Blocks EurotradeCFD’s Solve Smart, 4X News

IBKR Jumps on September DARTs, Equity Growth

Oanda: A Closer Look at Its Licenses

FCA Urges Firms To Report Online Financial Crime

Service Sector Surveys Show Slowdown In September Despite Rebound In Employment

Rate Calc