AAFX TRADING Spreads, leverage, minimum deposit Revealed

Abstract:AAFX is one of the world’s growing Forex & CFD providers. The company offers Foreign Exchange and 1000+ CDFs trading on multiple trading platforms, including the globally popular AAFX 4 platform. The tradable instruments also include energies, commodities, stocks, cryptocurrency, equity indices, and precious metals. The broker also provides three accounts with a maximum leverage of 1:2000. The minimum spread is from 0 pips and the minimum deposit is $100. AAFX is still risky due to its unregulated status, and high leverage.

| AAFXReview Summary | |

| Founded | 2015-01-08 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

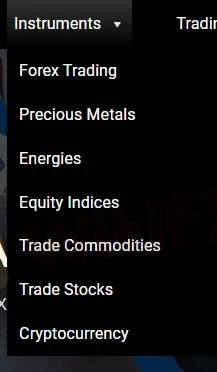

| Market Instruments | Forex/Energies/Commodities/Stocks/Cryptocurrency/Equity indices/Precious metals |

| Demo Account | ✅ |

| Leverage | Up to 1:2000 |

| Spread | As low as 0 pips |

| Trading Platform | AAFX(PC/Mac) |

| Min Deposit | $100 |

| Customer Support | Phone: +85(28) 19 810 79 |

| Phone: +61(28) 00 350 80 | |

| Email: support@aafxtrading.com | |

| Facebook/Twitter/Instagram/Tiktok/Skype | |

| Live chat | |

AAFX Information

AAFX is one of the worlds growing Forex & CFD providers. The company offers Foreign Exchange and 1000+ CDFs trading on multiple trading platforms, including the globally popular AAFX 4 platform.Thetradable instruments also include energies, commodities, stocks, cryptocurrency, equity indices, and precious metals. The broker also provides three accounts with a maximum leverage of 1:2000. The minimum spread is from 0 pips and the minimum deposit is $100. AAFX is still risky due to its unregulated status, and high leverage.

Pros and Cons

| Pros | Cons |

| Commission free | Unregulated |

| Swap free | High max leverage |

| 24/5 customer support | MT4/MT5 unavailable |

| Various tradable instruments | |

| Spread as low as 0 pips | |

| Demo account available |

Is AAFX Legit?

AAFX is not regulated, making it less safe than regulated brokers.

What Can I Trade on AAFX?

AAFX offers various market instruments, including forex, energies, commodities, stocks, cryptocurrency, equity indices, and precious metals.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energies | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrency | ✔ |

| Equity Indices | ✔ |

| Precious Metals | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

AAFX has three account types: fixed, ECN, and VIP. Traders who want low spreads can choose a VIP account, and those with a sufficient budget can also open a VIP account.

In addition, the demo account is predominantly used for familiarizing traders with the trading platform and for educational purposes only. Forex Islamic accounts are also known as swap-free accounts as they imply no swap or rollover interest in overnight positions, which is against the Islamic faith. AAFX also offers our Islamic accounts to all clients

| Account Type | Fixed | ECN | VIP |

| Maximum Leverage | 1:2000 | 1:2000 | 1:2000 |

| Spread | As low as 2 Pip | As low as 0.6 Pip | As low as 0.4 Pip |

| EA Allowed | ✔ | ✔ | ✔ |

| Swap free | ✔ | ✔ | ✔ |

| Minimum Deposit | $100 | $100 | $20000 |

AAFX Fees

The spread is as low as 0 pips, the commission is $0 and the swap is free. The lower the spread, the faster the liquidity.

Leverage

The maximum leverage is 1:2000 meaning that profits and losses are magnified 2000 times.

Trading Platform

AAFX provides a propriety trading platform available on PC and Mac to trade, instead of the authoritative MT4/MT5 with mature analysis tools and EA intelligent systems.

| Trading Platform | Supported | Available Devices |

| AAFX | ✔ | PC/Mac |

Deposit and Withdrawal

The minimum deposit is $100 and a 35% bonus for the first-time deposit. AAFX accepts Perfect Money, Payza, Neteller, Skrill, Bitcoin, and WebMoney for deposit and withdrawal, whose deposit times are instant, withdrawal times are within 24 hours, and associated fees are 0.

| Funding Methods | Deposit time | Min. Deposit | Fees | Withdrawal time | Min. withdrawal | Restriction |

| Bitcoin | Instant | 100 EUR/USD | 0 | Within 24 hours | 100 EUR/USD | No |

| Skrill | Instant | 100 EUR/USD/GBP | 0 | Within 24 hours | 100 EUR/USD/GBP | No |

| Neteller | Instant | 100 EUR/USD/GBP | 0 | Within 24 hours | 100 EUR/USD/GBP | No |

| Perfect Money | Instant | 100 EUR/USD | 0 | Within 24 hours | 100 EUR/USD | No |

| WebMoney | Instant | 100 EUR/USD | 0 | Within 24 hours | 100 EUR/USD | No |

| Sticpay | Instant | 100 EUR/USD | 0 | Within 24 hours | 100 EUR/USD | No |

Latest News

CySEC Withdraws CIF License of OBR Investments Ltd (OBRInvest)

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Rate Calc