Hengda Group Spreads, leverage, minimum deposit Revealed

Abstract: Hengda Group, founded in China in 2021, operates as an online trading platform providing financial market services. However, its website's unavailability raises concerns about legitimacy and regulatory status. Operating without regulatory oversight, Hengda Group poses risks, lacking safeguards against potential misconduct. Investors may grapple with uncertainties regarding financial practices and consumer protection. Due diligence becomes imperative, given the absence of regulatory supervision amplifying vulnerability to financial and operational risks. Notable pros include a diverse range of market instruments and a user-friendly platform, while cons encompass regulatory absence, a non-functional website, transparency issues, a lack of educational resources, and unavailable customer service channels. Investors must carefully assess associated consequences before engaging with Hengda Group.

| Aspect | Information |

| Company Name | Hengda Group |

| Registered Country/Area | China |

| Founded Year | 2021 |

| Regulation | Not regulated |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 100x |

| Spreads | Starting from 0.05% |

| Trading Platforms | Web-based platform |

| Tradable Assets | Spot trading for over 100 cryptocurrencies, margin trading, derivatives trading, staking |

| Account Types | Basic, Standard, VIP |

| Customer Support | Not available |

| Deposit & Withdrawal | Wire transfer, credit card, and cryptocurrency |

| Educational Resources | Not available |

Overview of Hengda Group

Hengda Group, founded in China in 2021, operates as an online trading platform providing financial market services. However, its website's unavailability raises concerns about legitimacy and regulatory status. Operating without regulatory oversight, Hengda Group poses risks, lacking safeguards against potential misconduct. Investors may grapple with uncertainties regarding financial practices and consumer protection. Due diligence becomes imperative, given the absence of regulatory supervision amplifying vulnerability to financial and operational risks. Notable pros include a diverse range of market instruments and a user-friendly platform, while cons encompass regulatory absence, a non-functional website, transparency issues, a lack of educational resources, and unavailable customer service channels. Investors must carefully assess associated consequences before engaging with Hengda Group.

Is Hengda Group legit or a scam?

Hengda Group operates without regulatory oversight, posing inherent risks. The absence of regulatory scrutiny raises concerns about transparency, accountability, and compliance. Investors and stakeholders may face uncertainties regarding financial practices, ethical standards, and consumer protection. Without regulatory checks, Hengda Group's activities lack a safeguard against potential misconduct, fraud, or market manipulation. This unregulated status heightens the need for due diligence, as the absence of regulatory supervision amplifies the vulnerability to financial and operational risks, making it imperative for investors to carefully evaluate and understand the potential consequences associated with engaging with an unregulated entity like Hengda Group.

Pros and Cons

| Pros | Cons |

| Wide range of market instruments | Not regulated |

| High leverage | Website unfunctional |

| User-friendly trading platform | Lack of transparency |

| Lack of educational resources | |

| Customer channels not available |

Pros:

Wide Range of Market Instruments: Hengda Group offers a diverse array of market instruments, including spot trading for over 100 cryptocurrencies, margin trading with up to 100x leverage, derivatives trading for futures, options, and perpetual contracts, and staking for various cryptocurrencies.

High Leverage: The platform provides high leverage, catering to traders seeking amplified profit potential. This feature allows users to control positions worth up to 100 times their initial deposit, enhancing trading flexibility.

User-Friendly Trading Platform: Hengda Group's trading platform is designed with user-friendliness in mind. It offers an accessible interface, enabling traders to navigate seamlessly through real-time market data, order types, technical analysis tools, and trading history.

Cons:

Not Regulated: Hengda Group operates without regulatory oversight, introducing potential risks related to transparency, accountability, and compliance.

Website Unfunctional: The current inaccessibility of the platform's website hampers user convenience and raises questions about the platform's reliability.

Lack of Transparency: The lack of regulatory oversight contributes to a potential lack of transparency. Traders may face uncertainties regarding financial practices, ethical standards, and the overall reliability of the platform.

Lack of Educational Resources: Hengda Group does not provide educational resources in English. This absence limits new and existing users in gaining knowledge about cryptocurrency trading and staying updated on market trends and developments.

Customer Channels Not Available: Hengda Group does not offer customer service channels through the internet. The absence of clear avenues for reaching out for assistance or resolving inquiries may leave clients feeling uninformed and uncertain about the reliability of the company.

Market Instruments

Hengda Group offers a wide range of market instruments, including:

Spot Trading:

Hengda Group facilitates spot trading for a diverse array of over 100 cryptocurrencies, encompassing popular assets like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT). This feature allows users to engage in straightforward buying and selling of these digital assets at prevailing market prices.

Margin Trading:

The platform extends the option of margin trading, providing users with leverage of up to 100x. While this offers the potential for enhanced profits, it's important to note that such leverage also magnifies the associated risks, necessitating cautious and informed trading decisions.

Derivatives Trading:

Hengda Group diversifies its offerings by providing derivatives trading, encompassing futures, options, and perpetual contracts. This allows users to explore more advanced trading strategies beyond traditional spot trading, though it introduces complexities and risk factors that traders should be mindful of.

Staking:

The platform supports staking for a variety of cryptocurrencies, enabling users to participate in blockchain networks by locking and holding their assets. Staking provides an opportunity to earn rewards, typically in the form of additional cryptocurrency, but it also involves considerations regarding the specific terms and risks associated with each staking offering.

Popular Trading Pairs:

Hengda Group features popular trading pairs such as BTC/USDT, ETH/USDT, and USDT/USD, catering to users' preferences for widely traded and liquid markets.

Fiat Support:

In addition to cryptocurrencies, Hengda Group facilitates transactions with various fiat currencies, including USD, EUR, GBP, and CNY, providing users with flexibility in funding their accounts and managing withdrawals.

Account Types

Hengda Group offers three distinct account types catering to varying trading preferences: Basic, Standard, and VIP.

Basic Account:

Hengda Group's Basic account is tailored for entry-level traders, offering leverages up to 10x with a 0.10% spread. This account type does not require a minimum deposit, providing a no-barrier entry point for those new to cryptocurrency trading. Users can explore and practice trading strategies with a demo account, and access essential trading tools including charts, indicators, and order types.

Standard Account:

Designed for traders seeking a more comprehensive experience, the Standard account at Hengda Group supports leverages of up to 50x with a reduced spread of 0.07%. A minimum deposit of $100 is required for this account, offering a balance between accessibility and enhanced features. Traders benefit from the inclusion of advanced trading tools in addition to the basic tools available in the Basic account.

VIP Account:

Geared towards experienced and high-volume traders, the VIP account at Hengda Group provides the highest leverage of up to 100x, coupled with a minimal spread of 0.05%. This account type demands a substantial minimum deposit of $10,000, reflecting its exclusive nature. VIP account holders enjoy the lowest commission at 0.05%, access to advanced trading tools, and the same essential features as the Basic and Standard accounts.

| Feature | Basic | Standard | VIP |

| Leverage | Up to 10x | Up to 50x | Up to 100x |

| Spread | 0.10% | 0.07% | 0.05% |

| Commission | 0.15% | 0.10% | 0.05% |

| Minimum Deposit | None | $100 | $10,000 |

| Demo Account | Yes | Yes | Yes |

| Trading Tool | Charts, indicators, order types | Charts, indicators, order types, advanced trading tools | Charts, indicators, order types, advanced trading tools |

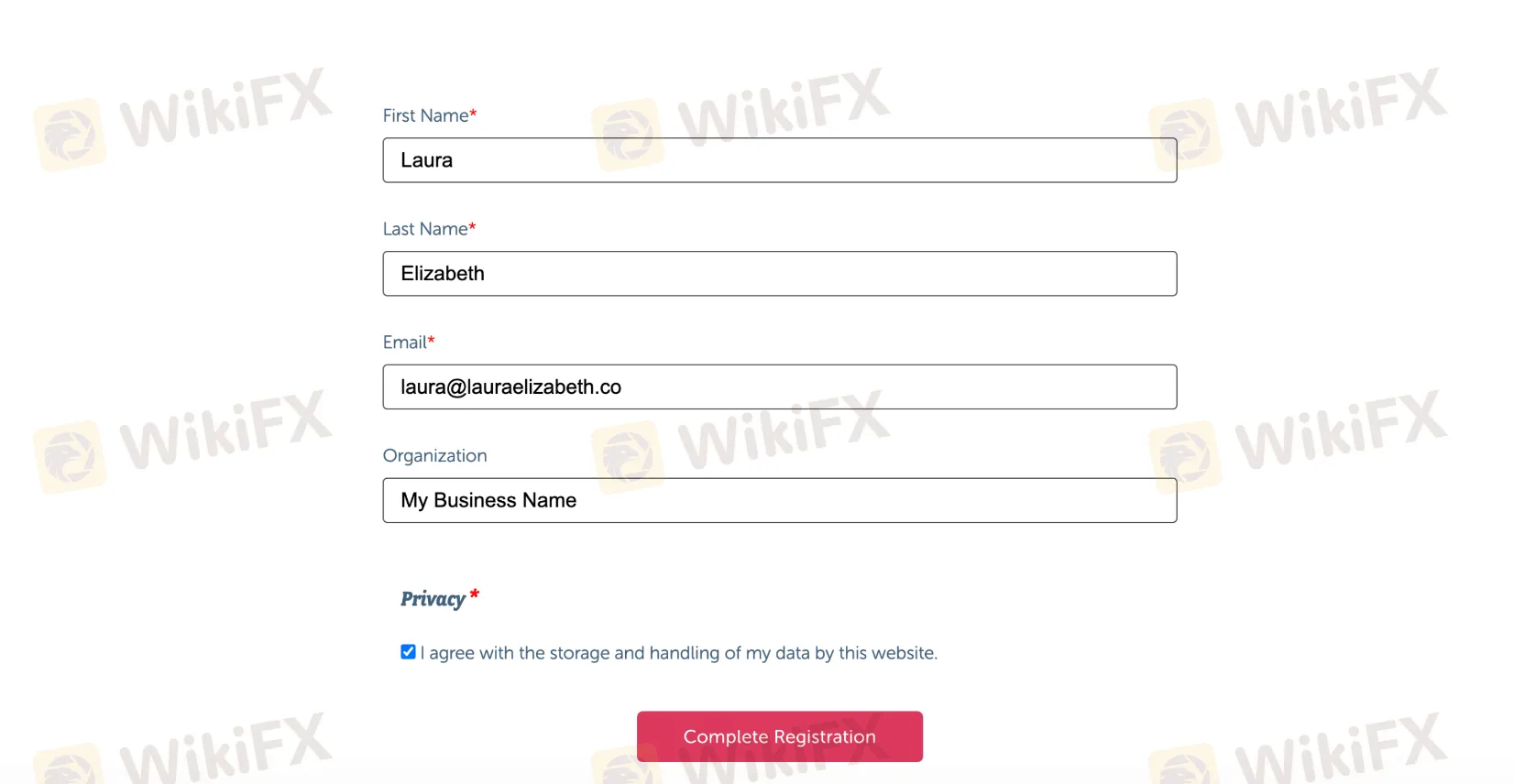

How to Open an Account?

Below is a detailed, step-by-step guide on how to open a Hengda Group account:

Visit the Official Website:

Navigate to Hengda Group's official website and locate the “Sign Up” or “Register” button on the homepage.

2. Provide Personal Information:

Fill in the required fields with accurate personal details, including your full name, email address, and contact information. Create a secure password for your account.

3. Select Account Type:

Choose the type of account you wish to open, such as Basic, Standard, or VIP. Consider your trading preferences and experience level when making this selection.

4. Verification Process:

Complete the necessary verification steps. This often involves confirming your email address and may require additional identity verification through the submission of relevant documents.

5. Deposit Funds:

Once your account is verified, log in and proceed to the deposit section. Choose your preferred funding method (crypto or fiat), and deposit the minimum required amount based on your selected account type.

6. Start Trading:

With a funded account, explore the trading platform's features. Utilize the demo account to practice, familiarize yourself with tools, and execute trades. Begin your live trading journey by monitoring the markets and executing trades based on your strategy.

Leverage

Hengda Group provides margin trading with a substantial leverage of up to 100x, allowing you to command a position valued at 100 times your initial deposit. While this presents an opportunity for increased profits, it's crucial to recognize that leverage also magnifies potential losses. Prudent risk management is essential, as the allure of amplified gains comes with the inherent risk of equally magnified setbacks. Investors should exercise caution, employ effective risk mitigation strategies, and thoroughly understand the implications of leveraging to make informed and responsible trading decisions within the Hengda Group platform.

Spreads & Commissions

Hengda Group offers varying spreads and commissions across its account types. The Basic account features a 0.10% spread and 0.15% commission. The Standard account has a reduced spread of 0.07% and a 0.10% commission. The VIP account offers the lowest spread at 0.05% and the lowest commission at 0.05%.

| Feature | Basic | Standard | VIP |

| Spread | 0.10% | 0.07% | 0.05% |

| Commission | 0.15% | 0.10% | 0.05% |

Trading Platform

Hengda Group's trading platform is a web-based interface designed for user-friendly navigation. The platform boasts simplicity in its design, offering an accessible experience for users.

Real-time Market Data:

Hengda Group's trading platform provides users with real-time market data, ensuring timely access to the latest information on asset prices and market trends. This feature is crucial for traders who rely on up-to-the-minute data to make informed decisions, capitalize on opportunities, and manage risks effectively. The platform offers a variety of features, including:

Order Types:

The platform supports a variety of order types, offering users flexibility in executing trades. Whether it's market orders for swift transactions or limit orders to set specific entry or exit points, Hengda Group's platform accommodates diverse trading strategies. The availability of multiple order types enhances the precision and customization of trading activities.

Technical Analysis Tools:

Traders can leverage technical analysis tools on Hengda Group's platform to scrutinize price charts and patterns. These tools empower users to conduct thorough market analysis, identify potential trends, and make data-driven decisions. The inclusion of technical analysis tools enhances the platform's utility for traders employing diverse analytical approaches.

Trading History:

The platform maintains a comprehensive trading history feature, allowing users to review past transactions and performance. This retrospective analysis aids in evaluating trading strategies, learning from past successes or mistakes, and refining approaches for future trades. The trading history feature contributes to transparency and accountability in users' trading activities.

Deposit & Withdrawal

Hengda Group offers a variety of payment methods for deposits and withdrawals, including wire transfer, credit card, and cryptocurrency.

Payment processing times vary depending on the payment method used. Wire transfers typically take 3-5 business days to process, while credit card deposits are processed instantly. Cryptocurrency deposits are processed within 10 minutes.

Hengda Group does not charge any fees for deposits. However, there may be fees associated with withdrawals, depending on the payment method used. For example, the withdrawal fee for wire transfer is $20, while the withdrawal fee for credit card is 3%. The withdrawal fee for cryptocurrency is 0.0005 BTC.

Customer Support

Hengda Group does not provide online customer service channels, compromising convenience and accessibility for its clients. The absence of such channels is a cause for significant concern, prompting inquiries into the company's commitment to transparency and addressing client needs. The lack of clear avenues for seeking assistance or resolving inquiries may leave clients feeling uninformed and uncertain about the company's reliability. This shortfall in customer service accessibility underscores the importance of Hengda addressing these concerns to build trust and confidence among its clientele.

Educational Resources

Hengda Group does not provide educational resources, and their website is presently inaccessible. This poses a challenge for new users seeking to understand cryptocurrency trading and Hengda's services. Furthermore, the absence of educational materials hinders existing users from staying informed about the latest cryptocurrency market trends and developments. Enhancing educational offerings would contribute to a more informed and engaged user base.

Conclusion

Hengda Group, a Chinese online trading platform, faces scrutiny due to an inaccessible website and lack of regulatory oversight. While it offers a wide range of market instruments and a user-friendly interface, its unregulated status poses inherent risks. Concerns about transparency, accountability, and customer support further complicate its appeal. Investors should exercise caution, conducting thorough due diligence and understanding the potential consequences before engaging with Hengda Group.

FAQs

Q: Is Hengda Group regulated by any financial authority?

A: No, Hengda Group operates without regulatory oversight, raising concerns about transparency and accountability.

Q: What trading features does Hengda Group offer?

A: Hengda Group provides spot trading for over 100 cryptocurrencies, margin trading with leverage, derivatives trading for futures, options, perpetual contracts, and staking.

Q: Can I access educational resources on Hengda Group's platform?

A: Unfortunately, Hengda Group does not offer educational resources in English, limiting user learning opportunities.

Q: What are the pros of using Hengda Group's platform?

A: Pros include a wide range of market instruments, high leverage, and a user-friendly trading platform.

Q: Is customer service available on Hengda Group's platform?

A: No, Hengda Group does not offer customer service channels through the internet, potentially leaving users without assistance.

Q: How can I open an account on Hengda Group?

A: To open an account, visit the official website, provide personal information, select an account type, complete the verification process, deposit funds, and start trading.

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

Malaysia’s EPF Declares Highest Dividend Since 2017 Amid Market Resilience

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

Rate Calc