FCCL Spreads, leverage, minimum deposit Revealed

Abstract:FCCL is an Australian-based financial services company that offers services in personal loans, home loans, insurance, and travel services. Although the company used to have an investment advisory license issued by the Australian Securities and Investments Commission (ASIC), its regulatory status has been revoked.

| FCCLReview Summary | |

| Founded | / |

| Registered Country/Region | Australia |

| Regulation | ASIC (Revoked) |

| Services | Personal loans, home loans, insurance, travel services |

| Trading Platform | New Payments Platform |

| Customer Support | Web chat, 24/7 support |

| Phone: +61 2 9735 9225 | |

| Mail: PO Box 7501, Silverwater NSW 2128, Australia | |

| Address: 28-38 Powell Street, Homebush NSW 2140 | |

| Social Media: Facebook, Twitter, YouTube, LinkedIn, Instagram | |

FCCL Information

FCCL is an Australian-based financial services company that offers services in personal loans, home loans, insurance, and travel services. Although the company used to have an investment advisory license issued by the Australian Securities and Investments Commission (ASIC), its regulatory status has been revoked.

Pros and Cons

| Pros | Cons |

| Specialized banking services | Revoked license |

| Live chat support | Service fees charged |

| Six account types |

Is FCCL Legit?

FCCL used to hold an investment advisory licence from the Australian Securities and Investments Commission (ASIC), but the company's regulatory status has been revoked. This means that its license to operate as an investment advisory firm in Australia has been terminated.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Australia Securities & Investment Commission | Revoked | FIREFIGHTERS & AFFILIATES CREDIT CO-OPERATIVE LIMITED | Investment Advisory License | 000240898 |

Services

FCCL offers a range of financial services, including accounts, credit cards, personal loans, home loans, insurance, travel services, and a mobile wallet.

| Services | Supported |

| Accounts | ✔ |

| Credit Card | ✔ |

| Personal Loans | ✔ |

| Home Loans | ✔ |

| Insurance | ✔ |

| Travel | ✔ |

| Mobile Wallet | ✔ |

Account Types

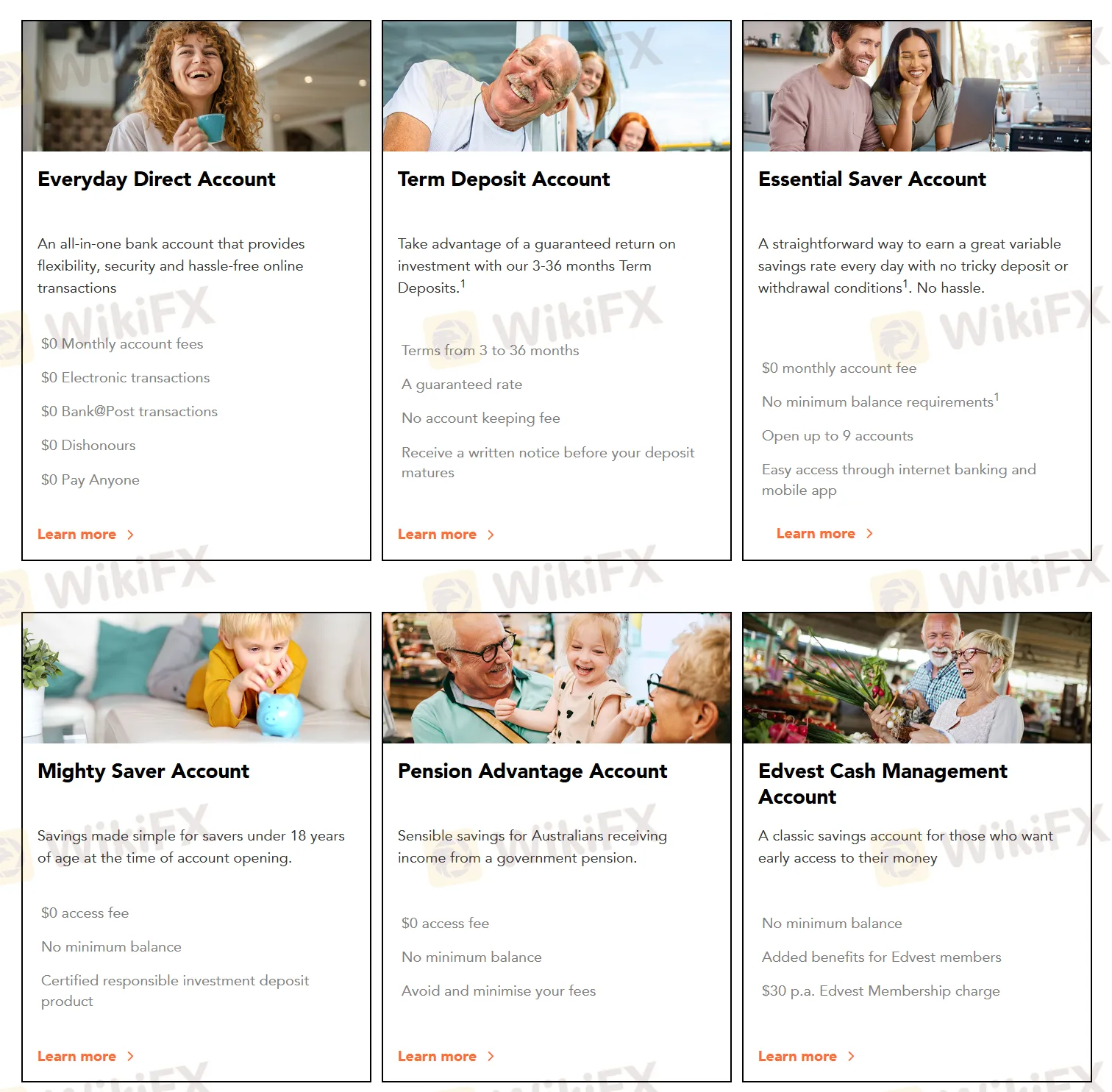

FCCL offers six distinct account types: Everyday Direct Account, Term Deposit Account, Essential Saver Account, Mighty Saver Account, Pension Advantage Account, and Edvest Cash Management Account, each designed to cater to specific customer needs, such as fee-free transactions, guaranteed returns, youth savings, pensioner benefits, and flexible access to funds.

| Account Type | Description | Key Features |

| Everyday Direct Account | An all-in-one bank account that provides flexibility, security, and hassle-free online transactions. | $0 Monthly account fees |

| $0 Electronic transactions | ||

| $0 Bank@Post transactions | ||

| $0 Dishonours | ||

| $0 Pay Anyone | ||

| Term Deposit Account | Take advantage of a guaranteed return on investment with our 3-36 months Term Deposits.¹ | Terms from 3 to 36 months |

| A guaranteed rate | ||

| No account-keeping fee | ||

| Receive a written notice before your deposit matures | ||

| Essential Saver Account | A straightforward way to earn a great variable savings rate every day with no tricky deposit or withdrawal conditions.¹ No hassle. | $0 monthly account fee |

| No minimum balance requirements | ||

| Open up to 9 accounts | ||

| Easy access through internet banking and mobile app | ||

| Mighty Saver Account | Savings made simple for savers under 18 years of age at the time of account opening. | $0 access fee |

| No minimum balance | ||

| Certified responsible investment deposit product | ||

| Pension Advantage Account | Sensible savings for Australians receiving income from a government pension. | $0 access fee |

| No minimum balance | ||

| Avoid and minimize your fees | ||

| Edvest Cash Management Account | A classic savings account for those who want early access to their money. | No minimum balance |

| Added benefits for Edvest members | ||

| $30 p.a. Edvest Membership charge |

Fees

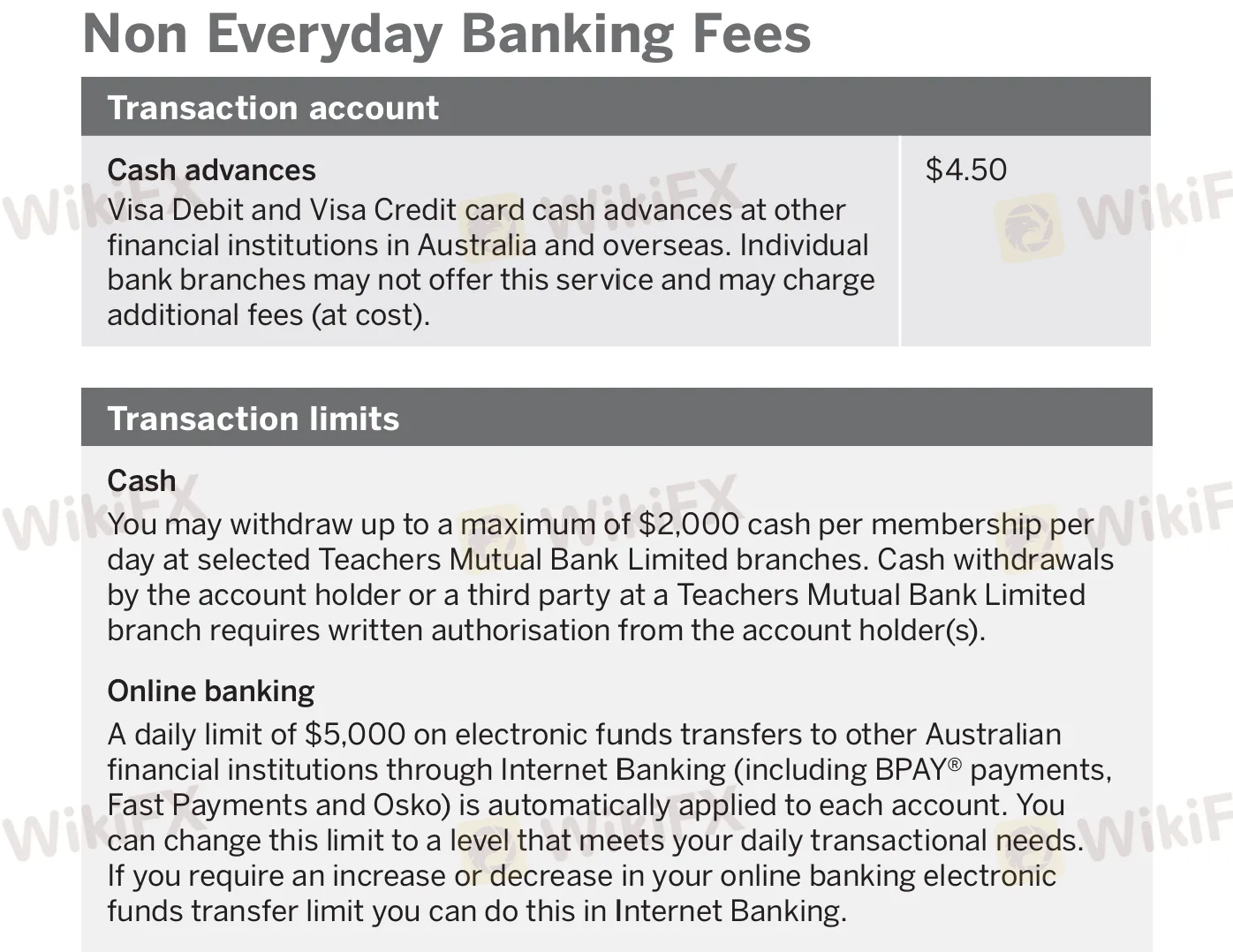

FCCL does not charge everyday banking fee but charges other service fees.

| Type | Fees |

| Cash Advances | $4.50 |

| Telegraphic Transfer | $30 |

| ATM Withdrawals Overseas | $4.50 |

| Personal Loan Application Fee | $150 |

Trading Platform

FCCL supports transactions through the New Payments Platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| New Payments Platform | ✔ | Desktop, Mobile, Web | / |

Deposit and Withdrawal

Firefighters Mutual Bank is launching PayTo, a new digital payments service that allows users to pre-authorize one-off or recurring near real-time payments from an eligible bank account to merchants, businesses, or institutions. Additionally, the bank offers access to other payment platforms such as Osko by BPAY and PayID, providing members with multiple options for convenient and efficient deposit and withdrawal services.

Latest News

Forex Swaps Explained in 5 Minutes – Everything You Need to Know

Binance Users Convert Crypto and Withdraw Instantly to Mastercard

FXPRIMUS Exposed: Withdrawal Denials, Account Blocks & Other Alarming Issues

Best MetaTrader Forex Brokers in the Philippines 2025

Best MT4 Brokers in the USA in 2025

What WikiFX Found When It Looked Into TradeFW

IG Prime Expands Real-Time Aussie Equities Data Access via CBOE FIX API

One Click on Facebook Cost a 77-Year-Old Over RM100,000

Should You Trust DeltaStock? Key Warning Signs to Consider

Interactive Brokers Launches TipRanks Analytics, Forecast Contracts in Europe

Rate Calc