Huarong Spreads, leverage, minimum deposit Revealed

Abstract: Huarong (now XinKong Capital) was founded in 1973 and is headquartered in Hong Kong. It provides full financial services through its licensed subsidiaries. It is funded by China's CITIC Financial AMC and offers securities trading, corporate finance, and asset management. While it holds Hong Kong SFC permits, their status is stated as “Exceeded”.

| Huarong Review Summary | |

| Founded | 1973 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC (Exceeded) |

| Products & Services | Securities Trading, Corporate Finance, Asset Management, Investment Advisory, IPO Underwriting, Wealth Management |

| Demo Account | ❌ |

| EUR/USD Spread | 2 pips |

| Trading Platform | Mobile App |

| Minimum Deposit | / |

| Customer Support | Tel: (852) 3965 3965 |

| Fax: (852) 3965 3705 | |

| Email: info@hrif.com.hk | |

Huarong Information

Huarong (now XinKong Capital) was founded in 1973 and is headquartered in Hong Kong. It provides full financial services through its licensed subsidiaries. It is funded by China's CITIC Financial AMC and offers securities trading, corporate finance, and asset management. While it holds Hong Kong SFC permits, their status is stated as “Exceeded”.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | No demo or Islamic (swap-free) accounts |

| Wide range of financial services | Exceeded license status |

| Multiple account types for individuals and corporates | Limited information on fees |

Is Huarong Legit?

| Licensed Entity | Regulated by | Regulatory Authority | Current Status | License Type | License No. |

| XinKong International Securities Limited | Hong Kong | Securities and Futures Commission (SFC) | Exceeded | Dealing in securities | ACV085 |

| XinKong International Capital Limited | Hong Kong | Securities and Futures Commission (SFC) | Exceeded | Dealing in securities | BGY986 |

Products and Services

Through its companies that are licensed in Hong Kong, Huarong offers a full range of financial services. China CITIC Financial AMC, the business's parent company, supports its services, which include securities trading, corporate finance advice, and asset management.

| Products & Services | Supported |

| Securities Trading | ✔ |

| Corporate Finance | ✔ |

| Asset Management | ✔ |

| Investment Advisory | ✔ |

| IPO Underwriting | ✔ |

| Wealth Management | ✔ |

Account Type

There are three primary categories of live trading accounts: Individual, Corporate, and Sole Proprietor/Partnership. The company does not have demo or Islamic accounts.

Huarong Fees

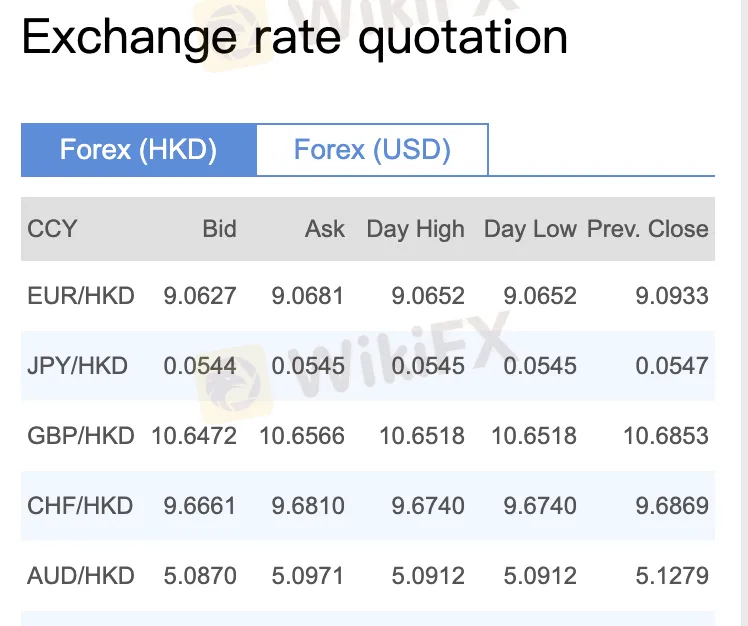

Huarong's forex trading fees, as indicated in bid-ask spreads, are generally reasonable and in line with industry averages.

| Currency Pair | Bid | Ask | Spread (Approx.) |

| EUR/HKD | 9.0627 | 9.0681 | 54 pips |

| JPY/HKD | 0.0544 | 0.0545 | 1 pip |

| GBP/HKD | 10.6472 | 10.6566 | 94 pips |

| EUR/USD | 1.1548 | 1.155 | 2 pips |

| USD/JPY | 144.03 | 144.17 | 14 pips |

| GBP/USD | 1.3567 | 1.3573 | 6 pips |

| AUD/USD | 0.6482 | 0.6492 | 10 pips |

Trading Platform

| Trading Platform | Supported | Available Devices |

| Mobile App (Android APK) | ✔ | Android |

| Mobile App (Android Google Play) | ✔ | Android |

| Mobile App (iOS English) | ✔ | iPhone |

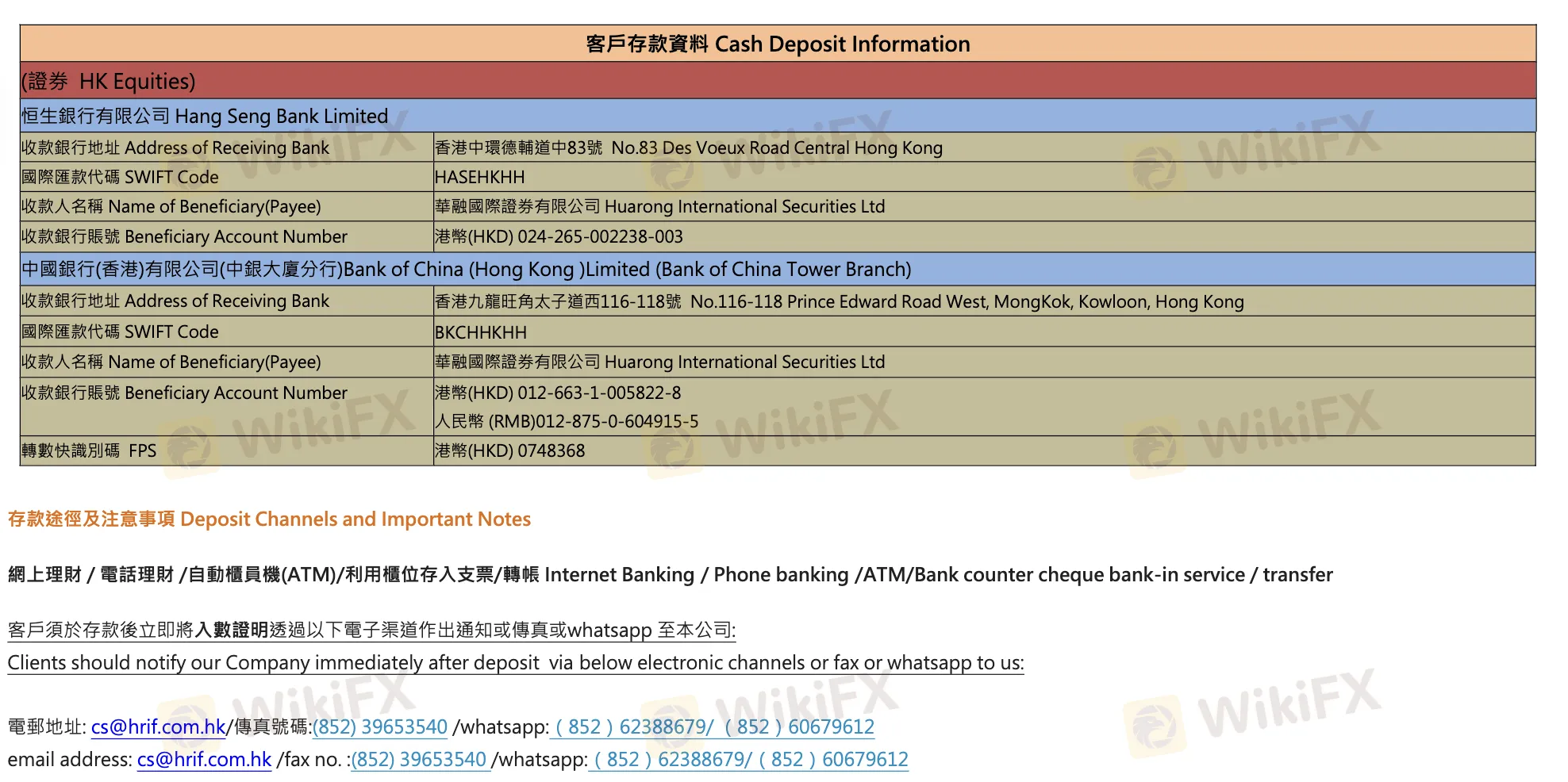

Deposit and Withdrawal

Huarong does not mention any deposit or withdrawal fees. Bank-related charges, such as cheque clearing fees or overseas remittance charges, may apply depending on the channel used.

| Payment Method | Available Currency | Processing Time |

| ATM / Internet Banking / Phone Banking / Bank Counter | HKD / RMB | Same day if before 5:00 PM |

| Cheque Deposit | HKD | After bank clearing |

| Withdrawal via Cheque | HKD | Same day if requested before 11:00 AM |

Latest News

RM750 Million Lost to Investment Scams in Just Six Months

5 things to know before the Thursday open: Meme stock revival, Trump's Fed visit, Uber's gender feature

Why Octa Is the Ideal Broker for MetaTrader 4 & 5 Users

CNBC's Inside India newsletter: Leaving, but not letting go — India's wealthy move abroad, but stay invested

Moncler raises prices on tariffs, may postpone store openings if downturn worsens

Titan FX Adds WhatsApp and Telegram for Enhanced Support

Nestle flags further potential price hikes as tariffs, commodities weigh on margins

Stop Level Forex: How Does it Help Traders Prevail When Losses Mount?

eToro Launches Spot-Quoted Futures Trading in Spain

Titan FX Introduces Redesigned Client Cabinet for Enhanced Usability

Rate Calc