2024-09-23 14:16

IndustryPsychological Biases in Trading

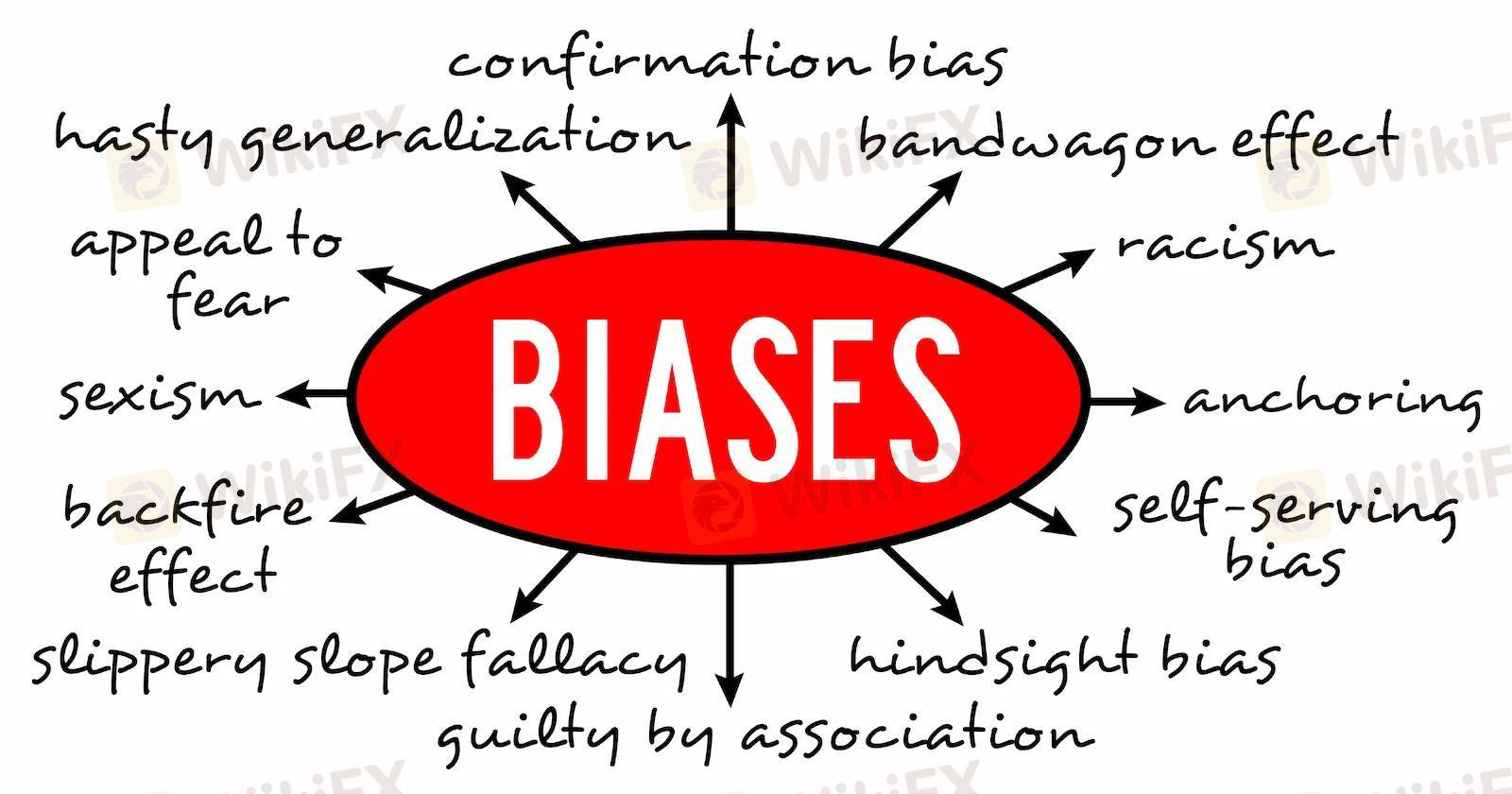

Cognitive dissonance, as explained by Leon Festinger, occurs when actions and beliefs clash, causing discomfort. In trading, this happens when traders ignore evidence that contradicts their strategies, driven by emotion or fear of being wrong. Confirmation bias (Peter Wason) reinforces this by filtering out conflicting information, and the Dunning-Kruger effect leads inexperienced traders to overestimate their abilities.

To succeed, traders must confront these biases, avoid overconfidence, and recognize their limitations. Success in trading requires self-awareness, resilience, and a disciplined approach to risk management. Embracing failure, criticism, and rigorous backtesting can help transform trading into a professional pursuit.

Ultimately, success isn’t guaranteed, but with hard work and persistence, it’s achievable.

Like 0

Xeelimus

Participants

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Psychological Biases in Trading

| 2024-09-23 14:16

| 2024-09-23 14:16Cognitive dissonance, as explained by Leon Festinger, occurs when actions and beliefs clash, causing discomfort. In trading, this happens when traders ignore evidence that contradicts their strategies, driven by emotion or fear of being wrong. Confirmation bias (Peter Wason) reinforces this by filtering out conflicting information, and the Dunning-Kruger effect leads inexperienced traders to overestimate their abilities.

To succeed, traders must confront these biases, avoid overconfidence, and recognize their limitations. Success in trading requires self-awareness, resilience, and a disciplined approach to risk management. Embracing failure, criticism, and rigorous backtesting can help transform trading into a professional pursuit.

Ultimately, success isn’t guaranteed, but with hard work and persistence, it’s achievable.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.