2024-09-24 13:12

业内Swing Trading

Swing Trading

Definition: Swing trading involves holding positions for shorter periods, typically 2-10 days, to profit from price movements.

Swing Trading Strategies:

1. Trend Following: Ride momentum.

2. Range Trading: Buy/sell within established ranges.

3. Breakout Trading: Enter on price breaks.

4. Mean Reversion: Buy/sell based on overbought/oversold conditions.

5. Candlestick Patterns: Identify reversals.

Swing Trading Benefits:

1. Lower risk compared to day trading.

2. Higher returns than long-term investing.

3. Flexibility in trading schedule.

4. Opportunity to capitalize on market fluctuations.

Swing Trading Risks:

1. Market volatility.

2. Overnight risks.

3. Gap risks.

4. Overtrading.

5. Emotional trading.

Swing Trading Indicators:

1. Moving Averages (MA).

2. Relative Strength Index (RSI).

3. Bollinger Bands.

4. MACD (Moving Average Convergence Divergence).

5. Stochastic Oscillator.

Swing Trading Setup:

1. Identify trend or range.

2. Set entry and exit points.

3. Determine position size.

4. Monitor and adjust.

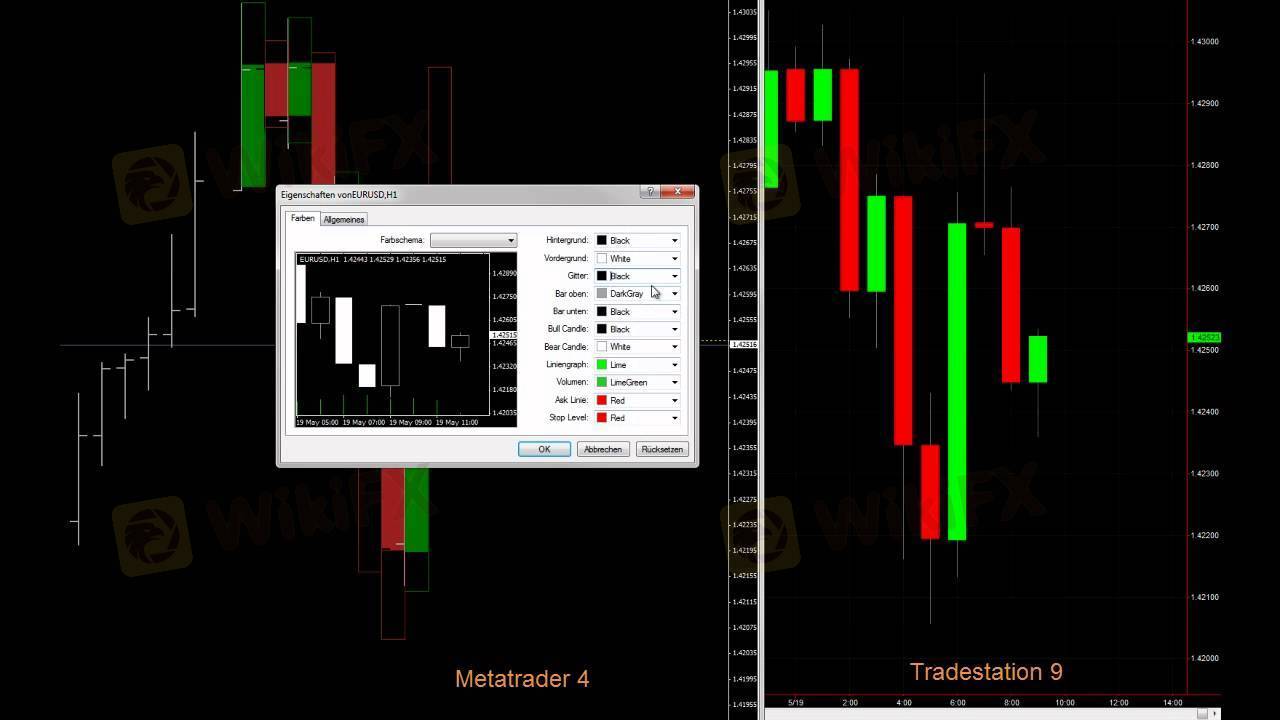

Swing Trading Platforms:

1. MetaTrader.

2. TradingView.

3. Interactive Brokers.

4. TD Ameritrade.

5. NinjaTrader.

Swing Trading Resources:

1. Investopedia.

2. TradingView.

3. The Balance.

4. Forbes.

5. Wikipedia (Swing trading).

Swing Trading Rules:

1. Set clear goals.

2. Manage risk.

3. Stay disciplined.

4. Continuously learn.

5. Monitor performance.

Example Swing Trading Plan:

Stock: XYZ

Timeframe: 4-hour chart

Trend: Uptrend

Entry: $50

Target: $60

Stop-loss: $45

Would you like me to elaborate on any specific aspect of swing trading or provide examples?

Like 0

Phong Hồng Lê

交易者

Hot content

业内

Event-A comment a day,Keep rewards worthy up to$27

业内

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

业内

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

业内

South Africa Event-Come&Win 240ZAR Phone Credit

业内

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

业内

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

平台

展会

IB

招聘

EA

业内

行情

指标

Swing Trading

| 2024-09-24 13:12

| 2024-09-24 13:12Swing Trading

Definition: Swing trading involves holding positions for shorter periods, typically 2-10 days, to profit from price movements.

Swing Trading Strategies:

1. Trend Following: Ride momentum.

2. Range Trading: Buy/sell within established ranges.

3. Breakout Trading: Enter on price breaks.

4. Mean Reversion: Buy/sell based on overbought/oversold conditions.

5. Candlestick Patterns: Identify reversals.

Swing Trading Benefits:

1. Lower risk compared to day trading.

2. Higher returns than long-term investing.

3. Flexibility in trading schedule.

4. Opportunity to capitalize on market fluctuations.

Swing Trading Risks:

1. Market volatility.

2. Overnight risks.

3. Gap risks.

4. Overtrading.

5. Emotional trading.

Swing Trading Indicators:

1. Moving Averages (MA).

2. Relative Strength Index (RSI).

3. Bollinger Bands.

4. MACD (Moving Average Convergence Divergence).

5. Stochastic Oscillator.

Swing Trading Setup:

1. Identify trend or range.

2. Set entry and exit points.

3. Determine position size.

4. Monitor and adjust.

Swing Trading Platforms:

1. MetaTrader.

2. TradingView.

3. Interactive Brokers.

4. TD Ameritrade.

5. NinjaTrader.

Swing Trading Resources:

1. Investopedia.

2. TradingView.

3. The Balance.

4. Forbes.

5. Wikipedia (Swing trading).

Swing Trading Rules:

1. Set clear goals.

2. Manage risk.

3. Stay disciplined.

4. Continuously learn.

5. Monitor performance.

Example Swing Trading Plan:

Stock: XYZ

Timeframe: 4-hour chart

Trend: Uptrend

Entry: $50

Target: $60

Stop-loss: $45

Would you like me to elaborate on any specific aspect of swing trading or provide examples?

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.