2024-11-10 23:33

IndustryPairs in Focus - AUD/USD, GBP/CHF, CAC 40, Nasdaq

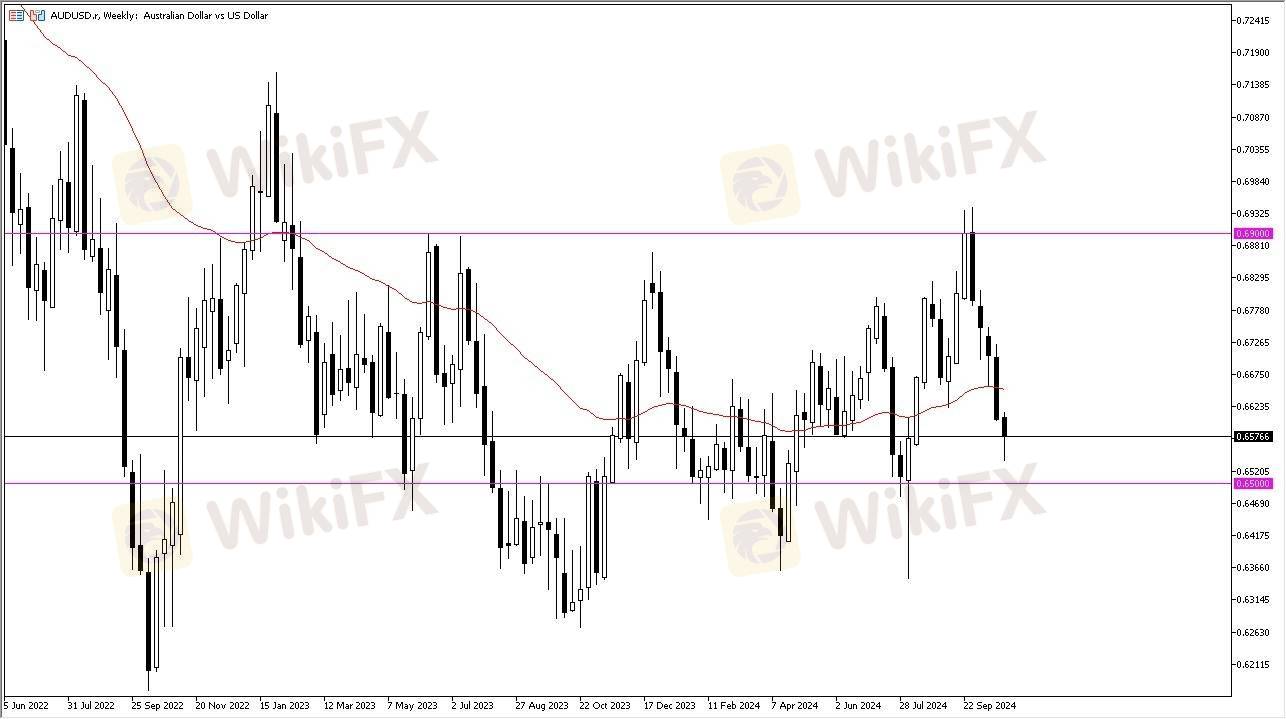

AUD/USD

The Australian dollar has been all over the place during the course of the week, as we had broken above the 50 Week EMA, then turned around to drop to the 0.65 level. All things being equal, this is a market that has been very noisy, and of course has a major influence put upon it by risk appetite, so with this being the case I think we have a situation where we are still trying to search for the bottom near the 0.65 level, so as long as we can stay above there, there might be traders willing to jump in and “by the dips” for short-term trades.

USD/CAD

The New Zealand dollar has been all over the place during the course of the week, as we continue to see a lot of noisy behavior. It’s probably worth noting that we are hanging around the crucial 0.60 level, which of course is a large, round, psychologically significant figure, but I also recognize that the true support from a longer-term standpoint is down at the 0.5850 level. In other words, we are getting fairly close to a point where the New Zealand dollar might become “too cheap.”

NASDAQ 100

The NASDAQ 100 has shot straight up in the air during the course of the week, as we continue to see a lot of bullish pressure, as the Federal Reserve cutting rates has boosted the market, right along with the idea of the US election having people willing to come in and buy stocks, as well as jumping in and taking a lot of risk in most markets. With this being the case, I think this continues to be a “buy on the dips” type of stock market.

WTI Crude Oil

The West Texas Intermediate Crude Oil market has gone back and forth during the course of the trading week, as we are closing out near the $70 level. Furthermore, the $65 level underneath will continue to be a major support level, as it has been important over the last 2 years. As long as we can stay above there, then it’s likely that there will be plenty of value hunters willing to jump in and pick oil out. If we were to break down below there, it would be a major disaster just waiting to happen. On the other hand, the market were to break above the $75 level, then we could see a shot toward the $82.50 level.

Like 0

金猫好返

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Pairs in Focus - AUD/USD, GBP/CHF, CAC 40, Nasdaq

| 2024-11-10 23:33

| 2024-11-10 23:33AUD/USD

The Australian dollar has been all over the place during the course of the week, as we had broken above the 50 Week EMA, then turned around to drop to the 0.65 level. All things being equal, this is a market that has been very noisy, and of course has a major influence put upon it by risk appetite, so with this being the case I think we have a situation where we are still trying to search for the bottom near the 0.65 level, so as long as we can stay above there, there might be traders willing to jump in and “by the dips” for short-term trades.

USD/CAD

The New Zealand dollar has been all over the place during the course of the week, as we continue to see a lot of noisy behavior. It’s probably worth noting that we are hanging around the crucial 0.60 level, which of course is a large, round, psychologically significant figure, but I also recognize that the true support from a longer-term standpoint is down at the 0.5850 level. In other words, we are getting fairly close to a point where the New Zealand dollar might become “too cheap.”

NASDAQ 100

The NASDAQ 100 has shot straight up in the air during the course of the week, as we continue to see a lot of bullish pressure, as the Federal Reserve cutting rates has boosted the market, right along with the idea of the US election having people willing to come in and buy stocks, as well as jumping in and taking a lot of risk in most markets. With this being the case, I think this continues to be a “buy on the dips” type of stock market.

WTI Crude Oil

The West Texas Intermediate Crude Oil market has gone back and forth during the course of the trading week, as we are closing out near the $70 level. Furthermore, the $65 level underneath will continue to be a major support level, as it has been important over the last 2 years. As long as we can stay above there, then it’s likely that there will be plenty of value hunters willing to jump in and pick oil out. If we were to break down below there, it would be a major disaster just waiting to happen. On the other hand, the market were to break above the $75 level, then we could see a shot toward the $82.50 level.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.