2024-11-13 15:05

IndustryYen Breaks 155 Per$, Raising Intervention Risk

JPY weakens past 155/USD for first time since July, increasing Japan's market intervention risk. Key factors:

Yen slides 0.3% to 155.04 vs USD

Losses extend after Trump's re-election as US president

Surging Treasury yields weigh on yen, 2-yr yield at highest since July

Market focus:

Yen near levels of last Japanese intervention

Japan's top FX official warns of one-sided, sudden moves

Bloomberg economist survey: median intervention trigger at 160 yen/USD

Trump policy potential impacts:

Expansionary, inflationary economic policies may reduce Fed rate cut willingness

Could further widen US-Japan interest rate gap, weakening yen

Market questions pace of narrowing interest rate differential

Japan govt & BOJ stance:

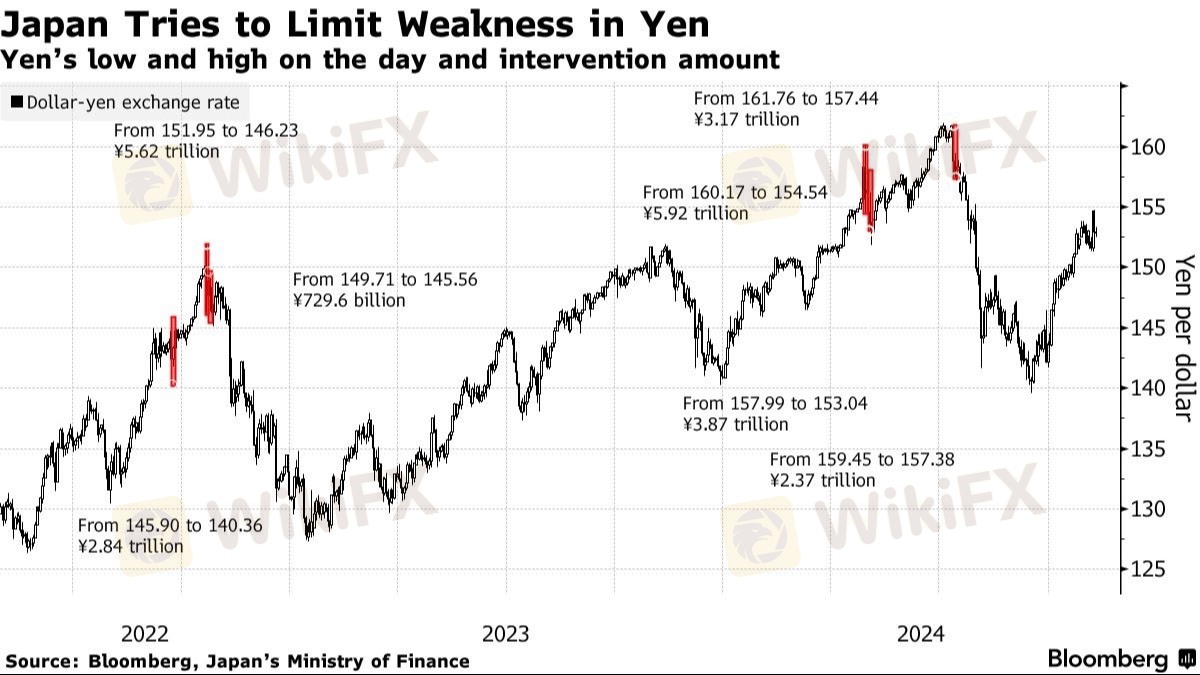

Record interventions this year in two rounds

¥9.8T ($63B) spent late Apr-early May

Additional ¥5.5T in early July

BOJ Gov Ueda acknowledges FX impact on Japan's price trends

Persistent yen weakness may prompt earlier rate hike consideration

#BOJ #JPY

Like 0

Gamma Squeezer

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Yen Breaks 155 Per$, Raising Intervention Risk

Hong Kong | 2024-11-13 15:05

Hong Kong | 2024-11-13 15:05JPY weakens past 155/USD for first time since July, increasing Japan's market intervention risk. Key factors:

Yen slides 0.3% to 155.04 vs USD

Losses extend after Trump's re-election as US president

Surging Treasury yields weigh on yen, 2-yr yield at highest since July

Market focus:

Yen near levels of last Japanese intervention

Japan's top FX official warns of one-sided, sudden moves

Bloomberg economist survey: median intervention trigger at 160 yen/USD

Trump policy potential impacts:

Expansionary, inflationary economic policies may reduce Fed rate cut willingness

Could further widen US-Japan interest rate gap, weakening yen

Market questions pace of narrowing interest rate differential

Japan govt & BOJ stance:

Record interventions this year in two rounds

¥9.8T ($63B) spent late Apr-early May

Additional ¥5.5T in early July

BOJ Gov Ueda acknowledges FX impact on Japan's price trends

Persistent yen weakness may prompt earlier rate hike consideration

#BOJ #JPY

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.