2024-11-13 22:25

IndustryOil Near $72 as Market Weighs Demand and Supply

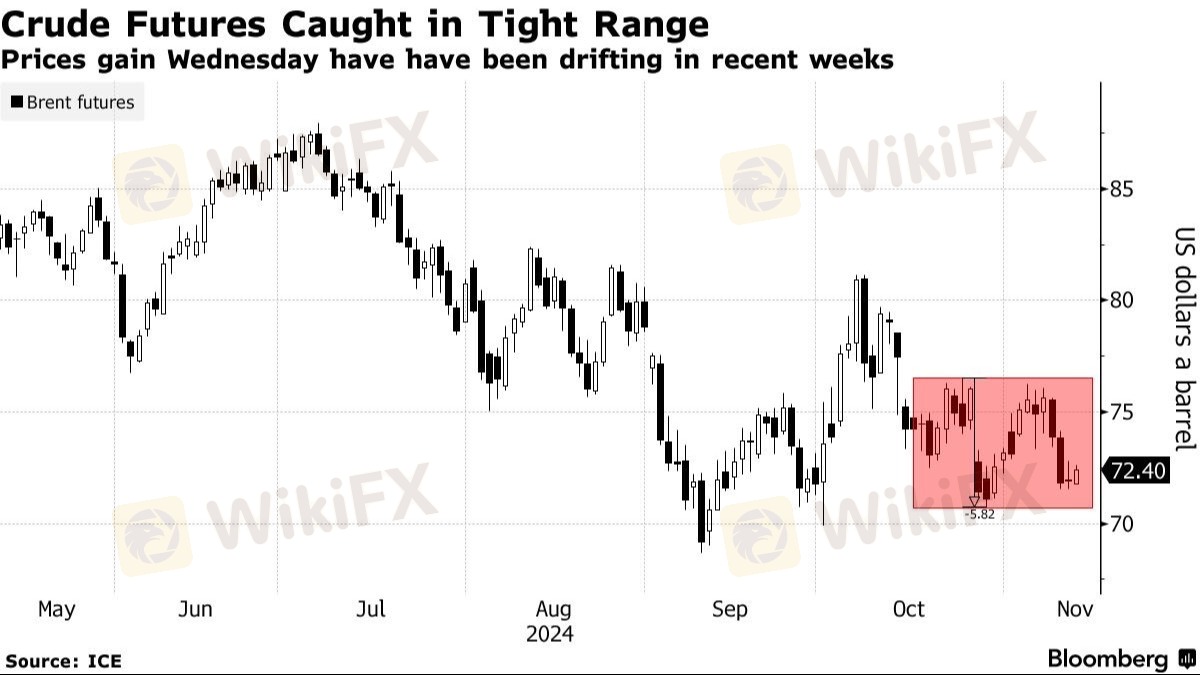

Brent crude holds around $72/barrel, trading in narrow range:

Little changed for second day, near month's low

Earlier support from pause in USD rally

Trading band of ~$5 for nearly a month

Market factors:

OPEC cuts demand growth forecast (4th consecutive month)

Awaiting US and IEA outlooks this week

Traders assessing 2025 consumption outlook

Concerns about potential oversupply next year

Expert view (Harry Tchilinguirian, Onyx Capital Group):

"The market is looking for a catalyst to break out. OPEC+ cuts afford somewhat of price support while macro economic realities put in place a cap."

Morgan Stanley outlook:

Cut oil price forecast

Predicts potential glut in 2025

Reduced consumption expectations for 2024 and 2025

Second Trump presidency could significantly impact prices, direction unclear

Key factors influencing oil market:

Geopolitical risk premiums

OPEC+ production cuts

Global economic conditions

#OilMarkets #CrudeOil #OPEC #WTI

Like 0

Gamma Squeezer

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Oil Near $72 as Market Weighs Demand and Supply

Hong Kong | 2024-11-13 22:25

Hong Kong | 2024-11-13 22:25Brent crude holds around $72/barrel, trading in narrow range:

Little changed for second day, near month's low

Earlier support from pause in USD rally

Trading band of ~$5 for nearly a month

Market factors:

OPEC cuts demand growth forecast (4th consecutive month)

Awaiting US and IEA outlooks this week

Traders assessing 2025 consumption outlook

Concerns about potential oversupply next year

Expert view (Harry Tchilinguirian, Onyx Capital Group):

"The market is looking for a catalyst to break out. OPEC+ cuts afford somewhat of price support while macro economic realities put in place a cap."

Morgan Stanley outlook:

Cut oil price forecast

Predicts potential glut in 2025

Reduced consumption expectations for 2024 and 2025

Second Trump presidency could significantly impact prices, direction unclear

Key factors influencing oil market:

Geopolitical risk premiums

OPEC+ production cuts

Global economic conditions

#OilMarkets #CrudeOil #OPEC #WTI

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.