2024-11-13 23:01

IndustryMarket Wrap(11.13)

US CPI data impacts markets:

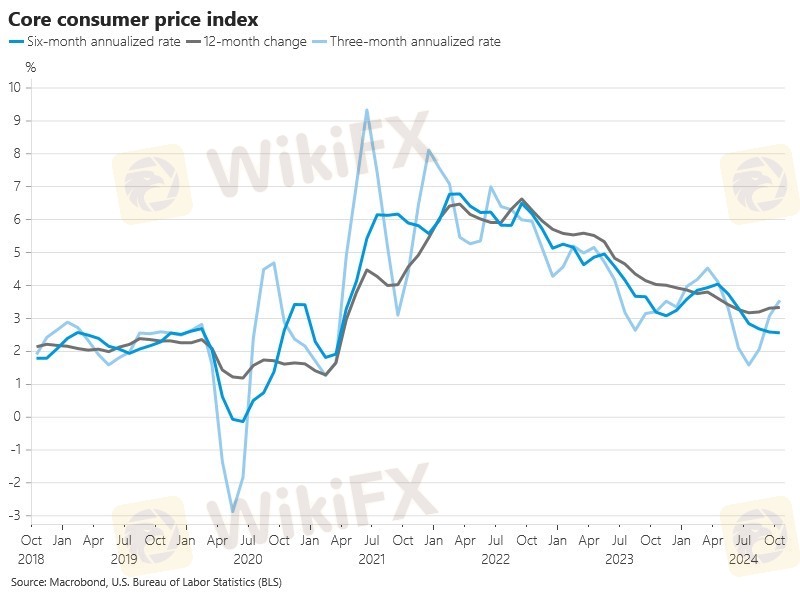

Oct inflation: 2.6%, core 3.3% (as expected)

US stock futures cut losses

Dollar retreats, Treasury yields drop

Gold extends rally

MSCI world index -0.17%, European shares dip

Market reactions:

US futures turn positive

2-yr Treasury yield falls to 4.256%

Dec rate cut probability: 69% vs 62% earlier

Euro up 0.1% at $1.0630

Yen at 154.615/USD

Expert view (Pavlik, Dakota Wealth):

"In-line inflation allows market to focus on positives: less regulation, potential business increase. We're on glide path to another rate cut."

Trump effect lingers:

Bond yields surged post-election

Expectations: lower taxes, higher tariffs

Potential GOP House majority adds uncertainty

Analyst: "Still repricing the Trump trade"

Commodities recover:

Gold +0.6% to $2,610/oz

Silver +0.8% to $30.93/oz

Brent crude +0.4% to $72.15/barrel

WTI +0.37% to $68.36/barrel

#US CPI #Fed #MarketReaction #TrumpEffect

Like 0

Gamma Squeezer

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Market Wrap(11.13)

Hong Kong | 2024-11-13 23:01

Hong Kong | 2024-11-13 23:01US CPI data impacts markets:

Oct inflation: 2.6%, core 3.3% (as expected)

US stock futures cut losses

Dollar retreats, Treasury yields drop

Gold extends rally

MSCI world index -0.17%, European shares dip

Market reactions:

US futures turn positive

2-yr Treasury yield falls to 4.256%

Dec rate cut probability: 69% vs 62% earlier

Euro up 0.1% at $1.0630

Yen at 154.615/USD

Expert view (Pavlik, Dakota Wealth):

"In-line inflation allows market to focus on positives: less regulation, potential business increase. We're on glide path to another rate cut."

Trump effect lingers:

Bond yields surged post-election

Expectations: lower taxes, higher tariffs

Potential GOP House majority adds uncertainty

Analyst: "Still repricing the Trump trade"

Commodities recover:

Gold +0.6% to $2,610/oz

Silver +0.8% to $30.93/oz

Brent crude +0.4% to $72.15/barrel

WTI +0.37% to $68.36/barrel

#US CPI #Fed #MarketReaction #TrumpEffect

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.