2024-11-15 05:59

IndustryU.S. 10-Year Treasury Yields Anomaly

### U.S. 10-Year Treasury Yields Anomaly

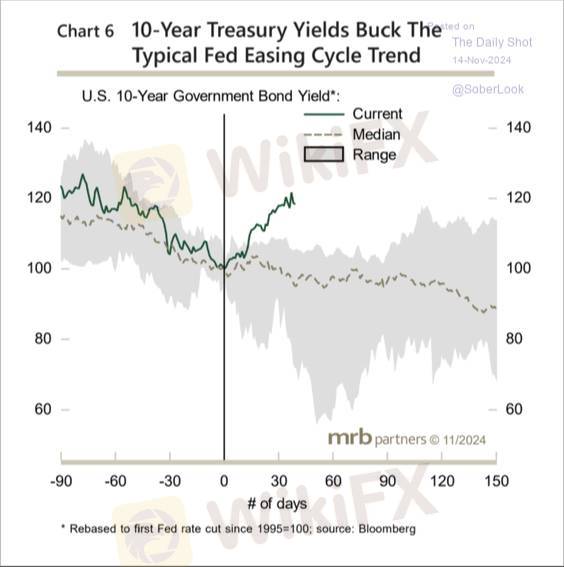

Recent data shows a significant deviation in the current 10-year U.S. Treasury yield from the typical historical trend during Federal Reserve easing cycles. Traditionally, the 10-year Treasury yield decreases following a Fed rate cut, but we now see an upward trend.

#### Cause Analysis

This anomaly may be due to changes in the global economic environment and market inflation expectations. Investors' optimism about the long-term outlook of the U.S. economy leads them to demand higher yields to compensate for potential future inflation.

#### Implications

This has important implications for investors and policymakers. Investors need to be more cautious in asset allocation, while policymakers may need more flexible and innovative measures to address the current economic environment.

By understanding this phenomenon, investors and policymakers can better navigate future economic challenges.

Like 0

Kevin Cao

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

U.S. 10-Year Treasury Yields Anomaly

Hong Kong | 2024-11-15 05:59

Hong Kong | 2024-11-15 05:59### U.S. 10-Year Treasury Yields Anomaly

Recent data shows a significant deviation in the current 10-year U.S. Treasury yield from the typical historical trend during Federal Reserve easing cycles. Traditionally, the 10-year Treasury yield decreases following a Fed rate cut, but we now see an upward trend.

#### Cause Analysis

This anomaly may be due to changes in the global economic environment and market inflation expectations. Investors' optimism about the long-term outlook of the U.S. economy leads them to demand higher yields to compensate for potential future inflation.

#### Implications

This has important implications for investors and policymakers. Investors need to be more cautious in asset allocation, while policymakers may need more flexible and innovative measures to address the current economic environment.

By understanding this phenomenon, investors and policymakers can better navigate future economic challenges.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.