2024-11-15 10:17

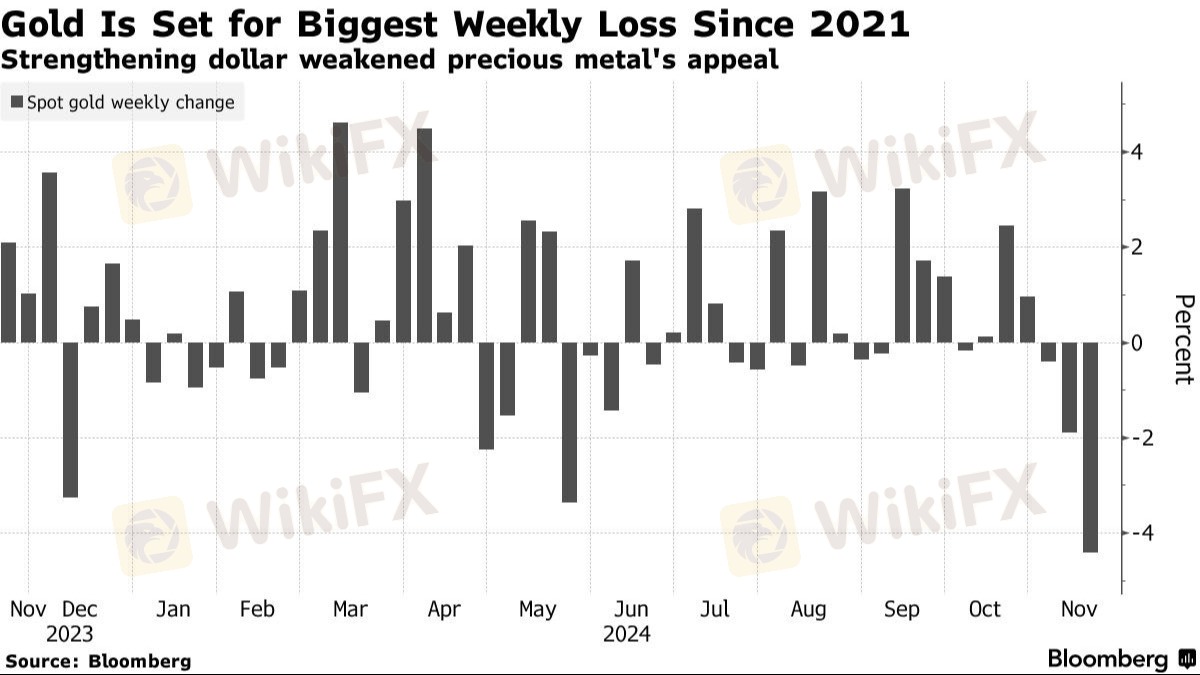

IndustryGold Near 2M Low as JPow Flags RateCut Restraint

Current gold market:

Near two-month low

Set for >4% weekly loss, biggest since June 2021

Down ~8% from Oct. 31 record high

Factors pressuring gold:

Persistent dollar strength (Bloomberg Dollar Spot Index at 2-year high)

Reduced expectations for December Fed rate cut

Rising US Treasury yields

Trump's election victory accelerating losses

Powell's impact:

Described US economy as "remarkably good"

Signaled no rush to cut interest rates

Comments led traders to pare back rate cut expectations

Gold's 2024 performance:

Up >20% year-to-date despite recent decline

Gains supported by:

Fed's earlier monetary easing

Central bank purchases

Geopolitical and economic risks driving haven demand

#GoldMarket #DollarStrength #FedPolicy

Like 0

Gamma Squeezer

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Gold Near 2M Low as JPow Flags RateCut Restraint

Hong Kong | 2024-11-15 10:17

Hong Kong | 2024-11-15 10:17Current gold market:

Near two-month low

Set for >4% weekly loss, biggest since June 2021

Down ~8% from Oct. 31 record high

Factors pressuring gold:

Persistent dollar strength (Bloomberg Dollar Spot Index at 2-year high)

Reduced expectations for December Fed rate cut

Rising US Treasury yields

Trump's election victory accelerating losses

Powell's impact:

Described US economy as "remarkably good"

Signaled no rush to cut interest rates

Comments led traders to pare back rate cut expectations

Gold's 2024 performance:

Up >20% year-to-date despite recent decline

Gains supported by:

Fed's earlier monetary easing

Central bank purchases

Geopolitical and economic risks driving haven demand

#GoldMarket #DollarStrength #FedPolicy

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.