2025-02-26 17:23

Industry6. AI-powered forex liquidity aggregation for brok

#AITradingAffectsForex

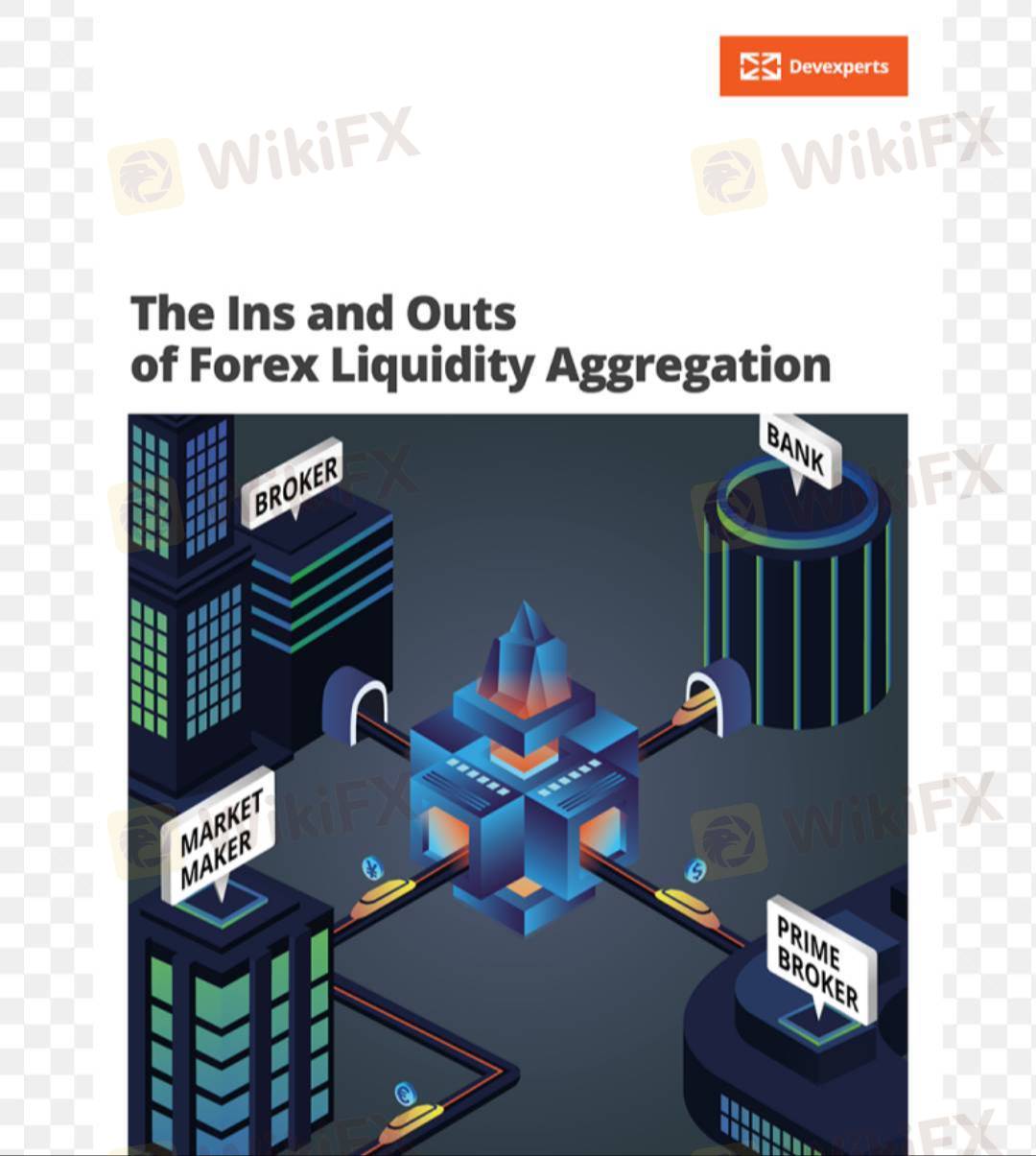

AI-powered forex liquidity aggregation for brokers is a cutting-edge solution that allows brokers to optimize their liquidity provision by sourcing and managing liquidity from multiple providers and trading venues in real-time. Liquidity aggregation combines liquidity from different sources into a single, cohesive stream, enabling brokers to offer more competitive pricing, better execution speeds, and improved market depth for their clients.

Here’s how AI-powered forex liquidity aggregation works and how it benefits brokers:

1. Real-Time Liquidity Sourcing:

AI-driven liquidity aggregation platforms can dynamically source liquidity from multiple providers based on real-time market conditions.

Dynamic Liquidity Pooling: AI algorithms can evaluate liquidity from different sources such as banks, hedge funds, liquidity providers, and exchanges. The AI system dynamically selects the best available liquidity at any given moment, taking into account factors like pricing, volume, and order book depth.

Smart Liquidity Routing: AI can intelligently route orders to the most appropriate liquidity providers based on factors like price, speed of execution, and available volume. For example, during periods of high volatility, AI might prioritize liquidity sources that offer faster execution speeds to avoid slippage.

2. Price Optimization and Best Execution:

AI can enhance the liquidity aggregation process by optimizing price feeds and ensuring brokers offer the best available prices to their clients.

Price Aggregation Algorithms: AI algorithms aggregate price quotes from different liquidity providers and select the best bid-ask spread, ensuring that brokers offer their clients the most competitive prices in real time.

Best Execution Compliance: Brokers are often required to meet best execution standards, meaning they must offer clients the best possible prices and minimize execution costs. AI helps brokers adhere to these standards by ensuring that orders are routed to the liquidity provider offering the best execution conditions at the time of the trade.

3. Liquidity Distribution Based on Client Type:

AI can help brokers optimize liquidity distribution according to their different types of clients (e.g., retail clients, institutional clients, high-frequency traders).

Client Segmentation: AI can segment clients based on their trading behavior and requirements. For instance, retail clients may have different liquidity needs compared to institutional clients, who may require deeper liquidity or faster execution speeds. AI adapts the liquidity sourcing and routing strategies accordingly, ensuring that each client receives the best possible service.

Customizable Liquidity Profiles: Brokers can set liquidity profiles based on client preferences, ensuring that each client gets access to the right type of liquidity. For example, a broker can provide retail clients with liquidity from lower-cost providers while ensuring institutional clients have access to premium liquidity sources.

4. AI-Driven Risk Management:

AI-powered liquidity aggregation platforms also provide brokers with enhanced risk management capabilities by analyzing market conditions and adjusting liquidity sourcing strategies accordingly.

Real-Time Risk Assessment: AI continuously monitors market conditions such as volatility, order book depth, and liquidity provider performance. Based on this data, AI can alert brokers to potential risks, such as slippage or execution delays, allowing brokers to adjust their liquidity sourcing to mitigate these risks.

Adaptive Hedging Strategies: AI can recommend or implement adaptive hedging strategies that help brokers protect themselves from market risks, especially during periods of low liquidity or high volatility. For example, if a broker anticipates a liquidity shortfall, AI can automatically hedge positions to reduce exposure.

5. Liquidity Pool Management and Monitoring:

AI systems can monitor and manage liquidity pools from various providers, ensuring that brokers have sufficient liquidity to execute client trades without delays.

Liquidity Pool Health Monitoring: AI can track the health of liquidity pools in real-time, detecting any potential issues with liquidity providers (e.g., insufficient volume or uncompetitive pricing). If a provider starts to show signs of illiquidity or poor pricing, AI can automatically reroute orders to other, more reliable liquidity providers.

Adaptive Liquidity Sourcing: In periods of low liquidity or high volatility, AI can increase the size of orders or diversify sources to maintain sufficient liquidity levels and reduce the risk of execution delays or price gaps.

6. Cost Reduction and Optimization:

AI can help brokers reduce the costs associated with liquidity aggregation by optimizing the use of liquidity sources and minimizing slippage.

Slippage Minimization: By continuously analyzing order flow and liquidity provider conditions, AI can

Like 0

FX2192840773

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

6. AI-powered forex liquidity aggregation for brok

India | 2025-02-26 17:23

India | 2025-02-26 17:23#AITradingAffectsForex

AI-powered forex liquidity aggregation for brokers is a cutting-edge solution that allows brokers to optimize their liquidity provision by sourcing and managing liquidity from multiple providers and trading venues in real-time. Liquidity aggregation combines liquidity from different sources into a single, cohesive stream, enabling brokers to offer more competitive pricing, better execution speeds, and improved market depth for their clients.

Here’s how AI-powered forex liquidity aggregation works and how it benefits brokers:

1. Real-Time Liquidity Sourcing:

AI-driven liquidity aggregation platforms can dynamically source liquidity from multiple providers based on real-time market conditions.

Dynamic Liquidity Pooling: AI algorithms can evaluate liquidity from different sources such as banks, hedge funds, liquidity providers, and exchanges. The AI system dynamically selects the best available liquidity at any given moment, taking into account factors like pricing, volume, and order book depth.

Smart Liquidity Routing: AI can intelligently route orders to the most appropriate liquidity providers based on factors like price, speed of execution, and available volume. For example, during periods of high volatility, AI might prioritize liquidity sources that offer faster execution speeds to avoid slippage.

2. Price Optimization and Best Execution:

AI can enhance the liquidity aggregation process by optimizing price feeds and ensuring brokers offer the best available prices to their clients.

Price Aggregation Algorithms: AI algorithms aggregate price quotes from different liquidity providers and select the best bid-ask spread, ensuring that brokers offer their clients the most competitive prices in real time.

Best Execution Compliance: Brokers are often required to meet best execution standards, meaning they must offer clients the best possible prices and minimize execution costs. AI helps brokers adhere to these standards by ensuring that orders are routed to the liquidity provider offering the best execution conditions at the time of the trade.

3. Liquidity Distribution Based on Client Type:

AI can help brokers optimize liquidity distribution according to their different types of clients (e.g., retail clients, institutional clients, high-frequency traders).

Client Segmentation: AI can segment clients based on their trading behavior and requirements. For instance, retail clients may have different liquidity needs compared to institutional clients, who may require deeper liquidity or faster execution speeds. AI adapts the liquidity sourcing and routing strategies accordingly, ensuring that each client receives the best possible service.

Customizable Liquidity Profiles: Brokers can set liquidity profiles based on client preferences, ensuring that each client gets access to the right type of liquidity. For example, a broker can provide retail clients with liquidity from lower-cost providers while ensuring institutional clients have access to premium liquidity sources.

4. AI-Driven Risk Management:

AI-powered liquidity aggregation platforms also provide brokers with enhanced risk management capabilities by analyzing market conditions and adjusting liquidity sourcing strategies accordingly.

Real-Time Risk Assessment: AI continuously monitors market conditions such as volatility, order book depth, and liquidity provider performance. Based on this data, AI can alert brokers to potential risks, such as slippage or execution delays, allowing brokers to adjust their liquidity sourcing to mitigate these risks.

Adaptive Hedging Strategies: AI can recommend or implement adaptive hedging strategies that help brokers protect themselves from market risks, especially during periods of low liquidity or high volatility. For example, if a broker anticipates a liquidity shortfall, AI can automatically hedge positions to reduce exposure.

5. Liquidity Pool Management and Monitoring:

AI systems can monitor and manage liquidity pools from various providers, ensuring that brokers have sufficient liquidity to execute client trades without delays.

Liquidity Pool Health Monitoring: AI can track the health of liquidity pools in real-time, detecting any potential issues with liquidity providers (e.g., insufficient volume or uncompetitive pricing). If a provider starts to show signs of illiquidity or poor pricing, AI can automatically reroute orders to other, more reliable liquidity providers.

Adaptive Liquidity Sourcing: In periods of low liquidity or high volatility, AI can increase the size of orders or diversify sources to maintain sufficient liquidity levels and reduce the risk of execution delays or price gaps.

6. Cost Reduction and Optimization:

AI can help brokers reduce the costs associated with liquidity aggregation by optimizing the use of liquidity sources and minimizing slippage.

Slippage Minimization: By continuously analyzing order flow and liquidity provider conditions, AI can

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.